Welcome to your comprehensive guide on forecasting digital asset movements. This systematic approach helps traders understand market behavior using historical data and mathematical tools.

Many investors seek methods to anticipate future market directions. Technical examination provides a structured framework for this purpose. It combines data science with market psychology.

This methodology differs significantly from other forecasting approaches. While fundamental analysis looks at project fundamentals, technical study focuses on price patterns and trading volumes.

Traders find this approach particularly valuable in volatile digital asset markets. The method adapts proven financial principles specifically for cryptocurrency environments.

This guide will walk you through essential concepts and practical applications. You’ll learn how to interpret chart formations and use key indicators effectively.

By combining this approach with other strategies, you can develop a more comprehensive trading plan. Remember that no method guarantees future results, but technical examination offers valuable insights.

Introduction to Crypto Price Prediction Technical Analysis

The discipline of chart examination has evolved significantly since its early beginnings. Modern methods build upon centuries of market observation and pattern recognition.

This methodology originated in 18th century Japan where merchants tracked rice market movements. They developed early charting techniques that form the basis of today’s sophisticated approaches.

Overview of the How-To Guide

Digital asset markets present unique challenges due to their extreme volatility. Technical examination adapts traditional financial principles specifically for these dynamic environments.

The approach differs fundamentally from other forecasting methods. While fundamental assessment looks at project value, technical study focuses purely on statistical trends and historical patterns.

This guide provides practical steps for implementing these strategies effectively. You’ll learn to interpret chart formations and use key indicators regardless of your experience level.

Mastering these methods helps market participants navigate the complex world of digital assets. Understanding both the power and limitations of technical examination is essential for successful trading.

Understanding the Basics of Cryptocurrency Market Dynamics

Grasping the forces that move digital asset values forms the bedrock of any forecasting strategy. These dynamics create the patterns that traders seek to identify.

Multiple factors interact to create the price movements visible on charts. Understanding these elements provides context for the patterns we’ll explore later.

Supply & Demand Fundamentals

The most basic economic principle drives all market activity. Scarcity combined with demand creates fundamental value pressure.

Assets with limited issuance, like Bitcoin’s 21 million cap, often appreciate as adoption grows. This relationship establishes the foundation for all price movement.

When demand outstrips available supply, values naturally increase. These forces create the trends that technical examination methods aim to capture.

Market Sentiment and Regulatory Impact

Public perception and news events cause rapid value swings. Positive developments like regulatory approval can trigger significant rallies.

Negative news often sparks sell-offs that appear as distinct chart patterns. Social media trends amplify these movements, creating volatile conditions.

Government policies dramatically affect overall market conditions. Favorable regulation may boost adoption, while restrictions can cause panic selling.

These sentiment shifts provide the raw data that forms chart patterns. Understanding this relationship helps interpret what technical examination reveals about market psychology.

Technological improvements also drive investor interest. Network upgrades that enhance speed or security often correlate with value appreciation.

Broader economic factors like inflation rates create the backdrop for these movements. On-chain metrics like transaction volume offer complementary data about network health.

Core Principles of Fundamental Analysis in Crypto

Unlike technical methods that study price movements, fundamental assessment looks at what gives an asset its worth. This approach examines the underlying factors that drive long-term value.

Fundamental analysis considers global economic trends and political developments. It also evaluates specific project qualities and market dynamics. This comprehensive view helps investors make informed decisions.

Assessing Project Metrics

Project evaluation focuses on qualitative factors that determine success. The development team’s experience and credibility matter greatly. A clear whitepaper detailing technology and use cases provides essential insights.

Tokenomics explains how the digital asset functions within its ecosystem. The project roadmap shows development plans and milestones. Competitive positioning reveals how the project stands against alternatives.

Evaluating Market Conditions and Financial History

Financial metrics offer quantitative data about market position. Market capitalization shows the total value of circulating supply. Trading volume indicates market interest and liquidity levels.

