The cryptocurrency landscape continues to evolve rapidly in 2024, with investors seeking strategic insights into the dynamic world of digital assets. A comprehensive cryptocurrency market comparison reveals fascinating trends in altcoin vs bitcoin analysis that demand careful examination.

Understanding the intricate performance metrics of digital currencies has become crucial for modern investors. The market presents unique challenges and opportunities, particularly for those looking to navigate the complex terrain of emerging cryptocurrency investment strategies.

Blockchain technology and digital asset markets have transformed dramatically, creating new pathways for investors to explore alternative investment vehicles. The relationship between Bitcoin and alternative cryptocurrencies presents a nuanced ecosystem of financial innovation.

Key Takeaways

- Cryptocurrency markets demonstrate increasing complexity in 2024

- Altcoins offer diverse investment opportunities beyond Bitcoin

- Technical analysis remains critical for understanding market dynamics

- Regulatory environments significantly impact crypto performance

- Diversification strategies are essential for managing crypto investments

Understanding the Cryptocurrency Market Dynamics

Cryptocurrency markets represent a complex and dynamic financial ecosystem that requires sophisticated analysis and deep understanding. Investors and traders navigate these markets by leveraging critical crypto market indicators that provide insights into market behavior and potential opportunities.

Successful navigation of digital asset markets demands a comprehensive approach to market analysis. Traders utilize multiple strategies to assess market conditions, focusing on key performance metrics that reveal underlying market trends.

Key Market Indicators for Crypto Analysis

Effective crypto market analysis relies on several crucial indicators:

- Price momentum

- Trading volume metrics

- Market sentiment indexes

- Network activity signals

Market Capitalization Impact on Trading

Market cap analysis provides critical insights into cryptocurrency valuation and market stability. Larger market capitalization typically suggests stronger investor confidence and reduced price volatility.

| Market Cap Range | Investor Risk Level | Potential Stability |

|---|---|---|

| $1B – $10B | Medium | Moderate |

| $10B – $100B | Low | High |

| $100B+ | Very Low | Very High |

Volume Analysis Techniques

Trading volume metrics reveal crucial market dynamics, helping investors understand potential price movements and market liquidity. Sophisticated traders examine volume trends to predict potential market shifts.

