Tired of trying to time the crypto market? Recurring cryptocurrency investments might be your answer. This strategy lets you invest a fixed amount at regular intervals, regardless of price fluctuations. Think of it as putting your crypto investing on autopilot. In this guide, we’ll walk through everything you need to know about setting up automated crypto purchases and implementing an effective dollar-cost averaging strategy.

Understanding Dollar-Cost Averaging in Cryptocurrency

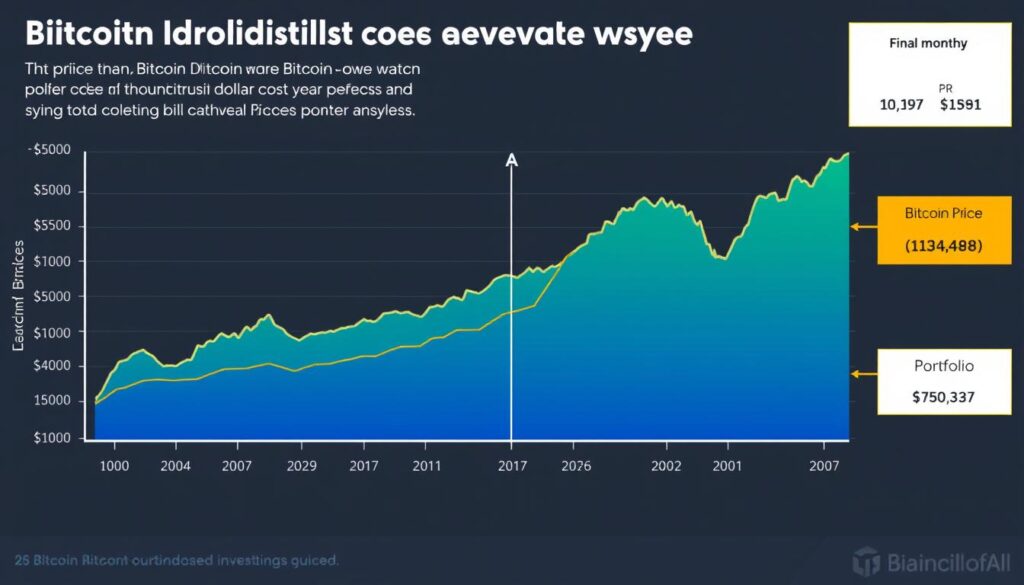

Dollar-cost averaging smooths out Bitcoin’s volatility compared to lump-sum investing

Dollar-cost averaging (DCA) is an investment strategy where you invest a fixed amount at regular intervals, regardless of the asset’s price. With cryptocurrency recurring investments, this approach helps mitigate the impact of volatility that’s common in crypto markets.

Why DCA Works for Cryptocurrency

Cryptocurrencies like Bitcoin and Ethereum are known for their price volatility. By spreading your purchases over time, you avoid the risk of investing all your money at a market peak. Instead, you buy more coins when prices are low and fewer when prices are high, potentially lowering your average cost per coin.

Research shows that investors who use DCA tend to stick with their investment plan during market downturns, rather than panic selling. This disciplined approach removes emotion from the equation and creates a sustainable investing habit.

“The best time to plant a tree was 20 years ago. The second best time is now. The same applies to cryptocurrency recurring investments.”

Benefits of Cryptocurrency Recurring Investments

Reduced Emotional Decision-Making

By automating your investments, you eliminate the stress of trying to time the market perfectly. This removes emotional decision-making from your investment strategy.

Lower Average Cost Potential

When prices drop, your fixed investment amount buys more cryptocurrency. Over time, this can result in a lower average purchase price compared to lump-sum investing.

Consistent Wealth Building

Regular investments help build your crypto portfolio steadily over time, regardless of market conditions. This consistency is key to long-term growth.

Simplified Investment Process

Once set up, recurring investments require minimal maintenance. This “set it and forget it” approach makes investing accessible even for busy individuals.

