The IRS treats digital coins as property, so selling, swapping, or using them triggers a capital gain or loss in most cases.

When you earn coins — through mining, staking, or as payment — that value is counted as ordinary income and must be shown on your tax return.

Disposals must be reported on Form 8949 and Schedule D, while income entries often go on Schedule 1 or Schedule C. Keep clear records of dates, amounts, fees, fair market value in USD, and wallet details to stay compliant.

For 2024, short-term gains are taxed at ordinary income rates (10%–37%), while long-term gains use 0%, 15%, or 20% brackets. Using crypto to buy goods or services is a disposal and needs conversion to dollars at the time of the transaction.

Exchanges are issuing more 1099 forms and the IRS is expanding data matching. This guide will cover taxable vs. non-taxable events, cost basis methods, special situations, enforcement trends, software automation, and expected 2025 reporting updates.

For a deeper dive into derivatives and specific filing issues, see this resource on crypto derivatives reporting.

Key Takeaways

- The IRS classifies coins as property, causing capital gains or losses on disposal.

- Report disposals on Form 8949 and Schedule D; report earned income on Schedule 1 or Schedule C.

- Maintain full records: dates, USD values, fees, and wallet sources.

- 2024 rates: short-term = ordinary income; long-term = 0%, 15%, or 20%.

- Exchanges’ 1099 forms and IRS matching make accurate reporting essential.

Why this Ultimate Guide matters for United States crypto investors right now

Record-keeping is now part of investing. The IRS added a virtual currency question to Form 1040 and enforcement has grown since 2019. That means routine wallet activity can trigger review.

Exchanges already send 1099 forms, and agencies use blockchain analytics to match on-chain moves to identities. New broker reporting via Form 1099-DA will broaden data visibility starting in 2025.

How 2024 tax rates apply matters. Short-term gains face ordinary brackets while long-term sales may get lower capital rates. Knowing which outcome applies helps with planning.

- Faster enforcement and exchange disclosures raise audit risk without clean records.

- The Form 1040 question means every filer must acknowledge crypto interactions.

- Clear workflows capture trades, income events, and transfers across platforms.

- Proactive filing reduces misunderstandings about anonymity and lowers penalties.

This guide shows how to organize data, choose cost basis methods, and prepare ahead of year-end to avoid extensions and last-minute surprises.

How the IRS classifies cryptocurrency and why it matters for your taxes

The IRS treats digital tokens as property. That label changes how gains and earnings are recorded and the forms you must file.

Property, not currency: IRS Notice 2014-21

IRS Notice 2014-21 states that digital assets are property, not legal tender. This means any disposal is treated like a sale of property and must be measured in USD at the time of the event.

Capital gains vs. ordinary income at a glance

When you sell, trade, or spend an asset, that disposal is a taxable event that creates capital gains or losses. These are calculated as proceeds minus cost basis and reported on capital gain forms.

- Earnings from mining, staking, airdrops, or pay are counted as ordinary income at fair market value on receipt and may be subject to income tax.

- Holding without action is not a taxable event until a sale, trade, or spend occurs.

- Classification affects which forms to file and how to compute your overall tax liability.

- Track both capital and income components across all crypto transactions to avoid penalties and interest.

Cryptocurrency tax implications and reporting requirements for US traders

Not every move with digital assets creates a reportable event; knowing which actions trigger a liability keeps filings accurate. Below is a clear list of what usually counts as taxable and what typically does not.

Defining taxable events across crypto transactions

Taxable events generally include:

- Selling coins for USD or another fiat currency.

- Swapping one token for another (crypto-to-crypto trades).

- Using tokens to buy goods or services (spending).

- Disposing of assets you received from mining, staking, or compensation.

What remains tax-free under current rules

Non-taxable activities commonly are:

- Buying tokens with fiat and simply holding them.

- Transferring between your own wallets (no sale).

- Using crypto as loan collateral unless the collateral is seized or sold.

How to report: capital disposals are listed on Form 8949 and summarized on Schedule D. Earned income goes on Schedule 1 or Schedule C depending on whether the activity is personal income or business-related.

Accurate filings depend on tracking acquisition dates, USD basis, proceeds, fees, and wallet sources. To report crypto correctly, keep records that tie each disposal to its original cost basis so gains losses can be calculated and the right tax forms chosen.

