Digital ledgers sometimes need to change their rules. This process is called a fork. It represents a split in the underlying code that defines how transactions are validated.

These changes can happen as planned improvements or as responses to different views among participants. The reasons vary from technical improvements to security enhancements.

There are two main types of these changes. One creates a permanent divergence, while the other maintains compatibility with older software versions.

Understanding these mechanisms is vital for anyone in the crypto space. They are the primary way a blockchain evolves and adapts to new requirements.

Key Takeaways

- A fork is a change to a blockchain’s protocol or rule set.

- Forks can be scheduled upgrades or responses to community disagreements.

- The two primary types are hard forks and soft forks.

- These changes allow a network to implement improvements and security fixes.

- Understanding forks is essential for informed investment and development decisions.

- Forks reflect a blockchain’s ability to evolve and maintain consensus.

Understanding Blockchain fork hard soft upgrade

A divergence in a network’s protocol can reshape its economic model and community alignment overnight. For those with financial stakes, these events are critical. They demand a clear understanding of the potential outcomes.

Importance for Investors

For investors, a protocol change is a significant event. A hard divergence can instantly duplicate assets, creating tokens on two separate paths. This situation forces strategic decisions about which chain to support.

Liquidity may fragment, and the fundamental economics of the asset can shift. These changes directly influence long-term value and alter existing risk models. While short-term prices might not always react, the long-term impact on utility is often profound.

Technical Perspectives and Community Impact

From a technical view, these events test a network’s strength. They show how well developers and users can coordinate to implement necessary changes.

The level of agreement within the community determines success. A unified community leads to a smooth upgrade. Disagreement can cause fragmentation. This process serves as a key indicator of the network’s health and governance effectiveness.

What is a Fork in Blockchain Technology?

The digital ecosystem of a cryptocurrency network evolves through deliberate modifications to its fundamental architecture. These protocol adjustments create defining moments that can reshape the entire network’s trajectory.

At its core, a protocol change represents a divergence in the network’s rule set. This split occurs when participants implement new software that alters how transactions validate and consensus forms.

Basics of Protocol Changes

When a network undergoes these changes, it essentially creates two potential paths forward. One continues following the existing rules while the other adopts the new protocol. This process allows for necessary improvements while maintaining network integrity.

Modifications typically emerge from community needs for enhanced security, added features, or resolved disagreements. The implementation involves careful coordination among developers and users to ensure smooth transition.

| Aspect | Before Change | During Transition | After Implementation |

|---|---|---|---|

| Rule Set | Single protocol | Dual path possibility | New established rules |

| Network Consensus | Uniform validation | Potential division | Revised agreement method |

| Software Version | Current release | Update availability | New stable version |

| Community Alignment | Established norms | Decision phase | Path determination |

These fundamental alterations serve as the primary mechanism for network evolution. They demonstrate how decentralized systems adapt to technological advances and community needs.

The upcoming sections will explore the two main types of these protocol changes in detail. Understanding this foundation prepares readers for more complex distinctions.

Exploring Hard Fork: Definition, Features & Use Cases

A permanent divergence in a network’s protocol rules can create entirely independent ecosystems with different governance models. This type of change represents the most significant modification a cryptocurrency can undergo.

Definition and Characteristics

A hard fork creates two separate chains that operate independently. Nodes running old software versions cannot validate transactions on the new chain.

This process requires majority consensus from network participants. The change is permanent and not backward-compatible with previous rules.

Advantages and Disadvantages

The main advantage is freedom to implement major improvements. Developers can enhance scalability and introduce critical security patches.

However, this approach risks community fragmentation. Users may face confusion about which chain to support, and older nodes become obsolete.

Notable Real-World Examples

Bitcoin Cash emerged from a 2017 hard fork over block size disagreements. It aimed to offer faster payments but most liquidity stayed with Bitcoin.

Other examples include Ethereum Classic and Monero’s privacy enhancements. Each case demonstrates different reasons for protocol changes.

Diving into Soft Fork: Definition, Features & Use Cases

Backward-compatible protocol changes represent a more gradual approach to network evolution. This method allows systems to improve while maintaining unity among participants.

