Navigating the fast-moving world of digital assets requires sharp tools. For traders, recognizing key formations on a chart is a fundamental skill. One of the most trusted signals for a potential trend change is a specific reversal formation.

This guide focuses on the head and shoulders chart patterns. Many experts consider it one of the most reliable and easy-to-identify formations in technical analysis.

It provides clear visual cues when a bullish trend may be losing steam. This allows you to spot opportunities for when a bearish move might begin.

The real power of this setup lies in its practicality. It offers defined points for entry, stop-loss placement, and profit targets. This makes it incredibly useful for building a solid trading plan.

Mastering this concept can significantly improve your market timing and decision-making. This is especially true in the volatile crypto space, where assets trade around the clock.

Whether you are new to the markets or have experience, understanding this powerful pattern is a valuable addition to your strategy.

Introduction to the Head and Shoulders Pattern

Among the most dependable signals in market analysis is a distinctive three-peak formation. This setup has proven valuable across various financial instruments over many decades.

Overview of the Pattern

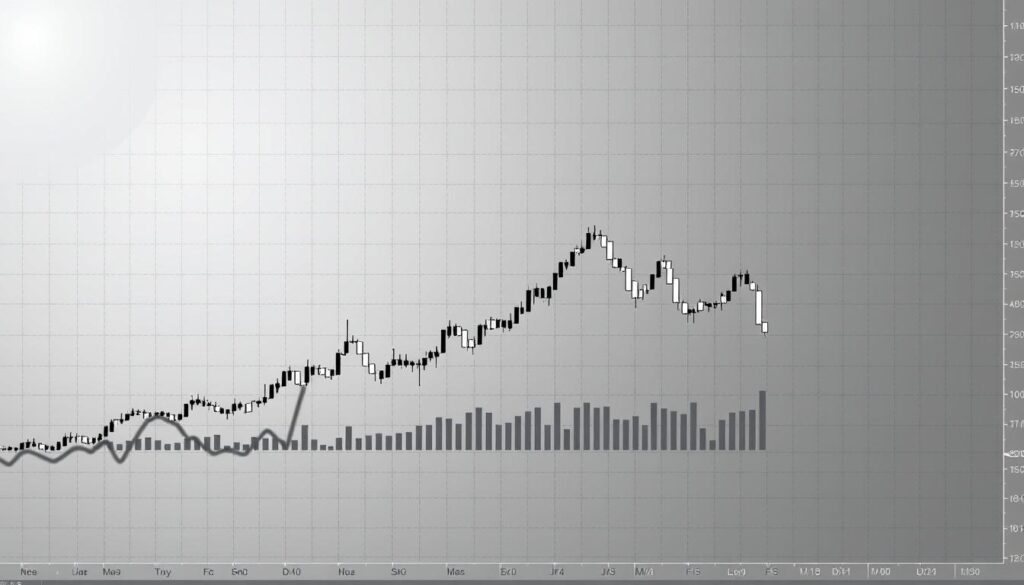

The head shoulders pattern earns its name from its visual similarity to a human silhouette. It features three peaks with the middle one standing highest. This configuration typically emerges after sustained upward movement.

This chart pattern serves as a reliable reversal signal. It indicates that buying pressure may be weakening. Traders watch for this formation to anticipate potential downward moves.

| Market Type | Pattern Effectiveness | Time Frame Adaptability | Trader Usage |

|---|---|---|---|

| Traditional Stocks | High Reliability | Multiple Time Frames | Decades of Application |

| Forex Markets | Strong Performance | Intraday to Weekly | Widespread Adoption |

| Cryptocurrency | Equally Effective | All Chart Intervals | Growing Popularity |

Historical Context in Trading

This formation has deep roots in traditional technical analysis. Analysts have applied it successfully for generations. The methodology transfers well to modern digital markets.

The consistency of this analysis approach across different eras demonstrates its robustness. Market psychology remains consistent despite technological evolution. This makes the pattern equally relevant today.

Bitcoin price patterns head shoulders: Core Components

Breaking down this formation into its fundamental parts provides clarity on its predictive power. The setup consists of three distinct peaks that create a recognizable silhouette. Each component plays a crucial role in signaling potential trend changes.

Key Elements: Left Shoulder, Head, and Right Shoulder

The left shoulder represents the initial peak during an upward trend. This marks the first sign of exhaustion as buying pressure begins to fade. A decline follows as sellers start to gain control.

The head forms as the highest point in the entire configuration. This occurs after the left shoulder and shows one final strong push by buyers. However, this surge proves temporary before another decline begins.

The right shoulder develops as the third and final peak. It typically reaches a lower level than the head, indicating weakening momentum. This confirms that sellers are now dominating the market action.

Symmetry between the two shoulders is essential for a valid head shoulders pattern. The left and right peaks should appear at approximately the same height. Perfect alignment isn’t always necessary, but close similarity strengthens the signal.

