The global market for blockchain-based assets has exploded, surpassing $20 billion in 2025. Analysts predict it could grow tenfold by 2030, driven by evolving ownership models and cultural shifts. This growth isn’t limited to static images—creative works now include music, virtual spaces, and even intellectual property rights.

Blockchain technology has redefined how creators and enthusiasts interact. Transactions now carry immutable proof of authenticity, eliminating doubts about originality. This system benefits both emerging artists and established collectors by creating transparent, accessible opportunities.

Modern platforms offer more than sales—they’re hubs for community building and cultural exchange. Unlike traditional galleries, these spaces operate 24/7, letting users engage across time zones. The shift toward digital ownership also opens doors for fractional investments and dynamic portfolio strategies.

Key Takeaways

- Global blockchain asset markets could exceed $211 billion by 2030

- Secure verification systems protect creators and buyers

- New platforms blend commerce with cultural participation

- 24/7 access enables real-time global transactions

- Strategic platform selection impacts collection value

This guide explores how to identify platforms that align with your goals, prioritize security, and leverage emerging trends. Whether you’re preserving cultural artifacts or building an innovative portfolio, understanding this landscape is essential.

Introduction to Digital Art and NFT Marketplaces

The creative world shifted dramatically when blockchain introduced provable ownership to intangible works. While traditional art relies on physical certificates, digital files now carry embedded authenticity through tokenization. This breakthrough solved a decades-old problem: distinguishing originals from infinite copies.

Modern creators leverage this technology to monetize their work in groundbreaking ways. Artists receive automatic royalties through smart contracts whenever their pieces resell—a feature absent in conventional art markets. Collectors gain access to verifiable histories, ensuring they support genuine creators rather than imitators.

These platforms break down barriers that once limited artistic exposure. A painter in Nairobi can now reach buyers in New York without gallery representation. Formats have expanded beyond static images to include:

- 3D animations with interactive elements

- Algorithm-generated patterns that evolve over time

- Multi-layered compositions viewable in virtual reality

The leading platforms offer advanced discovery tools, letting enthusiasts filter works by style, artist reputation, or cultural movement. Built-in social features foster direct connections between makers and their audiences, transforming passive buyers into active community members.

As ownership models evolve, so do investment strategies. Some collectors focus on emerging talents, while others seek pieces that reflect technological innovation. This diversity creates a dynamic ecosystem where creativity and commerce intersect seamlessly.

Understanding NFTs and Their Impact on Digital Art

Ownership of creative works faced a revolution when blockchain introduced unique identifiers to digital files. Unlike traditional certificates, these tokens embed proof directly into non-interchangeable assets, solving duplication issues that plagued artists for decades.

Key Characteristics and Unique Attributes

Each token carries an unalterable code, making it distinct from others. This verifiable scarcity transforms how we value online creations. Blockchain records every transfer, creating permanent histories for collectibles.

Smart contracts automate royalty payments, ensuring creators earn from resales. This system empowers makers while giving buyers confidence in authenticity. It’s a win-win model reshaping creative economies.

From Experimental Beginnings to Cultural Shifts

Early projects like Colored Coins (2012) tested tokenization concepts. The 2017 launch of CryptoKitties proved blockchain could support rare digital items. That same year, CryptoPunks introduced algorithmically generated characters.

Everything changed in 2021. Beeple’s $69 million Christie’s auction shattered perceptions about digital worth. Major institutions began recognizing tokenized works as legitimate art pieces.

Today’s landscape blends technology with culture. Royalty structures support sustainable careers, while transparent records build trust. This evolution continues unlocking possibilities for creators worldwide.

Best NFT Marketplaces for Digital Art Collectors

Collectors today navigate a vibrant ecosystem of platforms tailored to different artistic and financial goals. Since 2017, OpenSea has dominated as the most versatile venue, supporting Ethereum, Polygon, and Klaytn blockchains. Its zero upfront costs for creators and credit card compatibility make it ideal for newcomers and seasoned enthusiasts alike.

Rarible takes a democratic approach with community-led governance and adjustable fees between 2.5% and 15%. This structure empowers users to influence platform updates while accommodating varied budget ranges. The integrated minting tools simplify turning digital files into tradeable assets.

Emerging players like Magic Eden focus on niche blockchain ecosystems, offering curated selections for targeted audiences. Meanwhile, LooksRare and Blur attract active traders through reduced transaction costs and advanced analytics dashboards. These platforms prioritize speed and data-driven decision-making.

Key differentiators include:

- Blockchain compatibility affecting transaction speeds

- Fee models balancing creator profits and buyer costs

- Governance systems shaping platform evolution

Savvy collectors often use multiple venues to access exclusive drops and diverse artistic styles. While established names provide stability, newer entrants foster innovation through experimental features. This dynamic landscape ensures options for every acquisition strategy.

