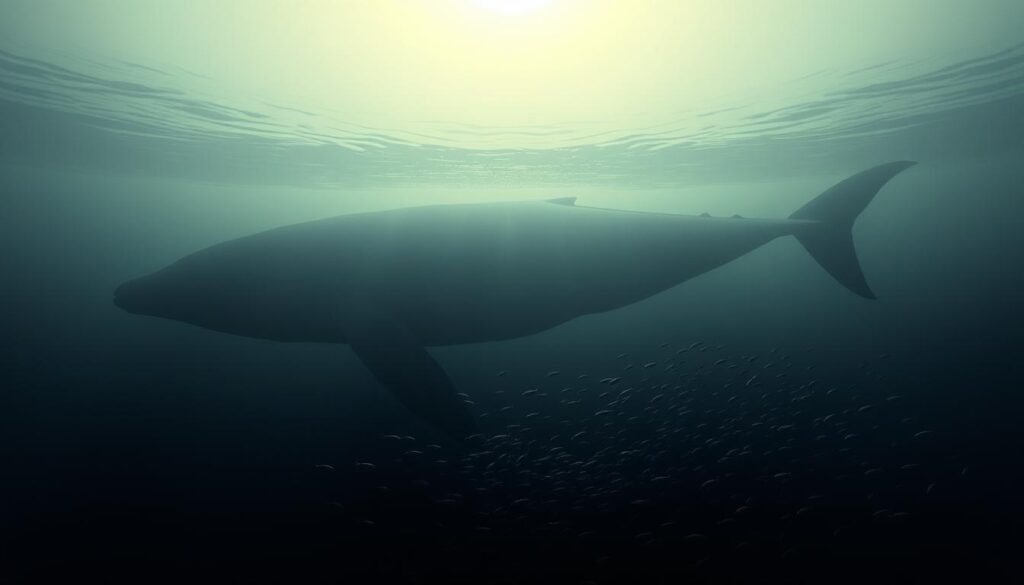

The digital currency landscape moves at lightning speed. A single large transaction can send shockwaves across the entire market. Major holders, often called “whales,” possess the power to influence prices dramatically in a matter of minutes.

Consider a past event: in August 2025, a sale of 24,000 Bitcoin, valued at nearly $2.7 billion, triggered a rapid price drop. This single action led to over $500 million in leveraged positions being liquidated almost instantly. It highlighted a critical vulnerability for everyday traders.

Historically, keeping an eye on these major players was a manual chore. Traders would spend hours checking blockchain data and setting up individual wallet notifications. This method was not only time-consuming but often resulted in delayed information, making it hard to act proactively.

This article explores a modern solution to this challenge. We will examine how new technologies are changing the game for market participants. The goal is to provide timely insights that empower better decision-making.

Key Takeaways

- Major holders, or “whales,” can cause significant market volatility with single large transactions.

- Historical events show that whale activity can lead to rapid price drops and massive liquidations.

- Traditional manual monitoring methods are often too slow to provide a trading advantage.

- Advanced systems offer a way to monitor large-scale movements more efficiently.

- Gaining early insight into these activities can be crucial for managing investment risk.

- The transparent nature of blockchain technology provides a unique opportunity for analysis.

- Staying informed helps traders move from a reactive to a proactive strategy.

Understanding Crypto Whales and Their Market Impact

The distribution of digital wealth follows a pattern where a small percentage of accounts control significant portions of circulating supply. These major holders possess the ability to influence price action through their transaction decisions.

Defining Crypto Whales

Substantial cryptocurrency accumulations define what constitutes a major player. While no universal threshold exists, industry standards help identify these entities.

Bitcoin whales typically control 1,000+ BTC, representing approximately 40% of total supply. Ethereum counterparts hold 10,000+ ETH, influencing decentralized finance ecosystems. Alternative digital assets see even greater concentration, with major accounts controlling 5-20% of circulating tokens.

| Whale Category | Minimum Holdings | Market Influence | Typical Impact |

|---|---|---|---|

| Bitcoin Whales | 1,000+ BTC | Supply Control | $100M+ Moves |

| Ethereum Whales | 10,000+ ETH | DeFi Ecosystem | Smart Contract Effects |

| Altcoin Whales | 5-20% Supply | Relative Dominance | Disproportionate Swings |

How Whale Movements Influence Market Trends

Large transaction movements create immediate reactions across exchange platforms. The March 2024 incident demonstrates this power clearly.