- Analyze daily trading volumes

- Compare cross-exchange activities

- Monitor order book depth

- Track institutional investment flows

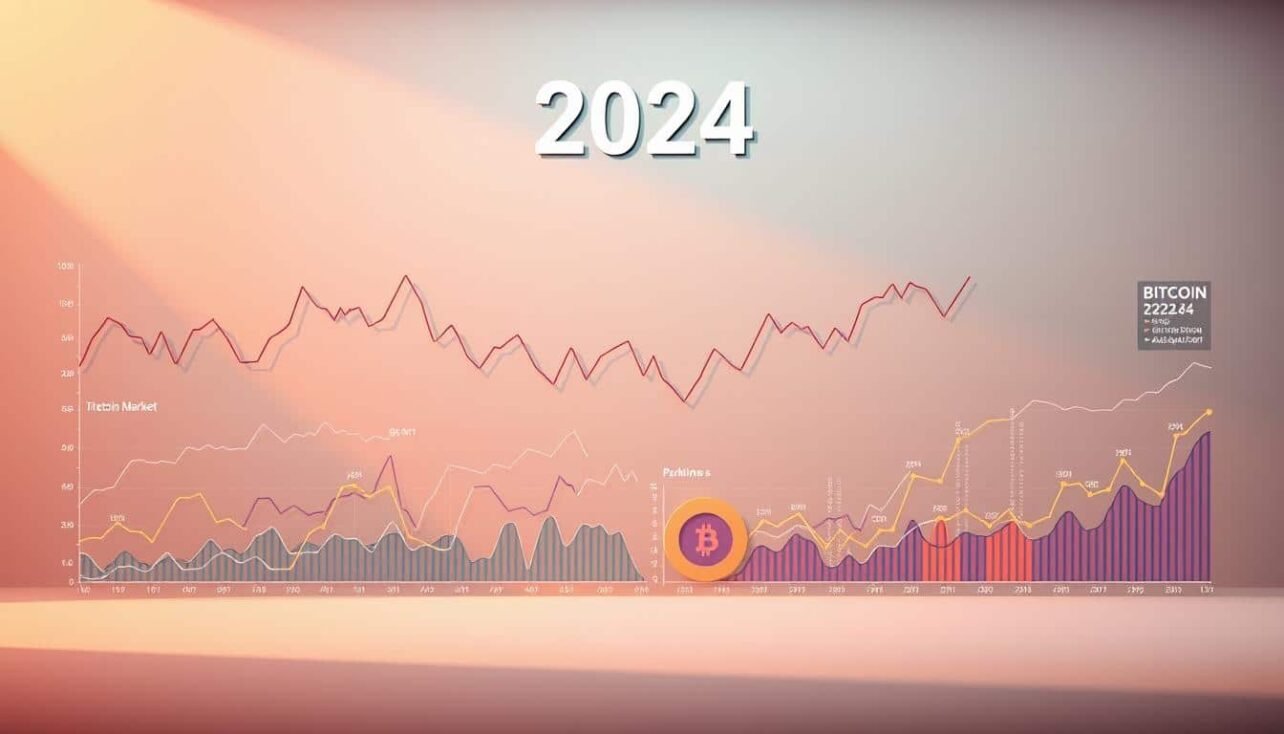

Historical Bitcoin Price Movements and Market Dominance

Bitcoin’s price history represents a remarkable journey of digital currency evolution. From its inception in 2009 at virtually zero value to reaching unprecedented heights, Bitcoin has transformed the global financial landscape. Cryptocurrency market dynamics have been significantly shaped by Bitcoin’s remarkable trajectory.

The crypto market dominance of Bitcoin has been a critical factor in understanding its economic impact. Key milestones highlight its unprecedented growth:

- 2010: First notable price emergence at $0.20

- 2013: Crossed $1,000 for the first time

- 2017: Reached nearly $20,000

- 2021: Achieved all-time high of $69,000

Market sentiment and technological advancements have played crucial roles in Bitcoin’s price fluctuations. Regulatory changes, institutional investments, and global economic conditions have continually influenced its valuation.

| Year | Price Milestone | Market Impact |

|---|---|---|

| 2009 | $0 | Initial cryptocurrency launch |

| 2013 | $1,000 | Mainstream recognition |

| 2021 | $69,000 | Institutional investment surge |

| 2024 | $70,184 | Continued market expansion |

Bitcoin’s price history demonstrates its potential as a transformative financial asset. The cryptocurrency’s market dominance continues to influence global investment strategies and technological innovations.

Major Altcoin Performance Metrics in 2024

The cryptocurrency landscape continues to evolve rapidly, with altcoin performance in 2024 showcasing dynamic market trends and exciting investment opportunities. Understanding the intricate details of altcoin growth trends becomes crucial for investors seeking strategic insights into the crypto market share.

The current crypto ecosystem reveals fascinating patterns of development and innovation across various digital assets. Investors are increasingly focusing on alternative cryptocurrencies that demonstrate unique value propositions and technological advancements.

Top Performing Altcoins

In 2024, several altcoins have distinguished themselves through remarkable performance metrics:

- Ethereum (ETH): Continues to lead with significant technological upgrades

- Solana (SOL): Demonstrates exceptional transaction speed and scalability

- Cardano (ADA): Showcases robust ecosystem development

- Binance Coin (BNB): Maintains strong market presence

Market Share Distribution

| Altcoin | Market Share (%) | Performance Rating |

|---|---|---|

| Ethereum | 18.5% | High |

| Solana | 7.3% | Very High |

| Cardano | 5.6% | Moderate |

| Binance Coin | 4.9% | Strong |

Growth Patterns Analysis

Analyzing altcoin growth trends reveals several key insights. Technological innovation, adoption rates, and ecosystem development play critical roles in determining an altcoin’s market performance. Investors should pay close attention to project fundamentals, developer activity, and real-world utility when evaluating potential investments.

The crypto market share continues to fragment, with emerging altcoins challenging established players through innovative blockchain solutions and unique value propositions.

