Fibonacci retracement levels have become an essential tool for cryptocurrency traders seeking to predict potential price reversals and support/resistance zones. This mathematical sequence, discovered centuries ago, has proven remarkably effective in modern financial markets, including the volatile world of cryptocurrency trading. In this comprehensive guide, we’ll explore how to leverage Fibonacci retracement levels to enhance your cryptocurrency price predictions and improve your trading decisions.

Understanding Fibonacci Retracement: Origins and Mathematical Basis

The Fibonacci sequence appears throughout nature and forms the basis of retracement levels

The Fibonacci sequence is a series of numbers where each number is the sum of the two preceding ones: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, and so on. This sequence was introduced to Western Europe by Leonardo Pisano (known as Fibonacci) in the 13th century, though its origins trace back to ancient Indian mathematics between 450-200 BCE.

What makes this sequence remarkable is the ratio between consecutive numbers. As the sequence progresses, the ratio between adjacent numbers approaches approximately 0.618 (or its inverse, 1.618), known as the “Golden Ratio.” This ratio appears repeatedly in nature, art, architecture, and—importantly for traders—financial markets.

Why Fibonacci Works in Cryptocurrency Markets

Fibonacci retracement levels work in cryptocurrency markets for two primary reasons:

Bitcoin price chart with Fibonacci retracement levels showing key support and resistance zones

Key Fibonacci Retracement Levels for Cryptocurrency Trading

The most commonly used Fibonacci retracement levels in cryptocurrency trading are 23.6%, 38.2%, 50%, 61.8%, and 78.6%. While 50% is not derived from the Fibonacci sequence itself, it’s included because it’s a significant psychological level where traders often expect reversals.

| Fibonacci Level | Calculation | Significance in Crypto Trading |

| 23.6% | Derived from dividing a number by the number three places to its right | Shallow retracement, often seen in strong trends |

| 38.2% | Derived from dividing a number by the number two places to its right | Moderate retracement, common in bull markets |

| 50% | Not a Fibonacci ratio but included for its psychological importance | Major psychological level, significant support/resistance |

| 61.8% | The Golden Ratio, derived from dividing a number by the next number | The most powerful retracement level, often the “last line of defense” |

| 78.6% | Square root of 0.618 | Deep retracement, often indicates potential trend reversal |

The 61.8% Golden Ratio is particularly significant in cryptocurrency price prediction

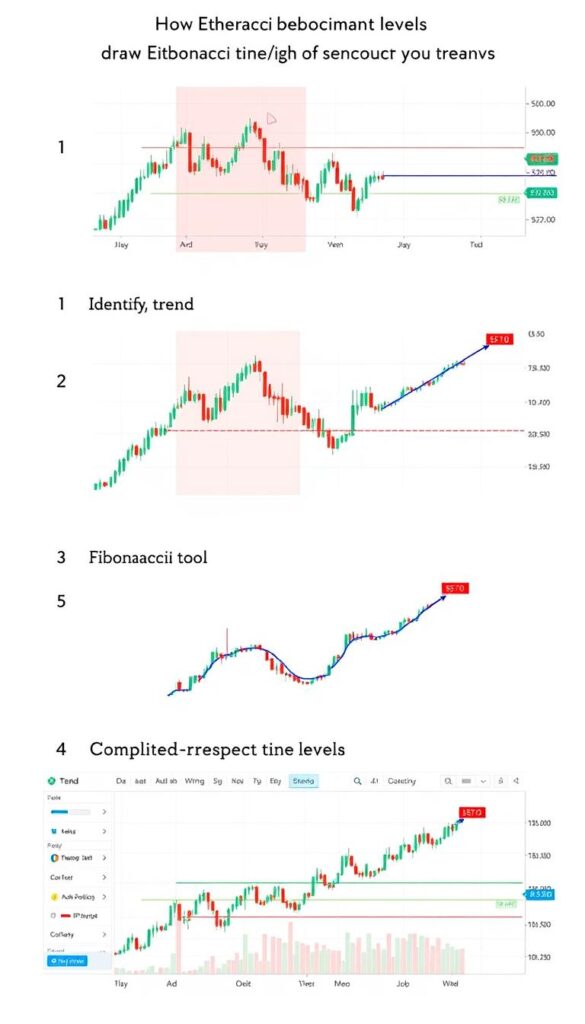

How to Draw Fibonacci Retracement Levels on Cryptocurrency Charts

Drawing Fibonacci retracement levels on cryptocurrency charts is straightforward once you understand the process. Here’s a step-by-step guide:

Step-by-step process for drawing Fibonacci retracement on an Ethereum chart

Common mistakes to avoid when drawing Fibonacci retracement levels

Tips for Selecting the Right Swing Points

The effectiveness of Fibonacci retracement levels depends heavily on selecting the appropriate swing points. Here are some tips:

