Welcome to your starting point for understanding the digital ledger. This guide explores the public records of digital asset transactions. We will break down the core concepts that form the foundation of this powerful analytical field.

Our journey will cover essential metrics and practical analysis techniques. You will learn how to interpret the vast amounts of information recorded on public ledgers. This knowledge is crucial for anyone looking to gain a deeper market perspective.

This transparent information levels the playing field. Individual investors can access the same insights as large institutions. Moving beyond basic charts allows for more informed and strategic decision-making.

This ultimate guide is structured to take you from fundamentals to advanced applications. We prepare you to use these insights effectively in today’s dynamic markets.

Key Takeaways

- This guide introduces the fundamental concepts behind public transaction records.

- Learn key metrics and analysis techniques used by market participants.

- Gain a deeper understanding of market movements beyond simple price charts.

- Access the same transparent information available to institutional investors.

- The guide is structured to progress from basics to practical applications.

- On-chain information provides a powerful tool for informed decision-making.

Introduction to Crypto Network Activity On Chain Data

This guide is designed to build your knowledge systematically. We start with core ideas and move toward practical strategies. You will gain a solid foundation for making smarter investment choices.

Overview of the Ultimate Guide

Many traders look only at price charts. However, proficient analysts use public ledger information to confirm their ideas or find new opportunities. This approach is called on-chain analysis.

Our guide mirrors this professional method. Each chapter adds a new layer of understanding. You will progress from basic terms to advanced investment techniques.

This creates a complete learning path. It empowers you with the same insights available to large firms.

Setting the Stage with Key Definitions

Let’s clarify some essential terms. Information recorded directly on a digital ledger is considered on-chain. Details held elsewhere are off-chain.

On-chain information is open for everyone to see. It includes several key components:

- Details of all transfers

- Smart contract operations

- Wallet holdings

- Overall system statistics

This transparency offers a real-time view of market sentiment and liquidity. It moves beyond speculation to focus on actual user behavior and value movement.

Understanding On-Chain Data Fundamentals

Let’s dive into the core principles that make public ledger information a powerful analytical tool. This foundation is essential for interpreting the vast amounts of data available.

What is On-Chain Data?

On-chain data refers to all information permanently recorded on a public blockchain. This includes every transfer, smart contract execution, and wallet balance.

Think of it as a public, digital record book. Major systems like Bitcoin and Ethereum maintain this transparent ledger. Everyone can see the same details that large players use.

Benefits of Transparency and Immutability

The open nature of this system is revolutionary. It allows anyone to verify information directly, creating a trustless environment.

Once a transfer is confirmed, it becomes an unchangeable part of the history. This immutability provides a level of security traditional finance cannot match. Your analysis is based on verified facts, not estimates.

This combination empowers individual investors with institutional-grade insights for smarter decision-making.