When is crypto taxed? Understanding taxable events

Understanding which actions trigger a taxable event clears up when you must report gains or income. Disposal actions create capital consequences, while receiving coins often creates ordinary income.

Disposals: selling, trading, and spending

Disposal events that produce capital gains include selling for USD, swapping one token for another, or using coins to buy goods services.

- Selling on an exchange or moving assets from a wallet to sell both trigger capital gains.

- Swaps count as disposals; compute proceeds and compare to your basis to get capital gains.

- Spending crypto to pay for items creates a separate capital gain or loss at the time of purchase.

Earning: mining, staking, airdrops, and pay in crypto

Receiving coins from mining, staking, airdrops, or as compensation is ordinary income at fair market value. That amount may be subject to income tax when received.

After you report that income and pay tax, keep the basis records so future disposals show any additional capital gains or losses. Note that crypto exchanges may issue 1099 forms, but you remain responsible for accurate filing.

How crypto is taxed: short-term and long-term capital gains rates for 2024

Your holding period is a simple rule that can shift a profit from ordinary brackets to preferential rates. If you sell within one year, gains are short-term and taxed at ordinary income rates. Hold longer than one year and those profits generally qualify for lower long-term capital gains tax.

Short-term gains follow ordinary income brackets

Short-term gains use 2024 ordinary brackets for single filers: 10% up to $11,600; 12% $11,601–$47,150; 22% $47,151–$100,525; 24% $100,526–$191,950; 32% $191,951–$243,725; 35% $243,726–$609,350; 37% over $609,350.

Long-term capital gains brackets

Long-term rates for singles are 0% up to $47,025; 15% $47,026–$518,900; and 20% over $518,900. Similar thresholds apply by filing status.

How progressive brackets apply

Remember: the system is marginal. Each slice of income is taxed at its bracket, not the whole amount at one flat tax rate. That means a single sale can span multiple brackets.

- Short-term vs. long-term: ≤1 year = ordinary rates; >1 year = preferential capital gains tax.

- Holding period matters: a one-year wait can lower your gains tax significantly.

- Plan sales: spreading disposals across years can manage overall tax rates and reduce income tax spikes from earnings.

Ordinary income from crypto: what counts and how it’s reported

Rewards, bonuses, and payments in digital assets usually count as ordinary income at receipt. That rule applies to mining, staking, airdrops, referral bonuses, and wages paid in tokens.

Mining and staking rewards measured at fair market value

Mining and staking payouts are recorded as income at the fair market value when you receive them. Convert the timestamped value to USD and keep that figure as your basis.

If the activity is a business, report on Schedule C and watch for self-employment tax. Hobby earnings generally go on Schedule 1 instead.

Compensation, referrals, and learn-to-earn income

Airdrops, referral bonuses, and payroll paid in tokens are ordinary income at the moment of receipt. Later sales of those same coins create separate capital gains or losses based on the recorded basis.

- Types taxed as ordinary income: mining, staking, airdrops, referrals, compensation.

- Measure at receipt: use market value in USD with precise timestamps.

- Filing paths: Schedule 1 for hobby income; Schedule C for business income and self-employment tax concerns.

- Forms: platforms may issue 1099-MISC, but you must still report even without a form.

Always include all crypto income on your tax return and keep documentation to support amounts. Use tools that capture the market value at receipt to simplify records and help you correctly report crypto.

Calculating capital gains and losses on cryptocurrency

The core calculation compares what you received at sale to what you paid plus acquisition fees. Use USD values with exact timestamps to avoid mismatches when you compute gains or losses.

Cost basis, proceeds, and fees: the core formula

Cost basis equals your purchase price plus acquisition fees. Selling fees reduce the proceeds at disposal.

Adjusted proceeds = fair market value at sale minus selling fees. Adjusted basis = purchase price plus acquisition costs. Subtract basis from proceeds to find capital gains or losses.

Adjusted basis: incorporating purchase and disposal costs

Example: buy $1,000 in BTC, sell at $1,200. After fees, your adjusted proceeds are $1,200 minus selling fees. The $200 difference is a capital gain.

A capital loss works the same way in reverse. Losses first offset gains, then up to $3,000 may reduce other ordinary income. Any excess loss carries forward to future years.

- Track every wallet and exchange so all gains losses aggregate correctly across accounts.

- Income-received coins have a basis equal to their fair market value when received.