Practical Examples: Fibonacci Retracement in Bitcoin and Ethereum

Bitcoin (BTC) Example

Bitcoin price action respecting the 61.8% Fibonacci retracement level during a bull market

In this Bitcoin example, we can observe how price respected the key Fibonacci retracement levels during a significant uptrend:

Ethereum (ETH) Example

Ethereum price repeatedly finding support and resistance at Fibonacci retracement levels

Ethereum provides another excellent example of Fibonacci retracement levels in action:

Master Fibonacci Retracement Trading

Download our free Fibonacci retracement template for cryptocurrency trading. Includes pre-configured levels, entry/exit strategies, and risk management guidelines.

Combining Fibonacci with Other Technical Indicators

While Fibonacci retracement levels are powerful on their own, their effectiveness increases dramatically when combined with other technical indicators. This approach, known as confluence, provides stronger signals and reduces false positives.

Combining Fibonacci retracement with RSI for stronger trading signals

Fibonacci + RSI (Relative Strength Index)

The RSI is a momentum oscillator that measures the speed and change of price movements. When combined with Fibonacci retracement levels:

Fibonacci + Moving Averages

Fibonacci levels gaining strength when aligned with key moving averages

Moving averages identify the average price over a specific period, smoothing out price action. When they align with Fibonacci levels:

Fibonacci + Volume Profile

Volume profile shows the trading activity at specific price levels. When combined with Fibonacci:

Volume profile confirming the significance of Fibonacci retracement levels

Enhance Your Technical Analysis Skills

Get our complete guide on combining Fibonacci retracement with other technical indicators for more accurate cryptocurrency price predictions.

Real-World Case Studies: Successful and Unsuccessful Fibonacci Trades

Successful Case Study: Bitcoin’s Golden Pocket Bounce

Bitcoin’s strong bounce from the 61.8%-65% “Golden Pocket” Fibonacci zone

In this case study from March 2023, a trader successfully used the Fibonacci “Golden Pocket” (the zone between 61.8% and 65%) to enter a profitable Bitcoin long position:

Unsuccessful Case Study: Ethereum’s Failed Support

Ethereum breaking through expected Fibonacci support levels, resulting in a failed trade

Not all Fibonacci trades work out. This case study examines a failed trade where Ethereum broke through expected Fibonacci support:

