Interoperability lets ledgers share data, move value, and talk natively. This removes digital silos for enterprises and creates smoother multi-chain experiences across finance and commerce.

Market momentum is clear: the sector is set to grow from $650 million in 2024 to $7.90 billion by 2034 at a 28.30% CAGR. More than 70% of U.S. financial firms are exploring interoperable stacks, and some report up to 80% cost savings on cross-border payments versus legacy rails.

Readers will get practical guidance on architecture choices—bridges, relay chains, IBC zones, sidechains, and Layer 2—plus integration patterns for legacy systems. Expect notes on protocol selection, security best practices like HSM-backed keys and multisig, and regulatory readiness for U.S. rules.

Finally, learn how emerging intelligence tools help route transactions, predict congestion, and optimize fees to improve ROI, liquidity, and operational resilience across the multi-chain ecosystem.

Key Takeaways

- Interoperability enables native exchange of data and value across ledgers.

- Market growth is rapid—major adoption by financial institutions is underway.

- Enterprise architectures include relay chains, IBC, bridges, and Layer 2 options.

- Security and U.S. regulatory readiness are critical design factors.

- Intelligent routing and analytics cut costs and boost performance.

What Blockchain Interoperability Means Today

Interoperability ties messaging, value transfer, and shared state proofs so enterprises can run unified workflows across ledgers and partners. It enables companies to collaborate without intermediaries, supporting seamless data sharing and movement of assets across platforms.

Without it, each chain’s consensus rules, data models, and governance create the “island problem” that traps assets and fragments records. That leads to duplicated processes, manual reconciliation, and slower time-to-value for cross-enterprise projects.

How it works and the main trade-offs

- Scope: message passing, value transfer, and cryptographic proofs between ledgers support unified business flows.

- Design gaps: differing consensus, data structures, and runtimes make native cross-chain communication non-trivial.

- Spectrum: ad hoc bridges can be quick pilots; protocol-native channels like IBC or Relay Chain approaches verify proofs and reduce operational risk.

- Enterprise gains: better availability of shared datasets for analytics, compliance, and ESG reporting.

Governance complexity, cross-domain security, and performance are the key challenges to address as systems evolve from pilots to production-grade networks.

Why Interoperability Matters for U.S. Enterprises

For U.S. enterprises, native cross-ledger exchange turns slow, manual workflows into real-time processes that scale. This boosts operational efficiency, trims costs, and makes seamless data exchange possible across partners and geographies.

Operational efficiency, cost reduction, and seamless data exchange

Seamless data exchange across networks reduces manual reconciliations, accelerates settlements, and lowers error rates in enterprise operations.

Firms adopting interoperable stacks report up to 80% transaction cost reductions for cross-border payments versus legacy rails. That drives treasury savings and better cash flow visibility.

Competitive advantage in finance, supply chain, healthcare, and retail

- Finance: access to broader liquidity, cross-market instruments, and integrated compliance reporting.

- Supply chain: unified track-and-trace across permissioned and public chains, faster vendor onboarding, and fewer disputes.

- Healthcare: permissioned sharing links hospital records with research and device data while preserving auditability and HIPAA-aligned controls.

- Retail: interoperable loyalty points, tokenized promotions, and asset portability to boost retention.

| Use case | Primary KPI | Impact | Notes |

|---|---|---|---|

| Cross-border payments | Transaction cost | Up to 80% reduction | Treasury and FX savings |

| Supply chain traceability | Settlement time | Reduced by days | Better ESG data consolidation |

| Healthcare data sharing | Data discrepancies | Fewer errors | Permissioned access, audit trails |

Market Snapshot and Growth Signals at the Present Time

Current metrics point to a turning point: the interoperability market stood at $650M in 2024 and is forecast to reach $7.90B by 2034 at a 28.30% CAGR. That ramp signals rising demand for production-grade stacks across industries, not just experimental pilots.