Supply mechanisms include maximum supply and inflation rates. These factors influence scarcity and potential appreciation. Understanding these elements helps assess the financial situation properly.

| Metric Category | Key Components | Purpose | Example Metrics |

|---|---|---|---|

| Project Metrics | Qualitative Factors | Assess long-term potential | Team experience, whitepaper quality |

| Financial Metrics | Market Data | Evaluate current position | Market cap, trading volume |

| On-Chain Metrics | Blockchain Data | Measure network health | Transaction count, active addresses |

Combining fundamental technical analysis approaches creates a powerful strategy. Fundamentals help select promising assets while technical methods optimize timing. This dual approach provides comprehensive market understanding.

Getting Started with Technical Analysis for Crypto

Beginning your journey into market examination requires the right set of digital instruments. This approach relies on mathematical indicators derived from past market data.

The core idea is that established patterns and trends often persist. This methodology helps traders identify potential opportunities.

Tools and Platforms for Chart Analysis

Various chart formats serve as the foundation for this type of study. Each offers a unique perspective on market behavior.

- Line Charts: Display closing values over a selected period.

- Bar Charts: Show open, high, low, and close data points.

- Candlestick Charts: The most popular format for detailed pattern recognition.

- Point and Figure Charts: Focus purely on significant value movements.

Many exchanges, like CoinJar, integrate professional-grade charting tools such as TradingView. These platforms provide the necessary features for generating actionable signals.

The first practical step involves opening an account with a reputable platform. You can then choose a strategy that aligns with your goals.

Consider starting with a demo account to practice with virtual funds. This allows you to test strategies without financial risk. Modern platforms also offer features to copy successful traders, providing valuable learning experiences.

Essential Technical Indicators for Crypto Trading

Mastering key mathematical tools provides traders with actionable insights into market behavior. Most experienced market participants use five to seven core technical indicators to generate comprehensive signals.

These quantitative measurements help identify patterns and potential opportunities. Each indicator offers unique perspectives on market dynamics.

Relative Strength Index (RSI) and MACD

The relative strength index measures momentum on a 0-100 scale. Readings above 70 suggest overbought conditions, while values below 30 indicate oversold territory.

Moving average convergence divergence combines multiple exponential moving averages. This popular indicator identifies trend changes and momentum shifts effectively.

Moving Averages and Bollinger Bands

Simple and exponential moving averages smooth price data to reveal underlying trends. The 50-day and 200-day periods are commonly used for long-term analysis.

Bollinger bands create dynamic boundaries around a moving average. Band width reflects volatility levels, helping identify potential reversal points.

These indicators work best when combined rather than used alone. Each provides different insights into market movements and trends.

While powerful, these tools occasionally generate false signals. Using multiple technical indicators together creates more reliable trading decisions.

Support and Resistance Levels: An In-depth Look

Understanding where markets tend to pause and reverse forms the cornerstone of effective trading strategies. These critical junctures represent concentrations of market psychology where buyers and sellers reach equilibrium.

Markets naturally create these significant levels through repeated interactions between participants. As asset values fluctuate, distinct support and resistance zones emerge from collective behavior patterns.

Identifying Key Price Points

Locating meaningful support resistance areas requires examining historical chart data. Look for price points where reversals occurred multiple times, indicating strong market memory.

When values approach established support zones, buying activity typically increases. Traders anticipate bounces from these psychologically significant levels. Conversely, resistance areas often trigger selling pressure as participants expect pullbacks.

These dynamic support resistance levels constantly evolve with market conditions. Broken support frequently becomes new resistance, creating role reversal opportunities.

| Level Type | Formation Process | Market Psychology | Trading Application |

|---|---|---|---|

| Support | Previous lows before rallies | Buyer concentration zone | Potential buying opportunities |

| Resistance | Previous highs before declines | Seller concentration zone | Potential selling opportunities |

| Strong Levels | Multiple confluence factors | Enhanced market memory | Higher probability signals |

Effective traders combine these support resistance levels with other indicators. This multi-factor approach helps confirm signals across different time frames and market conditions.

Analyzing Trends and Chart Patterns

Chart formations provide a visual roadmap of market psychology and potential future movements. These recognizable shapes are foundational to this type of market study.

They help forecast direction based on historical performance. Understanding these formations is crucial for any market participant.

Japanese Candlestick Patterns

Japanese candlesticks are the most common chart type for this methodology. Each candle represents a specific period, showing the open, high, low, and close values.