Reduced Timing Risk

By spreading purchases across time, you reduce the risk of investing all your funds at an inopportune moment, protecting against poor market timing.

Better Sleep at Night

With an automated strategy in place, you’ll worry less about daily price movements and focus more on long-term growth potential.

Ready to start your automated crypto journey?

Our free DCA calculator helps you plan your strategy and see potential results based on historical data.

Top Platforms for Cryptocurrency Recurring Investments

Several cryptocurrency exchanges and specialized platforms offer recurring buy features. Here’s how they compare:

| Platform | Minimum Investment | Supported Coins | Recurring Buy Fee | Withdrawal to Cold Wallet |

| Coinbase | $10 | 100+ | 1.49% + spread | Yes |

| Binance | $15 | 350+ | 0.5% + spread | Yes |

| Kraken | $20 | 65+ | 1.5% + spread | Yes |

| Swan Bitcoin | $10 | Bitcoin only | 0.99% | Yes (auto-withdrawal) |

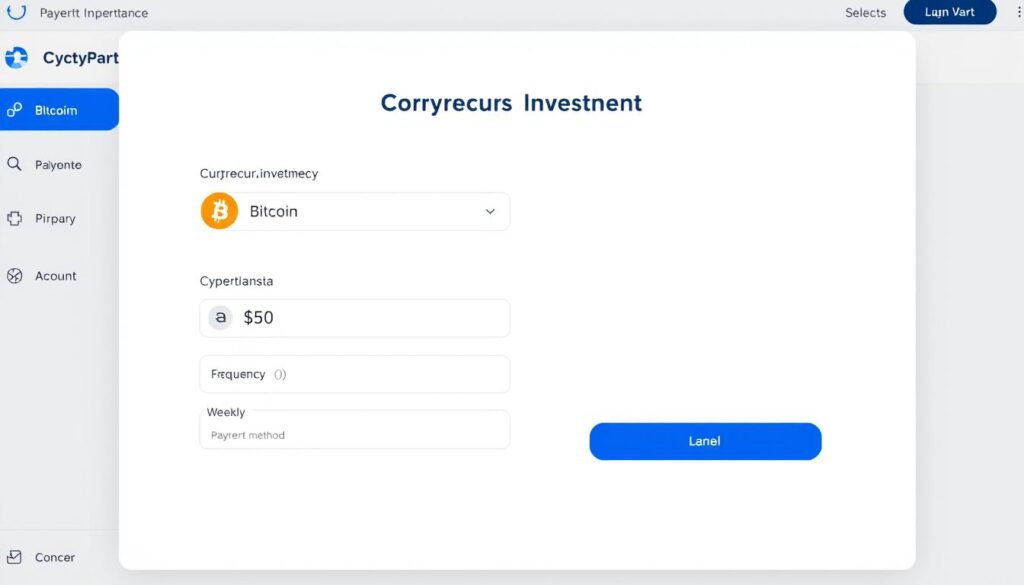

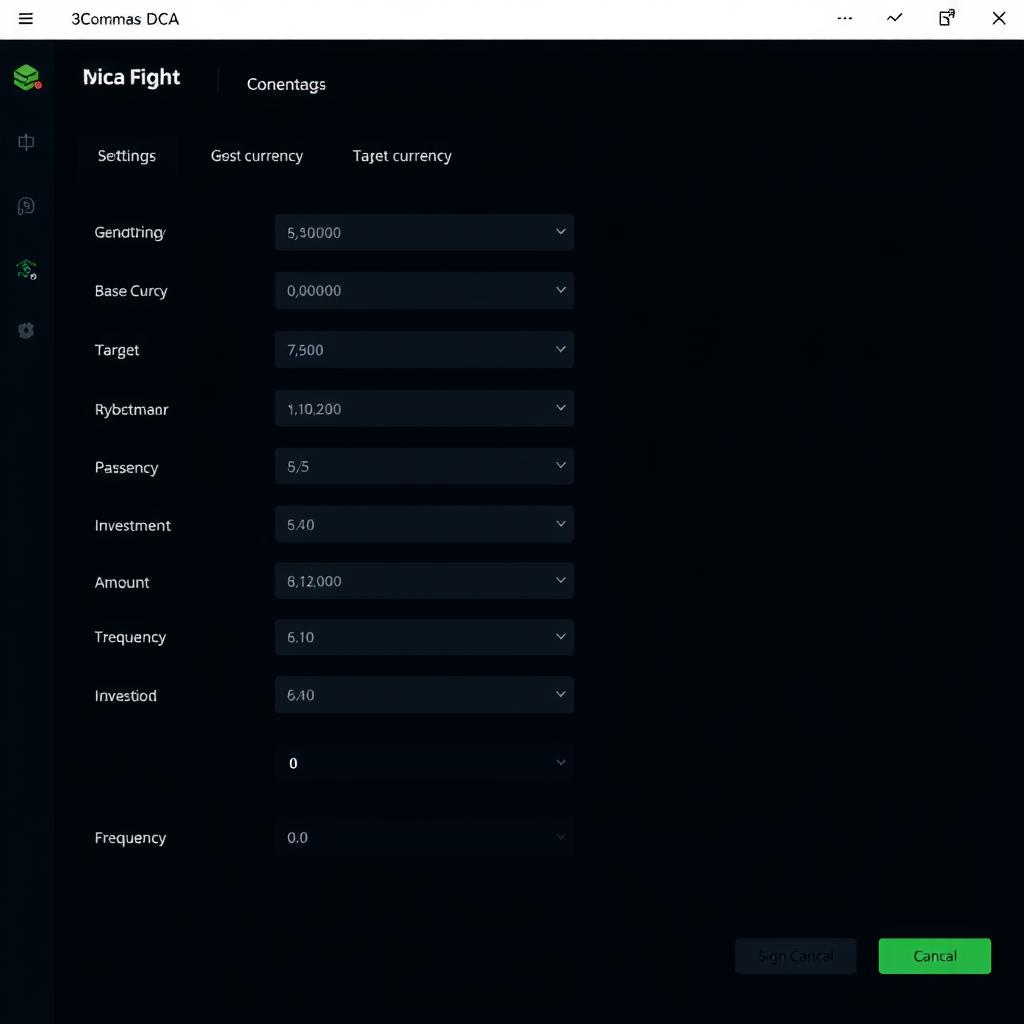

Example of a recurring investment setup page on a crypto exchange

Step-by-Step Guide to Setting Up Cryptocurrency Recurring Investments

Setting up recurring cryptocurrency investments is straightforward on most platforms. Here’s a general process that works across most exchanges:

- Choose a reputable exchange – Select a platform that supports recurring buys and offers the cryptocurrencies you’re interested in.

- Create and verify your account – Complete the registration process and verify your identity according to KYC requirements.

- Connect a payment method – Link your bank account, debit card, or other payment option to fund your purchases.

- Navigate to the recurring buy section – Look for “Recurring,” “Auto-invest,” or “DCA” in the platform’s menu.

- Select your cryptocurrency – Choose which digital asset(s) you want to purchase regularly.

- Set your investment amount – Decide how much you want to invest each period (e.g., $50 per week).

- Choose your frequency – Select daily, weekly, bi-weekly, or monthly investments.

- Review and confirm – Check all details and activate your recurring investment plan.

