Now Reading: How Federal Reserve Crypto Interest Rate Impacts Investments

- 01

How Federal Reserve Crypto Interest Rate Impacts Investments

How Federal Reserve Crypto Interest Rate Impacts Investments

Monetary policy decisions create powerful waves across all financial markets. For anyone with investments, understanding this connection is essential. The relationship between policy changes and asset prices has become a central focus for modern investors.

This dynamic has evolved significantly since late 2021. That period marked a major turning point for many asset classes. A new era of policy tightening began, which dramatically altered the landscape for traders and long-term holders alike.

After a series of steady meetings, a shift occurred in late 2024. This move signaled a change in the economic outlook. It’s a clear example of how policy adjustments create ripple effects that touch everything from stocks to digital assets.

This guide will explore the historical patterns and current trends. We will examine why certain sectors react so strongly to these announcements. Our goal is to provide actionable insights for navigating today’s complex financial environment.

Federal Reserve crypto interest rate Overview

The connection between monetary authority decisions and digital asset performance has become increasingly apparent. Investors now recognize how central banking actions influence various investment classes.

Definition and Recent Trends

Monetary policy serves as the primary mechanism for controlling economic activity. Digital currencies show particular sensitivity to these adjustments.

In September 2024, the central bank reduced borrowing costs by 25 basis points. This brought the target range to 4.0-4.25 percent. The move ended a period of stability that lasted through five consecutive meetings.

Significance for Investors and Market Movements

Market reactions in the digital asset space often exceed those in traditional finance. This creates unique opportunities and risks for portfolio management.

Historical patterns reveal strong correlations between policy changes and cryptocurrency valuations. The peak in November 2021 coincided with signals about future restrictive measures.

Potential additional reductions through 2025-2026 could support digital asset appreciation. Improved liquidity conditions typically benefit these markets.

Background on Federal Reserve Rate Adjustments

Recent monetary adjustments by America’s central bank reveal a dramatic shift in economic strategy. The transition from aggressive tightening to current easing measures represents a fundamental change in approach.

Historical Rate Cuts and Policy Shifts

The nation’s central banking system implemented eleven consecutive increases during the previous tightening cycle. This restrictive period began in 2022 and significantly impacted various asset classes.

According to Octavio Sandoval of Illumen Capital, these policy changes directly influenced market valuations. The introduction of restrictive measures caused appropriate declines across equities and digital assets.

Timestamps and Meeting Outcomes

Key decision points mark important turning points in monetary policy. November 2021 signaled a pivotal moment when markets recognized impending changes.

The timeline below shows significant meeting outcomes and their economic context:

| Meeting Date | Policy Action | Funds Rate Range | Economic Context |

|---|---|---|---|

| December 2023 | 25 basis point reduction | Previous range maintained | Initial easing signal |

| Five consecutive meetings | Steady policy maintained | Range unchanged | Economic uncertainty period |

| September 16-17, 2024 | 25 basis point cut | 4.0% to 4.25% | Tariff disruptions and rising unemployment |

This pattern demonstrates how monetary policy adjustments respond to changing economic conditions. Each meeting outcome reflects careful consideration of multiple factors.

Market Response to Rate Cuts and Shifts

Asset price movements follow identifiable trajectories during transitions between different monetary policy phases. Investor reaction varies significantly based on whether policy adjustments signal economic weakness or proactive management. This creates distinct patterns across the entire policy cycle.

When borrowing costs increased, market participants anticipated slower economic conditions. This negative sentiment pushed stock prices lower throughout 2022. The shift in outlook became clear by 2023.

Investor Reactions and Trading Patterns

Clarity about the end of rising costs triggered a dramatic reaction. Major indexes like the S&P 500 gained approximately 24% in 2023. The Nasdaq Composite climbed around 43% that same year.

This positive momentum continued through 2024. Markets reached new highs in 2025 after recovering from temporary disruptions. Steve Azoury of Azoury Financial notes that anticipation alone can drive market movements.

