The meteoric rise of NFTs has transformed digital artwork, sports memorabilia, and other collectibles into assets worth millions. While blockchain technology provides authentication, it doesn’t protect against theft, hacking, or platform failures. As high-profile NFT thefts continue making headlines—with some collectors losing millions in digital assets overnight—the need for robust NFT insurance and protection strategies has never been more critical. This guide explores how to safeguard your valuable digital investments through specialized insurance solutions and technical security measures.

Why Insurance Is Critical for High-Value NFTs

Unlike physical assets that can be insured against damage or theft through traditional policies, NFTs exist in a relatively new insurance landscape. When you purchase an NFT worth thousands or millions of dollars, you’re essentially acquiring a digital certificate of ownership recorded on the blockchain—but this doesn’t automatically protect you from various risks.

Common Risks to NFT Investments

- Theft through compromised digital wallets or marketplace accounts

- Phishing attacks targeting your private keys

- Platform failures or bankruptcies where NFTs are stored

- Smart contract vulnerabilities leading to asset loss

- Counterfeit or copyright-infringing NFTs that become worthless

- Loss of access credentials (private keys or passwords)

The irreversible nature of blockchain transactions means that once an NFT is stolen, recovery is extremely difficult. Unlike credit card fraud where transactions can be reversed, blockchain’s immutability—while a strength for authentication—becomes a liability when theft occurs.

“While blockchain technology suggests heightened security for digital assets through its distributed ledger, there is nothing to prevent thieves from stealing NFTs like any other digital asset. The theft of an NFT is irreversible because blockchain transactions are irreversible.”

Protect Your Digital Investments

Don’t wait until it’s too late. Assess your NFT collection’s vulnerability with our comprehensive risk evaluation tool.

Leading NFT Insurance Providers Compared

The insurance industry has been slow to develop comprehensive coverage for NFTs, but several providers have emerged with specialized solutions. Here’s how the top options compare:

| Insurance Provider | Coverage Type | Maximum Coverage | Specialized for NFTs | Notable Features |

| Coincover | Digital Asset Protection | Up to $1M per asset | Yes | Theft protection, private key recovery, multi-signature security |

| Nexus Mutual | Smart Contract Cover | Varies by contract | Partial | Decentralized coverage pool, community governance |

| Evertas | Crypto Asset Insurance | Custom limits | Yes | Institutional-grade coverage, regulatory compliance |

| YAS Digital Limited | Microinsurance for NFTs | Up to $500K | Yes | Fine art focus, pay-per-use model |

| Lloyd’s of London | High-Value Asset Insurance | Custom underwriting | Emerging | Tailored policies for collectors, institutional backing |

What to Look for in NFT Insurance Coverage

Coverage Scope

Ensure the policy covers theft, phishing attacks, and smart contract failures. Some policies may exclude certain types of NFTs or only cover specific marketplaces.

Valuation Method

Understand how the insurer values your NFTs. Some use purchase price, others use market value at time of loss, which can vary dramatically in volatile markets.

Claim Process

Review the claim verification process. How will you prove ownership and loss? What documentation is required? How quickly are claims processed?

Insurance Tip: Most traditional homeowners or renters insurance policies explicitly exclude digital assets. Even scheduled personal property endorsements typically don’t extend to NFTs. Always confirm coverage specifics with your provider.

7 Technical Protection Strategies for NFT Security

Beyond insurance, implementing robust security measures is essential for protecting your NFT investments. These technical strategies form the foundation of comprehensive NFT protection:

1. Cold Wallet Storage Best Practices

Cold wallets (hardware wallets) store your private keys offline, making them inaccessible to online hackers. This is the gold standard for NFT security.

- Purchase hardware wallets directly from manufacturers, never from third-party resellers

- Set up your device with a strong PIN and recovery phrase

- Store your recovery phrase offline in multiple secure locations (consider a safety deposit box)

