Managing taxes for digital currencies has become a critical task for investors. The rules are getting stricter around the world. Keeping up can feel overwhelming without the right help.

Today’s platforms use smart technology to change this difficult job. They turn a slow, manual process into a fast and accurate one. This helps traders and investors stay compliant with less effort.

Gone are the days of tracking everything on spreadsheets. Now, powerful systems can automatically process thousands of transactions. They work across many exchanges and wallets.

Getting your reporting right is more important than ever. Authorities like the IRS are paying close attention to digital asset activities. Proper documentation is a must.

This guide will explore the top solutions available. We will compare their features, costs, and who they best serve. Our goal is to help you find the perfect fit for your portfolio’s complexity.

Key Takeaways

- Modern tools are essential for handling digital currency taxes accurately.

- Advanced technology automates what was once a manual and error-prone process.

- These platforms can manage a high volume of transactions from various sources.

- Accurate reporting is crucial due to increased regulatory scrutiny.

- This guide will help you select the right solution based on your specific needs.

Introduction to AI Crypto Tax Calculation and Optimization Software

The landscape of digital asset taxation has undergone a radical transformation, leaving manual methods obsolete. The ecosystem now spans countless exchanges and complex protocols. This expansion makes sophisticated tools essential for accurate tax reporting.

Every trade, stake, or swap can be a taxable event. Tracking these transactions manually is a huge challenge. Modern platforms automate this entire process.

These systems import data and calculate gains or losses. They save users a significant amount of time. The best software also generates the necessary forms for compliance.

Precision is non-negotiable today. Regulatory bodies have advanced tracking abilities. Reducing errors through automation protects users from penalties.

The right solution fits your specific needs. It handles a few trades or thousands of transactions. This guide explores the top platforms for managing your crypto taxes effectively.

Understanding Crypto Tax Software and Its Importance

The complexity of tracking digital currency activities across numerous platforms makes specialized tools indispensable. These platforms are designed to handle the entire financial reporting lifecycle for your portfolio.

In most countries, digital assets are classified as property. This means nearly every action, from a simple trade to receiving staking rewards, is a reportable event. Manually logging these activities is prone to mistakes.

The core function of these platforms is automation. They connect directly to your exchange accounts and digital wallets using secure APIs. This allows for the automatic import of your complete history.

Once imported, the system intelligently categorizes each transaction. It identifies trades, income, and transfers, applying the correct rules. A critical step is converting values to your local currency using historical rates for precise gain and loss figures.

For active traders, manual tracking is virtually impossible. These tools provide continuous, accurate records, protecting you from penalties and audit stress. They also offer strategic insights to help manage your financial obligations effectively.

AI crypto tax calculation and optimization software: Features & Benefits

Today’s financial technology solutions provide comprehensive tools that address the unique challenges of digital currency management. These platforms offer sophisticated features that transform complex reporting into a streamlined process.

Automation stands as the foundation of modern platforms. Systems automatically import transactions from exchanges and wallets. This eliminates manual data entry and reduces errors significantly.

Compliance capabilities ensure reports meet specific jurisdictional requirements. Platforms generate forms tailored to different tax authorities worldwide. This guarantees accurate filing regardless of location.

Security measures protect sensitive financial information. Reputable services use encryption and read-only access. Your assets remain secure throughout the process.

