In the fast-paced world of cryptocurrency trading, AI-powered trading bots have emerged as essential tools for traders seeking to maximize profits while minimizing emotional decision-making. These automated systems work tirelessly to execute trades based on predefined strategies, analyze market trends, and capitalize on opportunities 24/7—even while you sleep. With the crypto market’s notorious volatility and round-the-clock operation, these intelligent bots offer a competitive edge that human traders simply cannot match alone.

What Are AI Crypto Trading Bots?

AI crypto trading bots are sophisticated software programs that use artificial intelligence and machine learning algorithms to analyze market data, identify patterns, and execute trades automatically. Unlike traditional trading bots that follow rigid rules, AI-powered bots can adapt to changing market conditions, learn from historical data, and improve their strategies over time.

Key Benefits of AI Crypto Trading Bots

Ready to Automate Your Crypto Trading?

Discover the top AI-powered trading bots that can help you trade smarter, faster, and more efficiently.

Top 7 Best AI Crypto Trading Bots

After extensive research and testing, we’ve identified the seven most effective AI crypto trading bots currently available. Each platform offers unique features, pricing models, and specializations to suit different trading styles and experience levels.

| Platform | Best For | Free Plan | Starting Price | Supported Exchanges |

| 3Commas | Advanced traders | Yes (Limited) | $14.50/month | 16+ |

| Cryptohopper | AI automation | Yes (Trial) | $19/month | 18+ |

| Bitsgap | Grid trading | Yes (Trial) | $22/month | 25+ |

| Pionex | Free built-in bots | Yes (Full) | Free | 1 (Own exchange) |

| Coinrule | Beginners | Yes (Limited) | $29.99/month | 10+ |

| Shrimpy | Portfolio rebalancing | Yes (Limited) | $15/month | 16+ |

| TradeSanta | Long/short strategies | No | $14/month | 8+ |

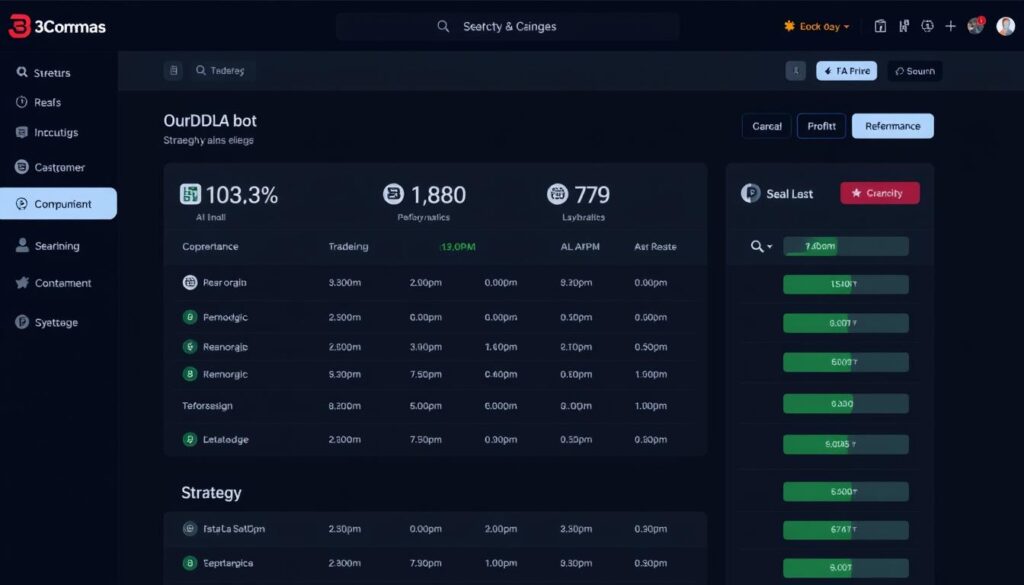

1. 3Commas – Best for Advanced Traders

3Commas stands out as a comprehensive trading platform designed for traders who want deep customization and control over their automated strategies. With its powerful suite of bots and advanced features, it’s particularly well-suited for experienced traders looking to optimize their performance across multiple exchanges.

