Navigating the world of digital assets requires more than just watching price charts. It demands a deep understanding of the fundamental forces that drive a project’s long-term potential. This is where the study of a token’s economic design becomes essential for any serious participant.

This economic framework, often called tokenomics, examines the core principles that govern a digital asset. It looks at how supply, demand, distribution, and utility work together to create value within a blockchain ecosystem. For investors, grasping these concepts is not optional; it is a critical skill for making informed decisions.

A well-structured economic model can signal a project’s commitment to sustainability and growth. Conversely, a poorly designed system often leads to negative outcomes. This resource will equip you with the knowledge to distinguish between the two, helping you identify opportunities with solid foundations.

Key Takeaways

- Tokenomics is the study of the economic principles governing a digital asset.

- It is a vital tool for investors to assess a project’s long-term viability.

- Key factors include supply metrics, distribution plans, and real-world utility.

- A strong economic design creates a foundation for sustainable value.

- Understanding these concepts helps protect against unsustainable projects.

- This knowledge allows for more data-driven investment choices in the cryptocurrency market.

Introduction to Cryptocurrencies and Tokenomics

Modern digital assets represent more than just currency – they function within intricate economic frameworks that determine their long-term success. The study of token economics examines how these systems create sustainable value for all participants.

This field combines technology and traditional economics principles. It explores how digital tokens are created, distributed, and circulated within their blockchain environments.

Understanding these systems requires knowledge of several key factors. Supply schedules, inflation rates, and distribution methods all influence a token‘s performance in the market.

Well-structured economic design aligns stakeholder incentives and fosters network growth. This creates sustainable models that benefit everyone involved in the ecosystem.

For those making investment decisions, grasping these concepts is essential. It helps evaluate projects beyond surface-level appeal and identify genuine value opportunities in the cryptocurrency space.

What Are Tokens?

Tokens represent one of the most fundamental innovations in digital finance, providing programmable assets that operate within established blockchain networks. These digital units serve as the building blocks for countless applications across the ecosystem.

Definition and Characteristics

A token is a type of digital asset created and managed on an existing blockchain platform. Unlike standalone currencies, tokens leverage the security and infrastructure of their host network.

These assets are typically created using smart contract functionality. This allows for automated processes and complex economic models that traditional systems cannot easily replicate.

Tokens can represent diverse rights and values. They may grant access to services, provide voting power, or represent ownership stakes in various projects.

| Feature | Coins | Tokens |

|---|---|---|

| Blockchain Infrastructure | Native to their own blockchain | Built on existing blockchain platforms |

| Creation Method | Through blockchain protocol | Via smart contracts |

| Dependency | Independent currency | Requires host blockchain’s native coin |

| Development Complexity | High (requires full blockchain) | Lower (uses existing infrastructure) |

| Examples | Bitcoin, Ethereum | UNI, USDC |

Difference Between Coins and Tokens

The primary distinction lies in blockchain infrastructure. Coins operate on their own native networks, while tokens are built on top of existing platforms.

Coins serve as the fundamental currency of their respective chains. Tokens, however, provide specialized functionality within larger ecosystems.

This difference impacts development requirements and operational dependencies. Understanding this separation helps investors evaluate project fundamentals more effectively.

Types of Tokens in the Crypto Ecosystem

The digital asset landscape features diverse token categories that serve specialized functions within blockchain networks. Each type offers distinct value propositions to participants in these decentralized systems.

Understanding these classifications helps investors evaluate projects more effectively. Different token structures serve unique purposes across various protocols.

Security and Utility Tokens

Security tokens represent ownership stakes in blockchain protocols. They function similarly to traditional equity investments, where holders benefit from value appreciation.

These tokens divide into equity tokens and asset-backed varieties. Equity tokens provide partial ownership of a protocol, while asset-backed tokens derive value from real-world assets like real estate or commodities.

