Digital currencies rely on special systems to stay secure and trustworthy. One of the most important systems is called proof of work. This method helps networks verify transactions without needing banks or other middlemen.

The concept became famous with Bitcoin’s creation. It uses computer power to solve complex math problems. When a problem gets solved, new transaction groups get added to the digital ledger.

This process creates a competitive environment where participants use their computing resources. The first to solve the puzzle earns rewards. This system ensures that no single entity can control the network.

Understanding this consensus mechanism is crucial for anyone exploring crypto technologies. Our article will break down how it works, its benefits, and important considerations.

Key Takeaways

- Proof of work is a fundamental security system for many digital currencies

- It replaces traditional middlemen with mathematical verification

- Participants compete using computational power to validate transactions

- The system prevents any single party from controlling the network

- It requires significant energy but provides strong security guarantees

- Bitcoin popularized this approach, but many other cryptocurrencies use it

- Understanding this concept is essential for grasping how decentralized networks operate

Understanding Blockchain Mining Proof of Work

At the heart of decentralized digital systems lies a clever verification method that eliminates the need for traditional intermediaries. This approach creates a secure environment where mathematical certainty replaces human trust.

Definition and Basic Concept

The proof work system functions as a consensus mechanism requiring participants to demonstrate computational effort. They solve complex mathematical puzzles that demand significant resources.

This investment ensures validators have skin in the game before earning transaction approval rights. The approach makes manipulating historical data economically impractical across the entire network.

Historical Evolution and Context

While the concept existed before Bitcoin, Satoshi Nakamoto’s 2009 implementation revolutionized digital currency. It solved the persistent “double-spending problem” that plagued earlier attempts.

The evolution transformed theoretical computer science into practical global security. Numerous cryptocurrencies now use variations of this mechanism, adjusting parameters for their specific needs.

This created a trustless environment where code-based verification replaces institutional oversight in financial transactions.

The Process Behind Blockchain Mining

Digital ledger maintenance requires participants to compete in solving complex mathematical challenges using computing resources. This validation process ensures that only legitimate transactions become permanent records.

How Miners Solve Cryptographic Puzzles

Network participants called miners begin by gathering pending transactions into a temporary block. They then run this data through hashing algorithms repeatedly. Each attempt involves adjusting a special number called a nonce.

The goal is to find a specific hash value that meets the network’s difficulty requirements. This mathematical puzzle requires tremendous computational power. Successful miners earn the right to add the new block to the chain.

The Role of Computational Power and Hashing

Specialized computers perform trillions of calculations per second during this process. The hashing function converts block data into fixed-length strings. Each hash must be lower than the target value.

This system maintains consistent time intervals between blocks. The difficulty adjusts automatically based on total network power. This ensures fair competition among all participants.

Understanding how cryptocurrency mining works helps appreciate the security behind digital transactions. The entire system relies on mathematical certainty rather than human trust.

Consensus Mechanisms in Blockchain Networks

Digital trust emerges from protocols that coordinate independent validators toward common truth. These systems replace centralized authorities with mathematical rules that everyone follows.

Consensus mechanisms form the foundation for agreement across distributed networks. They enable all participants to maintain identical records without trusting any single entity.

Validating Transactions Through Proof Work

The validation process begins when network members verify new transactions. Each proposed block undergoes rigorous checks by multiple participants.

This distributed verification prevents fraudulent activities like double-spending. The mechanism ensures every transaction follows established protocol rules before acceptance.

Reaching Network Consensus Securely

Agreement occurs when most network members accept a new block as valid. This collective approval creates irreversible consensus across the system.

The security comes from economic costs. Altering historical transactions would require redoing enormous computational work. This makes attacks impractical.

This approach balances security with decentralization. It creates trust through verification rather than institutions.

Advantages and Environmental Impact of Proof of Work

The debate surrounding digital consensus often centers on two critical factors: security benefits and environmental costs. This verification method offers distinct advantages that have proven effective over time.

Benefits of Decentralized Validation and Security

Decentralized validation stands as the system’s primary strength. No single entity controls transaction approval across the network.

Thousands of independent participants worldwide contribute computational resources. This distribution of power creates robust security against manipulation.

The approach establishes a direct link between real-world resources and network protection. Attacks become economically impractical due to the enormous power required.

Energy Consumption and Environmental Considerations

Energy consumption represents the most significant criticism of this mechanism. Major networks use electricity comparable to entire countries’ annual usage.

Environmental concerns focus on carbon emissions from non-renewable energy sources. The industry increasingly adopts renewable resources to power operations.

Critics highlight the disproportion between energy use and transaction throughput. Supporters argue this consumption provides essential security guarantees.

Balancing security needs with environmental responsibility drives innovation in both efficiency and renewable adoption.

Real-World Applications and Use Cases

Beyond theoretical concepts, actual deployments show how decentralized networks function across various industries. These systems power everything from digital currencies to supply chain management.

Bitcoin and Cryptocurrencies Utilizing Proof Work

Bitcoin remains the most prominent example of this consensus system in action. The network processes billions in transactions daily while maintaining security through distributed validation.

Other major cryptocurrencies like Bitcoin Cash and Litecoin use similar approaches. Each adjusts parameters for different transaction speeds and security needs.