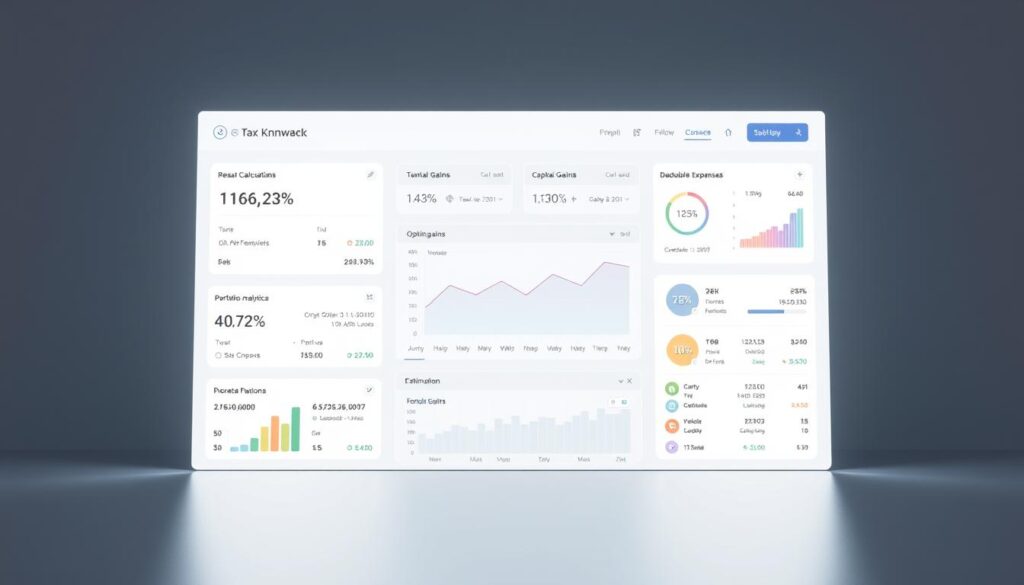

Integrated portfolio tracking provides real-time visibility into holdings. Investors can monitor performance across all connected accounts. This helps with strategic decision-making throughout the year.

| Feature Type | Primary Benefit | Key Capability | User Advantage |

|---|---|---|---|

| Automated Import | Time Savings | Real-time Sync | Reduced Manual Work |

| Compliance Tools | Accuracy | Jurisdiction-Specific Forms | Audit Protection |

| Security Protocols | Data Protection | Encrypted Storage | Peace of Mind |

| Portfolio Management | Strategic Insight | Performance Analytics | Informed Decisions |

Optimization features identify opportunities to minimize liabilities. The software suggests strategic timing for transactions. This proactive approach can lead to substantial savings.

These combined features make digital asset management efficient and compliant. The right platform turns annual reporting into a manageable task. It provides value beyond mere compliance season.

Key Features to Look for in Crypto Tax Software

Selecting the right tool for your portfolio management requires a keen eye for specific, high-impact functionalities. Not all platforms deliver the same level of performance or ease.

The best solutions combine powerful automation with an intuitive design. This balance is crucial for both new and experienced investors.

Automation and Integration

Superior platforms offer extensive integrations with hundreds of exchanges and wallets. This allows for bulk import of historical data, saving immense time.

Seamless API connections provide continuous synchronization of all transactions. Your data stays current without manual effort. Read-only permissions keep your assets secure.

Real-time reporting is a game-changer. It gives you instant visibility into your financial position throughout the year. This empowers strategic decision-making.

User-Friendly Design

A clean, logical interface is non-negotiable. Complex calculations should feel straightforward for all users.

Look for clear navigation and visual dashboards. The workflow from data import to generating reports should be simple. Helpful support and documentation are vital.

Affordability is also key. Pricing should scale fairly with your transaction volume. The value in time saved and accuracy gained should be clear.

Finally, flexibility matters. A top-tier calculator can often handle traditional assets like stocks alongside digital ones. This provides a complete financial picture.

Detailed Product Roundup: Best Platforms for Accurate Crypto Tax Returns

Our 2025 analysis reveals a clear hierarchy among the leading platforms for financial reporting on digital assets. This evidence-based comparison evaluates eight top solutions.

Each platform was assessed on key criteria. We looked at exchange support, calculation accuracy, ease of use, and value. Security and specialized features for different user types were also critical.

The top-tier options stand out for their overall excellence. Koinly leads with a 4.9/5 rating as the best overall solution. CoinLedger, rated 4.8/5, excels for active traders. CoinTracker (4.7/5) is optimized for centralized exchange users.

Specialized platforms cater to specific needs. TokenTax serves high-volume professional traders. CryptoTaxCalculator handles complex DeFi and NFT activity expertly. Blockpit is tailored for European Union users.

For enterprise and US-focused needs, TaxBit offers institutional-grade support. ZenLedger provides comprehensive IRS-compliant reporting.