Key Features

Supported Exchanges

Integrates with 16+ major exchanges including Binance, Coinbase Pro, Kraken, and Bitfinex.

Pricing

Pros

Cons

Ready to Take Your Trading to the Next Level?

3Commas offers a free plan to get started with automated trading. Upgrade anytime to access more advanced features.

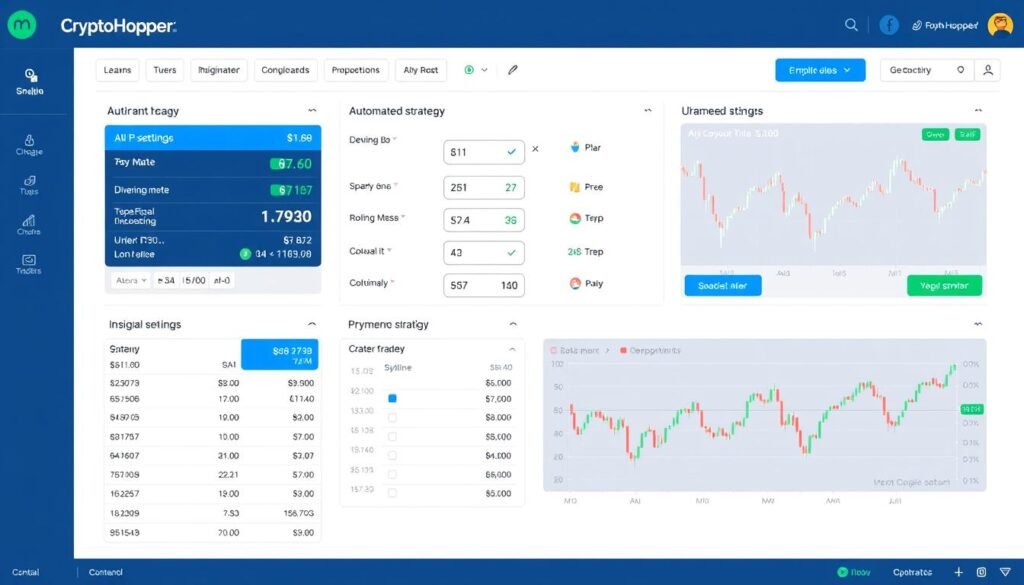

2. Cryptohopper – Best for AI Automation

Cryptohopper is renowned for its powerful AI-driven features and cloud-based architecture that keeps your bots running 24/7 without requiring your computer to stay on. It’s particularly popular for its marketplace where users can buy and sell trading strategies.

Key Features

Supported Exchanges

Works with 18+ exchanges including Binance, Coinbase Pro, Kraken, and KuCoin.

Pricing

Pros

Cons

Harness the Power of AI Trading

Try Cryptohopper’s AI-powered trading features with their 7-day free trial. No credit card required.

