Digital transaction systems are reshaping how organizations operate. At their core, these technologies offer enhanced security and operational clarity, creating trust in data exchanges. Two distinct approaches have emerged to meet varying operational demands.

One model prioritizes controlled access, ideal for enterprises managing sensitive workflows. The alternative operates as an open ecosystem, fostering decentralized collaboration. Both frameworks utilize distributed ledgers but differ in governance and accessibility.

Organizations must evaluate factors like data privacy requirements and partnership dynamics when choosing solutions. Healthcare providers, financial institutions, and supply chain managers increasingly adopt tailored systems to streamline complex processes. These implementations demonstrate how adaptable ledger technology addresses real-world challenges.

This analysis explores how each model functions in practical scenarios. We’ll break down their technical distinctions and showcase where they deliver maximum value. By understanding these differences, decision-makers can align technological investments with strategic objectives.

Key Takeaways

- Digital ledger systems enhance security through decentralized verification

- Access control models vary based on organizational privacy needs

- Industry-specific implementations drive operational efficiency

- Public and private systems balance transparency with data protection

- Implementation choices impact collaboration and scalability

Understanding Permissioned Blockchain Networks

Tailored solutions are transforming how companies protect their digital assets. Restricted-access ledger systems operate as invitation-only environments where verified members manage transactions. These setups prioritize operational oversight over complete decentralization, making them ideal for industries handling confidential records.

Security Layers and Data Protection

Multi-layered authentication ensures only approved users interact with the network. Features include:

- Biometric verification for participant identification

- Role-based permissions for task-specific access

- End-to-end encryption for sensitive records

Healthcare providers use these measures to share patient histories securely. Financial institutions leverage transaction visibility controls to meet audit requirements without exposing client details.

Custom Rules for Industry Needs

Companies design governance models matching their operational rhythms. Supply chain managers might implement real-time tracking rules, while banks could enforce automated compliance checks. Platforms like Hyperledger Fabric allow:

- Adjustable validation protocols

- Scalable membership structures

- Performance-focused consensus methods

This flexibility lets enterprises balance speed with security. Energy companies, for instance, optimize these systems for cross-border trade documentation, reducing processing times by 68% in recent implementations.

Exploring Permissionless Blockchain Networks

Open digital ecosystems are redefining collaboration across global networks. These public systems enable anyone to verify transactions or propose changes through collective oversight. Unlike restricted models, they operate on principles of transparency and equal participation.

![]()

Decentralized Governance and Open Access

Public ledgers eliminate centralized authority by distributing decision-making power. Participants collectively validate transactions using mechanisms like Proof of Work or Proof of Stake. Bitcoin’s mining process and Ethereum’s staking model demonstrate how these systems maintain integrity without gatekeepers.

Every user holds equal voting rights in protocol upgrades. This approach prevents single entities from altering rules for personal gain. Networks achieve consensus through mathematical algorithms rather than organizational hierarchies.

Security, Consensus, and Performance Dynamics

Distributed validation creates inherent security through cryptographic checks. Thousands of nodes cross-verify each transaction, making unauthorized changes nearly impossible. However, global participation introduces scalability challenges.

Systems balance speed with decentralization by optimizing validation processes. Ethereum’s shift to Proof of Stake reduced energy use by 99.95% while maintaining robust safeguards. These innovations address throughput limitations without compromising core principles.