Definition and Key Features

A soft fork introduces new rules that remain compatible with older software versions. Nodes running previous versions can still validate transactions under the updated protocols.

This approach typically tightens existing rules rather than creating entirely new ones. The key features include maintaining network cohesion and requiring only partial adoption from nodes.

Benefits and Limitations

The primary advantage lies in seamless implementation. Older nodes continue functioning while benefiting from enhanced security features. This reduces disruption during updates.

However, backward compatibility constrains the scope of possible updates. Significant improvements may require more comprehensive changes. The Segregated Witness implementation demonstrated how soft forks can address complex transaction issues effectively.

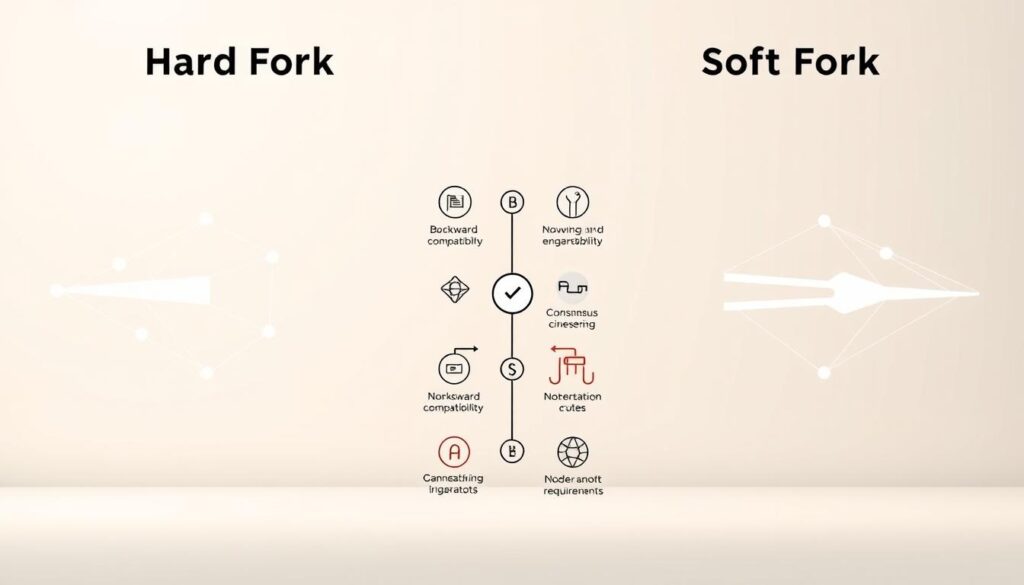

Comparing Hard Fork and Soft Fork

Protocol modifications in decentralized systems come in fundamentally different forms, each with unique implications for network participants. Understanding these distinctions helps users navigate the complex landscape of digital currency evolution.

Backward Compatibility and Consensus Requirements

The most critical difference lies in backward compatibility. A hard fork creates a permanent break with previous software versions, requiring all nodes to upgrade. In contrast, a soft fork maintains compatibility, allowing older nodes to continue functioning.

Consensus requirements also vary significantly. Implementing a hard fork typically demands broad agreement across the network due to its disruptive nature. Soft forks can proceed with support from a smaller subset of participants.

Impact on Network Structure and Governance

These approaches produce dramatically different network outcomes. A hard fork results in a permanent chain split, creating two independent paths. This division can reflect deep community disagreements about protocol direction.

Soft forks preserve network unity by avoiding permanent divisions. They represent a more conservative approach to implementing changes while maintaining cohesion among developers and users.

| Comparison Aspect | Hard Fork | Soft Fork | Key Difference |

|---|---|---|---|

| Backward Compatibility | Not compatible | Fully compatible | Mandatory vs optional upgrades |

| Consensus Requirement | Majority agreement | Partial support sufficient | Broad vs targeted coordination |

| Network Impact | Creates new chain | Updates existing chain | Division vs unity |

| Implementation Flexibility | Radical changes possible | Conservative modifications | Scope of protocol alterations |

| Risk Level | High disruption risk | Low disruption risk | Community cohesion impact |

Impact on Network, Governance, and Security

The consequences of a protocol split reach deep into the ecosystem’s core. They test the strength of its social and technical foundations.