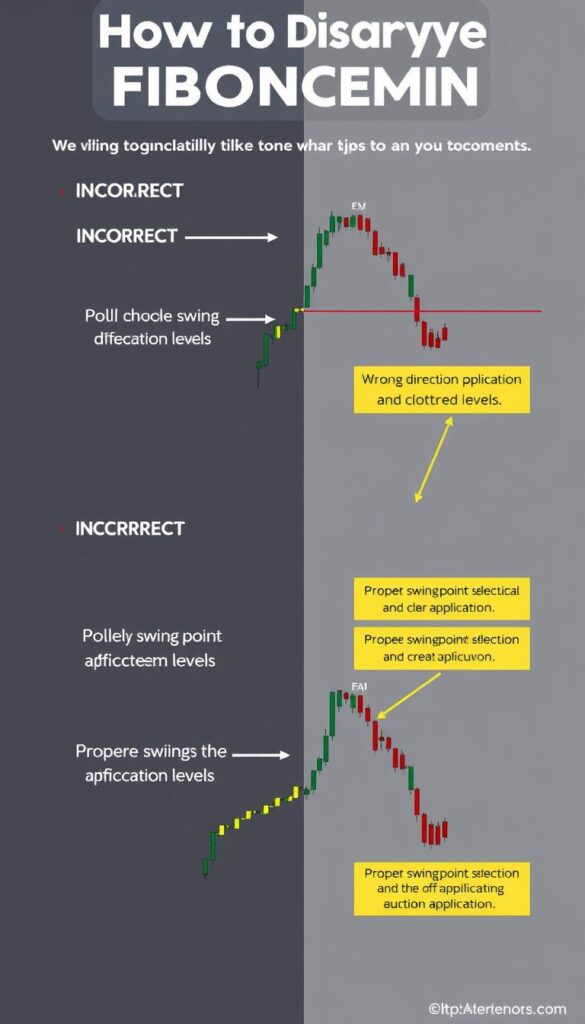

Common Mistakes to Avoid When Using Fibonacci Retracement

Effective Fibonacci Usage

- Using Fibonacci with trend confirmation

- Combining with other technical indicators

- Selecting significant swing points

- Applying proper risk management

- Using appropriate timeframes

- Looking for confluence with other support/resistance

Common Fibonacci Mistakes

- Using Fibonacci in ranging/sideways markets

- Relying solely on Fibonacci without confirmation

- Selecting insignificant swing points

- Ignoring market context and fundamentals

- Using too many Fibonacci levels simultaneously

- Forcing Fibonacci to fit your bias

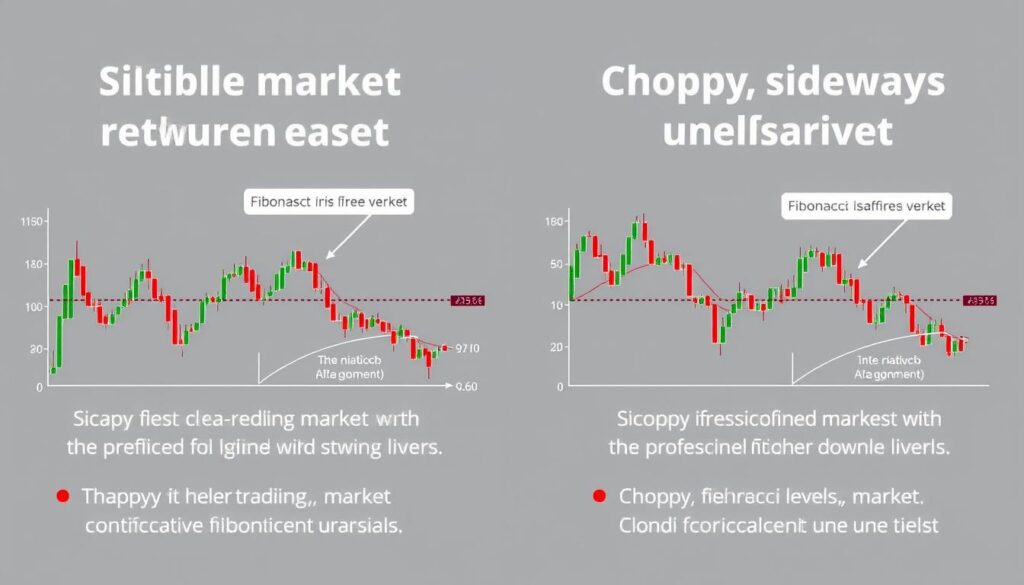

Mistake #1: Forcing Fibonacci on Unsuitable Charts

Suitable trending market (left) vs. unsuitable ranging market (right) for Fibonacci analysis

Fibonacci retracement works best in trending markets with clear directional movement. Applying it to sideways, choppy markets often leads to false signals and losses. Before using Fibonacci, confirm that the market is in a clear trend.

Mistake #2: Ignoring Market Context

Fibonacci retracement is just one tool in technical analysis and should not be used in isolation. Always consider:

Mistake #3: Poor Risk Management

Proper risk management when trading with Fibonacci retracement levels

Even the best Fibonacci analysis can fail. Always implement proper risk management:

Advanced Fibonacci Techniques for Cryptocurrency Trading

Fibonacci Extensions for Price Targets

Using Fibonacci extensions to set precise price targets in cryptocurrency trading

While retracement levels help identify potential reversal points, Fibonacci extensions help set price targets beyond the original trend. Common extension levels include 127.2%, 161.8%, and 261.8%.

To use Fibonacci extensions:

Fibonacci Time Zones

Fibonacci time zones helping predict when significant price movements might occur

Fibonacci time zones help predict when significant price movements might occur, rather than at what price level. They apply the Fibonacci sequence to time rather than price.

To use Fibonacci time zones:

Multiple Timeframe Analysis

Using Fibonacci retracement across multiple timeframes provides a more comprehensive view of potential support and resistance levels.

Fibonacci retracement analysis across daily, 4-hour, and 1-hour timeframes showing confluence

Conclusion: Responsible Use of Fibonacci Retracement in Cryptocurrency Trading

Fibonacci retracement levels provide a powerful framework for predicting potential cryptocurrency price movements. When used correctly, they can help identify key support and resistance levels, offering valuable entry and exit points for trades. However, they are most effective when:

Remember that no technical analysis tool is infallible, especially in the volatile cryptocurrency markets. Fibonacci retracement levels should be one component of a comprehensive trading strategy, not the sole basis for trading decisions.

By understanding both the power and limitations of Fibonacci retracement, you can use this ancient mathematical sequence to navigate the modern world of cryptocurrency trading more effectively, potentially improving your ability to predict price movements and make profitable trading decisions.

Start Your Fibonacci Trading Journey Today

Download our comprehensive Fibonacci Trading Bundle for cryptocurrency traders. Includes templates, guides, case studies, and expert strategies.

No comments yet