Utility tokens operate within specific protocol ecosystems. They enable access to services rather than serving as direct investments. Users typically employ them for payment within their native environments.

Transactional and Governance Tokens

Transactional tokens facilitate exchanges across multiple ecosystems. They function as medium-of-exchange instruments for goods and services without central authority involvement.

Governance tokens empower holders with voting rights on protocol decisions. This on-chain governance allows for transparent, organized decision-making processes. Holders can influence the direction of decentralized networks through their voting power.

Each token category carries different risk profiles and regulatory considerations. Investors should understand these distinctions when evaluating digital assets.

Fundamentals of Tokenomics

At the heart of every successful digital asset lies a carefully constructed economic blueprint. This framework determines how value flows through the entire ecosystem.

The study of tokenomics examines how digital assets are designed from inception. It covers initial distribution, ongoing supply management, and real-world utility.

Core Concepts and Importance

A strong economic model aligns incentives for all participants. Developers, users, and investors benefit when the system works harmoniously.

This alignment creates sustainable value beyond short-term speculation. Well-designed tokens serve clear purposes within their ecosystems.

Poor economic planning often leads to project failure. Misaligned incentives can destroy community trust and token value.

| Strong Tokenomics | Weak Tokenomics |

|---|---|

| Clear utility and demand drivers | Vague or nonexistent use cases |

| Balanced supply and distribution | Excessive inflation or concentration |

| Aligned stakeholder incentives | Conflicting interests among groups |

| Sustainable reward structures | Unsustainable emission schedules |

| Transparent governance mechanisms | Opaque decision-making processes |

Understanding these fundamentals helps investors identify promising opportunities. It separates serious projects from those relying on hype.

Mastering tokenomics principles provides a significant advantage in evaluation. This knowledge supports better investment decisions and risk assessment.

Token Supply Metrics Explained

Supply measurements provide essential insights into how a token’s availability and scarcity are managed over time. These metrics help investors understand the fundamental economics behind any digital asset.

Three key measurements form the foundation of supply evaluation. Each offers distinct perspectives on current and future token availability.

Total Supply vs. Circulating Supply

Total supply represents all tokens currently in existence. This includes both freely traded tokens and those held in reserve.

Circulating supply refers only to tokens available for trading. These are the tokens actively moving through the market.

The relationship between these two metrics reveals important information. A large gap suggests significant future selling pressure as locked tokens become available.

Maximum Supply and Its Implications

Maximum supply defines the absolute limit of tokens that can ever exist. This hard cap is programmed directly into the token’s code.

Tokens with a fixed maximum supply create inherent scarcity. This scarcity can influence long-term price stability and value appreciation.

Some assets have no maximum supply limit. These require careful evaluation of inflation mechanisms and demand growth to maintain sustainable value.

Strategies for Token Distribution and Allocation

How a project divides its initial token supply reveals much about its priorities and long-term vision for stakeholder alignment. This allocation blueprint determines who holds influence and how incentives are structured from day one.

A well-crafted distribution plan balances competing needs. It must reward early supporters while preventing excessive concentration that could harm the ecosystem.

Stakeholder Allocation and Vesting Schedules

Most allocation strategies divide tokens among key groups. The development team, early investors, community members, and protocol treasury typically receive designated portions.

Common allocations range from 10-20% for the core team and advisors. Early investors often receive 15-30%, while community incentives may claim 20-40% of the total supply.

Vesting schedules prevent immediate sell-offs that could destabilize prices. These mechanisms gradually release tokens to team members and investors over 2-4 years.

Lockup periods create initial cliffs where no tokens are released. This demonstrates commitment to long-term success rather than short-term gains.

Investors should scrutinize distribution plans for red flags. Excessive allocations to insiders or short vesting periods can signal potential problems.

Transparent allocation strategies build trust and reduce centralization risks. They align all stakeholders toward sustainable growth rather than quick profits.