Why this matters: rising capital, enterprise procurement, and protocol roadmaps shorten the timeline from lab to live. Over 70% of U.S. finance firms are exploring adoption, and many evaluate tokenization, CBDC readiness, and ESG reporting as near-term drivers.

Key growth indicators to watch

- Liquidity and TVL: Cosmos IBC shows $2.35B TVL across 115+ connected networks vs. Polkadot’s $196M, highlighting different adoption profiles.

- Protocol progress: Polkadot advancing XCMP from HRMP affects messaging efficiency and enterprise timelines.

- Operational expectations: buyers now seek SLA-backed services, better observability, and multi-year platform agreements.

- Tooling and cost: adaptive routing and fee optimization using machine learning reduce congestion risk and total cost of ownership.

For businesses evaluating a future blockchain strategy, these market signals favor modular architectures that integrate with existing IT. Teams should weigh TVL, developer traction, and roadmap maturity when choosing between build and buy.

Key Challenges Blocking Cross-Chain Communication

A key roadblock for multi-ledger work is that old enterprise systems were never built to exchange signed proofs or event streams with new ledgers. This gap slows adoption and raises integration costs.

Legacy cores, throughput ceilings, and settlement delays

Many enterprises run aging ERP and bespoke middleware that limit standardized cross-domain messaging. Custom adapters add time and budget to every rollout.

Throughput caps—Ethereum’s ~15 TPS baseline, for example—worsen when cross-chain confirmations stack. That pushes settlement from minutes to hours and strains SLAs.

Data models, consensus diversity, and language fragmentation

Heterogeneous data schemas and incompatible serialization demand robust mapping and validation pipelines. That increases testing and audit scope.

Differences in consensus mechanisms and finality assumptions make cross-domain settlement guarantees complex. Smart contract language fragmentation adds tooling gaps.

- Operational risks: managing multiple transactions, proofs, and connectors raises failure and security vectors.

- Mitigations: adopt idempotent operations, retries, and compensating transactions to preserve consistency.

- Visibility: require observability across app, protocol, and infra layers before production rollout.

| Challenge | Impact | Recommended action |

|---|---|---|

| Aging systems & custom APIs | Slow integration, higher costs | Phased modernization, API gateways |

| Throughput & cross confirmations | Latency, missed SLAs | Batching, Layer 2, adaptive routing |

| Schema and language mismatch | Validation failures, audit risk | Mapping pipelines, standardized contracts |

Regulatory and Compliance Drivers in the United States

Regulatory change is now a core design factor for any enterprise rolling assets across various ledgers and providers. Firms must map reporting, custody, and license risks when assets cross state and federal boundaries.

Evolving federal and state rules

The SEC’s shifting views on token classification affect issuance, custody, and secondary transfers across networks. FinCEN enforces BSA thresholds such as the $10,000 reporting trigger, which may require policy controls for automated transfers.

State regimes like New York’s BitLicense can apply differently to multi-party flows. Enterprises should model obligations across jurisdictions and partners to avoid gaps in compliance.

Designing KYC/AML, audit trails, and vendor controls

Legacy monitoring tools often fail to correlate addresses and entities across chains. Build unified KYC/AML services and standardized, tamper-evident logs that enrich data with cross-chain provenance and risk scores.

Security and segregation of duties matter: role-based access, HSM-backed keys, and deterministic event records simplify regulator-ready reporting.

| Driver | Impact | Recommended action |

|---|---|---|

| SEC token guidance | Classification risk for issuers and custodians | Legal review; custody controls; recordable event logs |

| FinCEN / BSA ($10,000) | Reporting triggers for programmatic transfers | Policy controls, threshold checks, automated alerts |

| State licenses (BitLicense) | Multi-state operational obligations | Vendor due diligence; license mapping; contract clauses |

For practical integration patterns and vendor assessments, see blockchain interoperability guidance that aligns compliance and technical design.