The most critical rule requires the head to extend significantly above both shoulders. If all three peaks appear too close in height, the formation loses reliability. This height difference confirms the genuine exhaustion of the prior trend.

Identifying Chart Formations in Bitcoin Trading

Visual pattern recognition forms the foundation of effective technical analysis in volatile markets. Traders must develop the skill to spot reliable formations as they develop. This ability helps anticipate potential trend changes before they fully materialize.

The first step involves confirming a sustained upward movement on the chart. This head shoulders pattern typically emerges after prolonged bullish activity. Look for clear visual cues that distinguish it from regular market fluctuations.

Spotting the Left Shoulder

The initial peak forms during an established uptrend. This creates the left shoulder as the price reaches a new high before retracing. The subsequent decline should be noticeable but not extreme.

Traders watch for symmetry between the formation’s components. The pullback after this peak sets the stage for the complete pattern. This early identification helps prepare for the full development.

Recognizing the Head and Right Shoulder

The middle peak extends significantly higher than the initial shoulder. This forms the distinctive head of the formation. A decline follows this highest point, showing weakening momentum.

The final peak creates the right shoulder at a lower level than the head. This completes the three-peak structure that defines this reversal signal. The entire configuration confirms seller dominance in the crypto market.

| Pattern Component | Key Characteristic | Market Signal | Confirmation Requirement |

|---|---|---|---|

| Left Shoulder | Initial peak during uptrend | First sign of exhaustion | Clear retracement follows |

| Head | Highest point of formation | Final bullish push | Significantly above shoulders |

| Right Shoulder | Third peak at lower level | Seller dominance confirmed | Symmetry with left shoulder |

Using multiple time frames strengthens pattern validation. Formations on daily or weekly charts often provide more reliable signals. Patience remains essential when waiting for complete development.

Chart Analysis: The Role of the Neckline and Volume

The neckline serves as the critical threshold that validates the entire reversal formation. This support level transforms visual recognition into actionable trading signals. Proper interpretation separates successful trades from false alarms.

Understanding how to correctly draw and analyze this component is essential for any technical analyst working with this pattern.

Drawing and Interpreting the Neckline

To draw the neckline, connect the low point after the left shoulder with the low before the right shoulder forms. This creates the definitive support level for the entire chart formation.

The neckline can appear horizontal, upward-sloping, or downward-sloping. All variations are technically valid, though horizontal lines are most common. The formation only confirms when price closes below this critical line.

Traders should exercise caution with descending necklines. These can sometimes evolve into falling wedge patterns, creating potential false signals.

Using Volume to Confirm the Pattern

Volume analysis provides crucial confirmation for the head shoulders setup. Typically, volume peaks during the left shoulder formation. It then decreases during the head and increases again with the right shoulder.

The breakdown below the neckline should occur on high volume. This confirms genuine selling pressure rather than a temporary fluctuation. Low volume during the head indicates weakening buyer interest.

This volume signature strengthens the bearish reversal thesis. It adds conviction to the pattern‘s predictive power on any market chart.

Using the Head and Shoulders Pattern for Trading Decisions

The true value of pattern recognition lies in its application to real-world trading decisions. This involves precise entry points, disciplined risk management, and clear profit target strategies.

Mastering these steps transforms a visual setup into a systematic trade plan.

Entry, Stop Loss, and Profit Target Strategies

Traders often debate the optimal entry time. One school enters immediately after a candle closes below the neckline. The alternative waits for a price retest of the neckline from below, which often provides a superior risk-to-reward ratio.

For stop-loss placement, consider the “two-candle rule.” Instead of placing the stop above the breakdown candle, move it two candles back. This gives the trade necessary breathing room. Alternatively, place the stop above the right shoulder for a tighter stop or above the head for a wider one.

Profit targets should be multiple. The primary objective is the pattern’s height projected downward from the neckline. Always aim for a minimum 1:3 risk-to-reward ratio.

Risk Management Techniques

Never enter a position until the head shoulders pattern is fully confirmed. This requires a close below the neckline, preferably on strong volume. Patience at this time is critical.

Proper position sizing is essential. Even high-probability setups can fail. Adjust your strategy for different chart time frames. Longer-term patterns generally require wider stops and larger targets.

These risk management decisions protect your capital. They ensure you remain in the game long enough for your edge to play out.

Complementary Technical Tools in the Analysis

Smart traders know that combining visual formations with mathematical indicators creates a powerful analytical edge. Relying solely on one method can lead to false signals in volatile conditions.

Using additional technical indicators provides crucial confirmation for your primary analysis. This multi-layered approach significantly improves your trading accuracy.

Integrating RSI and MACD

The Relative Strength Index (RSI) offers valuable momentum insights. Look for bearish divergence where the asset makes a higher high but RSI shows a lower high.

This signals weakening buying pressure during the formation’s development. It adds conviction to the potential reversal setup.