All these tools meet baseline standards for accuracy. Your choice should align with your individual needs. The following sections provide deep dives into the top three platforms to guide your decision.

In-Depth Review: Koinly’s Approach to Simplified Tax Filing

Leading our detailed analysis is Koinly, the platform that earned a 4.9/5 rating for its exceptional balance of power and simplicity. It supports an impressive network of over 700 exchanges and hundreds of blockchains.

This extensive integration allows users to consolidate data from virtually any source. The platform brings everything into one comprehensive calculation.

Stand-Out Features of Koinly

Koinly’s synchronization speed stands out significantly. It imports transaction data rapidly through API connections or CSV uploads.

The system maintains accuracy while stripping away unnecessary complexity. Clear categorization and intuitive navigation guide users from import to final report.

Comprehensive documentation features step-by-step guides with screenshots. This minimizes technical barriers for less experienced users.

Multiple accounting method options include FIFO, LIFO, and HIFO. These tools help legally minimize financial obligations through strategic approaches.

Areas for Improvement

The free account functions more as a preview than a full solution. Downloading complete forms requires a paid subscription.

Some users note the interface can occasionally present clarity challenges. Navigation options may not be immediately obvious to newcomers.

The platform focuses specifically on preparation without extensive portfolio management features. This focused scope keeps the tool streamlined for its primary purpose.

Koinly remains ideal for investors prioritizing simplicity and speed in generating accurate documents. For broader context, explore our complete crypto tax software reviews.

In-Depth Review: CoinLedger for Comprehensive Reporting

Formerly known as CryptoTrader.tax, CoinLedger specializes in transforming chaotic transaction histories into organized tax-ready documents. This platform earns its 4.8/5 rating by making comprehensive financial reporting remarkably straightforward.

CoinLedger guides users through a clear four-phase workflow. The process moves from Import to Classify, Review, and finally Tax Reports. This structure ensures no critical steps are missed in documentation.

Easy Data Import & Export

The platform offers flexible import options to accommodate different comfort levels. Users can establish secure API connections to major exchanges or upload CSV files manually.

Export functionality stands out with seamless integration into popular filing systems. Your completed crypto tax data transfers directly into TurboTax, TaxAct, and other major platforms. This eliminates manual re-entry and formatting headaches.

Efficient Tax Form Generation

CoinLedger automatically distinguishes between short-term and long-term capital gains. This optimization ensures proper tax treatment based on holding periods. The system applies correct accounting methods for maximum accuracy.

A unique income report consolidates earnings from staking, mining, and other activities. This provides a complete picture of your cryptocurrency-based salary. The platform’s educational resources help users understand complex situations.

Areas for improvement include limited portfolio tracking features compared to competitors. The absence of a free tier also means users must commit before testing functionality.

CoinLedger remains ideal for active traders and miners seeking comprehensive reporting with minimal hassle. Its direct TurboTax connection and educational support make complex crypto tax situations manageable.

In-Depth Review: Crypto Tax Calculator for Accurate DeFi Reporting

Investors navigating the intricate world of decentralized finance need specialized tools for accurate tax reporting. Crypto Tax Calculator earns a solid 4.5/5 rating for its exceptional handling of complex DeFi transactions and NFT activities.

This platform stands out for addressing the new 1099-DA form reconciliation requirements. Many investors struggle with exchange-reported cost basis information. The system verifies accuracy and fills missing data effectively.

Innovative Features and Tools

The platform supports over 3,500 integrations across exchanges, wallets, and protocols. Unlimited currency handling makes it ideal for diverse, multi-chain portfolios.

Advanced blockchain analytics power the automated categorization system. It intelligently classifies complex transaction types according to IRS rules. This reduces manual review time for activities like liquidity pool transactions.

Beyond basic reporting, the tax calculator identifies optimization opportunities. Real-time portfolio tracking helps users make informed decisions throughout the year.

Ideal for High-Volume Traders

Pricing scales from $49 to $499 annually based on transaction volume. Features like bulk editing and automated error detection become increasingly valuable for active traders.