- Record timestamps, market value in USD, fees, and source to support your calculations.

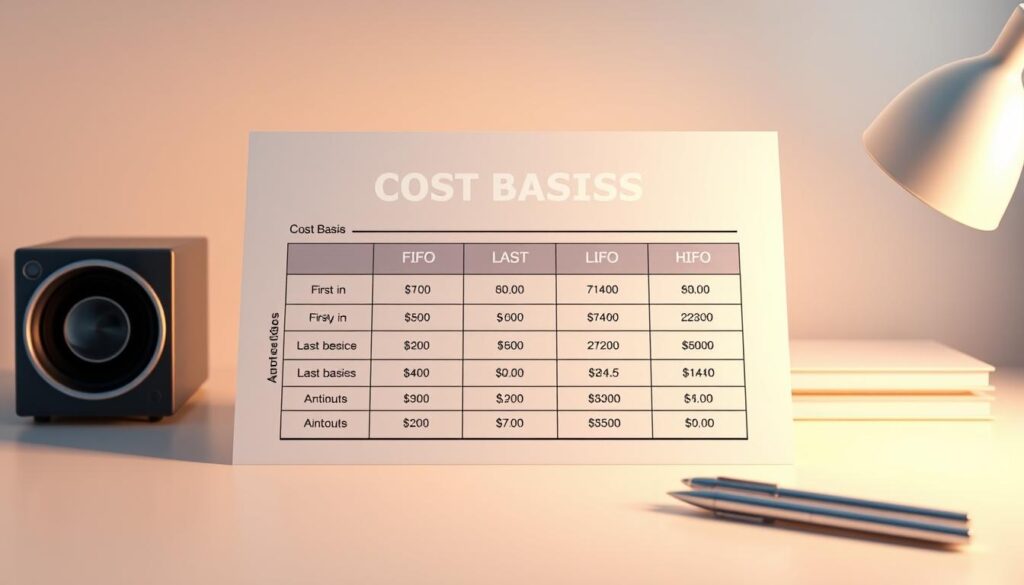

Choosing a cost basis method: FIFO, LIFO, HIFO, and specific identification

The method you pick to assign acquisition costs affects realized gains and future filings.

- FIFO (first-in, first-out) uses oldest lots first and is the default on many platforms.

- LIFO (last-in, first-out) or HIFO (highest-in, first-out) can lower current gains in rising markets.

- Specific identification lets you pick exact lots to sell to manage outcomes precisely.

When each method helps: LIFO/HIFO often minimize gains tax during bull runs by matching recent high-cost lots to sales. FIFO may produce larger losses in falling markets, which can offset other income.

Documentation for specific identification must include lot IDs, acquisition dates, unit costs, and timestamps. Exchanges may omit transfers on 1099-Bs, so keep independent records.

Apply one method consistently on your return, keep supporting records with your chosen method, and review the choice yearly based on trading patterns, goals, and new tax forms. Doing so helps when you must report cryptocurrency activity and file accurate tax reporting on required tax forms.

Non-taxable crypto activities most traders overlook

You can perform certain operations without creating a tax event, provided you keep clear records. Buying with fiat, simply holding assets, and moving coins between your own accounts are usually not taxable. These actions establish facts you’ll need later but do not trigger immediate liability.

Buying, holding, and wallet-to-wallet transfers

Buying tokens with cash or bank funds is not a sale. That purchase creates your purchase price or basis for future disposals.

Holding assets without selling does not create a taxable event. Taxation generally happens when you dispose or convert.

Transfers between your own crypto wallets keep the same basis. Still, track dates, amounts, and wallet addresses to prove continuity.

Using assets as collateral

Putting coins up as loan collateral is typically non-taxable unless the lender liquidates the collateral. If seized or sold, that disposal creates a taxable event and you must calculate gains or losses.

- Record everything: timestamps, transfer IDs, and platform notes help if you later must show provenance.

- Watch transfer fees: some network fees can affect basis or be treated as disposals; record them when you move assets.

- Plan activity: avoid unneeded disposals so you don’t have to pay taxes more often than required.

Clear records of crypto transactions make it easier to identify non-taxable moves and prepare accurate returns. If you ever need to use crypto in a taxable way, those notes speed calculations and reduce mistakes.

Special situations: airdrops, hard forks, gifts, and donations

Special events can change how you report value and what you owe. Airdrops and coins from hard forks usually create ordinary income at the moment they land in your account.