Sector-by-Sector Analysis

Different sectors experience varying levels of volatility during policy transitions. High-growth technology stocks showed more pronounced swings. Some software companies remained below their previous peaks.

In contrast, profitable large-cap technology firms consistently achieved new records. Their quality and earnings power provided stability throughout the policy cycle. This demonstrates how fundamental strength buffers against market fluctuations.

| Sector Category | 2022 Performance | 2023 Performance | 2024-2025 Trend |

|---|---|---|---|

| High-Growth Tech | Significant declines | Strong recovery | Mixed results, below peaks |

| Large-Cap Tech | Moderate pressure | Solid gains | Consistent new highs |

| Broad Market Indexes | Negative territory | 24-43% gains | All-time highs achieved |

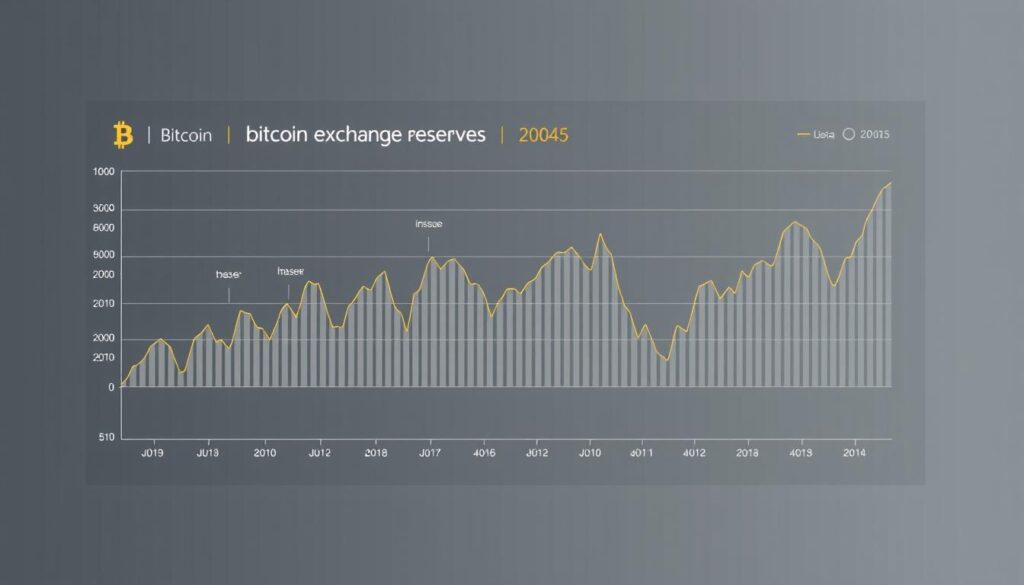

Impacts on Cryptocurrency Investments

The performance of cryptocurrencies is deeply intertwined with broader financial conditions. These digital assets showed clear patterns during recent economic shifts.

Their value faced pressure when the economic outlook suggested higher borrowing costs. This trend reversed as conditions improved.

Bitcoin ETF and Other Crypto Influences

A major development arrived with the launch of Bitcoin ETFs. These funds provided a new, regulated path for capital to enter the market.

This innovation boosted the price of Bitcoin independently. It also lifted other major digital currencies like Ethereum.

Political events also played a role. The election of a president seen as friendly to the sector added positive sentiment. Traders bet heavily on future price appreciation.

Volatility and Risk Management

Navigating the digital asset space requires careful attention to risk. The collapse of major exchanges hammered trader confidence.

This created extreme price swings beyond normal market movements. Effective management became essential for portfolio safety.

| Influence Factor | Impact on Crypto Assets | Investor Consideration |

|---|---|---|

| ETF Approval & Inflows | Significant price support | New institutional capital source |

| Political Sentiment | Short-term price catalyst | Adds speculative volatility |

| Exchange Stability | Critical for market confidence | Major source of systemic risk |

Investors must monitor both monetary policy and sector-specific news. This dual focus is key to managing the inherent volatility of these assets.