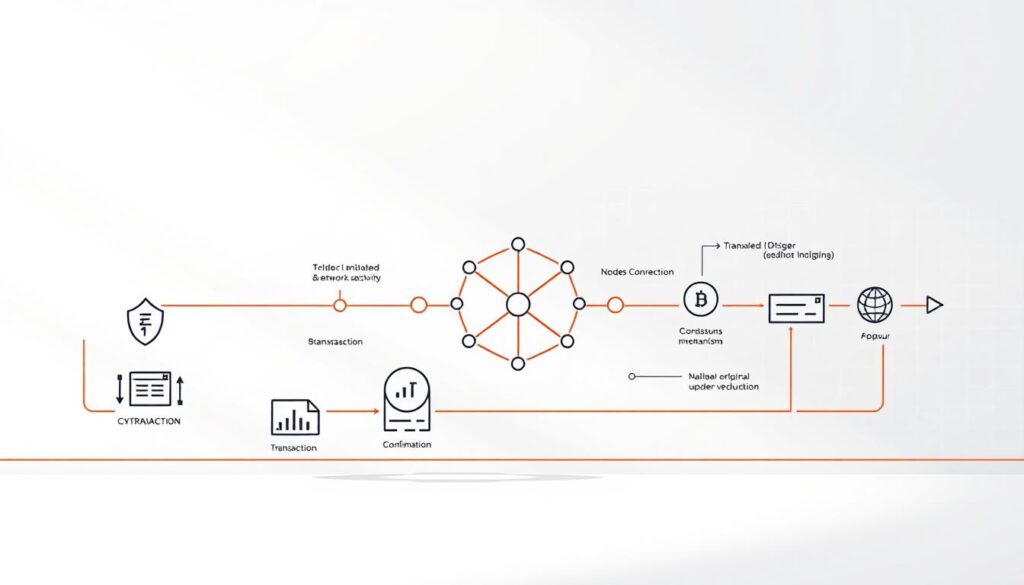

How Blockchain Technology Enables On-Chain Analysis

The architecture of blockchain technology provides the fundamental infrastructure that makes detailed transaction analysis possible. This system creates a permanent, auditable record of all operations.

When a participant initiates a transfer, the details are broadcast to the peer-to-peer system. Nodes then work to validate this information.

Consensus protocols like Proof-of-Work or Proof-of-Stake are crucial. They ensure agreement on the state of the ledger before new information is added to a block.

Once confirmed, the record becomes immutable. This creates a reliable history that forms the basis for all detailed on-chain analysis.

Digital assets are issued and moved by these public systems. Every action is recorded transparently.

Specialized firms index this raw information. They parse it into user-friendly formats for investors.

The distributed nature of the system means thousands of computers hold identical copies. This prevents tampering and guarantees information integrity.

While anyone can run a node to access this information directly, most people use simplified platforms from data providers. This technical foundation explains why blockchain-based information is often considered more reliable than traditional financial reports.

The Importance of Data Transparency in Blockchain Networks

Unlike traditional financial records, blockchain-based information offers complete openness. This public visibility creates a foundation of trust that traditional systems cannot match.

Every operation recorded on the distributed ledger remains permanently accessible. This allows anyone to verify transactions without relying on intermediaries.

Auditing and Verification Benefits

The auditing advantages of this technology are significant. Researchers and investors can independently confirm all system operations.

They don’t need permission from centralized authorities. This independent verification extends to token movements and protocol behavior.

Public addresses provide pseudonymity while maintaining transparency. This balance ensures privacy without sacrificing accountability.

The open structure enables detailed economic analysis. Analysts can track fund flows and identify emerging patterns.

This transparency reduces information asymmetry across markets. It allows for early detection of suspicious operations or system weaknesses. The verification benefits support robust blockchain security frameworks.

Key Metrics for Evaluating Network Activity

Measuring user participation and economic movement requires concrete statistical tools. Analysts rely on specific indicators to gauge the health of digital asset ecosystems.

These quantitative measurements provide objective insights into market dynamics. They help identify trends that may not be visible through price analysis alone.

Active Addresses and Transaction Volume

Active addresses count unique wallets participating in transfers during a specific period. This metric serves as a proxy for user engagement levels.

Transaction volume quantifies the total economic movement across the system. Higher numbers indicate increased economic intensity and real money flow.

Market Value to Realized Value (MVRV) and SOPR

The MVRV ratio compares current market capitalization to the realized value of all coins. This helps identify potential overvaluation or undervaluation conditions.

SOPR reveals whether holders are selling at profit or loss. It calculates selling price divided by the original cost basis for each transfer.

| Metric | Purpose | Calculation | Interpretation |

|---|---|---|---|

| Active Addresses | Measure user participation | Unique wallets in transfers | Higher = more engagement |

| Transaction Volume | Gauge economic activity | Total value transferred | Higher = more intensity |

| MVRV Ratio | Assess valuation levels | Market cap ÷ Realized value | >1 = overvalued, |

| SOPR | Track profit/loss selling | Selling price ÷ Cost basis | >1 = profit taking, |

Decoding the Process of On-Chain Transactions

The journey of a transaction from initiation to final confirmation demonstrates the reliability of distributed ledger systems. This multi-step pathway ensures every transfer becomes a permanent part of the public record.