Airdrops and forks treated as income

When you receive new tokens from an airdrop or fork, record their fair market value at receipt. That amount is treated as ordinary income and may increase your income tax for the year.

Later sales use that income‑recognized basis to compute capital gains or losses.

Gifts and charitable donations

Gifts to a recipient are typically not taxable to the receiver. Donors who give large amounts may need to file a gift tax return if they exceed annual thresholds.

Donating tokens to a qualified charity often yields a tax deduction equal to the fair market value and can avoid capital gains that would arise from selling first.

- Keep written acknowledgments from charities and receipts for donations.

- For non‑cash gifts over $500 use Form 8283; if over $5,000, secure an appraisal when required.

- Crypto received as payment for goods services is treated as income at receipt and does not qualify as a gift or donation.

Reporting crypto on your tax return: forms and workflows

Listing every sale, swap, or spend on the correct form avoids mismatches with IRS data. Use a clear step-by-step workflow to move from raw trades to filed numbers. That reduces audits and errors.

Form 8949 and Schedule D for capital gains

Complete form 8949 for each disposal with dates acquired and sold, proceeds, cost basis, fees, and gain or loss. Totals from Form 8949 transfer to Schedule D to summarize overall capital results.

Schedule 1 vs. Schedule C for crypto income

Report ordinary income on Schedule 1 when activity is occasional or hobby-like. Use Schedule C when the activity is a business and subject to self-employment tax. Choose the correct path before you file to avoid later amendments.

Form 1040 virtual currency question

Answer the Form 1040 virtual currency question truthfully and ensure entries on your tax return match the forms you file. Inconsistencies often trigger notices.

- Reconcile exchange exports with wallet transfers to avoid missing lots and wrong bases.

- Keep supporting documents for every line on your forms; audits request source files.

- Suggested workflow: import data, reconcile transfers, compute gains/losses, generate forms, then review before you submit to report crypto.

When you prepare to file, double-check Form 8949 entries, confirm your totals on Schedule D, and ensure income paths align so you can accurately report crypto on your annual tax return.

Understanding 1099 forms from crypto exchanges

Exchange-issued 1099s can simplify filings, but each form covers different events and may leave gaps.

1099-B, 1099-MISC, and 1099-K: what each covers

1099-B lists sales and proceeds. It may omit cost basis if you trasferred assets between wallets before a sale, so expect reconciliation.

1099-MISC reports miscellaneous income such as staking rewards, airdrops, or referral payments when amounts exceed platform thresholds. Include those entries on your filings even if you don’t get a separate form.

1099-K was once used to show gross payments and confused many filers; a number of platforms have stopped issuing it because totals lacked cost basis and context.

What to expect from the new Form 1099-DA

Form 1099-DA arrives in 2025 to expand broker disclosures of gains and losses for digital assets. Expect more detailed lot data from many venues, which should reduce mismatches but also raise scrutiny.

- 1099-B can show basis gaps after wallet transfers; keep your own lot records to reconcile.

- 1099-MISC captures earnings like staking or airdrops; include these on your returns.

- Form 1099-DA will standardize broker data, making it easier to match platform numbers to your ledger.

Remember: receiving or not receiving a platform form does not change your duty to report all taxable activity. Align exchange exports with your records to avoid notices and streamline tax reporting on your tax returns.

Record-keeping and crypto tax software that can save you time

Good record-keeping turns a messy year of trades into neat, defensible numbers on your tax return. Use tools that capture dates, amounts, wallet addresses, fees, and USD conversions at receipt and disposal.

Tracking fair market values, dates, wallets, and fees

Essential fields include acquisition and disposal dates, quantity, fair market and market value in USD, network fees, and the sending/receiving wallet addresses.

Keep timestamps with each entry so you can prove basis. The IRS can audit past returns up to six years, so retain records year over year.

Importing from exchanges and wallets to automate reporting

crypto tax software can import tens of thousands of transactions from exchanges and crypto wallets. It consolidates trades, detects missing cost basis, and reconciles transfers automatically.

Good tax software shows gains/losses, supports FIFO/LIFO/HIFO and specific identification, and exports Form 8949-ready files you can use with your tax return.

- Automates USD conversion using recorded market value at each timestamp.

- Finds gaps after wallet moves and flags unlinked lots.