These events reveal how well a system can adapt under pressure. The outcomes shape the future path for all involved.

Influence on Community and Developer Dynamics

A major code change can split a community into competing groups. Developers may choose different paths, fragmenting talent.

Miners and users must also pick a side. This decision affects the new network‘s power and value.

Uneven migration among these key participants creates instability. It challenges the long-term health of the project.

Security Considerations and Protocol Changes

Any code modification introduces potential risk. A permanent split can lead to replay attacks.

This is when a transaction on one chain is copied to another. It is a serious security threat for users.

Even minor changes need strong support from miners. Without it, temporary weaknesses can appear.

These events are a true test of a project’s governance. They show how well the system handles major protocol updates.

Real-World Examples and Case Studies

Historical events in cryptocurrency development provide valuable insights into protocol evolution mechanisms. These real-world situations show how theoretical concepts play out with actual consequences for networks and participants.

Case Study: Bitcoin and Bitcoin Cash Hard Fork

The 2017 creation of Bitcoin Cash demonstrated how technical disagreements can lead to permanent splits. The debate centered on block size limits and transaction throughput capabilities.

Proponents wanted larger blocks for immediate scaling. Others preferred smaller blocks with second-layer solutions. This philosophical divide resulted in a new chain with different rules.

Despite Bitcoin Cash’s technical implementation, most support remained with Bitcoin. The original network retained developer talent and market value. This outcome shows the challenges of major protocol changes.

Case Study: Bitcoin’s SegWit Soft Fork

Segregated Witness offered a contrasting approach to network improvement. This backward-compatible change addressed transaction malleability while increasing effective capacity.

The solution restructured how data was stored within blocks. This improved efficiency without creating a permanent split. It also enabled innovations like the Lightning Network.

Implementation required broad consensus but maintained network unity. The successful adoption demonstrated Bitcoin’s ability to evolve gradually. This case serves as a strong example of conservative protocol enhancement.

Conclusion

For those engaged with digital assets, grasping the nature of protocol updates is a cornerstone of strategic insight. These events are not merely technical but reflect the overall health and governance of a network.

The choice between a permanent divergence and a backward-compatible modification involves significant strategic considerations. Each path offers different levels of disruption and potential for introducing new features.

Understanding these dynamics is crucial for assessing an asset’s long-term value and trajectory. For a deeper dive into the distinct implications for institutional investors, further research is recommended.

Ultimately, the successful navigation of these changes demonstrates a system’s resilience and capacity for evolution, key indicators for its future relevance.

FAQ

What is the main difference between a hard fork and a soft fork?

The core distinction lies in backward compatibility. A hard fork introduces new rules that are not compatible with the old software, creating a permanent split in the network. A soft fork, however, is backward-compatible, meaning nodes that haven’t upgraded can still participate, but they won’t access the new features.

How does a protocol upgrade affect the value of a cryptocurrency?

These changes can significantly influence a digital asset’s market price. A successful upgrade that improves scalability or security often boosts investor confidence and value. Conversely, a contentious split can create uncertainty and volatility, as seen with the creation of Bitcoin Cash from Bitcoin.

Can a soft fork become a hard fork?

In certain situations, yes. If a significant portion of the network’s participants, like miners, reject the new soft fork rules, it can lead to a chain split, effectively turning the intended soft fork into a hard fork. This highlights the importance of widespread community consensus.

What role do miners play in a network upgrade?

Miners are critical for validating transactions and securing the chain. Their adoption of new software rules determines the success of an upgrade. For a soft fork to activate, a majority of mining power must signal support. Their collective action helps maintain network integrity during these transitions.

Are forks a security risk for users?

While the process carries inherent complexities, it doesn’t automatically pose a direct security threat to user funds. The primary risk involves potential network instability or confusion during a split. Users should ensure their transactions are broadcast on the intended chain and keep their software updated for optimal safety.

No comments yet