Step-by-Step Breakdown of a Transaction

Every on-chain transaction begins when a user signs a transfer with their private key. This digital signature authorizes the movement of assets from their wallet.

The signed transaction then broadcasts to participating computers across the system. These nodes verify the details before the transfer enters the mempool.

In the mempool, unconfirmed transactions wait for validation. They compete for inclusion in the next block based on fees and priority settings.

Miners or validators select transactions to bundle into new blocks. This process secures the system through cryptographic puzzles or asset staking.

Final confirmation occurs when the new block joins the chain. The transaction becomes immutable and cannot be reversed.

Validation through Proof-of-Work and Proof-of-Stake

Different blockchain protocols use distinct validation methods. Proof-of-Work requires miners to solve complex mathematical problems.

Proof-of-Stake relies on validators who stake their own assets. Both approaches ensure network security and transaction finality.

| Validation Method | Security Mechanism | Energy Usage | Transaction Speed |

|---|---|---|---|

| Proof-of-Work | Computational puzzles | High | Moderate |

| Proof-of-Stake | Asset staking | Low | Fast |

Transaction speed and cost depend on current system congestion. Higher activity levels typically mean longer wait times and increased fees.

Comparing On-Chain vs. Off-Chain Transactions

Understanding the distinction between different transaction types is essential for navigating digital asset ecosystems effectively. Each method serves specific purposes with unique advantages and limitations.

On-chain transfers occur entirely on the main distributed ledger. These operations are permanently recorded with full transparency. Bitcoin and Ethereum mainnet operations represent classic examples.

Off-chain solutions like Polygon and Arbitrum operate through secondary layers. They process transfers outside the primary system using payment channels. This approach enables near-instant processing at minimal cost.

Security represents a critical difference between these methods. On-chain transactions benefit from the highest security level through immutable settlement. Off-chain alternatives involve additional trust assumptions with intermediaries.

Speed and cost considerations often drive the choice between methods. Off-chain solutions excel for frequent, small payments due to rapid processing and low fees. On-chain transfers become expensive during periods of high system congestion.

The transparency trade-off is significant for analytical purposes. Off-chain operations lack the same visibility that makes on-chain information valuable for market analysis. Each approach serves distinct use cases based on your specific needs.

Detailed Analysis of Crypto Network Activity On Chain Data

Modern analytics platforms offer immediate visibility into the actual behavior of market participants. This approach transforms raw information into actionable intelligence for strategic decision-making.

Real-Time Monitoring with Analytics Tools

Every digital asset transfer leaves permanent traces that analysts can examine. Specialized platforms parse this information as it happens. This provides a real-time window into market dynamics.

Traders gain insights like identifying major holders and tracking exchange flows. They can detect accumulation or distribution patterns among significant participants. This detailed examination combines multiple metrics for comprehensive understanding.

The table below shows key monitoring capabilities available through modern platforms:

| Monitoring Feature | Data Source | Analytical Benefit | Practical Application |

|---|---|---|---|

| Whale Wallet Tracking | Large holder addresses | Early trend detection | Spot accumulation phases |

| Exchange Flow Analysis | Deposit/withdrawal patterns | Sentiment indicators | Predict selling pressure |

| Network Health Metrics | Transaction statistics | Ecosystem vitality | Assess adoption levels |

| Real-time Alerts | Live transfer monitoring | Immediate response | Capitalize on opportunities |

Continuous observation allows analysts to spot developing trends. They can respond to market movements as they unfold. This proactive approach provides a significant advantage in fast-moving digital asset markets.