Color-coding indicates whether the asset gained or lost value. The body and wicks of each candle tell a detailed story about trader behavior during that session.

Candles with small or no wicks signal strong, decisive sentiment. Long wicks, however, suggest indecision and a battle between buyers and sellers.

| Candlestick Component | Visual Feature | Market Sentiment Indicated |

|---|---|---|

| Long Body | Large colored rectangle | Strong buying or selling pressure |

| Small Body | Tiny colored rectangle | Market indecision or consolidation |

| Long Upper Wick | Thin line above body | Sellers pushed the value down from highs |

| Long Lower Wick | Thin line below body | Buyers pushed the value up from lows |

Pattern Recognition for Trend Reversals

Specific candlestick formations can signal when a trend is losing momentum. The Hammer pattern is a key bullish reversal signal.

It appears at the bottom of a downtrend. This pattern has a small body at the top and a long lower wick.

This shape indicates that sellers drove values lower, but buyers aggressively stepped in to push the closing value near the high. It suggests a potential shift in control.

Recognizing these formations requires practice. Successful traders confirm these visual signals with other indicators like trading volume.

Implementing Moving Averages and Bollinger Bands Strategies

Moving averages and Bollinger Bands offer distinct approaches to tracking market behavior. These tools help identify directional movements and potential turning points.

They work across various time frames to reveal underlying patterns. Understanding their implementation can enhance your market approach.

Simple vs. Exponential Moving Averages

Simple moving averages calculate the average of past values equally. A 50-day SMA uses fifty days of data points divided by fifty.

Exponential moving averages prioritize recent data in their calculations. This makes them more responsive to current movements.

Popular EMA settings include 12-day and 26-day for short-term perspective. The 50-day and 200-day periods suit longer-term trend identification.

When a shorter-period moving average crosses above a longer one, it suggests upward momentum. This crossover system generates actionable signals for market participants.

Bollinger Bands create dynamic boundaries around a simple moving average. The bands expand and contract based on standard deviation measurements.

Narrow bands indicate calm conditions, while wide bands show increased activity. These indicators help spot potential reversal zones when values touch the band edges.

Combining these tools creates a powerful strategy. Use moving averages to determine the overall direction. Then apply Bollinger Bands for precise entry timing within that trend.

Risk Management Strategies for Crypto Trading

Protecting your capital is the most critical skill in digital asset markets. Proper risk controls help traders identify potential losses before they occur.

Every investment decision should include clear exit strategies. Stop-loss orders automatically close positions when price reaches predetermined levels.

Stop-Loss, Position Sizing, and Volatility Management

Position sizing determines how much capital to risk per trade. This calculation considers account size and risk tolerance.

Digital asset markets show higher standard deviation than traditional investments. This requires wider stop-loss settings to accommodate larger swings.

| Strategy | Primary Function | Key Benefit |

|---|---|---|

| Stop-Loss Orders | Limit potential losses | Automated protection |

| Position Sizing | Control exposure per trade | Prevents portfolio damage |

| Volatility Management | Adjust for market swings | Accommodates price fluctuations |

Trading psychology plays a crucial role in risk management. Fear and greed often lead to poor decisions.

Discipline helps traders stick to their plans during volatile periods. Recognizing emotional triggers improves long-term results.