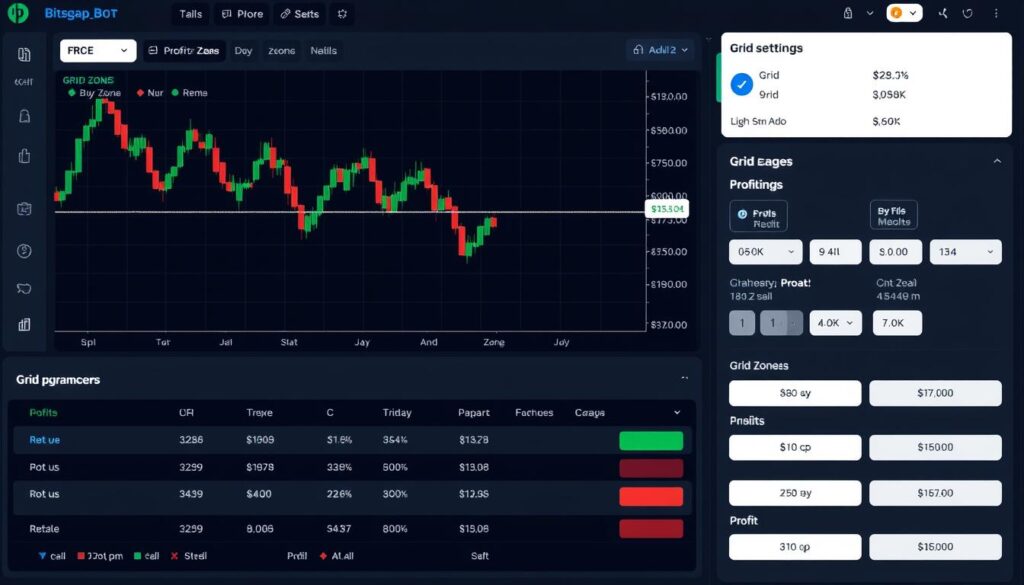

3. Bitsgap – Best for Grid Trading

Bitsgap excels in grid trading strategies, allowing traders to profit from sideways markets by automatically buying at support levels and selling at resistance. Its intuitive interface and powerful tools make it accessible to traders of all experience levels.

Key Features

Supported Exchanges

Integrates with 25+ exchanges including Binance, Bybit, Kraken, and KuCoin.

Pricing

Pros

Cons

Master Grid Trading with Bitsgap

Try Bitsgap’s powerful grid trading bots with their 14-day free trial and see how you can profit in any market condition.

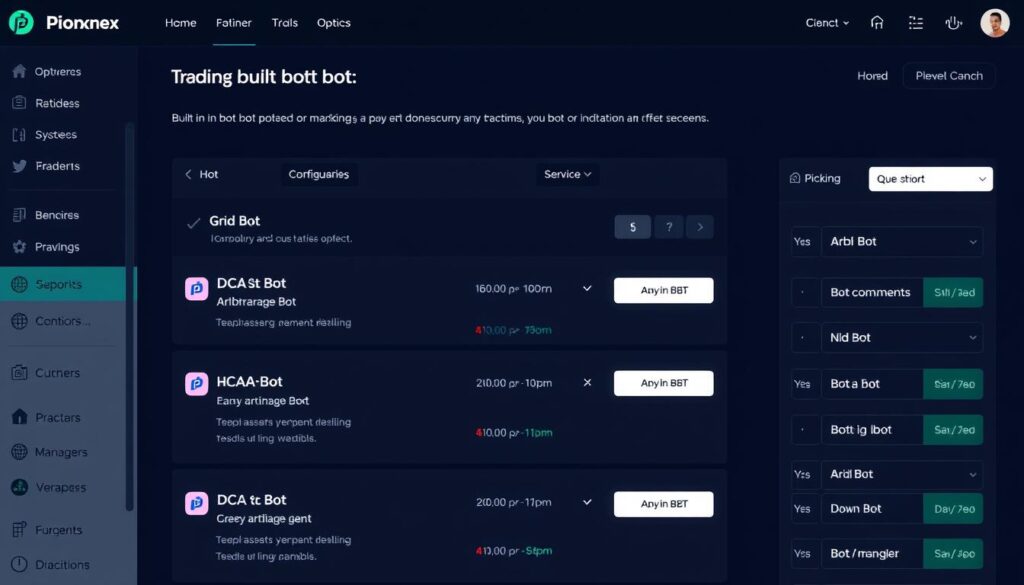

4. Pionex – Best Free Trading Bots

Pionex stands out by offering 16 free built-in trading bots on its exchange platform. Unlike other services that charge subscription fees, Pionex only makes money from its standard trading fees, making it an excellent option for traders on a budget.

Key Features

Supported Exchanges

Pionex is its own exchange, integrating liquidity from Binance and HTX.

Pricing

Pros

Cons

Start Trading with Free Bots

Access 16 professional trading bots completely free on Pionex. No subscription fees, just standard trading fees.