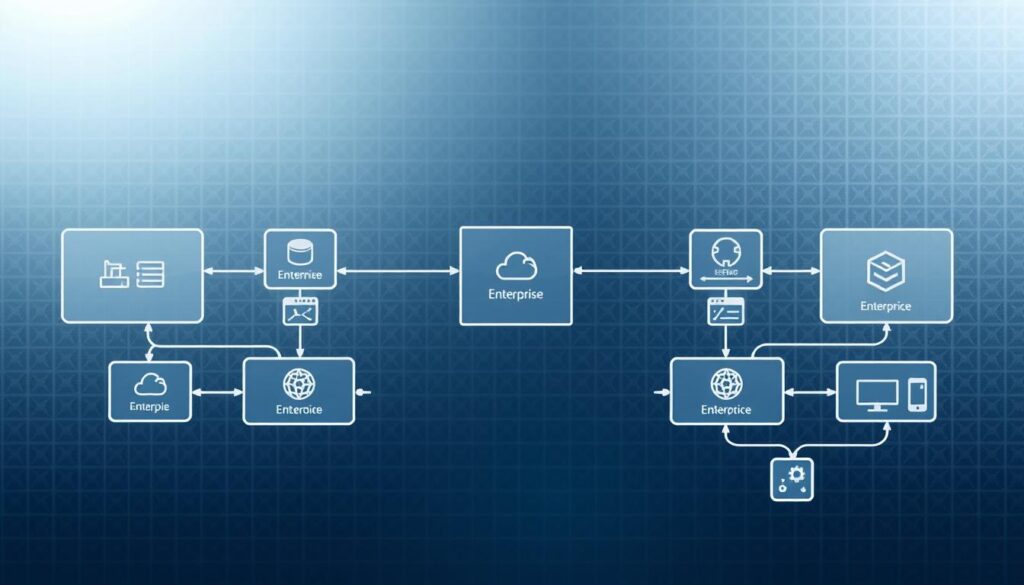

Architectural Patterns: Bridges, Sidechains, Relay Chains, and IBC

Design choices shape where trust, cost, and performance live. Compare liquidity reach, throughput goals, and concentrated risk before selecting an approach.

Bridge trade-offs

Bridges lock assets on one chain and mint wrapped tokens on another to enable liquidity. That model is fast to deploy but creates high-value targets at locking contracts, validators, or multisig custodians.

Relay chain vs. sovereign zones

A relay chain centralizes shared security and coordination for parachains, simplifying cross-chain communication and recovery. By contrast, sovereign zones use inter-blockchain communication with lightweight clients, proofs, and packet routing to preserve zone autonomy.

Sidechains and Layer 2

Sidechains and Layer 2s offload transactions and batch-settle to mainnets. They isolate execution for gaming or payments while using two-way pegs to move value.

Operational and security checklist: formal verification, robust security audits, relayer incident plans, governance cadence, and tooling maturity.

| Pattern | Primary benefit | Key risk |

|---|---|---|

| Bridge | Fast liquidity across networks | Concentrated attack surface at locks |

| Relay Chain | Shared security, unified messaging | Central coordination limits sovereignty |

| IBC / Sovereign Zones | Zone autonomy, proof-based packets | Complex UX and client sync |

| Sidechain / L2 | High TPS, specialized workloads | Challenge in finality and recovery |

Evaluating Leading Interoperability Protocols and Stacks

Choose a protocol by matching its trust model, throughput, and governance to your workload and compliance needs.

Polkadot: shared security and relay chain trade-offs

Polkadot’s relay chain offers shared security for parachains, so enterprises rarely need to run full validator sets. Tests in late 2024 showed theoretical throughput across connected chains reaching up to 140,000 transactions per second.

XCMP is still rolling out. HRMP remains a practical interim for cross -chain messaging but has lower efficiency and higher latency.

Cosmos: sovereign zones and inter-blockchain communication

Cosmos prioritizes sovereignty via inter-blockchain communication (IBC). IBC is production-ready and connects 115+ networks with about $2.35B TVL and strong user counts by mid-2025.

Golang-based Cosmos SDK often yields faster time-to-market compared with Rust/Substrate customization work.