- Encourages periodic imports to avoid year-end backlogs and errors.

Compliance and enforcement: can the IRS track your crypto?

Modern enforcement uses both exchange data and chain analysis. The IRS receives 1099 feeds from platforms and pairs those with blockchain analytics to follow transfers across addresses.

Exchange reporting and blockchain analytics

Platforms send summary forms that let authorities link on‑site accounts to transactions. Analysts then trace flows on public ledgers to identify likely owners.

This combination means fewer truly anonymous moves. If you used an exchange that issued a 1099, the agency can often reconcile that file with chain records.

Penalties for non-reporting and amending past returns

Failing to disclose taxable events can lead to serious consequences. Penalties for fraud include large fines, up to $250,000, and possible imprisonment in severe cases.

- Important note: personal casualty and theft losses are generally not deductible for individuals from 2018–2025.

- Taxpayers who missed prior entries should file an amended return with Form 1040X to correct earlier years.

- Paying taxes owed before an investigation begins can reduce enforcement risk and lower potential penalties.

- Document any incidents of lost stolen assets even if deductions are limited; records help explain gaps and protect your position.

Proactive fixes and clear documentation often lower overall tax liability. Acting early to amend and to pay taxes due is a practical step to avoid harsher enforcement.

Strategies to reduce your crypto tax liability legally

Smart planning can shrink your capital gains tax bill while keeping you within the law. Use holding choices, loss harvesting, giving, and retirement accounts to shape outcomes.

HODL for long-term rates; tax-loss harvesting

Hold assets more than 12 months to access lower capital gains tax rates. Longer holding often reduces gains tax on sales.

Harvest losses to offset gains losses in the same year. A realized capital loss can offset gains, then up to $3,000 of ordinary income per year with carryforwards.

IRAs, donations, and cost basis choices

Use a self-directed IRA to defer or eliminate income tax on growth inside the account, subject to IRS rules.

Donating appreciated coins to a qualified charity usually yields a tax deduction at fair market value while avoiding capital gains on the sale.

- Review cost basis methods annually; HIFO may reduce gains tax in rising markets.

- Precise records are required for timely loss harvesting and for tracking cost basis.

- The wash sale rule does not currently apply to these assets, which offers flexibility when harvesting.

Key 2025 developments and critical deadlines US traders should know

Plan now. Calendar dates and new broker disclosures arriving in 2025 mean you must sync ledgers and act before deadlines.

April, June, and October filing timelines

Annual deadlines:

- April 15 — regular filing deadline for most individuals.

- June 15 — deadline for citizens and residents living abroad to file without extension.

- October 15 — final deadline when an extension has been granted.

Reporting changes and data matching implications

Beginning in 2025 brokers will issue form 1099-da to disclose digital-asset disposals. This expands the data the IRS can cross-check against your books.

Expect stronger data matching. More detailed broker feeds will increase notices when figures differ. Reconcile exchange exports, wallet records, and cost basis before filing tax returns.

The Tax Cuts and Jobs Act rules limiting certain casualty and theft deductions remain in effect through 2025. Keep that in mind when you plan losses or charitable moves.

- Align disposals around prevailing tax rates and bracket management across calendar years.

- Set calendar reminders for April, June, and October deadlines.

- Estimate and pay quarterly amounts if you expect large gains to avoid penalties.

Your next steps to stay compliant and optimize this tax year

Start by pulling complete exports from every exchange and wallet you used this year. Import those files into a single ledger or reputable software to reconcile transfers and fill any gaps.

Compute gains and losses, then generate Form 8949 and Schedule D totals and prepare any income schedules needed. Accurately answer the Form 1040 virtual currency question and report crypto activity on your tax return.

Before year‑end, consider loss harvesting, timing disposals to favor long‑term capital gains, or gifting appreciated assets to charity. If you realise large gains, set reminders to estimate and pay taxes or quarterly amounts to avoid penalties.

Keep full records for at least six years to support capital gains and income entries. If past years are incomplete, file amendments promptly to reduce risk and ensure your next tax return is complete.

FAQ

What is the IRS classification of virtual currency and why does it matter?

The IRS treats virtual currency as property, not money, under Notice 2014-21. That classification means gains or losses from sales, trades, and disposals are reported as capital gains or losses, while income from mining, staking, airdrops, or compensation is reported as ordinary income at fair market value when received.