Technical Analysis Tools for Crypto Trading

Crypto technical analysis stands as a critical skill for traders navigating the volatile cryptocurrency markets. Successful traders leverage sophisticated trading indicators to decode complex market movements and predict potential price trends.

Key trading indicators provide insights into market dynamics and help investors make informed decisions. Traders typically focus on several essential tools:

- Moving Averages: Track price trends across different timeframes

- Relative Strength Index (RSI): Measure momentum and identify overbought/oversold conditions

- Bollinger Bands: Assess market volatility and potential price breakouts

Chart patterns play a crucial role in crypto technical analysis. Traders recognize specific visual formations that signal potential market reversals or continuations. Some prominent chart patterns include:

- Head and Shoulders

- Double Top/Bottom

- Triangle Formations

- Fibonacci Retracement Levels

Advanced cryptocurrency traders combine multiple trading indicators to develop robust analysis strategies. By integrating different technical tools, investors can increase their probability of successful trades while minimizing potential risks.

Understanding these technical analysis tools requires continuous learning and practice. Cryptocurrency markets evolve rapidly, demanding traders stay updated with the latest analytical techniques and market trends.

Altcoin Market Analysis vs Bitcoin Performance: Key Differences

The cryptocurrency landscape presents a complex ecosystem where Bitcoin and altcoins interact dynamically. Understanding their unique characteristics is crucial for effective digital asset risk assessment and strategic investment decisions.

Investors navigating the crypto market must recognize the nuanced relationships between Bitcoin and alternative cryptocurrencies. Altcoin-bitcoin correlation reveals intricate patterns that challenge traditional investment assumptions.

Correlation Patterns

Crypto volatility analysis demonstrates that altcoins often exhibit more pronounced price fluctuations compared to Bitcoin. Key correlation characteristics include:

- Direct price movement synchronization

- Lagging response to market trends

- Amplified price sensitivity

Volatility Comparison

The crypto market’s inherent volatility creates significant differences between Bitcoin and altcoin performance. Factors influencing volatility include:

- Market capitalization

- Trading volume

- Technological infrastructure

- Investor sentiment

Investment Risk Assessment

Digital asset risk assessment requires comprehensive evaluation of multiple factors. Sophisticated investors analyze technological fundamentals, market dynamics, and regulatory environments to make informed decisions.

Understanding these intricate relationships enables more strategic cryptocurrency investment approaches, balancing potential returns with calculated risk management.

Impact of Market Sentiment on Crypto Prices

The cryptocurrency market thrives on investor psychology and social media influence, creating dynamic price movements that challenge traditional financial models. Crypto market sentiment plays a crucial role in determining the valuation of digital assets, with emotional responses often driving rapid price fluctuations.

Investors navigate the complex landscape of cryptocurrency through several key sentiment indicators:

- Social media trending topics

- Influencer commentary

- News event analysis

- Online community discussions

Different cryptocurrencies experience unique sentiment dynamics. Bitcoin typically demonstrates more stable sentiment patterns, while altcoins can experience more volatile emotional trading responses.

| Sentiment Source | Impact Level | Price Volatility |

|---|---|---|

| Twitter Discussions | High | Moderate to Extreme |

| Reddit Community | Medium | Low to Moderate |

| Major News Outlets | Very High | Significant |

Understanding these sentiment dynamics helps investors make more informed decisions in the rapidly evolving cryptocurrency ecosystem. Advanced sentiment tracking tools now provide real-time analysis of market psychology, enabling more strategic investment approaches.

Regulatory Influences on Bitcoin and Altcoin Markets

The cryptocurrency landscape continues to evolve rapidly, with crypto regulations becoming increasingly sophisticated across global markets. Governments and financial institutions are developing comprehensive frameworks to address the unique challenges presented by digital currencies.

Blockchain compliance has emerged as a critical focus for policymakers worldwide. Different regions have adopted varying approaches to cryptocurrency legislation, creating a complex regulatory environment for digital asset investors.

