This guide frames practical entry timing in a 24/7 crypto market. It explains how global order flow and liquidity shape the actual price an investor pays. Recent 90‑day data before June 5, 2025 showed clearer U.S. buying windows in afternoons and evenings across bitcoin, ether, solana, doge, and shib.

No single clock or calendar guarantees the lowest price. Timing edges are probabilities informed by recent patterns and market structure. Mondays and Thursdays offered more buying opportunities, while Sundays were weakest. End‑of‑month softness and frequent drawdowns around the 10th were noted.

This introduction previews how cycle phases — accumulation through markdown — affect entries. Combine intraday, weekly, and monthly edges with cycle context, not in isolation. Emphasize risk‑first planning: dollar‑cost averaging is a baseline, with opportunistic buys layered in. External factors like macro moves, regulation, and adoption can shift short windows, so disciplined execution beats prediction.

Key Takeaways

- Use data-backed windows within cycles rather than seeking a perfect moment.

- Afternoons and evenings showed better U.S. buying edges in recent 90‑day data.

- Mondays and Thursdays outperformed; Sundays lagged.

- DCA reduces timing risk; add opportunistic buys when odds favor entry.

- Cycle awareness and liquidity flow matter more than exact timestamps.

What “best time to buy” really means in 24/7 crypto markets

In global, always-on trading, the idea of an ideal entry is about repeatable edges in liquidity and order flow — not a magical hour that always yields the lowest prints.

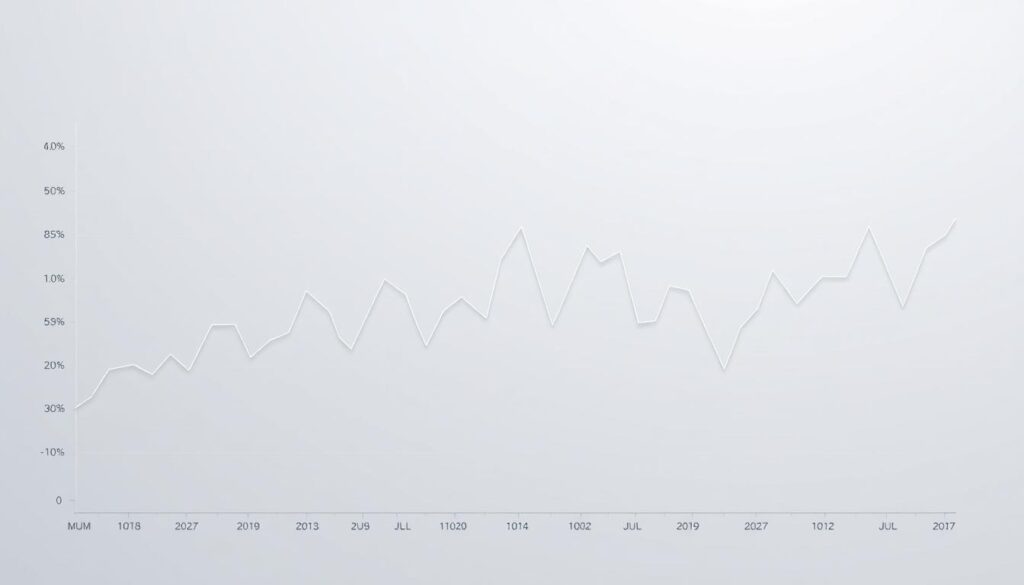

Patterns matter: recurring windows can bring tighter spreads, deeper bids, and steadier prices. Over the 90 days before June 5, 2025, U.S. afternoons and evenings often offered cleaner fills across BTC, ETH, SOL, DOGE, and SHIB. Monday showed the most regular dislocations, Thursday followed, and Sunday tended to be thin and jumpy.

Treat timing as an incremental edge layered on a sound risk plan. Use DCA as your discipline anchor, then add opportunistic entries when liquidity and sentiment align. Even the best statistical windows can fail during sudden volatility, major headlines, or abrupt sentiment swings.

- Use rolling windows (for example, 90 days) to update assumptions as regimes shift.

- Track your fills versus daily ranges and average true range to validate any edge.

- Blend scheduled buys with selective, smaller opportunistic adds during favorable windows.