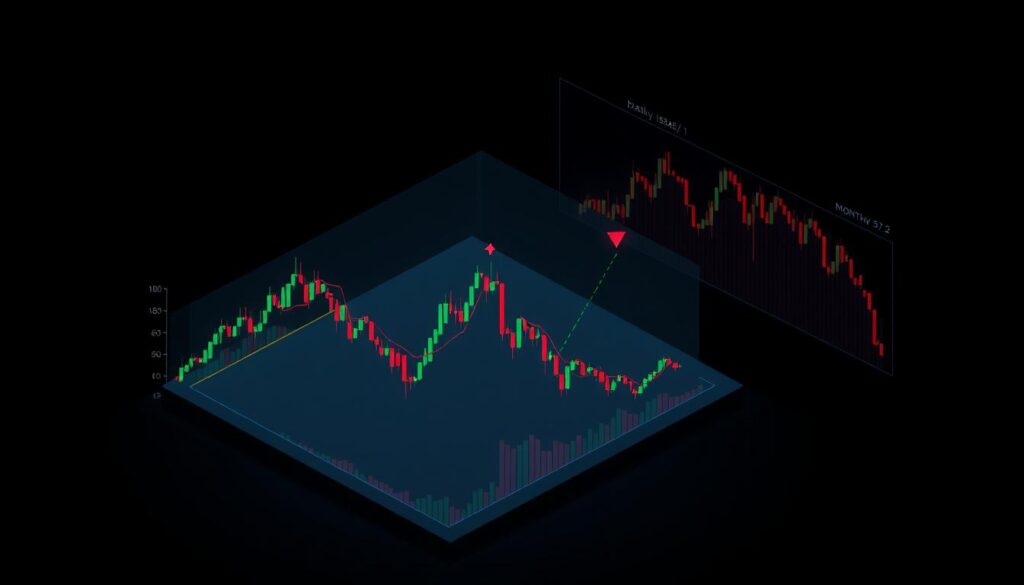

Multiple Time Frame Analysis for Better Entries

The strategic combination of various chart periods offers traders a multidimensional view of market structure. This approach examines asset movements across different horizons simultaneously.

Each time frame reveals unique aspects of market behavior. Longer periods show broader trends while shorter frames display entry opportunities.

Benefits of Using Diverse Time Frames

Market participants typically use larger charts to establish primary direction. Weekly or monthly views filter out minor fluctuations.

Smaller time frames help pinpoint precise entry points. This layered approach confirms signals across multiple perspectives.

| Time Frame | Primary Purpose | Typical Users | Indicator Complexity |

|---|---|---|---|

| Monthly/Weekly | Trend identification | Long-term investors | Multiple indicators + fundamentals |

| Daily | Support/resistance levels | Swing traders | Moderate indicator use |

| 4-Hour/Hourly | Entry timing | Day traders | Fewer, faster indicators |

| Minutes | Precision execution | Scalpers | Minimal indicators |

This methodology reduces false signals through confirmation across frames. Traders gain confidence when different periods align.

The approach requires discipline to respect the primary trend direction. Avoid letting short-term noise contradict established longer-term movements.

Combining Fundamental and Technical Analysis

Blending qualitative research with quantitative measurements provides a complete trading methodology. This integrated approach leverages the strengths of both evaluation systems.

The synergy between these methods creates a powerful framework. Fundamental analysis identifies promising digital assets based on intrinsic value. Technical analysis then determines optimal timing for market entries.

Integrating Qualitative and Quantitative Data

This combined strategy follows a logical workflow. First, screen the crypto market using fundamental assessment. Look for projects with strong technology and solid teams.

Next, apply chart study to identify entry points. This dual approach reduces risk significantly. It ensures investments have both long-term merit and short-term timing advantages.

| Analysis Phase | Primary Focus | Key Questions | Data Type |

|---|---|---|---|

| Fundamental Screening | Project Viability | Is the asset undervalued? | Qualitative |

| Technical Timing | Market Entry | When to enter position? | Quantitative |

| Integrated Decision | Risk Management | Does timing support fundamentals? | Combined |

The fundamental technical analysis approach works particularly well in volatile conditions. It helps traders navigate price disconnects between intrinsic value and market movements.

Utilizing On-Chain and Project Metrics

Blockchain networks offer unique transparency through publicly available transaction data. These on-chain metrics provide objective insights into actual network usage and health.

While running your own node offers the most accurate data, free online tools make this analysis accessible. Platforms like CoinMarketCap provide comprehensive network indicators.

Key On-Chain Indicators for Crypto Evaluation

Transaction count measures network activity but can be misleading. Users might inflate numbers by moving funds between personal wallets.

Transaction volume provides better economic insight. It shows the total value transferred during specific periods.