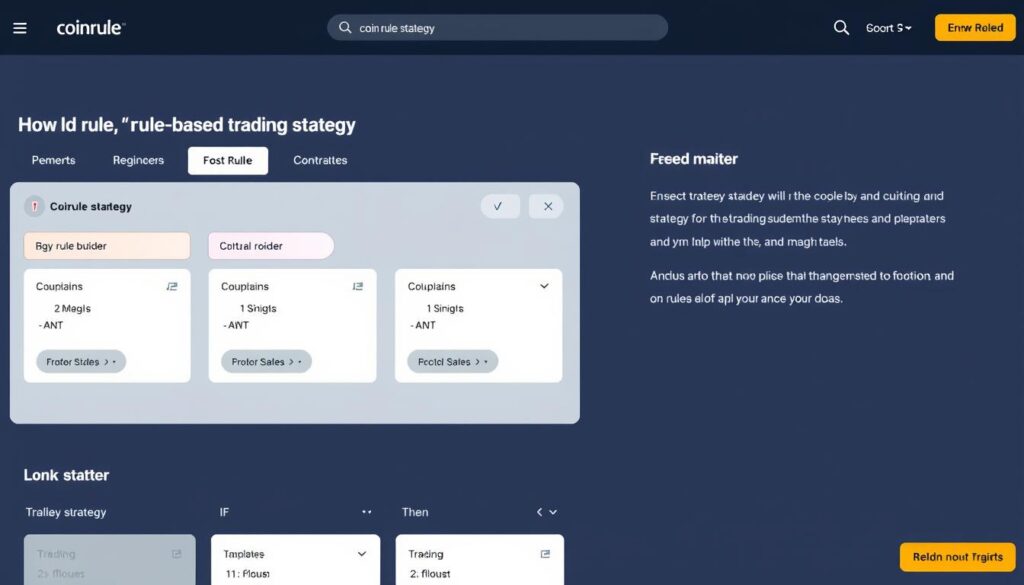

5. Coinrule – Best for Beginners

Coinrule offers a no-code approach to automated trading, making it perfect for beginners. Its intuitive rule-based system allows traders to create strategies using simple “if-this-then-that” conditions without any programming knowledge.

Key Features

Supported Exchanges

Works with 10+ exchanges including Binance, Coinbase Pro, Kraken, and more.

Pricing

Pros

Cons

Automate Your Trading Without Coding

Get started with Coinrule’s free plan and create your first automated trading strategies in minutes.

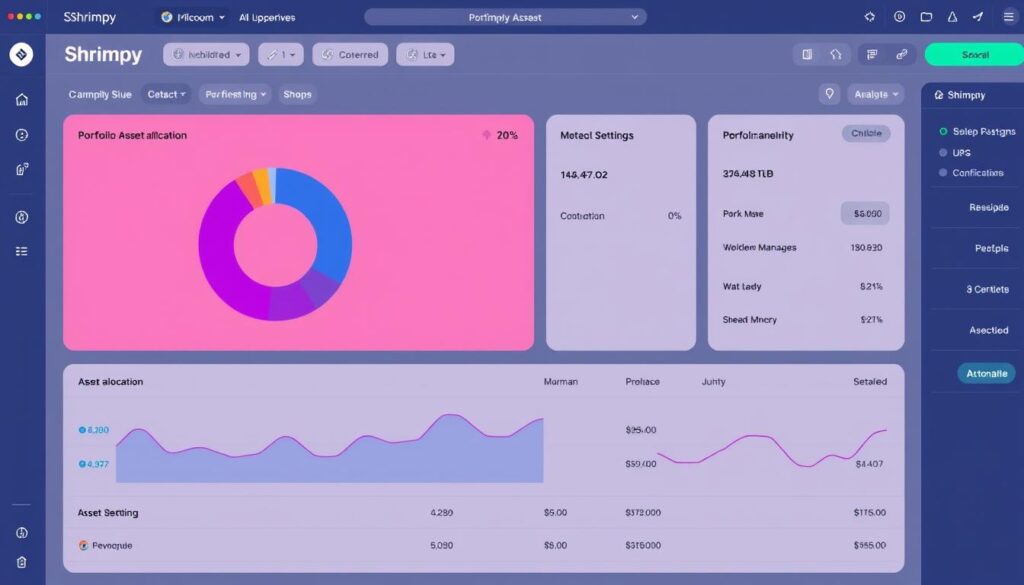

6. Shrimpy – Best for Portfolio Rebalancing

Shrimpy specializes in portfolio management and automated rebalancing, making it ideal for long-term investors rather than active traders. Its social trading features also allow users to follow and copy successful investors’ portfolios.