Enterprise-focused stacks and developer experience

Basel Protocol and Hyperlane target enterprise integration, offering configurable security and connectors to directory services and policy engines.

Developer choice matters: Rust/Substrate gives deep control and performance tuning. Golang/Cosmos SDK favors modular builds and developer productivity.

| Feature | Polkadot | Cosmos |

|---|---|---|

| Security model | Relay chain shared security | Chain sovereignty (IBC) |

| Messaging status | XCMP rolling out; HRMP interim | IBC production-ready |

| TVL / ecosystem | $196M; growing | $2.35B; 115+ networks |

- Decision cues: use TVL, network count, and developer skills to assess maturity and TCO.

- Operational: weigh validator choice, monitoring needs, and SLA requirements.

- Workloads: map throughput and latency needs to each stack’s performance profile.

Implementing Interoperability in Enterprise Systems

A structured discovery of use cases, transaction volumes, and regulatory boundaries drives sensible architecture choices.

Assessing scope and skills

Start by cataloging target geographies, peak volumes, and compliance requirements. This helps teams choose patterns that fit cost and risk profiles.

Include a skills inventory and training plan tied to protocols, client libraries, and DevSecOps. Advisory services can bridge gaps during early rollouts.

Integration patterns and data flows

Use API gateways for ingress/egress control and ESBs for transformation and routing. Event-driven architectures with message queues enforce at-least-once delivery and idempotency.

Build canonical data models and mapping pipelines to keep seamless data integrity across systems and applications.

Monitoring, SLAs, and runbooks

Traditional tools miss cross-domain traces. Deploy observability that correlates on-chain events with off-chain logs, traces, and metrics.

Align SLAs end-to-end—include relayers, bridge operators, and custodial services—and add alerting for latency and failure thresholds.

| Area | Recommended action | Benefit |

|---|---|---|

| API / ESB | Gateway auth, routing, transformation | Consistent data formats; fewer integration errors |

| Event bus | Queues, retries, backpressure handling | Reliable cross-chain communication and reduced duplication |

| Observability | Correlated traces and alerts | Faster incident detection; SLA adherence |

| Org & security | CoE, product owners, token-based auth, secrets rotation | Scalable operations and stronger security posture |

Roll out iteratively with canary routes, feature flags, and rollback plans to limit blast radius and refine workflows.

Security and Risk Management Across Different Blockchain Networks

Strong security for cross-chain workflows begins with identity and key models that separate duties and create clear audit trails.

Identity, key management, and multi-signature controls with HSMs

Separate initiation, signing, and release so no single actor can move high-value assets without cryptographic attestation.

Use HSM-backed custody and quorum-based multisig for signing. Add rotation schedules and break-glass procedures for emergency access.

Smart contract audit depth for cross-chain pathways and HTLCs

Cross-chain smart contract flows, HTLC logic, and oracle links have complex state dependencies. Require deeper audits, formal verification, and focused fuzz testing.

Include threat models for failure modes, reorgs, and delayed finality during reviews.

Standardizing controls across heterogeneous consensus mechanisms

Different consensus mechanisms affect finality and recovery. Standardize logging, monitoring, and incident playbooks that map to each chain’s guarantees.

- Apply risk-based transaction limits and anomaly detection.

- Encrypt data in transit and at rest with tamper-evident audit trails.

- Run red teams, tabletop exercises, and cross-chain outage simulations.

- Vet vendors—bridges, relayers, RPC and custody—with SLAs and third-party attestations.

| Control Area | Recommended Action | Benefit |

|---|---|---|

| Key custody | HSMs, multisig, rotation, break-glass | Reduced single-point compromise |

| Contract assurance | Formal verification, deep audits, bug bounties | Fewer exploitable logic errors |

| Operational response | Incident runbooks, monitoring, SLAs | Faster containment and recovery |

For aligned thinking on token risks and routing impact, see AI token potential.

artificial intelligence blockchain interoperability solutions

Adaptive routing layers use live mempool feeds and fee curves to shape multi-chain throughput efficiently.