Market cycles explained: accumulation, markup, distribution, markdown

Understanding where an asset sits in its cycle helps investors choose when to add or reduce exposure.

Four phases: accumulation is quiet buying after a markdown. Markup follows as prices rise and momentum builds. Distribution is where sellers take profits near highs. Markdown brings declines and capitulation.

Bull vs. bear: a bull market brings optimism, rising participation, and stronger price moves. Bear markets are dominated by fear and heavy selling pressure. Media coverage often amplifies both feelings.

Investor sentiment and media narratives create feedback loops. Positive headlines and retail interest can accelerate markups. Conversely, security events or crackdowns can magnify markdowns.

- Watch trend signals and price movements to separate healthy pullbacks from early markdowns.

- Track external factors such as regulatory changes, macro liquidity, and technological adoption that can lengthen or compress cycles.

- Map strategy to the phase: accumulate late in markdowns, scale into early markups, and de-risk during distribution.

For a deeper primer on cycle mechanics and practical guides, see crypto market cycles.

Bitcoin halving and structural supply shocks that precede bull runs

A predictable, protocol-level event like halving can reset long-term supply dynamics and reshape investor expectations.

How the mechanism works: roughly every four years the bitcoin block reward cuts in half. That reduction slows new supply issuance and lowers the flow of fresh coins entering exchanges and wallets.

Supply and demand link: with reduced issuance, steady or rising demand can produce a supply-demand realignment that supports higher price discovery over time. Historical cycles show major bull runs often followed halving events, though timing and magnitude vary.

Positioning before and after halving

Pre-halving, many investors stage entries across accumulation and early markup phases with defined risk limits and smaller tranche sizes.

- Track bitcoin price reaction and miner behavior closely.

- Watch on-chain flows, exchange balances, and inflows from institutions.

- Plan for macro swings—liquidity, policy, and adoption milestones can amplify or damp moves.

Post-halving tactics often include riding emerging trends, taking partial profits into strength, and rebalancing assets. Scenario plan for upside continuation and downside whipsaws; halving is a structural factor, but disciplined execution determines outcomes.

Intraday trends: best time of day to buy based on recent patterns

Intraday patterns in U.S. sessions showed repeatable windows where execution improved across major coins. Over the 90 days before June 5, 2025, afternoons and evenings in U.S. hours often delivered deeper liquidity and tighter spreads for BTC, ETH, SOL, DOGE, and SHIB.

Afternoons and evenings in the United States: why liquidity matters

Deeper books mean cleaner fills. When North American traders overlap with European and later Asian activity, order books firm up and spreads compress. That improves prices for limit and market orders and reduces slippage for large fills.

Correlated activity across BTC, ETH, SOL, DOGE, and SHIB

Activity was correlated across these assets, indicating broad participation rather than isolated moves. That correlation suggests liquidity cycles drive price movements across asset groups, so watch the leading pair for early signals.

Using trading volume and volatility windows to refine entries

Monitor trading volume and realized volatility to time entries within the intraday range. Use average true range bands and limit orders to reduce slippage and avoid chasing sudden price action spikes.

- Log fills versus the day’s high-low to measure execution quality.

- Use smaller tranches across an afternoon window to smooth entries.

- Combine scheduled DCA with alerts for volume surges or pullbacks in preferred assets.

Caution: sudden volatility can widen spreads and accelerate movements. Treat intraday edges as complements to cycle-aware strategy and strict risk controls.

Weekly rhythm: Monday and Thursday opportunities vs. Sunday risk

Early-week sessions tend to recover mispricings that form over thin weekend trading.

Why Mondays often offer better entries. In the 90 days before June 5, 2025, Monday produced roughly twice as many buying opportunities as Thursday. Weekend moves can leave brief dislocations. When full liquidity returns, mean reversion and steadier order books can improve execution and lower realized prices for careful buyers.

Thursday windows can also help. Positioning and fund flows toward week’s end sometimes create favorable depth. Use these sessions for staged adds when your plan calls for selective accumulation.

Avoiding weekend liquidity traps

Sunday is the riskiest day. Liquidity thins, spreads widen, and slippage rises. Small orders may be fine, but larger fills often cost more in real terms.

- Reduce size on weekends; save larger allocations for early-week sessions with better depth.