Utilizing Advanced Analytics Tools for On-Chain Data

Modern technology solutions bridge the gap between raw blockchain records and practical investment insights. Specialized platforms handle the complex tasks of querying and processing public ledger information.

These services present findings in user-friendly formats. This eliminates the need for deep technical expertise in working with distributed systems directly.

Overview of Leading Platforms like Dune and Glassnode

Dune Analytics integrates a cutting-edge data platform with advanced visualization capabilities. It’s particularly valuable for users comfortable with SQL queries. The platform features comprehensive dashboarding tools.

Glassnode provides polished pre-built analytics for viewing broader market trends. It offers curated charts and metrics through an intuitive interface. Some advanced users desire additional custom indicators beyond the standard offerings.

DeFi Llama serves as the largest decentralized finance data aggregator. It delivers real-time information about Total Value Locked and annual percentage yields. The service provides comprehensive project statistics completely free of charge.

Cross-asset providers like Coin Metrics standardize methodologies across different systems. This enables fair comparisons of transaction patterns. Each platform serves distinct user needs in comprehensive market research.

While powerful, these analytical tools can present learning curves. Beginners may start with simpler explorers before advancing to sophisticated platforms. The right choice depends on your specific analytical requirements and technical comfort level.

Interpreting Crypto Whale Movements and Market Trends

Large digital asset holders, often called ‘whales,’ create ripples across markets with their transaction patterns. Their operations are fully visible on the public ledger, giving everyone access to the same powerful information.

This transparency enables real-time tracking of significant wallet behavior. You can observe when major BTC holders move assets to centralized exchanges (CEXs) or decentralized wallets (DEXs).

Strong inflows to CEXs often signal an intent to sell. Movements into private DEX wallets typically suggest a long-term holding strategy. This interpretation is a core part of sophisticated market examination.

| Whale Movement | Typical Destination | Common Interpretation |

|---|---|---|

| Accumulation | Private/DeFi Wallets | Bullish sentiment, preparing for price rise |

| Distribution | Centralized Exchanges (CEXs) | Bearish signal, preparing to sell holdings |

| Repositioning | Between Protocols/DEXs | Strategic shift, seeking new opportunities |

Tracking these flows helps identify what tokens large players are buying or selling. Monitoring interactions with leading DEXs like Uniswap provides further clues.

Large holder behavior often precedes major price shifts. However, use this information as one signal among many. Some sophisticated participants may create misleading patterns.

Evaluating Transaction Volume and User Activity

Two fundamental metrics offer a clear window into the economic pulse of a distributed ledger system. They help gauge genuine participation and the intensity of value movement.

This examination moves beyond simple price charts. It reveals the underlying strength or weakness of an ecosystem.

Insights from Active Addresses

Active addresses count unique wallets involved in transfers over a set period. This number serves as a strong proxy for user engagement.

A steady rise in daily active addresses, like on Ethereum, suggests growing adoption. It often reflects increased use of decentralized applications.

However, analysts must be cautious. Spam or automated bots can sometimes inflate these figures.

Combining this metric with transfer quality provides deeper, more accurate insights.

Understanding Daily Transaction Patterns

Transaction volume measures the total value of assets moved within a specific timeframe. It directly quantifies economic activity.

High volumes typically signal robust demand and healthy liquidity. Conversely, low volumes may indicate market stagnation or reduced interest.

Surges in volume during bullish markets are particularly telling. They often mean institutions and long-term holders are actively participating.

| Metric | Primary Insight | Analytical Consideration |

|---|---|---|

| Active Addresses | Level of user participation | Check for artificial inflation from bots |

| Transaction Volume | Intensity of economic movement | Correlate with price trends for context |

Analyzing these patterns across daily, weekly, and monthly views helps distinguish short-term trading from long-term adoption trends.