Crypto Tokenomics Analysis Guide

Thorough economic examination serves as the first line of defense against poorly designed digital asset projects. This systematic approach helps investors identify sustainable opportunities while avoiding potential pitfalls.

A proper evaluation begins with comprehensive document review. Investors should study whitepapers, technical specifications, and official announcements to understand the economic model.

The project’s core purpose must align with the token’s actual function. Determine whether it serves genuine utility or exists primarily for fundraising without clear value accrual.

Stakeholder allocation patterns reveal centralization risks. Pay close attention to team holdings, vesting schedules, and upcoming unlock events that could impact the market.

| Strong Evaluation Practice | Weak Evaluation Practice |

|---|---|

| Examines all project documentation thoroughly | Relies solely on social media hype |

| Assesses genuine utility and demand drivers | Ignores actual use case validation |

| Analyzes vesting schedules and unlock events | Overlooks future selling pressure risks |

| Compares against sector competitors | Evaluates in isolation without context |

| Identifies red flags in allocation patterns | Misses concentration and centralization risks |

Supply dynamics require careful scrutiny of maximum caps, circulating amounts, and inflation mechanisms. These factors determine long-term scarcity and value preservation.

Governance structures should provide meaningful participation rather than cosmetic features. Evaluate voting mechanisms and community involvement levels.

This investment framework represents one component of comprehensive due diligence. It should complement technology assessment and team evaluation for informed decisions.

Inflation, Mint, and Burn Dynamics

Unlike traditional currencies with fixed monetary policies, digital assets employ real-time supply adjustments through minting and burning operations. These mechanisms give protocols unprecedented control over their economic ecosystems.

Understanding Mint Rate and Its Effects

The mint rate determines how quickly new tokens enter circulation. This creation process directly impacts inflation levels within the ecosystem. Projects without maximum supply caps can mint tokens indefinitely.

High mint rates increase the total supply rapidly. This can dilute value for existing holders unless demand grows correspondingly. Sustainable models balance minting with genuine utility needs.

Burn mechanisms work in the opposite direction. They permanently remove tokens from circulation by sending them to inaccessible addresses. This reduction creates scarcity that can benefit holders through potential price appreciation.

Many protocols implement systematic burn programs using transaction fees or revenue. Ethereum’s fee burning and Binance’s periodic BNB burns demonstrate this approach in action.

In decentralized networks, mint and burn rates are often governed by community votes. Token holders collectively decide monetary policy through democratic processes. This aligns incentives across the entire ecosystem.

Investors should examine these dynamics carefully. Calculate net inflation by comparing new token creation against burn volumes. Assess whether the current balance supports long-term value preservation.

Token Utility and Ecosystem Use Cases

Effective token design requires meaningful utility that creates genuine demand through real-world applications. This practical functionality gives digital assets purpose beyond market speculation.

A token’s value depends on its actual use cases within the digital ecosystem. Strong utility aligns with project goals and encourages organic participation from users.

Real-World Functionality and Incentive Mechanisms

Tokens serve practical functions like paying transaction fees on their native blockchain. This creates consistent demand tied directly to network activity.

Access and membership privileges represent another key utility. Holders can gain premium features or community participation rights.

Staking mechanisms allow users to lock tokens for rewards and governance participation. This secures the network while incentivizing long-term holding.

Application in Trading, Staking, and Payments

In trading environments, tokens serve as base pairs in decentralized exchanges. They also function as collateral in lending protocols.

Payment utility positions tokens as exchange instruments for goods and services. This requires sufficient adoption and price stability.

Liquid staking innovations let users earn yields while maintaining liquidity. This eliminates the traditional tradeoff between rewards and capital flexibility.

Governance, Voting, and Community Involvement

Community-driven decision-making represents a fundamental shift from traditional corporate structures to collective ownership models in digital protocols. This approach gives token holders direct influence over project direction through organized voting systems.