Global Compliance Standards

Understanding the global regulatory landscape requires careful examination of key jurisdictional approaches:

- United States: Strict SEC oversight and classification of cryptocurrencies

- European Union: Comprehensive MiCA regulation framework

- Japan: Advanced cryptocurrency licensing system

- Singapore: Progressive and innovation-friendly regulatory approach

Legislative Changes Effects

Recent cryptocurrency legislation has significantly impacted market dynamics, influencing investor sentiment and market capitalization.

| Region | Regulatory Impact | Market Response |

|---|---|---|

| United States | Enhanced KYC Requirements | Increased Institutional Confidence |

| European Union | Consumer Protection Laws | Improved Market Transparency |

| China | Strict Cryptocurrency Restrictions | Market Volatility |

Investors must stay informed about evolving crypto regulations to navigate the complex digital asset landscape effectively. Proactive compliance remains crucial for sustainable cryptocurrency investments.

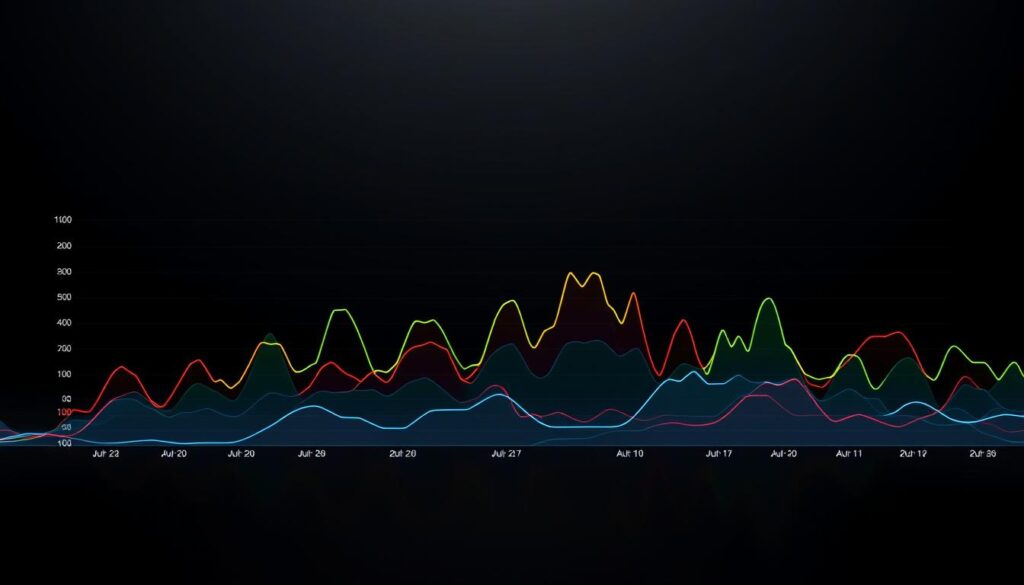

Trading Volume Analysis: Bitcoin vs Altcoins

Crypto trading volume serves as a critical indicator of market activity and investor sentiment in the digital asset landscape. Understanding the nuances of exchange data analysis reveals important insights into market dynamics between Bitcoin and alternative cryptocurrencies.

Market liquidity comparison demonstrates significant variations across different digital assets. Traders and investors closely monitor these metrics to gauge market health and potential investment opportunities.

- Bitcoin consistently maintains the highest trading volume globally

- Major altcoins show fluctuating volume patterns

- Emerging cryptocurrencies display more volatile trading characteristics

Key factors influencing crypto trading volume include:

- Market sentiment

- Global economic conditions

- Regulatory developments

- Technological innovations

Advanced investors leverage exchange data analysis to identify potential market trends and make informed trading decisions. The relationship between trading volume and price movements provides crucial insights into market psychology and potential future performance.

Cryptocurrency exchanges play a pivotal role in determining market liquidity. Different platforms exhibit unique trading volume characteristics, creating opportunities for sophisticated trading strategies.

Investment Strategies for Diversified Crypto Portfolios

Navigating the complex world of cryptocurrency investing requires strategic planning and careful digital asset allocation. Crypto portfolio diversification has become increasingly important for investors seeking to maximize returns while managing potential risks in the volatile digital asset market.

