Imagine trading cryptocurrencies directly with someone without banks, brokers, or centralized platforms. This is now possible through cross-chain technology that lets users exchange tokens across separate blockchain networks. These transactions only finalize when both parties meet predefined conditions, eliminating the risk of one side backing out.

This innovation reshapes decentralized finance (DeFi) by letting individuals retain full control of their assets. Unlike traditional methods, funds never sit in third-party wallets during the process. If either participant fails to act, the entire transaction cancels automatically, protecting everyone involved.

The system solves a major challenge in crypto adoption: moving value between ecosystems like Bitcoin and Ethereum. By enabling direct peer-to-peer trades, it unlocks liquidity trapped in isolated networks. This aligns with Web3’s core philosophy of minimizing trust in intermediaries while boosting financial flexibility.

Key Takeaways

- Enables direct crypto exchanges between different blockchains

- Transactions complete only when both parties fulfill conditions

- Removes reliance on centralized exchanges or custodians

- Protects users through automatic cancellation of incomplete deals

- Enhances liquidity across decentralized finance platforms

- Maintains alignment with Web3’s trustless principles

As the multi-chain ecosystem grows, this technology becomes vital for seamless asset movement. The following sections break down how these swaps function technically and why they matter for DeFi’s future.

Understanding the Basics of Atomic Swaps

In the realm of cryptocurrency, direct asset exchange across separate blockchain networks is now achievable through innovative protocols. These systems, known as atomic swaps, use self-executing agreements to facilitate trades between participants. This approach removes third-party control, letting users maintain ownership of their digital assets throughout the process.

Definition and Core Concepts

Atomic swaps rely on smart contracts – programmable codes that enforce trade terms automatically. The term “atomicity” ensures transactions succeed completely or reverse entirely, preventing partial exchanges. If either party fails to meet conditions, funds return to their original wallets instantly.

Decentralization and Direct Peer-to-Peer Trading

This technology enables true peer-to-peer transfers without banks or exchanges holding assets temporarily. Users trade cryptocurrencies directly through secure cryptographic channels, maintaining custody at all times. By cutting out intermediaries, individuals set their own trade parameters while reducing fees and counterparty risks.

The Mechanics Behind Atomic Swaps

At the core of cross-chain exchanges lies a cryptographic protocol that ensures secure transactions between strangers. This system uses two interlocking security layers to verify actions and enforce deadlines automatically.

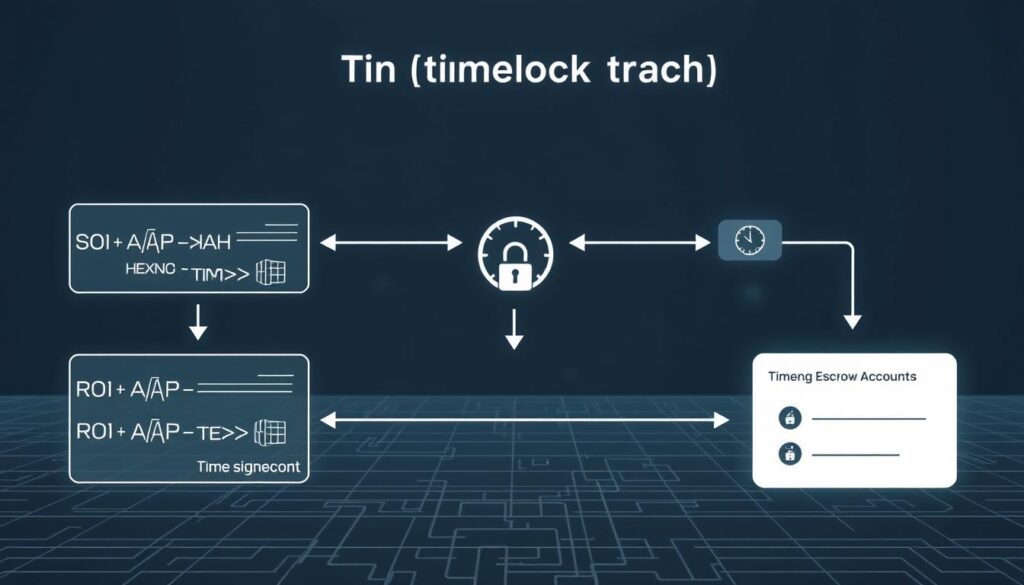

Hash Time-Locked Contracts (HTLCs) Explained

HTLCs act as digital safety deposit boxes controlled by code. When initiating a trade, both participants lock their funds into these programmable agreements. The hashlock feature requires cryptographic proof that each party fulfilled their obligations before releasing assets.

Here’s how it works:

- Each user generates a secret code (hash) to validate transactions

- Funds remain locked until both parties confirm receipt

- All actions occur through blockchain-verified steps

Time-Lock Features and Smart Contract Roles

The second security layer uses countdown timers. If either side fails to complete their part within set timeframes, the smart contract cancels the deal. Locked coins return to their original wallets, preventing loss from unresponsive traders.