Assessing Network Security Through Hash Rate and Miner Data

Mining operations form the backbone of security for distributed ledger technologies like Bitcoin. These systems rely on computational power to validate transfers and maintain integrity. Understanding mining metrics provides crucial insights into ecosystem health.

Role of Hash Rate in Network Stability

The hash rate measures the total computational power dedicated to securing a blockchain. Higher values indicate more miners are competing to validate operations. This creates a stronger defense against potential attacks.

When the hash rate climbs, it signals miner confidence in the system’s future value. Participants invest significant resources in hardware and electricity. A sharp decline, like during regulatory changes, can trigger market concerns about stability.

Mining Insights and Security Considerations

Miners select transactions to bundle into new blocks. They solve complex cryptographic puzzles to earn rewards. This process ensures each transfer becomes permanently recorded.

Consistent mining participation creates predictable security conditions. Volatility in mining activity raises questions about transaction finality. Sustained growth in computational power supports long-term valuation prospects for Proof-of-Work systems.

| Mining Metric | Security Impact | Market Signal | Investment Consideration |

|---|---|---|---|

| Hash Rate Trend | Direct correlation with attack resistance | Miner confidence indicator | Long-term stability assessment |

| Miner Distribution | Decentralization level | Geographic concentration risks | Regulatory exposure analysis |

| Block Time Consistency | Transaction finality reliability | Network health indicator | Operational efficiency measure |

| Mining Difficulty | Adaptive security mechanism | Participation competition level | Infrastructure investment requirements |

Leveraging On-Chain Analytics for Investment Strategies

The most successful investment strategies integrate multiple perspectives to form comprehensive views. Rather than relying on any single methodology, sophisticated market participants blend various analytical techniques.

This multi-faceted approach provides deeper insights into asset valuation and market dynamics. Each analytical method offers unique advantages that complement others when used together.

Combining On-Chain Data with Technical Analysis

Professional investors often use on-chain fundamentals to explain the “why” behind price movements that charts alone cannot reveal. When technical indicators show specific patterns, blockchain metrics can confirm or challenge these signals.

For example, a bullish technical setup gains stronger validation when on-chain metrics like MVRV ratios indicate undervaluation. This combination creates a more robust basis for investment decisions.

The table below shows how different analytical approaches complement each other:

| Analytical Approach | Primary Focus | Strengths | Integration Strategy |

|---|---|---|---|

| On-Chain Fundamentals | Network behavior & holder activity | Reveals underlying market sentiment | Confirms technical signals with fundamental data |

| Technical Analysis | Price patterns & market timing | Identifies entry/exit points | Uses chart patterns to time fundamental insights |

| Sentiment Indicators | Market psychology | Captures short-term mood shifts | Provides context for volume and activity spikes |

This integrated framework requires dynamic adaptation as markets evolve. Investors should regularly reassess their weighting of different metrics based on changing conditions.

Exploring Blockchain Data in Real-Time Market Conditions

The ability to monitor blockchain activity as it unfolds offers unprecedented access to live market intelligence. This immediate visibility transforms how analysts interpret current conditions and make strategic decisions.

Every digital asset transfer creates permanent records that specialized tools can examine instantly. These platforms decode actual participant behavior as events occur across distributed systems.

During high-traffic periods, operations compete for limited block space. This creates observable patterns in fee markets that reveal urgency levels among participants.

Real-time tracking allows professionals to identify emerging trends during their development phase. This provides opportunities to position ahead of major price movements rather than reacting afterward.

| Monitoring Application | Data Focus | Real-Time Benefit | Practical Example |

|---|---|---|---|

| Exchange Inflow Tracking | Deposit patterns to trading platforms | Early selling pressure detection | Monitoring during market stress events |

| Stablecoin Movement | USD-pegged asset flows | Volatility preparation signals | Tracking during price uncertainty |

| DeFi Protocol Interaction | Decentralized finance usage | Yield opportunity identification | Observing during farming seasons |

| Large Holder Behavior | Significant wallet operations | Institutional movement insight | Watching accumulation phases |

Effective real-time examination requires both appropriate technological tools and interpretive skill. Analysts must distinguish meaningful signals from short-term noise without overreacting to temporary fluctuations.