On-Chain Governance Mechanisms

On-chain governance leverages blockchain technology to create transparent voting processes. All decisions are recorded publicly and executed automatically by code.

This system eliminates the need for intermediaries. Token holders can participate directly in protocol decisions from anywhere in the world.

Decentralized Autonomous Organizations (DAOs) implement these governance frameworks. They allow community members to control treasury funds and strategic initiatives collectively.

| Governance Model | Decision Process | Community Control | Transparency Level |

|---|---|---|---|

| Fully On-Chain | Automatic execution via smart contracts | Complete community voting | Fully transparent |

| Hybrid Approach | Core team + community input | Partial community control | Selective transparency |

| Off-Chain Voting | Manual implementation after voting | Advisory role only | Limited visibility |

Active community participation indicates project health. High-quality discussions and diverse voter turnout signal strong alignment among users.

Evaluating governance quality involves analyzing voting patterns and proposal success rates. This helps assess true decentralization beyond surface claims.

Investment Considerations in Tokenomics

Evaluating a digital asset’s economic design is a critical step for any serious capital allocation. A well-structured model creates a foundation for sustainable growth and value appreciation. Conversely, a flawed system can lead to poor investment outcomes, regardless of the underlying technology.

For investors, this analysis helps move beyond short-term price movements. It focuses on the fundamental structures that determine a project‘s long-term viability in the competitive market.

Key factors to examine include supply scarcity and demand drivers. Scarcity is created through mechanisms like hard caps and burn functions. Strong demand comes from genuine utility within the ecosystem.

| Positive Economic Signals | Potential Red Flags |

|---|---|

| Clear utility driving organic demand | Vague use cases with weak utility |

| Transparent, gradual token distribution | Heavy concentration among insiders |

| Aligned incentives for all stakeholders | Misaligned rewards favoring early holders |

| Sustainable emission and reward schedules | Unsustainable high inflation rates |

Value accrual is another vital component. It defines how project success benefits token holders. Mechanisms can include fee sharing, staking rewards, or buyback programs.

Understanding upcoming token unlocks is crucial for price impact analysis. Large vesting schedule completions can increase circulating supply. This may create selling pressure that affects market valuations.

Ultimately, sound decisions require assessing these economic factors. They provide a framework for identifying investment opportunities with solid foundations for long-term value.