Active addresses count unique senders and receivers. This helps gauge genuine user adoption when combined with other data points.

| Metric | Primary Insight | Potential Limitations | Best Use Case |

|---|---|---|---|

| Transaction Count | Network activity level | Can be artificially inflated | General usage trends |

| Transaction Value | Economic activity scale | Doesn’t distinguish transaction types | Market health assessment |

| Active Addresses | User adoption growth | May include inactive accounts | Network expansion tracking |

| Network Fees | True demand measurement | Varies by network congestion | Urgency and priority analysis |

Fees paid indicate genuine network demand. Higher fees show users value faster transaction confirmation.

Hash rate (Proof-of-Work) and staking metrics (Proof-of-Stake) reveal network security. They show miner/validator confidence in the system.

No single metric provides a complete picture. Combine multiple indicators with other evaluation methods for comprehensive analysis.

Practical Steps to Execute Your First Crypto Trade

Taking your first step into active market participation requires practical implementation of learned concepts. This guide transforms theoretical knowledge into actionable trading steps.

Begin by opening an account with a reputable platform. Choose one offering comprehensive charting tools and demo features. This foundation supports your entire trading journey.

Setting Up a Demo Account and Testing Strategies

Practice with virtual funds before risking real capital. Demo accounts simulate live market conditions without financial consequences. They allow strategy testing and platform familiarization.

Select your approach based on goals and risk tolerance. Options include leveraged positions, long-term holding, or diversified ETF exposure. Each method suits different trader profiles.

Execute your first position by determining size and setting protection levels. Monitor using the analytical tools you’ve mastered. Watch for trend changes and key level tests.

Modern platforms offer social trading features. These let you observe experienced traders’ moves in real time. This provides valuable learning opportunities while potentially generating returns.

Close positions according to predetermined plans rather than emotions. Start small when transitioning to live markets. Gradually increase exposure as confidence grows.

Advanced Strategies: Leveraging AI and Automated Tools

Artificial intelligence is revolutionizing how investors approach digital asset evaluation. These advanced systems process information at speeds impossible for manual methods.

Automation in Technical Analysis

Systematic approaches remove emotional decision-making from the investment process. Automated rebalancing adjusts portfolio allocations on predetermined schedules.

Algorithmic trade execution enters and exits positions based on rule-based criteria. Risk screening filters assets that don’t meet safety parameters.

Using AI for Enhanced Crypto Insights

AI-powered platforms like Token Metrics scan thousands of cryptocurrencies using sophisticated models. They combine multiple indicators with fundamental data and market sentiment.

The Value Investor index delivered 86% annual returns with a 1.68 Sharpe ratio. The Balanced Investor index achieved 104% returns, while the Momentum Trader index reached 147%.

These tools democratize sophisticated analysis previously available only to institutional traders. Individual investors now benefit from systematic, emotion-free strategies.

Navigating Present Market Conditions for Future Trends

Strategic portfolio management now integrates digital assets as essential components for modern investors. Following strong performance periods, understanding current market conditions becomes crucial for positioning toward future trends.

Research shows even modest crypto exposure can enhance portfolio efficiency. Allocations of 1-3% to digital asset indices historically improved returns while managing risk effectively.

Assessing Market Volatility and Future Outlook

Portfolio frameworks vary by risk tolerance. Conservative investors might allocate 5% to value-oriented indices. Moderate risk profiles could target 15% in balanced approaches.

Aggressive investors may consider up to 25% across multiple cryptocurrency indices. The core-satellite model gains popularity for its balanced approach.

This strategy maintains 70-80% in traditional assets for stability. The remaining 20-30% accelerates growth through digital investment opportunities.

Successful navigation requires combining chart study with fundamental assessment. This approach helps identify sustainable movements amid market fluctuations.

Conclusion

Developing proficiency in chart interpretation techniques equips investors with valuable tools for strategic decision-making. This comprehensive guide has explored how historical patterns can inform future market movements.

The systematic approach to technical analysis helps identify potential opportunities through established indicators. Tools like moving averages and support levels provide actionable insights for market participants.

Remember that these methods work on probability rather than certainty. For deeper insights into market forecasting approaches, continuous learning remains essential.

Successful trading combines these techniques with risk management and fundamental assessment. Start with demo accounts and small positions to build confidence in your strategy.

Whether you’re a short-term trader or long-term investor, this framework supports more informed decisions in dynamic digital markets.

No comments yet