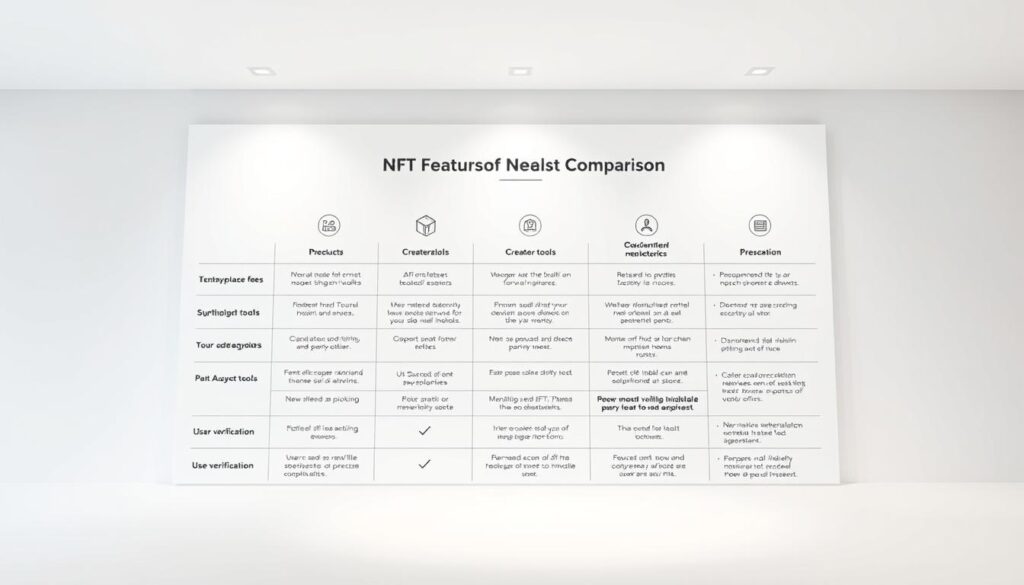

Key Features to Consider When Selecting an NFT Marketplace

Choosing where to buy or sell requires understanding how technical and financial factors shape your experience. Hidden costs and network limitations can turn a promising platform into a costly trap. Let’s break down critical elements that determine value and functionality.

Platform Fees, Gas Costs, and Commission Structures

Transaction expenses vary wildly across venues. OpenSea charges a flat 2.5% fee per sale, while Rarible allows adjustable rates between 2.5% and 15%. Blur stands out with zero platform fees, attracting high-volume traders.

Gas fees—the cost to process blockchain actions—depend on network congestion. Ethereum often costs $10-$50 per transaction during peak times. Alternatives like Polygon reduce this to pennies, making them ideal for frequent trades.

| Platform | Commission | Blockchain | Gas Cost Range |

|---|---|---|---|

| OpenSea | 2.5% | Ethereum/Polygon | $1.50-$50 |

| Rarible | 2.5-15% | Ethereum/Flow | $5-$70 |

| Blur | 0% | Ethereum | $8-$45 |

Blockchain Technology and Smart Contract Integration

Ethereum remains the dominant network due to its robust security and ERC721 standard. This protocol ensures assets can’t be duplicated or altered. Newer chains like Solana offer faster transactions but lack Ethereum’s ecosystem depth.

Smart contracts automate royalty payments and ownership transfers. Platforms using outdated systems risk delayed settlements or security gaps. Always verify if a venue supports automated creator payouts and multi-chain compatibility.

Top NFT Platforms Revolutionizing Digital Art Transactions

The sector has transformed through platforms prioritizing user empowerment and technical flexibility. Venues now compete through unique value propositions rather than just transaction volume, reshaping how creative works exchange hands globally.

Breaking Down Leading Transaction Hubs

OpenSea remains dominant with Ethereum, Polygon, and Klaytn blockchain compatibility. Its credit card integration bridges traditional finance with tokenized assets, lowering entry barriers. Rarible counters with adjustable 2.5-15% fees and decentralized governance via $RARI token voting.

| Platform | Blockchains | Fees | Standout Feature |

|---|---|---|---|

| OpenSea | 3+ | 2.5% | Fiat payments |

| Rarible | 2 | Adjustable | DAO governance |

| Magic Eden | Solana | 2% | Curated collections |

| Blur | Ethereum | 0% | Pro trading tools |

Reward Systems Reshaping Engagement

Modern venues foster loyalty through token distributions and governance rights. LooksRare awards $LOOKS tokens for listing items, while Blur offers airdrops to active traders. These models turn casual users into stakeholders invested in platform growth.

Royalty enforcement tools help creators earn sustained income. Magic Eden’s customizable percentages and automatic payouts address historical payment gaps in creative industries. Such features make these investment platforms vital for artists building long-term careers.

Emerging players target niche audiences through specialized curation. Platforms now host virtual galleries and AI-driven recommendation engines, creating tailored discovery experiences. This shift from generic marketplaces to purpose-built ecosystems marks the next evolution in digital ownership.

NFT Marketplaces with Innovative Tools for Artists and Collectors

Modern blockchain venues now prioritize sustainable careers for makers. Built-in royalty systems let artists earn 2.5-10% from every resale automatically. This ongoing income model replaces one-time payments common in traditional sectors.

Smart Contracts as Career Catalysts

Automated agreements ensure fair compensation without intermediaries. One painter reported earning $12,000 monthly from secondary sales alone. These tools let creators focus on their craft rather than chasing payments.

Minting processes have become accessible through drag-and-drop interfaces. Gas-free options reduce upfront costs, while batch uploads save hours during creation. Emerging platforms even offer AI-powered marketing to spotlight new talent.

Support features now include mentorship programs and collector analytics. Such resources help artists refine their strategies while building loyal audiences. This ecosystem turns fleeting sales into lasting professional relationships.

No comments yet