These automated agreements eliminate human error through:

- Pre-programmed expiration dates

- Instant refund mechanisms

- Decentralized verification processes

By combining these features, HTLCs create trustless environments where strangers can trade directly. The system’s design ensures complete transactions or full refunds – no middlemen required.

atomic swaps explained: Step-by-Step Process

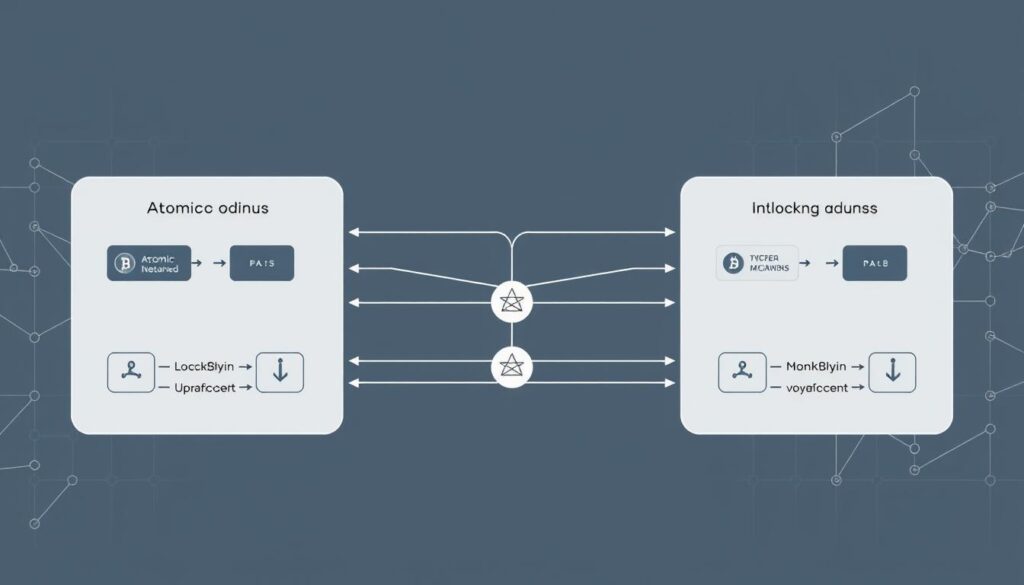

Let’s break down how cross-chain exchanges operate through a real-world scenario. Alice wants to trade 10 X tokens for Bob’s 10 Y tokens without intermediaries. They agree on terms and set a one-hour expiration window.

Contract Setup and Asset Locking

Alice starts by creating a contract address and depositing her tokens. This generates a unique private key only she knows. She then produces a cryptographic hash of this key – like a digital fingerprint – and shares it with Bob. This step locks her funds securely while allowing verification.

Verification and Reciprocal Locking

Bob checks the hash to confirm Alice’s deposit but can’t access the tokens without her private key. He creates his own contract address using Alice’s hash and locks his Y tokens. Both parties now have assets secured in separate blockchain agreements.

When Alice claims Bob’s tokens, she unintentionally reveals her private key. This action triggers two outcomes:

- Bob gains access to Alice’s original deposit

- The one-hour timer starts counting down

If either participant delays beyond the deadline, all funds automatically return to their owners. This dual-layer security ensures completed transactions or full refunds – no exceptions. The system’s design makes failed deals impossible once both sides fulfill requirements.

Advantages and Benefits of Atomic Swaps

Cross-chain trading methods are transforming how users exchange digital assets by offering unique advantages over conventional platforms. These peer-to-peer systems address critical pain points in decentralized finance, from excessive fees to counterparty vulnerabilities.

Reduced Counterparty Risks and Lower Costs

Traders retain full control of their funds throughout transactions, eliminating the need to trust centralized intermediaries. This setup drastically reduces exposure to exchange hacks or operational failures. Direct peer-to-peer swaps bypass third-party fees, making transactions more cost-effective than traditional methods like crypto derivatives trading.

Three security mechanisms stand out:

- Guaranteed execution – Funds only move when both parties fulfill requirements

- Automatic refunds – Failed deals return assets without manual intervention

- Fee elimination – No platform charges or withdrawal costs

Enhanced Liquidity and Direct Asset Exchanges

These systems unlock trapped value by connecting isolated blockchain networks. Users swap Bitcoin for Ethereum directly instead of using intermediate stablecoins, reducing transaction steps and slippage risks.

Key liquidity benefits include:

- Access to combined trading pools across multiple chains

- Increased market depth for niche cryptocurrencies

- Faster capital movement between DeFi platforms

By removing conversion barriers and centralized gatekeepers, cross-chain swaps empower traders with faster, cheaper, and more flexible exchange options. This approach aligns perfectly with decentralized finance’s core principles while solving real-world usability challenges.

Navigating the Challenges and Limitations

While cross-chain exchanges offer groundbreaking potential, several barriers hinder widespread adoption. These hurdles range from technical roadblocks to practical usability concerns that impact both novice and experienced traders.