Successful cryptocurrency investment strategies demand a comprehensive approach to portfolio management. Investors must carefully consider multiple factors when developing their digital asset allocation plan.

Risk Management Techniques

Effective risk management is crucial in cryptocurrency investing. Key techniques include:

- Implementing strategic position sizing

- Using stop-loss orders to limit potential losses

- Spreading investments across multiple cryptocurrencies

- Regularly monitoring market conditions

Portfolio Balancing Methods

Maintaining a balanced crypto portfolio requires ongoing attention and strategic adjustments. Consider the following approach to digital asset allocation:

| Asset Class | Recommended Allocation | Risk Level |

|---|---|---|

| Bitcoin | 40-50% | Medium |

| Large-cap Altcoins | 30-40% | Medium-High |

| Emerging Cryptocurrencies | 10-20% | High |

Investors should adjust their crypto portfolio diversification strategy based on individual risk tolerance and market conditions. Regular rebalancing helps maintain optimal asset allocation and manage potential market fluctuations.

Market Cycles and Their Impact on Cryptocurrency

Crypto market cycles represent the natural ebb and flow of cryptocurrency prices, characterized by distinct phases of growth and decline. Understanding these cycles is crucial for investors navigating the volatile digital asset landscape. The cyclical nature of cryptocurrency markets creates unique opportunities and challenges for traders and long-term investors.

The cryptocurrency market experiences distinct bull and bear markets that differ significantly from traditional financial markets. These cycles are driven by multiple factors:

- Technological innovations

- Regulatory developments

- Market sentiment

- Institutional investment trends

Cyclical analysis reveals patterns that help investors understand market dynamics. Bitcoin typically leads market movements, with altcoins following in subsequent waves. The typical crypto market cycle includes several key stages:

- Accumulation phase

- Markup/bull market

- Distribution phase

- Markdown/bear market

| Market Cycle Stage | Characteristics | Typical Duration |

|---|---|---|

| Accumulation | Stable prices, low volatility | 3-6 months |

| Bull Market | Rapid price appreciation | 12-18 months |

| Distribution | Price stabilization | 2-4 months |

| Bear Market | Price decline and consolidation | 6-12 months |

Successful cryptocurrency investors recognize that market cycles are not linear. Developing a strategic approach that accounts for these cyclical patterns can help mitigate risks and optimize investment potential in the dynamic crypto ecosystem.

Fundamental Analysis of Leading Altcoins

Cryptocurrency investors seek comprehensive strategies for evaluating altcoin potential beyond traditional financial metrics. Altcoin fundamental analysis provides critical insights into blockchain technology’s intrinsic value and long-term viability.

Successful cryptocurrency investments require deep understanding of blockchain technology comparison and specific cryptocurrency use cases. Investors must examine multiple dimensions to assess an altcoin’s genuine market potential.

Technology Assessment Strategies

Evaluating blockchain technologies involves analyzing several critical components:

- Network scalability and transaction speed

- Consensus mechanism efficiency

- Smart contract capabilities

- Security infrastructure

- Developer community engagement

Use Case Evaluation Framework

Robust altcoin fundamental analysis demands rigorous examination of real-world applications. Key considerations include:

- Practical industry problems solved

- Potential for widespread adoption

- Unique technological advantages

- Economic incentive structures

Investors must look beyond market speculation and understand the transformative potential of each blockchain project’s underlying technology and practical implementation.

Liquidity Factors in Crypto Markets

Cryptocurrency liquidity represents a critical component of digital asset trading, directly impacting investor strategies and market performance. Understanding market depth analysis helps traders navigate the complex landscape of crypto exchanges. The cryptocurrency market’s liquidity varies significantly across different digital assets.

Slippage in crypto trading emerges as a key concern for investors, especially when executing large transactions. Low liquidity can cause substantial price variations, making it challenging to buy or sell assets at desired rates. Traders must carefully assess market conditions to minimize potential financial risks.

- Bitcoin typically demonstrates higher liquidity compared to smaller altcoins

- Trading volume directly influences market depth and price stability

- Exchanges with higher trading volumes offer more reliable liquidity

Cryptocurrency exchanges play a pivotal role in determining market liquidity. Factors such as trading pairs, order book depth, and transaction speed significantly impact an asset’s tradability. Investors should consider these elements when selecting platforms for their crypto transactions.