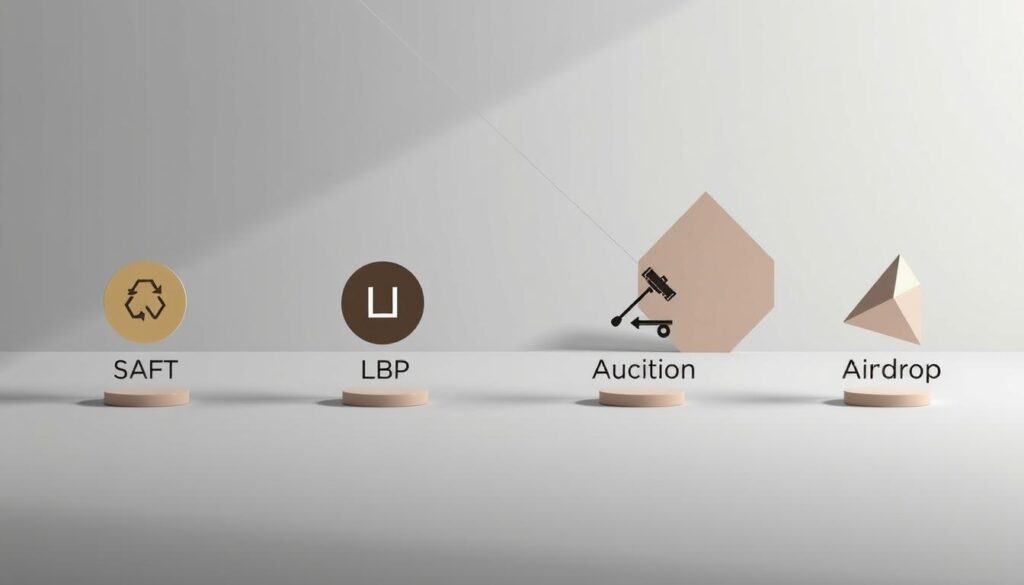

Token Launch Approaches: SAFTs, LBPs, Auctions, and Airdrops

Launch strategies determine how tokens first enter circulation, setting the stage for market dynamics and community development. Each method serves distinct purposes from capital raising to fair distribution.

The right approach balances secure distribution, liquidity establishment, and fair price discovery. Projects must choose based on their specific needs and resources.

Comparative Analysis of Launch Methods

SAFTs enable early fundraising through private agreements with accredited investors. These contracts provide capital before token creation but limit public participation.

Liquidity Bootstrapping Pools allow fair price discovery with minimal upfront capital. This method gradually adjusts token ratios to find organic market value.

Public auctions create transparent sales opportunities for broader participation. They can raise significant funds but risk concentration among large buyers.

Airdrops reward early adopters with free tokens, building instant community and liquidity. This approach generates publicity without regulatory complications.

Each method influences initial distribution fairness and long-term protocol health. Investors should evaluate these factors when assessing new tokens.

Case Studies: DOGE, BNB, and UNI

Real-world examples provide the clearest window into how different economic models play out in practice. Examining prominent digital assets reveals how supply mechanisms, distribution strategies, and utility creation impact long-term performance.

These case studies demonstrate that successful projects can follow diverse paths. Each approach carries distinct advantages and challenges for participants.

Insights from Dogecoin’s Inflationary Model

Dogecoin operates with no maximum supply limit, minting 10,000 new tokens every minute. This creates constant inflation without burning or staking rewards to counterbalance it.

The network currently circulates over 132 billion tokens. Despite weak fundamentals, cultural momentum has driven significant market value.

| Project | Supply Model | Key Mechanism | Primary Utility |

|---|---|---|---|

| Dogecoin (DOGE) | Inflationary (unlimited) | Continuous minting | Payment/cultural |

| Binance Coin (BNB) | Deflationary | Quarterly burns | Exchange ecosystem |

| Uniswap (UNI) | Fixed (1B cap) | Community governance | Protocol voting |

Binance Coin demonstrates deflationary design through regular token burns using platform revenue. This systematically reduces supply while aligning protocol success with holder value.

Uniswap allocated 60% of tokens to community interests through its DAO. The project’s governance focus gives holders direct influence over ecosystem development.

Each model serves different market needs while achieving notable adoption. Understanding these approaches helps investors evaluate new opportunities more effectively.

Risks and Challenges in Tokenomics

Even the most promising digital asset projects face significant economic challenges that can undermine their long-term viability. Understanding these potential pitfalls helps investors make more informed decisions and avoid common traps.

Potential Pitfalls and Supply Overhangs

Supply overhang represents one of the most critical risks for token holders. This occurs when large quantities of locked tokens approach their unlock dates.

Traders often monitor these schedules to anticipate periods of potential selling pressure. Even before actual sales occur, this anticipation can depress price levels across the market.

Excessive allocations to the team and early investors raise centralization concerns. When combined holdings exceed 30-40%, manipulation risks increase significantly.

| Risk Category | Primary Impact | Warning Signs |

|---|---|---|

| Supply Overhang | Price depression from unlock events | Large vesting cliffs approaching |

| Poor Liquidity | Amplified price impact from sales | Thin order books, low volume |

| Security Vulnerabilities | Protocol exploitation and value loss | Unaudited contracts, complex code |

| Regulatory Exposure | Limited listings, enforcement actions | Security-like characteristics |

Poor liquidity depth amplifies the impact of token sales. Projects with thin order books experience disproportionate price crashes during unlock events.