Technical Complexity and Compatibility Concerns

Setting up peer-to-peer trades demands technical expertise most casual users lack. Participants must exchange cryptographic hashes, negotiate timelock durations, and verify contract details manually. Many blockchains can’t interact due to incompatible hashing algorithms, limiting viable trading pairs.

Three critical compatibility issues persist:

- Networks require identical encryption standards

- No universal protocol for cross-chain communication

- Manual coordination for multi-step verification

User Experience and Liquidity Issues

The swap process involves more steps than centralized platforms, requiring users to manage multiple wallet confirmations and contract validations. Finding counterparties for niche tokens proves challenging, creating liquidity gaps in decentralized markets.

Privacy risks emerge despite the technology’s decentralized nature. Transaction patterns across multiple blocks expose trading activity, enabling blockchain analysis firms to track wallet addresses. Additionally, the absence of fiat currency support forces users to rely on traditional exchanges for cash conversions.

Current limitations include:

- No direct USD or EUR trading options

- Extended confirmation times compared to CEXs

- Market fragmentation across isolated networks

Atomic Swaps vs. Cross-Chain Bridges

Blockchain interoperability solutions take two distinct approaches to moving value across networks. One method prioritizes direct ownership, while the other focuses on flexible asset representation. Both aim to connect ecosystems but employ fundamentally different mechanisms.

Key Differences and Use Cases

Atomic swaps enable direct trades between users holding native coins on separate chains. No synthetic assets get created – you receive the original token from the counterparty. This method suits traders seeking pure peer-to-peer transactions without wrapped token risks.

Cross-chain bridges operate through custodial or algorithmic models. They lock your assets on one network and issue equivalent tokens on another chain. While convenient, these IOU-based systems have suffered $2.6 billion in hacks since 2021 due to centralized attack surfaces.

Security, Speed, and Operational Comparisons

Swaps eliminate third-party risks through self-executing contracts. Bridges rely on validators or smart contracts holding user funds, creating vulnerability points. However, bridges support more chains since they don’t require matching encryption protocols.

Consider these operational contrasts:

- Swaps need compatible hashing algorithms between networks

- Bridges work across any chains but introduce custodial risks

- Atomic transactions take longer but settle irreversibly

For frequent DeFi interactions across multiple platforms, bridges offer practicality. When exchanging large sums between trusted parties, swaps provide superior security through direct asset transfers.

Real-World Applications and Future Outlook

The practical implementation of cross-chain technology is reshaping financial ecosystems. Major DeFi platforms now integrate these protocols to enable direct asset transfers between networks like Ethereum and Solana. This shift reduces reliance on centralized exchanges while expanding access to global liquidity pools.

Integration with DeFi and Chainlink CCIP

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enhances swap capabilities through decentralized oracle networks. These systems verify off-chain data, enabling complex conditional trades across blockchains. Smart contracts now automatically execute multi-chain strategies, from yield farming to collateral transfers.

Evolving Trends in Cross-Chain Trading

New platforms combine user-friendly interfaces with advanced security features. Automated liquidity routers analyze multiple chains simultaneously, finding optimal trade paths in seconds. Partnerships between blockchain projects aim to standardize protocols, addressing current compatibility challenges.

Future developments focus on bridging traditional finance with Web3 ecosystems. Expect expanded support for real-world assets and regulatory-compliant trading frameworks. As interoperability improves, cross-chain swaps could become the default method for moving value in decentralized markets.

FAQ

How do cross-chain exchanges eliminate intermediaries?

Cross-chain exchanges use smart contracts to automate transactions between users. These contracts lock funds until both parties confirm the terms, enabling direct peer-to-peer trading without centralized platforms like Coinbase or Binance.

What role do hash time-locked contracts (HTLCs) play in secure transactions?

HTLCs ensure security by requiring participants to generate cryptographic proofs within a set timeframe. If either party fails, funds return automatically. This system prevents fraud in blockchains like Bitcoin and Ethereum.

What steps ensure funds remain safe during the process?

First, both users lock assets into smart contracts. Next, cryptographic keys are exchanged to verify the transaction. Finally, time-bound conditions trigger refunds if steps aren’t completed, minimizing risks.

How do these trades reduce costs compared to centralized platforms?

By removing intermediaries, users avoid deposit, withdrawal, and trading fees charged by platforms like Kraken. This also reduces delays caused by third-party approvals.

What challenges might users face with cross-chain compatibility?

Not all blockchains support the same protocols. For example, Bitcoin’s scripting language differs from Ethereum’s, requiring workarounds. Projects like Litecoin and Komodo have pioneered solutions for broader interoperability.

How do peer-to-peer exchanges differ from bridge solutions?

Peer-to-peer swaps occur directly between users via smart contracts, ensuring decentralization. Bridges, like Polygon’s PoS bridge, rely on custodians or validators, which can introduce centralization risks.

How are decentralized protocols integrating with DeFi ecosystems?

Projects like Chainlink’s Cross-Chain Interoperability Protocol (CCIP) enable seamless communication between networks. This allows platforms like Uniswap to expand liquidity pools across multiple chains.

No comments yet