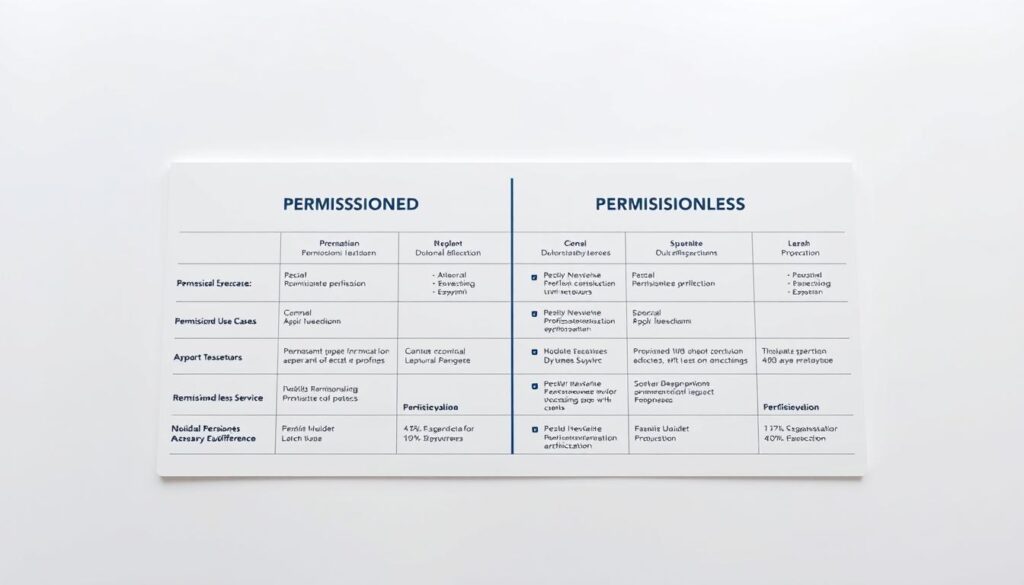

Permissioned vs permissionless blockchain networks business use cases explained

Selecting the right distributed ledger system requires understanding how governance and accessibility shape outcomes. Restricted-access models excel where compliance and privacy dominate, while open systems thrive in transparent, collaborative environments.

Core Contrasts in Functionality

Four critical factors separate these frameworks:

- Authority structure: Centralized oversight vs community-driven protocols

- Participation rules: Vetted membership vs anonymous involvement

- Speed vs decentralization: 1,000+ TPS in closed systems vs 10-50 TPS in public ones

- Security priorities: Role-based encryption vs cryptographic proof mechanisms

Implementation Decision Drivers

Healthcare consortia often select controlled ledger systems to share sensitive patient data securely. Cryptocurrency platforms leverage open validation for trustless transactions.

Key selection criteria include:

- Industry regulations requiring audit trails

- Data sensitivity levels

- Collaboration scope with external partners

- Throughput demands

Hybrid models are gaining traction, blending verification methods. A pharmaceutical company might use private validation internally while allowing public transparency for regulators.

Key Features Impacting Transactions and Security

The backbone of modern digital systems lies in their ability to process exchanges swiftly while maintaining ironclad protections. Architectural differences determine how platforms balance speed with safeguards, shaping their effectiveness across industries.

Transaction Efficiency and Scalability

Restricted systems achieve rapid processing through curated participation. With fewer nodes to coordinate, validation occurs in seconds rather than minutes. This streamlined approach enables:

- Higher throughput (1,200+ exchanges/second)

- Predictable latency under 0.5 seconds

- Linear scaling with added hardware

Open architectures face bottlenecks from global consensus requirements. Techniques like sharding help manage load but introduce complexity. Layer-2 solutions now boost capacity while preserving decentralization principles.

Mitigating Risks through Controlled Access

Identity verification slashes unauthorized activity risks in managed environments. Predefined rules govern who can initiate or validate exchanges, creating audit-ready trails. Financial institutions leverage these features for cross-border settlements requiring privacy-enhancing solutions.

Public systems counter threats through cryptographic proofs and distributed validation. While resilient to single-point failures, they remain vulnerable to 51% attacks in smaller networks. Hybrid models now combine verification methods to address these gaps.

Emerging technologies like zero-knowledge proofs enhance protections across both paradigms. These innovations enable confidential transactions without compromising validation integrity, reshaping security expectations.

Industry-specific Use Cases of Permissioned Blockchains

Regulated industries increasingly adopt controlled-access ledger systems to meet strict operational standards. These solutions enable secure collaboration while maintaining audit trails and participant accountability.