Influence on Stocks and Commodities

The divergence between stock and commodity performance during policy transitions reveals critical allocation insights. Each asset class responds uniquely to economic signals, creating distinct patterns for investors to analyze.

Comparative Analysis: Stocks vs. Commodities

High-growth stocks faced significant pressure during restrictive periods. Companies like Zoom Communications remained well below their previous peaks. Meanwhile, profitable large-cap stocks achieved consistent new highs.

This contrast demonstrates how quality and cash flow generation buffer against economic shifts. Strong fundamentals maintain appeal even when discount factors increase.

Trends in Oil, Gold, and Other Assets

Commodity markets showed varied responses to changing conditions. Oil prices spiked initially but proved short-lived. The precious metal gold powered higher as uncertainty grew.

Gold’s safe-haven status attracted capital during volatile periods. It reached record levels amid economic concerns and debt issues. Oil prices fluctuated between $70 and $85 before declining on growth fears.

This development highlights how different assets require distinct allocation approaches. Understanding these patterns helps optimize investment strategies across various markets.

Investor Sentiment and Market Liquidity

The availability of capital and market participants’ emotional responses form a critical nexus during economic transitions. These factors work together to shape investment flows across various asset classes.

Market psychology evolved significantly throughout recent economic cycles. Participants moved from cautious positioning during restrictive periods to embracing risk as conditions improved.

Shifts in Liquidity Amid Rate Changes

Capital availability serves as the primary channel through which monetary adjustments impact valuations. When borrowing costs rose, market liquidity contracted substantially.

This reduction in available funds flowed through to lower asset prices. The contraction was most severe during periods of consecutive increases. By 2023, conditions began stabilizing as participants anticipated policy normalization.

Community and Growth Perspectives

The digital asset community showed particular sensitivity to these liquidity shifts. As Dan Raju notes, “High rates scare investors away from riskier investments, while lowering rates is seen as positive for community sentiment.”

Growth outlooks improved significantly as easing measures commenced. This development encouraged capital deployment back into various markets. The shift supported higher valuations across multiple asset classes.

Investment Strategies Amid Changing Rate Environments

Successful investing requires adapting strategies to evolving economic conditions. The current period of monetary easing demands thoughtful portfolio adjustments. Investors need frameworks for both long-term positioning and short-term tactical moves.

Long-Term Portfolio Positioning

Greg McBride, CFA and Bankrate chief financial analyst, offers valuable investment advice. He notes that “for long-term investors, the pullbacks represent attractive buying opportunities.” This perspective helps investors see volatility as entry points rather than exit signals.

Warren Buffett’s wisdom applies well to these conditions. His observation about paying a high price for “cheery consensus” reminds us that the best opportunities often emerge when sentiment is poor. Maintaining a diversified approach across asset classes remains crucial.

Short-Term Tactical Adjustments

Short-term strategies should consider immediate impacts on different assets. Each policy adjustment affects various investments differently. Some respond quickly while others show delayed reactions.

Risk management needs regular recalibration during these cycles. Reducing exposure to assets that benefited from high costs makes sense. Increasing allocations to growth-oriented investments can capture benefits from improved liquidity.

ETFs provide diversified exposure to sectors likely to benefit from current conditions. Technology-focused funds and those targeting growth areas often perform well. This approach helps manage risk while positioning for potential gains.

Conclusion

Investment success in the current environment hinges on recognizing the interconnected nature of policy decisions and asset performance. The analysis reveals how monetary adjustments create ripple effects across all investment classes.

Digital assets show particular sensitivity to these changes. Their performance often exceeds traditional market reactions. This creates unique opportunities for strategic positioning.

Understanding these relationships helps investors navigate transitions between policy phases. It enables better risk management and opportunity identification. Strategic awareness separates successful investors from the crowd.

The key insight remains clear: diversified approaches combined with policy awareness provide the strongest foundation. This balance supports long-term growth while managing short-term volatility effectively.