The system creates new blocks approximately every 10 minutes. This predictable timeline helps businesses accepting digital payments.

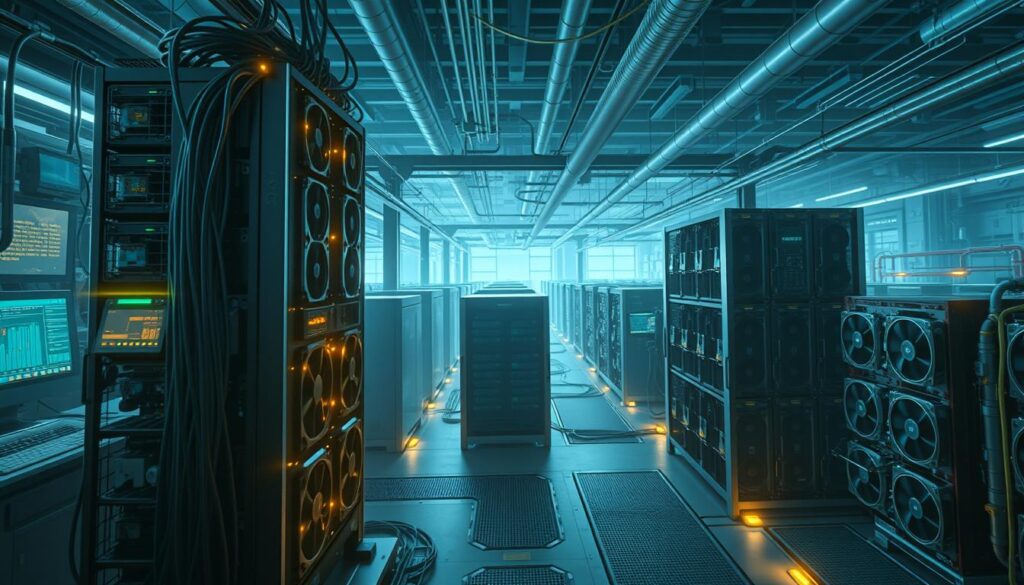

Business and Industrial Case Studies

Industrial operations have become dominant players in network security. Companies like FoundryDigital control significant portions of total network capacity.

These businesses operate massive facilities with specialized computers. They process trillions of hash attempts per second to find valid blocks.

Participants earn reward through newly created coins and transaction fees. This economic incentive drives network participation despite increasing difficulty.

Applications extend beyond currency to supply chain verification and digital ownership. The technology supports reliable operations at massive scale.

Comparative Analysis: Proof of Work vs. Proof of Stake

Resource allocation represents the primary distinction between major consensus systems used in cryptocurrency networks. These alternative mechanisms approach security and validation from fundamentally different perspectives.

Key Differences in Consensus Approaches

The proof work system relies on massive computational power to secure networks. Miners compete to solve complex mathematical puzzles, consuming significant energy in the process.

In contrast, proof stake requires participants to lock up crypto assets as collateral. Validators are chosen based on their stake amount rather than computing resources.

Transaction speed differs dramatically between these approaches. Proof work networks like Bitcoin create a new block every 10 minutes. Proof stake systems can process transactions in seconds.

Energy consumption represents another critical difference. The competitive mining process uses substantial electricity. Proof stake eliminates this energy-intensive competition.

Security models also vary significantly. Proof work ties security to real-world resource expenditure. Proof stake relies on economic incentives where validators risk their staked crypto.

Both systems serve the same fundamental need for decentralized consensus. However, they make different tradeoffs between security, efficiency, and environmental impact.

Conclusion

Security through mathematical certainty rather than institutional trust defines a new paradigm for digital systems. The proof of work mechanism has demonstrated remarkable resilience over fifteen years of operation.

This approach creates robust protection where manipulation becomes economically impractical. The energy requirements drive ongoing innovation in renewable resources and efficiency.

Understanding the proof of work mechanism helps stakeholders evaluate different blockchain networks. Each consensus model makes distinct tradeoffs between security, speed, and environmental impact.

As technology evolves, these foundational principles continue informing new developments. The balance between computational costs and network protection remains central to decentralized systems.

FAQ

What is the main purpose of proof of work in a system like Bitcoin?

The main purpose is to secure the network and validate transactions. It requires computers to solve complex math problems. This process prevents fraud and ensures all participants agree on the ledger’s state without needing a central authority.

Why does proof of work consume so much electricity?

It uses a lot of power because miners use powerful computers that run constantly. These machines compete to solve cryptographic puzzles. The first one to find the solution gets to add a new block and earn a reward, which drives high energy use.

How does proof of work differ from proof of stake?

Proof of work relies on computational power and energy to secure the network. Proof of stake, used by Ethereum, secures the network by having participants lock up or “stake” their own crypto assets. This method aims to use far less electricity.

Can proof of work networks handle a high number of transactions per second?

Generally, no. Networks like Bitcoin have limits on how many transactions they can process in a given time. The design prioritizes security and decentralization over speed, which can lead to slower transaction times compared to other systems.

What happens if a miner with a lot of computational power tries to attack the network?

This is known as a 51% attack. If one entity controls most of the network’s hash rate, they could potentially reverse transactions. However, this is extremely costly and would likely make their own cryptocurrency holdings worthless, making it an unprofitable endeavor.

No comments yet