Financial Services and Banking

Banks leverage managed ledgers for cross-border payments and trade finance. Identity verification protocols streamline KYC processes, reducing onboarding time by 40% in recent deployments. Automated compliance checks ensure adherence to anti-fraud regulations across 78 countries.

| Industry | Application | Key Benefit |

|---|---|---|

| Banking | Interbank settlements | Real-time audit trails |

| Healthcare | Patient data sharing | HIPAA-compliant access |

| Logistics | Cargo tracking | Tamper-proof records |

Supply Chain and Healthcare Implementation

Pharmaceutical companies use validated networks to track drug shipments from factories to pharmacies. Temperature sensors and location data create immutable quality assurance logs. Hospitals share encrypted patient records across authorized providers while meeting privacy regulations.

Government agencies deploy these systems for property registries and digital voting platforms. A European nation recently reduced land title disputes by 62% using managed ledger technology. Controlled participation ensures only verified officials can update critical public records.

Real-World Examples of Permissionless Blockchain Adoption

Open-source networks are revolutionizing how global communities exchange value and information. These systems empower users through collective governance while maintaining robust security protocols.

Cryptocurrency Platforms and Decentralized Finance

Digital currencies like Bitcoin demonstrate the power of open validation systems. Users worldwide transfer assets without banks through:

- Peer-to-peer transaction verification

- Automated smart contracts

- Decentralized exchanges

DeFi platforms now handle $80B+ in locked assets. Services like Uniswap enable trustless trading, while Aave facilitates borderless lending. These tools reduce remittance costs by 70% for migrant workers.

Digital Identity and Content Sharing

Self-sovereign identity solutions let users control personal data. Platforms like Civic allow:

- Portable credentials across services

- Selective data disclosure

- Fraud-resistant authentication

Creative industries leverage censorship-resistant networks for royalty management. Audius ensures musicians receive 90%+ of streaming revenue through transparent smart contracts. Open platforms also combat content removal risks faced by traditional social media.

Emerging applications include NFT gaming ecosystems and decentralized prediction markets. These innovations showcase how permissionless systems create new economic models through radical transparency.

Comparative Insights: Bridging Business Needs and Blockchain Models

Modern organizations face critical decisions when aligning operational frameworks with distributed ledger technologies. Strategic choices depend on balancing transparency needs with oversight requirements, particularly in regulated sectors. This section examines how identity protocols and governance structures shape real-world implementations.

Regulatory Compliance and Identity Verification

Industries like finance and healthcare require strict adherence to data protection laws. Managed systems enable centralized identity checks through pre-approved participant lists. This approach simplifies audit processes while meeting standards like GDPR or HIPAA.

Open networks employ self-sovereign identity tools, letting users control personal data. While empowering individuals, these decentralized methods complicate compliance verification. Financial institutions often prefer controlled systems for real-time monitoring of transactions, as seen in enterprise blockchain implementations.

Balancing Decentralization with Control

Distributed governance fosters innovation but challenges operational oversight. Supply chain consortia might adopt hybrid models, combining public transaction visibility with private validation nodes. This preserves accountability without sacrificing transparency.

Platforms handling sensitive content often prioritize moderation tools over censorship resistance. Media companies, for instance, use managed ledgers to track digital rights while maintaining editorial control. Energy traders blend both approaches, using open networks for market data and closed systems for contract execution.

Final Thoughts on Choosing the Right Blockchain Model

Selecting the optimal framework requires balancing operational priorities with technological capabilities. Controlled-access systems excel where data governance and regulatory adherence dominate. Open architectures thrive in environments valuing transparency over centralized oversight.

Three critical elements guide this decision: operational scale, compliance demands, and collaboration scope. Organizations handling sensitive records often favor private solutions with predefined participant rules. Public models suit projects needing broad user engagement without gatekeepers.

Key considerations include:

- Transaction throughput matching workflow demands

- Identity verification protocols for compliance needs

- Network growth potential across partner ecosystems

Hybrid approaches are gaining momentum, blending verification methods. A logistics consortium might use private validation for internal operations while enabling public tracking for clients. Such configurations address scalability challenges while maintaining audit trails.

Ultimately, successful implementations align validation mechanisms with strategic goals. Regular evaluations ensure systems adapt to evolving regulations and partnership dynamics. Emerging tools like modular architectures now let enterprises adjust access controls as needs change.

No comments yet