The 30-day money-back guarantee provides substantial trial time. This demonstrates confidence in the platform’s value proposition.

As an official partner of Coinbase and MetaMask, Crypto Tax Calculator offers enhanced integration capabilities. Global support extends to over 100 countries beyond the US market.

Comparing Pricing, Integrations, and Performance Across Tools

Price structures and connection capabilities vary significantly across different financial management solutions. This side-by-side analysis helps you evaluate which platform offers the best value for your specific needs.

Annual subscription fees range from free entry-level options to premium plans costing nearly $1,000. Most platforms cluster in the $49-$199 range for moderate transaction volumes. Higher tiers accommodate active traders with thousands of transactions.

Integration networks show substantial differences between platforms. Some support over 3,500 exchanges and wallets while others offer 500-800 connections. Broader integration reduces manual data entry requirements.

Performance factors include processing speed, categorization accuracy, and customer support quality. These elements significantly impact user experience during busy reporting seasons.

Free plans typically limit transaction counts and restrict form exports. They serve as preview versions rather than complete solutions. Paid subscriptions unlock full functionality.

The right tool often pays for itself through time savings and error prevention. Consider your annual transaction volume and integration needs when selecting a plan.

Navigating Regulatory Compliance and Tax Reporting in the US

The United States tax system treats cryptocurrency holdings with specific property-based rules. This classification means virtually every transaction creates potential obligations. Proper documentation forms the foundation of IRS compliance.

Capital gains follow the same structure as real estate assets. Profits are calculated from the difference between purchase and sale prices. You must report both gains and losses to establish accurate records.

Crypto-to-crypto trades trigger taxable events for the disposed asset. Each swap establishes a new cost basis for the acquired currency. Transfers between your own wallets remain non-taxable, while sending to others constitutes a disposition.

IRS Form 8949 and Schedule D serve as primary reporting mechanisms. These documents summarize transaction details and totals. Expert guidance ensures proper setup and categorization decisions.

Always fact-check calculations with qualified professionals before filing. Emerging requirements include increased scrutiny and new broker reporting rules. Accurate record-keeping helps avoid audit triggers.

Enhancing Tax Optimization with Advanced AI Techniques

Next-generation financial reporting systems employ advanced analytical methods that fundamentally change portfolio documentation. These intelligent platforms analyze vast amounts of blockchain data to understand transaction context beyond simple records.

Automated Categorization and Error Checks

Machine learning algorithms examine transaction patterns to properly classify complex activities. This includes DeFi liquidity provision, staking rewards, and NFT marketplace transactions.

Intelligent systems learn from millions of previous transactions to automatically categorize new activities. They reduce manual review burdens from thousands of transactions to only edge cases.

Anomaly detection features flag unusual patterns or missing data that indicate potential errors. This prompts users to review issues before they affect final calculations.

Predictive analytics project future liabilities based on current holdings and historical patterns. Users can model the impact of potential transactions before executing them.

Continuous portfolio monitoring identifies tax-loss harvesting opportunities. The system alerts users to optimal timing for capturing losses while maintaining market exposure.

Expert Tips for Streamlining Your Crypto Tax Process

Gaining control over your investment records requires combining smart tools with professional guidance. This approach saves significant time and reduces errors.

Following expert advice creates a smooth process. It turns complex documentation into a straightforward task.

Consulting a Tax Professional

Financial expert Ian Corzine recommends speaking with an accountant before choosing any platform. This initial step helps you select the right solution for your specific needs.

A professional provides guidance on complex accounting methods. They ensure your platform configuration matches your portfolio’s requirements.

This collaboration protects investors from costly mistakes. The upfront cost often pays for itself through accurate reporting.

Maximizing Software Benefits

Start tracking your trades early in the year. Regular updates prevent last-minute scrambling during filing season.

For minimal activity, explore free calculators available in many countries. These tools work well for simple situations.

All major platforms export directly to popular filing systems like TurboTax. This simplifies collaboration with your financial advisor.