Professional traders utilize advanced market depth analysis techniques to evaluate cryptocurrency liquidity. By examining order book structures and historical trading patterns, they can make more informed investment decisions and mitigate potential trading risks.

Institutional Investment Trends in Bitcoin and Altcoins

The landscape of institutional crypto investment has undergone significant transformation in recent years. Financial institutions are increasingly recognizing the potential of digital assets, with a particular focus on Bitcoin and select altcoins. This shift represents a crucial moment in the mainstream acceptance of cryptocurrency as a legitimate asset class.

Corporate Adoption Rates

Corporate Bitcoin adoption has accelerated dramatically, with major companies integrating cryptocurrency into their financial strategies. Key developments include:

- Increased treasury allocations to Bitcoin

- Growing acceptance of crypto payments

- Strategic investments in blockchain technologies

Investment Flow Patterns

Institutional interest in altcoins has become more nuanced, with investors carefully evaluating potential opportunities beyond Bitcoin. Sophisticated risk assessment now drives institutional crypto investment decisions, moving beyond initial speculative approaches.

| Asset Type | Institutional Interest | Investment Growth |

|---|---|---|

| Bitcoin | High | 45% Increase |

| Ethereum | Moderate | 30% Increase |

| Other Altcoins | Selective | 15% Increase |

The crypto market continues to mature, with institutional investors playing a pivotal role in establishing credibility and stability. Their strategic approach signals a new era of digital asset investment, bridging traditional finance with innovative blockchain technologies.

DeFi Impact on Altcoin Market Performance

Decentralized finance growth has revolutionized the cryptocurrency landscape, transforming how investors approach blockchain financial services. DeFi tokens analysis reveals a powerful shift in digital asset ecosystems, creating unprecedented opportunities for market participants.

The emergence of DeFi platforms has sparked significant changes in altcoin market dynamics. Innovative blockchain technologies are enabling new financial interactions beyond traditional cryptocurrency. Investors are increasingly drawn to decentralized platforms that offer:

- Automated lending protocols

- Yield farming opportunities

- Liquidity pool investments

- Decentralized exchange mechanisms

Blockchain financial services are expanding rapidly, with DeFi tokens demonstrating remarkable resilience and growth potential. These platforms eliminate intermediaries, providing users direct control over their financial transactions and investments.

The market has witnessed substantial capital inflows into DeFi projects, signaling growing confidence in decentralized technologies. Smart contracts and innovative token mechanisms continue to drive decentralized finance growth, attracting both retail and institutional investors seeking alternative financial solutions.

Cross-Market Correlation Analysis

Analyzing cross-market correlations reveals intricate relationships between cryptocurrencies and traditional financial markets. The crypto-traditional market correlation has become increasingly significant for investors seeking comprehensive portfolio strategies.

Inter-cryptocurrency relationships demonstrate complex dynamics that impact investment decisions. Researchers have identified several key patterns:

- Bitcoin’s dominance as a market leader

- Altcoin price movements relative to Bitcoin

- Emerging correlation patterns among different cryptocurrency classes

Diversification effects play a critical role in managing investment risk. Investors can leverage these insights to create more robust investment strategies that balance potential returns with risk mitigation.

Recent studies highlight several important observations about market correlations:

- Cryptocurrency markets show varying degrees of interconnectedness

- Traditional financial markets increasingly influence crypto asset performance

- Emerging digital assets create new correlation opportunities

Sophisticated investors recognize that understanding these complex market relationships is crucial for developing effective investment approaches. The evolving landscape of crypto-traditional market correlation continues to provide fascinating insights into global financial dynamics.

Advanced analytical tools now enable more precise tracking of inter-cryptocurrency relationships, empowering investors to make more informed decisions about portfolio allocation and risk management.

Future Outlook for Crypto Market Development

The cryptocurrency market continues to evolve with exciting blockchain industry trends reshaping digital financial landscapes. Technological innovations are driving significant transformations in how digital assets are developed, traded, and integrated into mainstream economic systems. Scalability solutions and advanced interoperability protocols are expected to play crucial roles in future cryptocurrency market predictions.