AI-driven routing: predicting congestion and optimizing fees and throughput

Models ingest mempool signals, historical latency, and fee dynamics to pick cost-effective paths for transactions. Reinforcement learning updates routing policies as network conditions shift.

Practical effects: lower fees, fewer failed transfers, and higher effective throughput across connected ledgers.

ESG reporting, CBDC preparedness, and tokenization use cases enhanced by AI

AI unifies disparate ESG data fields, flags anomalies, and prepares audit-ready reports for regulators and stakeholders.

For CBDC readiness, models run compliance checks and select corridors that meet jurisdictional rules. Tokenization workflows use risk scoring and liquidity routing to prioritize asset moves and reduce slippage.

- Ingest: mempool, fee curves, latency, TVL, and relayer health metrics.

- Learn: reinforcement approaches to adapt routing and batching strategies.

- Govern: drift detection, validation, and secure CI/CD for model deployment.

- Operate: co-pilot apps for alerts, root-cause analysis, and automated remediation.

| Capability | Benefit | Operational note |

|---|---|---|

| Predictive routing | Lower fees, fewer retries | Requires mempool and fee telemetry |

| ESG data unification | Audit-ready reporting | Map schemas and keep tamper-evident logs |

| CBDC corridor checks | Compliance-first routing | Embed jurisdictional rules in policy engine |

| Asset prioritization | Maximized liquidity, reduced slippage | Integrate price-impact models and pools |

Security note: protect model inputs and outputs from manipulation. Validate feeds, monitor for adversarial patterns, and include governance controls for any automated routing that moves assets.

Adoption blueprint: pilot with fee optimization, extend to routing, then broaden to full-stack observability and ops co-pilots. Start small, measure ROI, and harden model risk management before scaling.

From Use Cases to ROI: Finance, Supply Chain, and Beyond

Concrete business examples show how cross-ledger flows cut costs and unlock new revenue for finance, supply chain, and retail teams.

DeFi and cross-border payments

Enterprises report up to 80% lower costs for cross-border payments using interoperable networks versus legacy rails. That brings faster settlement, clearer counterparty visibility, and measurable treasury savings.

Supply chain traceability and data sharing

Manufacturers notarize events on permissioned ledgers and anchor proofs to public chains for independent verification. This hybrid model enables secure data sharing across partners while reducing disputes and stockouts.

Healthcare and retail applications

Permissioned data flows let providers share records with privacy-preserving access controls, accelerating research and care coordination.

Retail programs use portable loyalty points and tokenized assets to boost redemption rates and customer lifetime value.

- KPIs: fewer disputes, reduced compliance overhead, and improved inventory uptime.

- Ecosystem effect: interoperable applications attract partners and expand network value for businesses.

- Security note: apply robust security for tokenized assets and pick chains by latency, fees, and jurisdictional fit.

| Use case | Primary KPI | Impact |

|---|---|---|

| Finance | Transaction cost | Up to 80% reduction |

| Supply chain | Settlement time | Improved traceability, fewer stockouts |

| Healthcare / Retail | Data sharing & redemption | Faster collaboration; higher CLV |

Roadmap: start with targeted pilots, measure ROI, then scale with governance, risk controls, and performance benchmarks to move from proof-of-concept to enterprise-grade deployments.

Charting Your Interoperability Roadmap Forward

Start with a focused corridor that delivers quick ROI and builds operational confidence for broader rollouts.

Define a phased roadmap: discovery, protocol selection, integration blueprinting, pilot execution, and controlled scale-up. Align chosen protocols to business needs and regulatory posture, documenting trade-offs so teams can compare options.

Specify reference architectures for systems integration and event-driven communication. Embed security baselines—HSM-backed keys, multisig, and deep contract audits—into CI/CD and observability plans.

Measure KPIs like settlement time, reconciliation effort, failure rate, and cost-to-serve. Start with high-ROI corridors, validate controls with advisors, and iterate outward while keeping compliance and resilience front of mind.

No comments yet