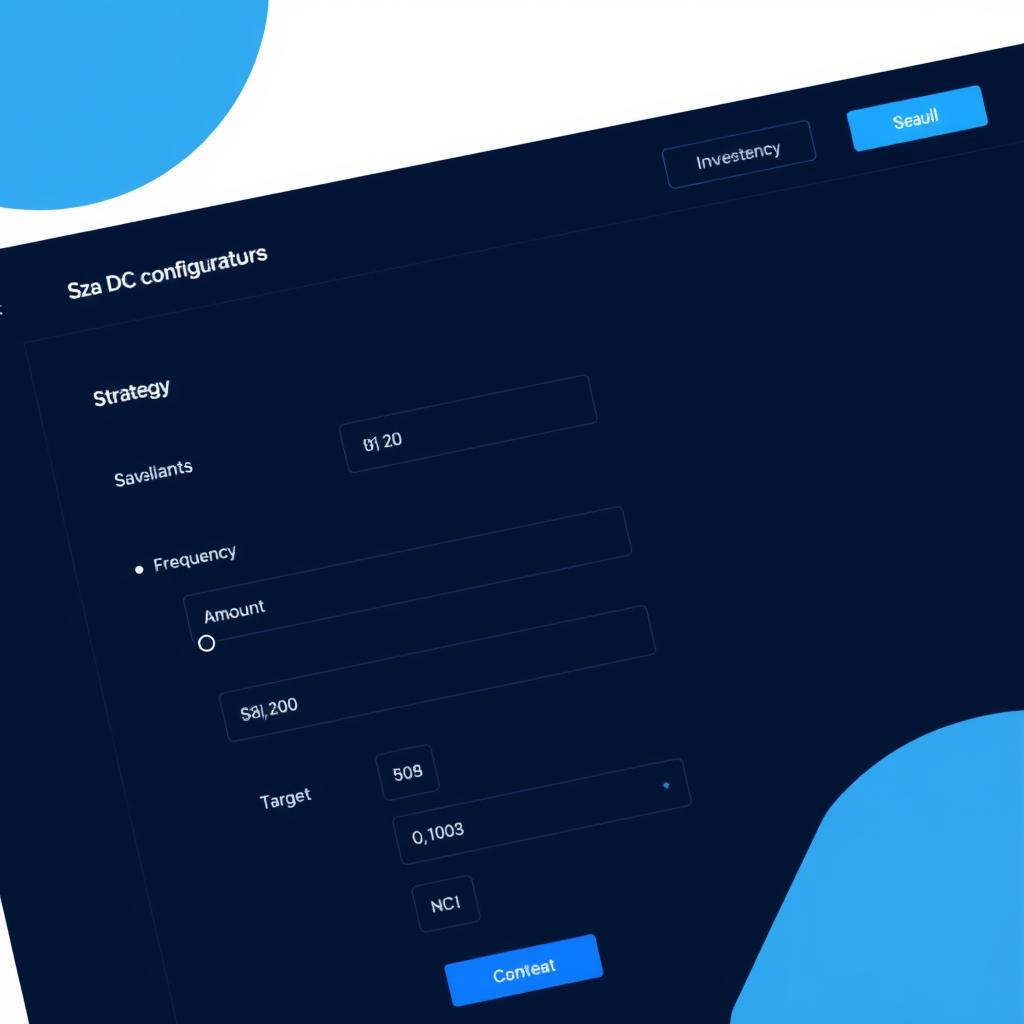

Setting up recurring crypto investments can be done easily from your smartphone

Platform-Specific Setup Instructions

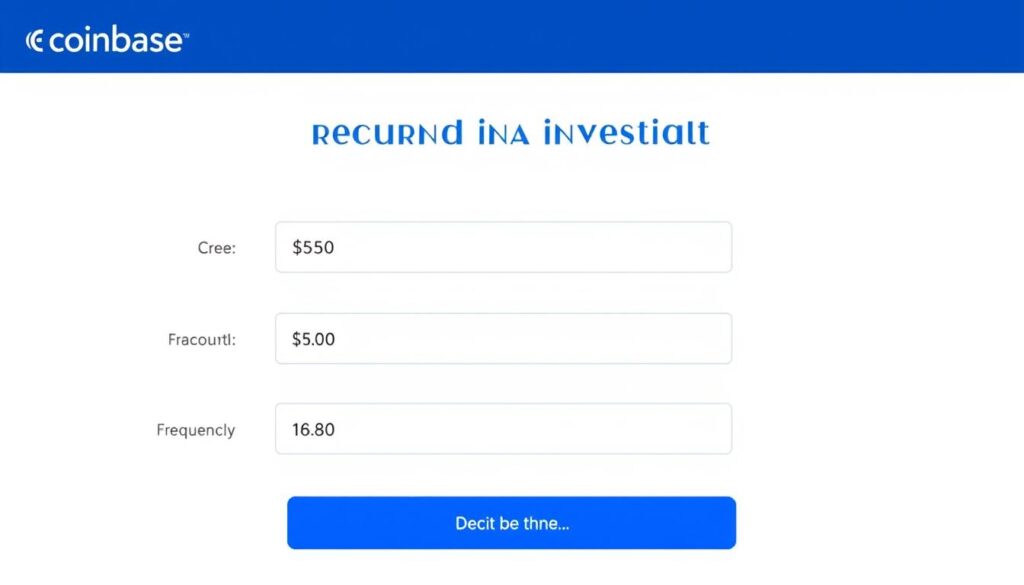

Coinbase

1. Log in to your Coinbase account and click “Trade” in the top navigation.

2. Select “Recurring” instead of “Buy once.”

3. Choose your cryptocurrency, amount, and frequency (daily, weekly, or monthly).

4. Select your payment method and confirm the setup.

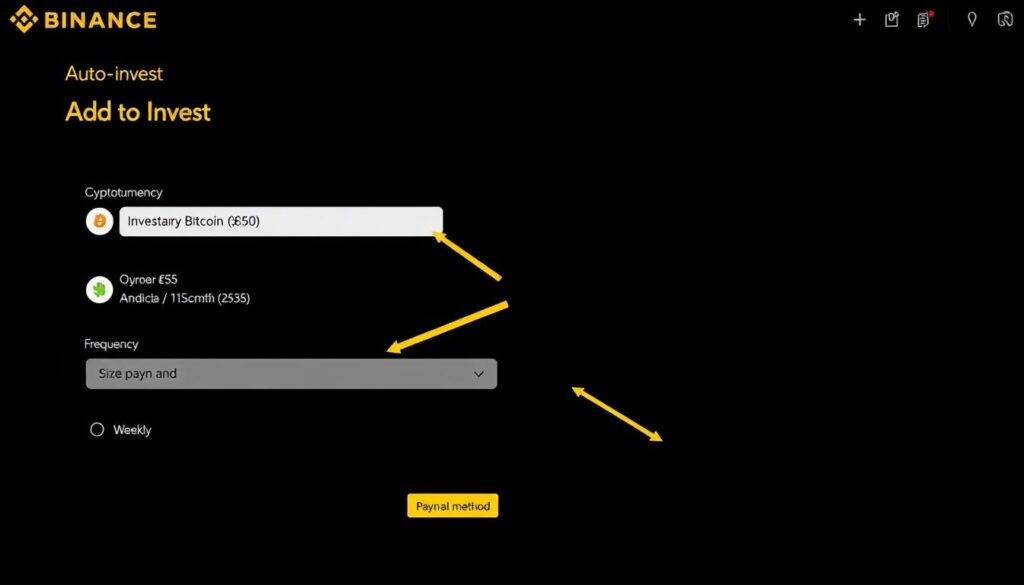

Binance

1. Navigate to “Earn” and select “Auto-Invest.”

2. Choose “Create a plan” and select your cryptocurrency.

3. Set your investment amount and frequency.

4. Review the details and click “Subscribe.”

Advanced Automation Tools for Cryptocurrency Recurring Investments

Beyond basic exchange features, several specialized tools can enhance your recurring investment strategy:

3Commas

3Commas offers advanced DCA bots that can execute more complex strategies, including grid trading and rebalancing alongside basic recurring buys.