Emerging use cases for blockchain technologies are expanding beyond traditional financial applications. Decentralized finance (DeFi) platforms and Web3 technologies are creating new opportunities for investors and developers. The future of digital assets looks increasingly sophisticated, with enhanced security protocols and more robust infrastructure supporting broader adoption across multiple sectors.

Regulatory environments will significantly impact cryptocurrency market development in the coming years. Governments worldwide are developing frameworks to balance innovation with consumer protection. This strategic approach will likely create more stable investment environments and attract institutional participants seeking transparent and compliant digital asset platforms.

Technology advancements and increasing institutional interest suggest a promising trajectory for cryptocurrencies. Strategic investments in blockchain research and development will continue driving market maturity. Investors and technologists should remain adaptable and informed about emerging trends that could reshape the digital asset ecosystem in the near future.

FAQ

What is the difference between Bitcoin and altcoins?

Bitcoin is the original cryptocurrency, while altcoins are alternative digital currencies created after Bitcoin. Altcoins often introduce different technological features, consensus mechanisms, or specific use cases that differentiate them from Bitcoin’s primary function as a store of value and digital currency.

How do market capitalization and trading volume impact cryptocurrency performance?

Market capitalization reflects the total value of a cryptocurrency, indicating its overall market presence. Trading volume shows the total amount of a cryptocurrency traded within a specific period, which helps assess market liquidity and investor interest. Higher market cap and consistent trading volume typically suggest more stability and market confidence.

What are the key factors to consider when investing in cryptocurrencies?

Investors should consider several critical factors: market volatility, technological fundamentals, regulatory environment, project team expertise, use case potential, historical performance, liquidity, and overall market sentiment. Diversification and risk management are essential strategies for navigating the complex cryptocurrency market.

How do DeFi projects impact the altcoin market?

Decentralized Finance (DeFi) projects have significantly transformed the altcoin market by introducing innovative financial services without traditional intermediaries. These projects create new investment opportunities, increase blockchain utility, and drive technological innovation, often leading to increased interest and value in related altcoins.

What technical analysis tools are most effective for crypto trading?

Effective technical analysis tools for cryptocurrency trading include Moving Averages, Relative Strength Index (RSI), Bollinger Bands, MACD (Moving Average Convergence Divergence), and Fibonacci Retracement. Traders typically combine multiple indicators to develop more comprehensive market insights and potential price movement predictions.

How do institutional investments affect cryptocurrency markets?

Institutional investments can significantly impact cryptocurrency markets by providing legitimacy, increasing market stability, driving liquidity, and influencing price movements. As more traditional financial entities enter the crypto space, they bring substantial capital, sophisticated trading strategies, and increased mainstream acceptance.

What are the primary risks associated with cryptocurrency investments?

Primary cryptocurrency investment risks include extreme price volatility, regulatory uncertainties, technological vulnerabilities, potential security breaches, market manipulation, and limited historical performance data. Investors should conduct thorough research, maintain a diversified portfolio, and only invest amounts they can afford to lose.

How do market sentiment and news impact cryptocurrency prices?

Market sentiment can dramatically influence cryptocurrency prices through social media trends, news events, regulatory announcements, influential endorsements, and global economic conditions. Positive or negative perceptions can cause rapid price fluctuations, making sentiment analysis a crucial aspect of cryptocurrency trading strategies.

What distinguishes successful altcoins from less performant cryptocurrencies?

Successful altcoins typically demonstrate strong technological innovation, clear use cases, active developer communities, robust security protocols, scalability, real-world adoption potential, and effective governance mechanisms. The ability to solve specific market problems or improve upon existing blockchain technologies often determines long-term success.

How frequently should a cryptocurrency portfolio be rebalanced?

Portfolio rebalancing frequency depends on individual investment strategies, market conditions, and risk tolerance. Generally, investors might consider rebalancing quarterly or semi-annually, or when significant market shifts occur. Regular portfolio assessment helps maintain desired asset allocation and manage potential risks in the volatile cryptocurrency market.

No comments yet