A single entity transferred 50,000 BTC to exchanges, triggering a 12% price decline within six hours. This shows how major holders can reshape market conditions rapidly.

These movements often signal upcoming trends before they become visible to general participants. The September 2024 accumulation of 100,000 ETH preceded a 25% rally, illustrating how crypto whales can indicate bullish patterns.

Understanding these dynamics provides trading advantages. It helps participants anticipate rather than react to market shifts caused by substantial crypto transactions.

The Evolution from Manual Tracking to AI-Powered Analysis

Early methods for observing large-scale transactions relied heavily on individual effort and constant vigilance. Traders spent countless hours reviewing blockchain explorers like Etherscan and SolanaFM. This manual approach involved setting up numerous wallet alerts and interpreting complex on-chain data.

Limitations of Traditional Whale Tracking

The traditional tracking process faced significant challenges. Limited label coverage made it difficult to identify the entities behind wallet addresses. Without proper identification, extensive investigative work was required through historical data.

Major whale accounts often use multiple wallets to obscure their activities. Manually linking dozens or hundreds of addresses through transaction pattern analysis became a massive time drain. The sheer volume of transactions and addresses made effective monitoring nearly impossible for individual traders.

Benefits of AI in Monitoring Wallet Movements

Artificial intelligence transformed whale tracking by processing millions of data points simultaneously. This technology can identify patterns across multiple blockchains in real-time. The system eliminates the delay inherent in manual methods.

Advanced analysis provides alerts within minutes rather than days after movements occur. This represents a fundamental shift from reactive observation to proactive pattern recognition. The new approach can identify accumulation and distribution phases before they become obvious to the broader market.

AI Crypto Whale Tracking and Alert Systems: How They Work

At the heart of contemporary monitoring technology lies a multi-stage process that filters, analyzes, and alerts on significant market movements. This systematic approach transforms raw information into actionable intelligence for traders.

Real-Time Data Aggregation and Pattern Recognition

Sophisticated platforms connect directly to blockchain networks through specialized interfaces. These connections provide continuous streams of transaction data across multiple digital asset ecosystems.

The system processes millions of data points simultaneously. It identifies transactions exceeding predefined thresholds, such as transfers worth over $1 million. Advanced pattern recognition detects behavioral signatures across connected wallets.

This analytical capability goes beyond simple size filtering. It can spot unusual timing, repeated patterns, and accumulation phases before they become obvious to general market participants.

Configuring Automated Alerts for Whale Movements

Traders can customize their monitoring parameters through intuitive interfaces. Settings include transaction size thresholds, specific wallet addresses, and token types of interest.

Platforms like Nansen enable multi-condition alerts that trigger only when multiple criteria are met simultaneously. This ensures higher signal quality and reduces false notifications.

Users receive instant notifications through preferred channels like Telegram or Discord. This automated configuration eliminates the time delay between major movements and trader awareness.

Essential AI Tools and Platforms for Whale Tracking

Selecting the right monitoring technology depends on individual trading needs, budget constraints, and desired depth of market insight. Both affordable and premium options offer distinct advantages for different types of market participants.

Low-Cost Versus Premium Solutions

Budget-friendly tools like ChatGPT Plus provide accessible analysis through specific prompts. These solutions help traders process blockchain data without expensive subscriptions.

Premium platforms deliver comprehensive features for professional users. They offer advanced pattern recognition and historical movement tracking across multiple digital assets.

| Feature | Low-Cost Solutions | Premium Platforms |

|---|---|---|

| Real-time alerts | Basic notifications | Multi-channel instant alerts |

| Data analysis depth | General market insights | Wallet clustering & profiling |

| Historical pattern recognition | Limited historical context | Comprehensive movement history |

| Cost effectiveness | High value for budget | Professional-grade pricing |

Case Studies of Successful Platform Implementations

One notable success involved Nansen’s Smart Money dashboard identifying OLAS token accumulation. This detection occurred weeks before the asset’s significant price appreciation.

The platform’s wallet profiling tools provided early signals that helped traders position themselves advantageously. This case demonstrates how proper analysis can translate into tangible trading benefits.

Developing Your AI-Powered Whale Tracking Strategy

Moving from theoretical knowledge to practical implementation separates casual observers from serious traders. A well-defined approach transforms overwhelming data into clear decision-making frameworks.