- Never connect your cold wallet to compromised devices

- Consider a dedicated computer for high-value NFT transactions

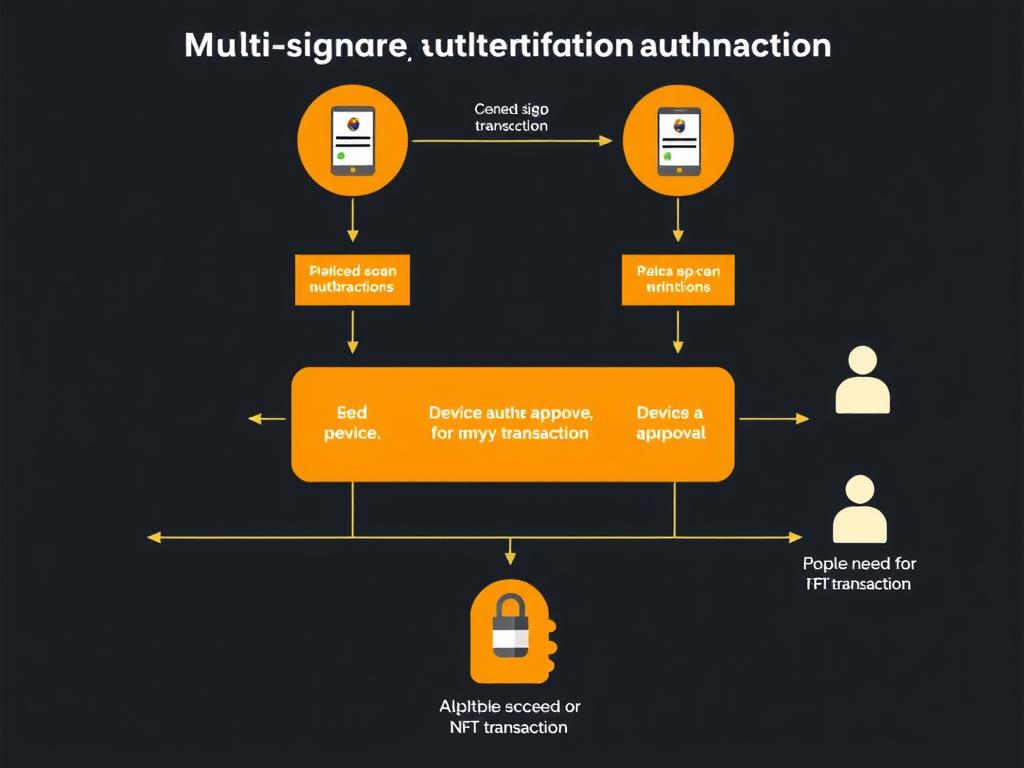

2. Multi-Signature Authentication Workflows

Multi-signature (multisig) wallets require multiple private keys to authorize transactions, significantly enhancing security for high-value NFTs.

- Configure a 2-of-3 or 3-of-5 signature requirement for transactions

- Distribute keys among trusted individuals or secure locations

- Implement time-locks for additional security on large transfers

- Document your multisig recovery process for heirs or trusted associates

- Test the recovery process periodically to ensure it works

3. Smart Contract Auditing Processes

Before purchasing valuable NFTs, verify the underlying smart contract has been professionally audited to minimize risk of vulnerabilities.

- Check if the project has undergone audits by reputable security firms

- Review audit reports for resolved and unresolved issues

- Verify the contract code is open-source and viewable on blockchain explorers

- Look for established standards compliance (e.g., ERC-721 or ERC-1155)

- Consider third-party verification services for high-value purchases

4. Marketplace Security Verification

Not all NFT marketplaces offer the same level of security. Research platform security measures before using them for high-value transactions.

- Enable all available security features (2FA, email confirmations)

- Verify marketplace insurance policies and recovery procedures

- Research the platform’s history of security incidents

- Use separate email addresses for different marketplaces

5. Secure Authentication Practices

Strong authentication is your first line of defense against unauthorized access to your NFT collection.

- Use hardware security keys (YubiKey) for critical accounts

- Implement unique, complex passwords for each platform

- Enable biometric authentication when available

- Regularly audit connected applications and revoke unnecessary access

6. NFT Provenance Verification

Before purchasing valuable NFTs, verify their authenticity and provenance to avoid counterfeit or unauthorized works.

- Verify creator’s official accounts and previous works

- Check transaction history on blockchain explorers

- Research the collection’s history and reputation

- Consider professional authentication services for high-value acquisitions

7. Regular Security Audits

Periodically review your NFT security posture to identify and address potential vulnerabilities.

- Conduct quarterly reviews of wallet security

- Update firmware on hardware wallets

- Rotate passwords and review account recovery options

- Test your backup and recovery procedures

Need Expert Security Guidance?

Our specialists can help implement these protection strategies for your valuable NFT collection.

Real-World NFT Theft and Recovery Case Studies

Understanding how NFT thefts occur and the recovery processes can help collectors better protect their assets. Here are notable cases that highlight both vulnerabilities and protection strategies:

Case Study: The $2.2 Million Wallet Compromise

Incident: In 2022, a high-profile collector lost 16 valuable NFTs worth approximately $2.2 million when attackers gained access to their hot wallet through a phishing attack.

Attack Vector: The collector clicked a malicious link that appeared to be from a legitimate NFT project, granting attackers access to their wallet.

Recovery Efforts: The marketplace flagged the stolen NFTs, but blockchain’s immutability prevented transaction reversal. The collector worked with blockchain forensics firms to track the assets.

Protection Lessons: This case highlights the importance of cold storage for valuable NFTs and the need for phishing awareness. Had the collector used a hardware wallet and verified all transaction requests, the theft could have been prevented.

Case Study: OpenSea Marketplace Vulnerability

Incident: In 2021, multiple OpenSea users lost a combined $1.7 million in NFTs due to a platform vulnerability.

Attack Vector: Attackers exploited a contract vulnerability that allowed them to purchase NFTs at previous listing prices far below current market value.