Key Features

Supported Exchanges

Integrates with 16+ exchanges including Binance, Coinbase, Kraken, and KuCoin.

Pricing

Pros

Cons

Optimize Your Crypto Portfolio

Try Shrimpy’s automated portfolio management tools with their free plan and see how rebalancing can improve your returns.

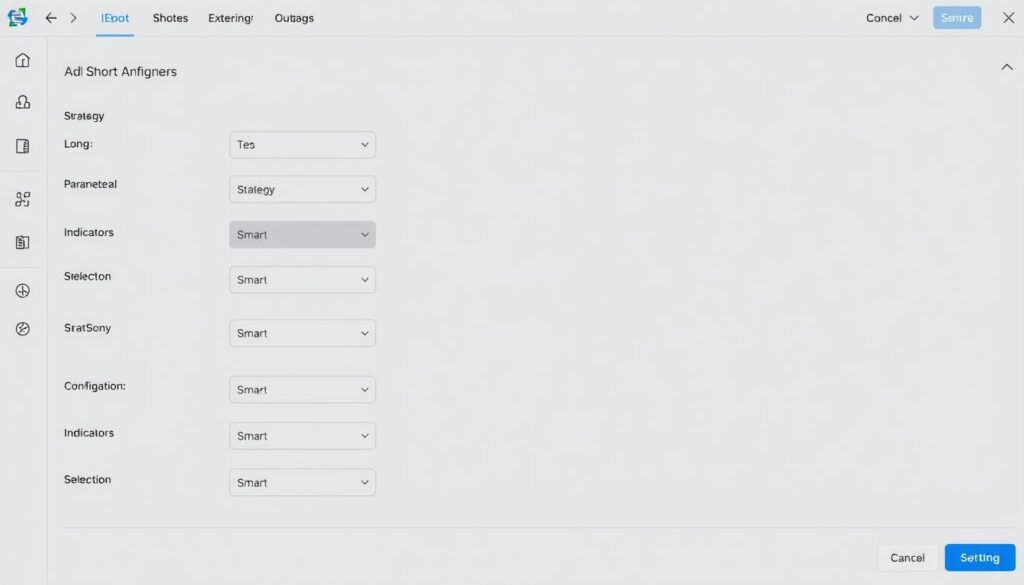

7. TradeSanta – Best for Long/Short Strategies

TradeSanta offers powerful bots for both long and short trading strategies, making it versatile for different market conditions. Its user-friendly interface and quick setup process make it accessible for traders of all experience levels.

Key Features

Supported Exchanges

Works with 8+ exchanges including Binance, Bybit, HitBTC, and HTX.

Pricing

Pros

Cons

Trade in Any Market Condition

Get started with TradeSanta’s long and short bots to profit in both bull and bear markets.

How to Choose the Right AI Crypto Trading Bot

Selecting the right AI crypto trading bot depends on your specific needs, experience level, and trading goals. Here are the key factors to consider when making your decision:

Key Selection Criteria

Trading Experience & Goals

Supported Exchanges & Assets

Features & Customization

Cost & Security

Pro Tip: Most platforms offer free trials or demo accounts. Take advantage of these to test the interface and features before committing to a paid subscription.

Understanding the Risks & Implementing Safeguards

While AI crypto trading bots offer numerous advantages, they also come with inherent risks that traders should understand and mitigate. Being aware of these challenges can help you implement appropriate safeguards and set realistic expectations.