MACD provides additional confirmation when its line crosses below the signal line. This often coincides with the neckline breakdown, validating increased bearish momentum.

These indicators help filter out unreliable chart patterns. Multiple confirming signals reduce the risk of entering based on misleading formations.

Always remember that technical indicators should complement rather than replace proper pattern identification. They work best when the broader market context supports the reversal signal.

Adapting Head and Shoulders for the Cryptocurrency Market

The cryptocurrency landscape presents unique conditions that affect traditional chart analysis. Digital assets trade around the clock with significant price swings. This environment demands careful application of established technical methods.

Understanding how to modify this approach for digital markets improves trading outcomes. The formation’s core principles remain valid despite market differences.

Advantages of the Pattern in Crypto Trading

This setup offers clear visual simplicity that benefits traders in fast-moving conditions. Even beginners can recognize the distinctive three-peak structure. This accessibility makes it valuable for crypto trading education.

The formation provides reliable reversal signals when properly identified. It helps traders anticipate trend changes in volatile markets. The neckline offers concrete reference points for risk management decisions.

Longer development timeframes encourage disciplined trading approaches. This prevents reactive decisions based on short-term market noise. Patient traders benefit from the pattern’s complete formation.

Common Challenges for Novice Traders

Subjective interpretation represents a significant hurdle for newcomers. Different analysts might draw necklines at varying angles. This can lead to inconsistent trading signals among market participants.

False signals occur when sudden news disrupts pattern development. Whale movements or regulatory announcements can invalidate technical setups. Crypto’s inherent volatility sometimes renders formations less reliable.

Sloping necklines present identification difficulties for inexperienced traders. Unlike horizontal lines, angled support levels require more advanced analysis skills. This complexity can challenge pattern recognition accuracy.

Case Studies: Real-World Applications in Bitcoin Markets

Case studies offer concrete evidence of how chart patterns perform in live markets. These real examples show the formation’s predictive power across different conditions.

Documented scenarios reveal valuable lessons about pattern reliability. They demonstrate both successful applications and important exceptions.

Success Stories and Notable Trades

One fascinating example involves a major currency pair. The EURUSD confirmed a clear reversal setup. However, sellers couldn’t maintain pressure below the critical support level.

The sustained break back above the neckline signaled long positions. This resulted in an impressive 800 pip rally. The initial head shoulders pattern transformed into its inverted counterpart.

This case highlights why failed formations deserve careful analysis. Sometimes the breakdown failure becomes a powerful continuation signal. Traders who recognized this shift captured substantial profits.

Different time frames show consistent pattern performance. Daily charts provide reliable signals for swing positions. Shorter intervals work well for tactical entries.

These real-world applications demonstrate the head shoulders pattern’s versatility. They show how proper identification leads to profitable trading decisions across various market conditions.

Integrating Additional Technical Indicators

Building a robust trading strategy involves layering multiple confirmation signals. While the core formation is powerful, its reliability increases when supported by other tools. This approach helps filter out noise and strengthens your conviction.

Using complementary technical analysis methods creates a stronger case for a potential reversal chart signal. It turns a single observation into a multi-faceted thesis.

Using Trend Lines, Moving Averages, and Oscillators

Trend lines can extend the story of a chart pattern. Drawing a line connecting the peaks highlights the resistance level. This often runs parallel to the neckline, framing the entire structure.

Moving averages offer dynamic support and resistance. A break below a key average, like the 50-period, near the neckline breakdown adds weight. It signals the larger trend may be shifting.

Oscillators provide momentum clues. Look for tools like the Stochastic or Commodity Channel Index (CCI). Overbought readings during the head’s formation suggest buyer exhaustion.

- Stochastic: Confirms momentum loss if it turns down from overbought territory.

- CCI: A move from positive to negative territory can confirm increasing selling pressure.

It is also crucial to recognize related patterns. A descending neckline might actually form a falling wedge pattern, which is a bullish signal. The inverted head shoulders is the bullish counterpart, signaling a potential uptrend reversal.

The goal is a confluence of signals, not complexity. Too many indicators can lead to confusion. Choose a few that you understand well for the clearest picture.

Conclusion

Effective market analysis hinges on the disciplined identification and implementation of proven chart formations. The distinctive three-peak configuration serves as a powerful tool for anticipating trend changes in volatile digital markets.

Proper recognition of the key components—including the symmetrical peaks and critical support level—forms the foundation for successful trading decisions. Patience remains essential, as premature entries based on incomplete formations significantly increase risk exposure.

This technical approach gains strength when combined with volume confirmation and complementary indicators. No single method guarantees success, making disciplined risk management through strategic stop-loss placement absolutely vital.

Traders should practice identifying these formations across various time frames and digital assets. Continuous refinement of these skills, coupled with detailed trade journaling, builds the expertise needed for long-term success in crypto markets.

No comments yet