Recovery Efforts: OpenSea reimbursed affected users and implemented new security measures, including automatic cancellation of inactive listings.

Protection Lessons: This case demonstrates the importance of marketplace security and the need for users to regularly review and cancel old listings. It also highlights the value of platforms that offer user compensation policies.

Recovery Success Factor: In cases where recovery was successful, the common elements were: quick detection, immediate reporting to marketplaces and law enforcement, engagement with blockchain forensics experts, and comprehensive documentation of ownership. Insurance played a critical role in financial recovery when direct asset recovery wasn’t possible.

NFT Collector’s Risk Assessment Checklist

Use this comprehensive checklist to evaluate your current NFT protection strategy and identify areas for improvement:

Storage Security Assessment

- Are high-value NFTs (>$10,000) stored in cold wallets?

- Do you use separate wallets for trading vs. long-term holding?

- Is your recovery phrase stored securely offline in multiple locations?

- Have you tested your recovery process in the last 6 months?

- Are your wallet firmware and software regularly updated?

Authentication Security Assessment

- Is two-factor authentication enabled on all marketplace accounts?

- Do you use hardware security keys for critical accounts?

- Are your passwords unique, complex, and managed with a secure password manager?

- Have you implemented multi-signature requirements for high-value transactions?

- Do you verify all transaction requests before signing?

Insurance Coverage Assessment

- Do you have specialized insurance for your NFT collection?

- Does your policy cover theft, phishing, and smart contract failures?

- Is your coverage limit appropriate for your collection’s value?

- Have you documented your collection with screenshots and transaction records?

- Do you understand the claim process and required evidence?

Get Your Complete Risk Assessment Tool

Download our comprehensive NFT security audit checklist with scoring system and personalized recommendations.

Emerging Solutions: Decentralized Insurance Pools

Beyond traditional insurance, the blockchain space is developing innovative decentralized insurance solutions that leverage the same technology that powers NFTs:

How Decentralized Insurance Works

Decentralized insurance pools operate through smart contracts where members contribute to a shared pool that pays out when verified claims occur. These systems use blockchain technology to automate claims processing and reduce overhead costs.

Key platforms in this space include:

- Nexus Mutual – Offers smart contract cover that can protect against technical failures in NFT contracts

- InsurAce – Provides protocol coverage that can extend to NFT marketplaces

- Bridge Mutual – Offers coverage for exchange hacks and stablecoin depegs

Advantages of Decentralized Insurance

- Lower premiums due to reduced overhead

- Automated claims processing through smart contracts

- Community governance allowing policy evolution

- No need for traditional underwriting

- Potential for coverage in areas traditional insurers avoid

Limitations of Decentralized Insurance

- Still emerging with limited track record

- Coverage caps may be lower than traditional insurance

- Claim verification can be technically complex

- Regulatory uncertainty in many jurisdictions

- Often requires cryptocurrency for premium payments

NFT Insurance vs. Physical Art Insurance: Understanding the Parallels

To better understand NFT insurance, it’s helpful to compare it with the well-established field of physical art insurance:

| Aspect | Physical Art Insurance | NFT Insurance |

| Valuation Method | Appraisals by certified art experts based on provenance, condition, and market comparables | Purchase price, recent sales of similar NFTs, creator reputation, and marketplace liquidity |

| Coverage Scope | Physical damage, theft, fire, water damage, transit damage | Wallet hacking, phishing attacks, smart contract failures, marketplace vulnerabilities |

| Documentation | Certificates of authenticity, provenance documents, condition reports, photographs | Transaction records, screenshots, wallet addresses, smart contract details |

| Security Requirements | Alarm systems, proper climate control, secure display methods, transportation protocols | Cold storage, multi-factor authentication, regular security audits, secure key management |

| Claim Process | Police reports, physical evidence, witness statements, condition documentation | Blockchain forensics, transaction logs, access records, digital evidence |

The key similarity is that both insurance types require proper documentation, security measures, and regular valuation updates. However, NFT insurance must address unique digital risks that have no physical equivalent.

Creating Your Comprehensive NFT Protection Strategy

Protecting valuable NFTs requires a multi-layered approach combining insurance coverage with robust security practices. As the market for NFT insurance continues to develop, collectors should:

- Assess your collection’s value and risk profile to determine appropriate insurance coverage needs

- Implement technical security measures including cold storage, multi-signature authentication, and regular security audits

- Document your collection thoroughly with transaction records, screenshots, and valuation information

- Stay informed about emerging threats and solutions in the rapidly evolving NFT security landscape

- Consider both traditional and decentralized insurance options to create comprehensive coverage

The NFT insurance market is still maturing, but proactive collectors who implement strong protection strategies now will be best positioned to safeguard their digital investments for the long term.

Secure Your Digital Collection Today

Our specialists can help you develop a comprehensive protection strategy tailored to your unique NFT portfolio.

No comments yet