This approach democratizes market intelligence previously available only to large institutions. Individual investors now access the same current information that professional firms utilize for strategic positioning.

How On-Chain Data Impacts DeFi, NFT, and Crypto Trends

Modern decentralized applications and digital asset markets depend on accessible public ledger information for sustainable growth. This transparency revolutionizes how participants evaluate opportunities and manage risks across emerging sectors.

Impact on DeFi Protocols and Yield Opportunities

Decentralized finance platforms leverage transparent records to build comprehensive analytics dashboards. These tools track critical metrics like Total Value Locked and annual percentage yield trends.

Platforms such as Dune Analytics enable custom SQL queries for monitoring lending risk and liquidity depth. This helps identify promising yield farming opportunities by observing capital movements between protocols.

The same analytical approach protects participants from potential risks. Suspicious patterns like sudden liquidity withdrawals become visible through careful examination of public records.

Emerging Trends in NFTs and Digital Assets

Unique digital items benefit significantly from transparent ownership tracking. Public ledgers reveal minting patterns, trading volumes, and holder distribution across marketplaces.

This visibility helps detect artificial trading activities and provides early signals of emerging trends. Informed participants can spot valuable collections before they gain mainstream attention.

Monitoring these activities offers strategic advantages in fast-moving digital asset markets. The combination of transparency and real-time access creates unprecedented opportunities for savvy investors.

Conclusion

Throughout this comprehensive exploration, we’ve uncovered how transparent ledger examination reshapes investment decision-making. The journey from fundamental concepts to advanced applications demonstrates the practical value of this analytical approach.

Blockchain transparency democratizes market intelligence, giving individual investors access to the same information as major institutions. Modern tools make sophisticated analysis accessible without requiring deep technical expertise.

Successful application requires combining multiple metrics rather than relying on single indicators. This evolving discipline demands continuous learning as new methodologies emerge.

Begin applying these concepts with basic metrics and gradually incorporate advanced techniques. Consistent monitoring of on-chain information provides sustainable competitive advantages in dynamic markets.

FAQ

What is the main difference between on-chain and off-chain transactions?

On-chain transactions are recorded directly on the blockchain ledger, like Bitcoin or Ethereum, and require validation by miners or validators. Off-chain transfers occur outside the main ledger, often for speed and lower cost, but they lack the same level of public transparency and final settlement.

How can I track large transfers by major holders, often called whales?

You can monitor whale movements using analytics platforms such as Glassnode or Nansen. These services track flows between wallets, showing when significant amounts of assets are transferred to or from exchanges, which can signal potential market trends.

Why is the hash rate an important security metric for a blockchain?

The hash rate measures the total computational power securing a Proof-of-Work network. A higher value indicates greater miner participation, making it exponentially more difficult and expensive for a malicious actor to attack the protocol, thus enhancing its stability.

What does the MVRV ratio tell us about market cycles?

The Market Value to Realized Value (MVRV) ratio compares an asset’s current market price to the average price at which all coins were last moved. A high ratio often suggests investors are sitting on large profits, potentially indicating a market top, while a low ratio can signal undervaluation.

Can on-chain analysis help with managing investment risk?

Yes. By examining metrics like exchange flows, active addresses, and realized profit/loss, investors can gauge market sentiment. Combining this information with traditional technical analysis provides a more robust basis for strategy and can help identify potential points of entry or exit.

How do analytics tools like Dune Analytics process this information?

Platforms like Dune Analytics use structured queries to pull raw information directly from a blockchain’s public ledger. They then visualize this data into dashboards, making complex metrics like daily transaction volume and user growth easy to interpret for analysis.

No comments yet