Security flaws in the protocol implementation can enable catastrophic exploits. These vulnerabilities might allow unlimited minting or treasury drainage.

Evaluating these risks requires careful examination of unlock schedules and holder concentration. This due diligence helps identify potential failure modes before they materialize in the market.

Future Trends and Innovations in Crypto Tokenomics

Next-generation token designs incorporate multi-layered mechanisms that align incentives across diverse stakeholder groups and protocols. These innovations create more sophisticated economic frameworks for sustainable value creation.

Emerging Models and Technological Developments

Restaking represents a significant advancement in capital efficiency. Protocols like EigenLayer enable users to secure multiple networks simultaneously with the same staked tokens.

This approach provides layered rewards while reducing capital requirements for new projects. It creates shared security infrastructure across established blockchain environments.

Liquid staking derivatives eliminate the traditional liquidity tradeoff. Users receive tradeable receipt tokens that represent their staked positions.

These tokens can be used across DeFi applications while earning staking rewards. This maintains capital flexibility within the broader ecosystem.

Protocol-driven buyback programs mirror traditional corporate practices. Platforms use generated revenue to purchase and often burn tokens.

This creates direct value flow from business success to holders. It represents a mature approach to tokenomics that complements a comprehensive fundamental analysis framework.

Real-world asset tokenization expands utility beyond digital environments. Tokens now represent ownership of physical assets like real estate and commodities.

Dynamic supply models adjust mint and burn rates algorithmically. This creates responsive monetary policies without manual governance interventions.

Cross-chain functionality enables tokens to operate across multiple blockchain ecosystems. This expands utility and liquidity beyond single-chain limitations.

Sustainable reward mechanisms replace inflationary emissions with organic revenue sharing. This aligns long-term holder interests with genuine protocol usage.

Conclusion

Understanding how digital assets are structured economically separates informed investment decisions from speculative gambling. This comprehensive exploration has covered essential tokenomics components that determine a project‘s potential for long-term success.

Well-designed economic models create sustainable frameworks that align stakeholder incentives. They generate organic demand through genuine utility and thoughtful supply management. Investors equipped with this knowledge can identify both opportunities and red flags in the market.

The case studies demonstrate diverse pathways to success, from community-driven appeal to deflationary mechanisms. Future innovations continue to expand the design space for sophisticated economic models.

Ultimately, mastering tokenomics principles provides a protective framework for investors. It helps identify well-structured projects positioned for sustainable value creation, making it an indispensable tool for navigating the digital asset landscape.

FAQ

What is the difference between a coin and a token?

A coin, like Bitcoin or Litecoin, operates on its own independent blockchain. A token, such as those built on Ethereum, relies on an existing blockchain and represents a specific asset or utility within a project’s ecosystem.

Why is circulating supply important for evaluating a project?

Circulating supply refers to the number of tokens currently available for trading on the open market. It is a critical metric because, along with price, it determines the market capitalization, giving a more accurate picture of value than total supply alone.

How does token utility impact long-term value?

Strong token utility creates real demand. When a token is used for payments, staking for rewards, or governance voting, it provides ongoing incentives for users to hold and use it, which can support its price and benefit the entire ecosystem.

What are the risks of a poorly designed token distribution model?

An unfair distribution can lead to a supply overhang, where large investors or the team hold a significant portion of tokens. If these tokens are suddenly sold, it can crash the price. Proper vesting schedules are essential to align incentives and protect the community.

What is the purpose of token burning?

Token burning is a strategy where a project permanently removes tokens from circulating supply. This reduction can increase scarcity, potentially leading to price appreciation if demand remains constant or grows. Binance Coin (BNB) famously uses a burn mechanism.

How does on-chain governance work?

In on-chain governance, token holders can vote directly on protocol changes and decisions. Their voting power is often proportional to the number of tokens they hold and stake. This gives the community direct control over the project’s future development.

No comments yet