Always verify final numbers with a qualified professional. Platform accuracy depends entirely on correct data input.

| Strategy | Key Action | Primary Benefit | Ideal For |

|---|---|---|---|

| Professional Consultation | Pre-selection advice | Customized setup | Complex portfolios |

| Early Implementation | Year-round tracking | Proactive planning | All investors |

| Free Tool Exploration | Cost assessment | Budget management | Minimal trades |

| Data Verification | Professional review | Error prevention | All asset holders |

These strategies help investors manage their assets effectively. A disciplined approach ensures compliance with less stress.

Future Trends in AI and Crypto Tax Solutions

Looking ahead, the capabilities of financial reporting platforms are set for a significant leap forward. Technological progress and clearer regulations will drive this change.

Predictive systems will become standard. They will model various financial scenarios for traders. This helps with planning transactions to manage liabilities effectively.

Cross-chain tracking will see major improvements. Blockchain analytics will automatically follow assets moving between networks. This solves a big headache for DeFi users.

Real-time regulatory adaptation is another key trend. Leading software will update its rules instantly when laws change. This keeps users compliant without manual updates.

These tools will also become more personalized. They will learn from your patterns to offer custom advice. The goal is a tailored solution for every investor.

For a deeper look at how these technologies will impact smaller firms, explore our analysis on the future of AI in tax technology.

In the coming years, these platforms will evolve into essential parts of financial planning. They will handle complex crypto tax reporting with ease and intelligence.

Conclusion

Choosing the right financial reporting platform can mean the difference between stressful tax seasons and streamlined processes. Modern solutions transform complex tracking into manageable compliance.

Our analysis highlights Koinly for overall balance, CoinLedger for active traders, and specialized tools for DeFi reporting. The ideal choice depends on your transaction volume and portfolio complexity.

Accurate documentation is essential in today’s regulated environment. Quality platforms provide strategic value beyond basic compliance. They help identify optimization opportunities throughout the year.

We encourage readers to evaluate their specific needs using our comprehensive crypto tax software comparison. Test platforms through free trials and consult professionals for implementation.

The digital asset landscape continues evolving with new regulations and asset types. Select platforms committed to ongoing development rather than static solutions.

While cryptocurrency taxation presents challenges, advanced tools make compliance entirely manageable. Investors can focus on wealth building while maintaining proper documentation of their assets.

FAQ

What is cryptocurrency tax software?

This is a specialized tool designed to automate the tracking and reporting of your digital asset transactions. It connects to your exchanges and wallets, importing trade data to calculate capital gains, losses, and income for accurate tax form generation.

Why do I need a dedicated platform for my digital asset taxes?

Manual accounting for numerous trades across different platforms is complex and error-prone. Using a dedicated solution ensures compliance with tax laws, saves significant time, and helps optimize your tax liability by accurately tracking cost basis and identifying losses.

Which exchanges and wallets are supported by these platforms?

Most leading tools support integrations with hundreds of popular exchanges like Coinbase, Binance, and Kraken, as well as software and hardware wallets. They also increasingly offer support for DeFi protocols and various blockchains to capture a complete financial picture.

How does the software handle different accounting methods like FIFO?

These applications typically allow you to select your preferred accounting method, such as FIFO (First-In, First-Out). The system then automatically applies this rule across all your transactions to consistently calculate gains and losses, which you can review before generating reports.

Can these tools help with tax optimization strategies?

A> Yes, advanced features can identify opportunities for tax-loss harvesting by pinpointing assets that have decreased in value. This allows you to strategically sell them to offset capital gains, potentially lowering your overall tax bill for the year.

What should I look for when choosing a platform?

Key factors include the number of supported integrations, the clarity of the user interface, the accuracy of calculations, the quality of customer support, and pricing plans that match your transaction volume. A free trial or plan is also beneficial for testing.

Are my financial details secure when using this software?

A> Reputable providers use bank-level security measures, including encryption and read-only API keys. This means the software can import your transaction history without having permission to withdraw funds or execute trades on your accounts.

What types of tax reports can I generate?

You can typically create IRS forms like Form 8949 and Schedule D, which detail your capital gains and losses. Many platforms also generate income reports for events like staking rewards, mining income, and forks, providing a comprehensive view for filing.

No comments yet