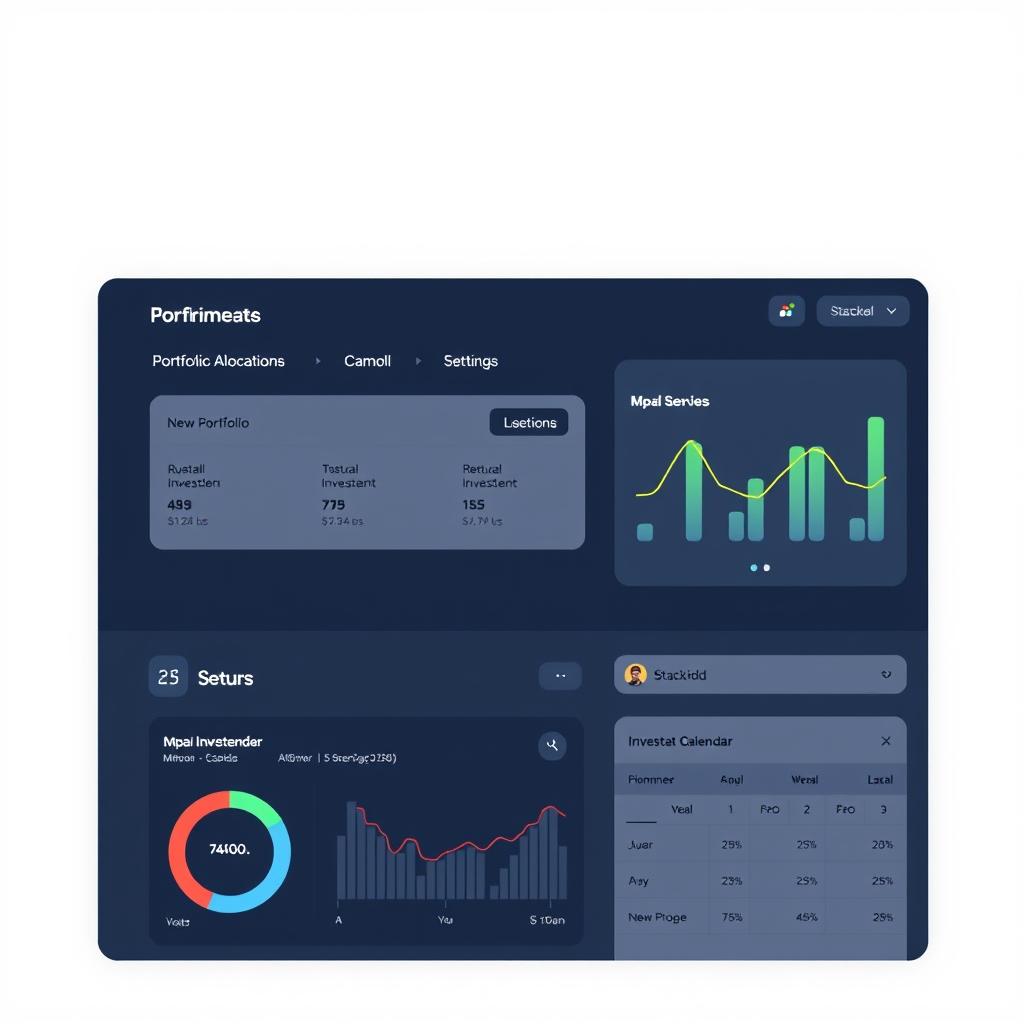

Stacked

Stacked combines portfolio management with automated investing features, allowing for more sophisticated recurring investment strategies across multiple assets.

Cryptohopper

Cryptohopper provides automated trading bots with DCA capabilities, allowing for customizable recurring investment schedules based on technical indicators.