Common Risks in Automated Trading

Market Volatility

Cryptocurrency markets are notoriously volatile, and even the most sophisticated AI can’t predict sudden market crashes or black swan events. During extreme volatility, bots may execute trades at unfavorable prices or fail to respond appropriately to rapid changes.

Technical Failures

Bots rely on continuous internet connectivity, API access, and proper functioning of the exchanges they interact with. Technical issues such as server downtime, API outages, or connectivity problems can disrupt trading operations and potentially lead to losses.

Security Risks

Granting trading bots API access to your exchange accounts introduces security considerations. If the bot platform is compromised or has vulnerabilities, your funds could be at risk. Additionally, poorly configured bots might execute unintended trades.

Strategy Limitations

No trading strategy works in all market conditions. Bots that perform well in trending markets might struggle in sideways or highly volatile conditions. Past performance is not indicative of future results, and backtested strategies may not perform as expected in live markets.

Effective Risk Mitigation Strategies

“The best trading bots don’t replace human judgment—they enhance it. Successful automated trading requires a balance of technological tools and human oversight.”

Practice Risk-Free Trading

Most platforms offer demo accounts or paper trading features. Start with virtual funds to test strategies without risking real money.

Conclusion: The Future of AI in Crypto Trading

AI crypto trading bots represent a significant advancement in how traders interact with cryptocurrency markets. By automating strategies, eliminating emotional decisions, and operating 24/7, these tools provide opportunities that would be impossible for human traders alone. As AI technology continues to evolve, we can expect even more sophisticated features and improved performance from these platforms.

When choosing the right bot for your needs, consider your experience level, trading goals, and risk tolerance. Beginners might start with user-friendly platforms like Coinrule or Pionex, while experienced traders might prefer the advanced features of 3Commas or Cryptohopper. Remember that no bot is perfect for all situations, and human oversight remains essential for successful automated trading.

The future of AI in crypto trading looks promising, with developments in machine learning, natural language processing, and predictive analytics likely to enhance bot capabilities further. As these technologies mature, we may see bots that can better adapt to changing market conditions, identify emerging patterns, and execute increasingly complex strategies.

Ready to Start Your Automated Trading Journey?

Choose the platform that best matches your trading style and experience level. Most offer free trials or demo accounts to help you get started.

Frequently Asked Questions

Are crypto trading bots legal?

Yes, crypto trading bots are legal in most countries. However, regulations vary by jurisdiction, so it’s important to ensure you’re operating within the laws of your country. Some exchanges also have policies regarding the use of automated trading tools, so check their terms of service before getting started.

Do I need programming skills to use a crypto trading bot?

Not necessarily. Many modern crypto trading bots offer user-friendly interfaces that require no coding knowledge. Platforms like Coinrule and Pionex are specifically designed for non-technical users. However, having some understanding of trading strategies and market concepts is still beneficial for configuring bots effectively.

How much money do I need to start using a trading bot?

The minimum investment varies by platform and exchange. Some platforms like Pionex allow you to start with as little as -, while others might require more substantial capital to effectively implement certain strategies. It’s generally recommended to start small while you’re learning how the bot works, then gradually increase your investment as you gain confidence.

Can trading bots guarantee profits?

No, trading bots cannot guarantee profits. While they can execute strategies more efficiently than humans and operate 24/7, they are still subject to market risks and volatility. Past performance is not indicative of future results, and all trading involves risk. Be wary of any platform that promises guaranteed returns, as this is typically a red flag.

How secure are crypto trading bots?

Security varies by platform. Reputable bots use encryption, two-factor authentication, and secure API connections. They should never require withdrawal permissions from your exchange account. To maximize security, use strong passwords, enable 2FA on both your bot platform and exchanges, and only grant the minimum necessary API permissions (trading only, no withdrawals).

What’s the difference between AI trading bots and regular trading bots?

Traditional trading bots follow rigid, predefined rules without adaptation. AI-powered bots use machine learning algorithms to analyze patterns, learn from historical data, and potentially adapt strategies based on changing market conditions. This can make AI bots more flexible and potentially more effective in diverse market scenarios, though they still require human oversight.

No comments yet