Establish a consistent morning routine that takes just ten minutes. Scan for overnight movements exceeding $10 million using your preferred platform. Analyze exchange inflow and outflow patterns during this brief session.

Setting Up a Daily Crypto Monitoring Workflow

Correlation checks against your current positions provide immediate context. This quick assessment helps shape your day trading plans with better risk management. The daily workflow ensures you start each session with current market intelligence.

Weekly analysis requires thirty minutes on weekends. Review historical performance of major accounts during this deeper dive. Identify newly active wallets and sector-specific movement patterns.

Integrating AI Insights into Trading Decisions

Configure real-time monitoring for whales holding your same assets. Set up automatic risk assessment when significant alerts trigger. Have pre-planned response strategies for different scenarios.

The “Smart Money Follow” approach identifies consistently profitable accounts. Mirror their major moves with appropriate position sizing. This systematic method achieves success rates between 60-70% when following proven performers.

Effective whale tracking requires discipline and systematization. Transform signals into a repeatable process rather than ad-hoc reactions. This structured approach maximizes your investment potential.

Leveraging Blockchain Data for Enhanced Analysis

Advanced blockchain data analysis moves beyond simple transaction watching to uncover hidden patterns in major holder behavior. This deeper examination reveals strategic movements that basic monitoring often misses.

Using APIs for Real-Time Blockchain Data

Connecting directly to blockchain networks through APIs provides immediate access to transaction streams. Providers like Alchemy, Infura, and QuickNode offer reliable data feeds.

After generating an API key, configure scripts to pull real-time data. Use query parameters to filter for specific criteria like transaction value or token type. This creates a focused feed of relevant activity.

Implement listener functions that scan new blocks continuously. These functions trigger alerts when transactions meet your predefined rules. This ensures no significant movement goes unnoticed.

Clustering and Graph Analysis Techniques

Clustering algorithms group wallets by behavioral patterns rather than just size. Techniques like K-Means identify accumulation clusters and distribution patterns across thousands of addresses.

Graph analysis treats each wallet as a node and each transaction as a connection. This mapping reveals how seemingly unrelated addresses form coordinated networks.

These techniques solve the challenge of holders using multiple wallets. They link thousands of addresses to reveal full strategic scope. Platforms like Nansen employ similar methods for comprehensive analysis.

| Data Provider | Primary Focus | API Access Level | Ideal For |

|---|---|---|---|

| Alchemy | Ethereum Ecosystem | Enterprise-Grade | Deep Protocol Analysis |

| Infura | Multi-Chain Support | Developer-Friendly | Custom Application Building |

| QuickNode | High-Speed Data | Scalable Solutions | Real-Time Trading Signals |

Integrating AI into Your Crypto Trading Strategy

Three proven methodologies can transform whale watching into profitable trading strategies. These approaches move beyond passive observation to active decision-making frameworks.

Smart Money Follow Strategy

The Smart Money Follow approach identifies historically successful major holders. Participants mirror their significant position changes with appropriate sizing.

Key implementation steps include:

- Tracking performance records of substantial accounts

- Setting notifications for major position adjustments

- Analyzing timing between movements and price action

- Executing similar trades with proportional investment amounts

This systematic method achieves success rates between 60-70% when following proven performers.

Distribution Warning Systems and Early Signals

Advanced monitoring detects selling patterns that often precede major market drops. These systems provide 4-12 hours of lead time before significant reactions.

Critical indicators include multiple whales moving to exchanges simultaneously. Unusual selling during positive news cycles often signals insider knowledge. Cross-chain coordination among major holders can indicate coordinated exits.

These early warning signals help traders protect their investments from sudden downturns.

Effective integration means whale intelligence should complement other analytical methods. The strongest trading signals occur when multiple approaches align with major holder behavior.

Advanced Techniques in AI Whale Tracking

Advanced analytical methods reveal coordinated behaviors that individual transaction watching cannot detect. These sophisticated approaches provide deeper market insights beyond basic movement alerts.

Wallet Clustering and Network Mapping

Machine learning models identify connected addresses that act in concert. This technique groups wallets by behavioral patterns rather than just transaction size.

When one address in a cluster moves, others often follow within 24-48 hours. This provides advance notice of larger coordinated activity.

Incorporating Sentiment Analysis for Predictive Insights

Sentiment analysis combines social media mood with major holder movements. Contrarian opportunities arise when substantial accounts accumulate during negative public sentiment.

This often signals major reversal points before they become obvious. The analysis helps identify when smart money contradicts retail opinion.