Which crypto events create taxable events I must report?

Taxable events include selling crypto for fiat, trading one token for another, spending crypto for goods or services, and receiving tokens as income (mining, staking, airdrops, employer compensation). Each triggers either capital gains reporting or ordinary income recognition depending on the situation.

When is a crypto gain short-term versus long-term?

A gain is short-term when you held the asset for one year or less before disposing; it’s taxed at ordinary income rates (10%–37%). Long-term gains apply to assets held more than one year and use lower capital gains brackets (0%, 15%, 20%), depending on taxable income.

How do I calculate capital gain or loss on a transaction?

Subtract your cost basis (purchase price plus fees) from the proceeds of the sale (amount received minus selling fees). Adjusted basis factors in transaction costs or improvements. The result is a capital gain or loss to report on Form 8949 and Schedule D.

Which cost-basis method should I use: FIFO, LIFO, HIFO, or specific identification?

Choice depends on your tax goals. FIFO is common and simple. HIFO or specific identification can minimize gains by selling highest-cost lots first. Specific identification requires robust records and clear documentation when you sell; the IRS expects consistent application once you choose a method.

Do wallet-to-wallet transfers trigger taxes?

No—transferring crypto between wallets you own is not a taxable event because no sale or exchange occurred. Keep clear records to prove common ownership and avoid complications if exchanges or auditors question the movement.

How are airdrops and hard forks treated for reporting?

Tokens received from airdrops or certain hard forks are typically ordinary income at the fair market value when you gain dominion and control. If you later sell those tokens, any change in value creates a capital gain or loss based on the basis established at receipt.

What forms do I use to report gains and income from digital assets?

Use Form 8949 to list individual transactions and Schedule D for aggregated capital gains or losses. Ordinary crypto income may belong on Schedule 1, Schedule C (if self-employment), or Form 1040 depending on the source. Keep the virtual currency question on Form 1040 answered accurately.

What do 1099 forms from exchanges cover and what is Form 1099-DA?

Exchanges may issue 1099-B for brokered sales, 1099-MISC for miscellaneous income, or 1099-K for payment transactions when thresholds apply. The new 1099-DA aims to report digital asset data, including basis and proceeds, to improve IRS matching—expect more exchange reporting in future seasons.

How should I track fair market value and records for receipts and disposals?

Record date and time of each transaction, amount received or spent, fiat equivalent at the transaction moment, wallet addresses, exchange statements, and fees. Use crypto tax software to import exchange histories, compute cost basis, and generate Form 8949-ready reports to simplify compliance.

Can the IRS trace my on-chain activity and exchange accounts?

Yes. The IRS uses information from exchanges, third-party data providers, and blockchain analytics firms to match transactions. Failing to report can lead to notices, penalties, interest, or audits. Maintain detailed records and correct past returns if needed.

Are lost or stolen tokens deductible?

Losses from theft or hacks are complicated. Casualty or theft deductions face strict rules; recent guidance narrowed allowable claims. Report ordinary capital losses from disposals, but consult a tax professional for theft or loss events to determine if any deduction is available.

How can I legally reduce crypto-related tax liability?

Consider holding assets for over one year to access long-term capital gains rates, use tax-loss harvesting to offset gains, contribute appreciated tokens to qualified charities, or explore retirement account strategies. Each move has rules and trade-offs—work with a tax pro or use software to model outcomes.

When are key 2025 deadlines and reporting changes I should watch?

Typical filing deadlines include April for annual returns and extended deadlines like June or October for specific filers. Expect ongoing reporting enhancements and broader data matching from exchanges in 2025. Stay current with IRS releases and exchange notices to avoid missed reporting windows.

Do I need crypto tax software and which features matter most?

Software saves time and reduces errors. Look for automatic import from exchanges and wallets, robust cost-basis method support (FIFO, HIFO, specific ID), accurate fair market value sourcing, Form 8949 output, and audit-ready records. Popular options include CoinTracker, Koinly, TaxBit, and CoinTracker integrates with many platforms.

How do gifts and donations of tokens affect reporting?

Donors may deduct the fair market value of donated crypto to a qualified charity if rules are met, subject to limits. Gifts to individuals typically carry no immediate income tax for the recipient; the donor may have gift tax filing obligations above annual exclusions. Keep appraisals and donation receipts.

No comments yet