Real-World Example: Bitcoin DCA vs. Lump Sum

12-month comparison of $12,000 invested as lump sum vs. $1,000 monthly DCA into Bitcoin

Let’s examine a real-world example of how cryptocurrency recurring investments performed compared to lump-sum investing:

| Investment Approach | Starting Amount | Final Value | Return | Maximum Drawdown |

| Lump Sum (January 2022) | $12,000 | $8,640 | -28% | -65% |

| Monthly DCA ($1,000/month) | $12,000 total | $10,920 | -9% | -25% |

In this example from the 2022 bear market, the DCA approach significantly outperformed the lump-sum strategy. By spreading investments throughout the year, the investor was able to purchase more Bitcoin at lower prices during market downturns, resulting in a better overall position despite the challenging market conditions.

While past performance doesn’t guarantee future results, this example illustrates how cryptocurrency recurring investments can help manage risk during volatile market periods.

Tax Implications and Security Considerations

Tax Considerations

Recurring cryptocurrency investments create multiple taxable events that must be tracked carefully:

- Each purchase establishes a new cost basis for that portion of your holdings

- You’ll need detailed records of all transactions for tax reporting

- Consider using crypto tax software like CoinTracker or Koinly to automate record-keeping

- Consult with a tax professional familiar with cryptocurrency regulations

Security Best Practices

Protect your recurring investments with these security measures:

- Enable two-factor authentication on all exchange accounts

- Consider transferring accumulated holdings to a cold wallet periodically

- Use unique, strong passwords for each platform

- Be cautious of phishing attempts targeting crypto investors

Regularly transfer your accumulated cryptocurrency to a hardware wallet for enhanced security

Troubleshooting Common Issues with Cryptocurrency Recurring Investments

What if my recurring payment fails due to insufficient funds?

Most platforms will attempt to notify you of the failed transaction. You’ll need to ensure adequate funds are available and manually initiate the missed investment if desired. Some platforms offer retry options or will automatically attempt the transaction again after a certain period.

How do I handle API connection issues with third-party automation tools?

If you’re using services like 3Commas or Cryptohopper and experience API connection problems:

- Check that your API keys have the correct permissions enabled

- Verify the API hasn’t expired or been revoked by the exchange

- Ensure the exchange isn’t experiencing downtime

- Contact the tool’s support team if issues persist

What happens if the cryptocurrency I’m investing in undergoes a fork?

During a blockchain fork, your recurring investment will typically continue purchasing the main chain’s token. If you want exposure to both chains after a fork, you may need to set up a separate recurring investment for the new token or adjust your existing plan.

How do I modify or cancel my recurring investment plan?

Most platforms allow you to modify or cancel your recurring investments through the same section where you set them up. Look for “Manage recurring investments,” “Recurring buys,” or similar options in your account settings. Changes typically take effect before the next scheduled transaction.

Example of a failed recurring payment notification with troubleshooting options

Getting Started with Your Cryptocurrency Recurring Investment Strategy

Implementing cryptocurrency recurring investments is one of the most effective ways to build a digital asset portfolio while managing volatility risk. By automating your purchases and taking advantage of dollar-cost averaging, you remove emotion from the equation and establish a disciplined approach to crypto investing.

Advantages

- Reduces impact of market volatility

- Creates a disciplined investing habit

- Eliminates the stress of timing the market

- Builds your portfolio gradually over time

- Works well in both bull and bear markets

Considerations

- May underperform lump-sum in strong bull markets

- Requires tracking multiple purchase points for taxes

- Transaction fees can add up over time

- Needs periodic review and adjustment

- Should be part of a broader investment strategy

Regular review of your cryptocurrency recurring investment performance helps optimize your strategy

Ready to start your automated crypto investment journey?

Download our free DCA calculator to plan your strategy and see potential results based on historical data.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments are subject to high market risk. Please conduct your own research and consider your financial situation before investing.

No comments yet