Building a Custom Onchain Signal Stack

Advanced machine learning processes multiple metrics simultaneously. These include exchange flows, profit ratios, and transaction patterns.

Custom signal stacks move beyond single indicators to predictive modeling. Machine learning models identify complex correlations human analysis might miss.

These techniques require more technical knowledge but provide significantly stronger signals. They reveal the full context of major holder behavior rather than isolated notifications.

Common Pitfalls and Red Flags in Whale Tracking

Navigating the world of large-scale transaction monitoring requires awareness of significant red flags that can mislead even experienced participants. Recognizing these limitations helps traders maintain realistic expectations about what major holder intelligence can achieve.

Fake Movements and Market Manipulation Concerns

Not all substantial transactions represent genuine investment decisions. Exchange rebalancing and custodial transfers often create false signals that shouldn’t trigger trading responses.

Sophisticated pattern analysis helps distinguish real activity from technical movements. It examines transaction destinations and timing patterns for authenticity.

Some major accounts deliberately create false signals to trigger retail reactions. Historical behavior analysis identifies wallets with manipulation track records.

Ensuring Reliable Risk Management Integration

Proper risk management remains essential regardless of signal quality. Traders must maintain stop-losses and position sizing discipline.

Regulatory movements by governments operate under different incentives than profit-seeking entities. Their actions often provide poor predictors of market direction.

Even the most informed major holders cannot predict unprecedented events like exchange collapses. These black swan scenarios invalidate all prior analysis.

| Common Pitfall | Detection Method | Risk Level |

|---|---|---|

| Fake Volume Creation | Order Book Depth Analysis | High |

| Wash Trading Patterns | Multi-Wallet Correlation | Medium-High |

| Regulatory Movements | Entity Identification | Variable |

| Over-reliance Risk | Portfolio Size Assessment | Medium |

Following major accounts should inform but not dictate trading decisions. Smaller portfolios have different risk tolerances than institutional entities. This balanced approach protects against specific failure modes inherent in large holder monitoring.

Conclusion

The true value of monitoring substantial account movements lies in contextual interpretation rather than mechanical replication. Smart market participants use this intelligence to validate trading ideas and spot potential turning points before broader recognition.

This approach provides a significant informational edge but cannot replace fundamental research or guarantee profitable outcomes. Major holders maintain capital advantages, yet modern tools offer visibility into their actual positioning.

Integrate these indicators within a comprehensive strategy that includes technical analysis and disciplined risk management. The technology democratizes access to crucial market intelligence previously available only to institutional players.

When used appropriately, these systems help traders stay ahead of major market moves while maintaining balanced investment approaches across different digital assets.

FAQ

What exactly is a ‘crypto whale’?

A crypto whale is an individual or entity that holds a very large amount of a particular digital asset. Their substantial holdings mean their trading activity can significantly influence market prices and sentiment.

How do whale movements impact market trends?

Large transactions from these major holders can cause rapid price shifts. When a whale moves assets to an exchange, it often signals a potential sell-off, while movements to cold storage can indicate a long-term holding strategy, affecting overall market psychology.

What are the main benefits of using artificial intelligence for monitoring?

AI-powered analysis automates the process of sifting through vast amounts of blockchain data. It identifies complex patterns and provides real-time alerts, giving traders a significant informational edge over manual methods.

How do I set up automated alerts for major wallet activity?

Most modern platforms allow you to configure custom notifications. You can set parameters based on transaction size, specific wallet addresses, or movements to and from known exchange wallets to receive instant signals.

What is the difference between low-cost and premium tracking tools?

Entry-level solutions offer basic alerts and data. Premium services typically include advanced features like predictive analytics, sentiment analysis, and integration with trading platforms for a more comprehensive investment strategy.

What is a ‘smart money follow’ strategy?

This approach involves analyzing the behavior of historically successful wallets and institutions. By following their accumulation or distribution patterns, traders aim to mirror the strategies of proven market participants.

How can I avoid being misled by fake whale movements?

It’s crucial to use tools that provide context, such as clustering analysis that links related wallets. Be skeptical of isolated large transactions and look for confirmation through sustained activity patterns and broader market conditions.

What role does sentiment analysis play in predictive insights?

Sentiment analysis tools scan news and social media to gauge market mood. When combined with on-chain data from large holders, this can offer a powerful, multi-dimensional view of potential price directions.

No comments yet