- Pair Monday buys with stop or alert thresholds to capture short, sharp dips.

- Track weekly results by day to confirm whether Monday/Thursday edges persist in current markets.

- Remember exogenous events can shift flows—keep risk limits intact and integrate weekly edges with intraday and cycle signals.

Monthly cadence: end-of-month softness and day-of-month anomalies

Monthly patterns show subtle shifts that can expand or compress price risk in the final third of each month. Aggregated 10-day windows in the recent 90-day sample showed more frequent drawdowns in the last ten days. The crypto market displayed this month-end softness most clearly among larger-cap pairs.

The 10th day effect appeared as the single day with the most recorded drops in the sample. Treat it as a signal, not a guarantee. One-off outliers can appear; don’t overfit your plan to a single date.

Plan laddered buys across the final third of the month. Use small, even tranches to capture lower prices without overcommitting on one day. Align DCA schedules so they tilt toward month-end while keeping steady contributions all month long.

- Large-cap consistency: BTC and ETH showed steadier moves; use tighter ranges.

- Altcoin variability: Smaller coins need wider ranges and smaller tranches.

- Measure results: Track realized entry vs. monthly VWAP to evaluate ladders.

Combine these monthly tendencies with weekly and intraday edges. Adapt if macro events cluster near month-end. For investors, disciplined execution beats chasing any single anomaly in crypto.

Altcoin season timing: signals when capital rotates from Bitcoin

Periods of broad altcoin strength show clear signals when capital shifts away from bitcoin toward diversified token sets.

Defining altseason: it occurs when BTC dominance falls and a wide set of coins rally together. That rotation lifts trading volume and creates cross‑asset momentum that investors watch for entry points.

Bitcoin dominance drops and the Altcoin Season Index

Watch the index. A rising Altcoin Season Index and a drop in bitcoin dominance are primary flags. In August 2025, dominance slipped from over 64% to about 59% while the index rose from 29 to 38.

Ethereum leadership, ETF inflows, and capital migration

Ethereum often leads rotations. ETF inflows and institutional interest can turbocharge ETH’s gains — in one recent month ETH outperformed BTC by roughly +54% vs. +10% — and that leadership usually precedes broader capital migration into large‑cap alts.

Rising alt trading volumes and liquidity breadth

Expanded trading volume across many coins signals breadth, not just a single pump. Track trading volume and order book depth to separate sustainable rotations from short squeezes.

Historical analogs and tactical rules

Past altseasons (2017–18, 2020–21) showed fast gains and sharp reversals. Use staged entries, buy pullbacks in leading sectors, and set stop rules.

- Monitor index readings and bitcoin dominance for early confirmation.

- Follow ETF flows and on‑chain signals for durable adoption signals.

- Rotate profits back into higher‑quality assets as sentiment heats up.

Best time to buy cryptocurrency based on market cycles and trends

Layering short-term windows over the big-picture cycle gives investors a clearer plan for staged entries.

Identify the cycle phase first: accumulation, markup, distribution, or markdown. Then add known intraday, weekly, and monthly edges to size buys and limit risk.

Combining cycle phase with intraday/weekly/monthly edges

When an asset sits in accumulation or early markup, blend steady DCA with Monday afternoon tranches where U.S. liquidity often tightens spreads.

During distribution, shrink sizes and use strict limit orders. In markdowns, stage buys on sharp dips and favor deeper liquidity windows while keeping dry powder.

Balancing DCA with opportunistic dips during markdowns

- Shift a portion of recurring buys toward the final 10 days of the month to lean into month-end softness.

- Keep full-month coverage so you don’t miss gradual moves; DCA smooths volatility.

- Review realized entries vs. average prices periodically to confirm the edge is real.

Remember: prices can overshoot. Avoid deploying all capital in one session. Large-cap assets usually follow patterns more reliably than smaller coins, so size and patience matter for long-term investors.

The indicator stack: technical, on-chain, and sentiment tools

Use a layered checklist of trend, on‑chain, and behavioral signals to raise the odds before committing capital. This stack turns noisy data into a compact decision flow that favors probability over guesswork.

Trend and momentum

Higher‑timeframe moving averages confirm the primary trend. Use the 50/200 MA crossover or slope to set directional bias.

RSI highlights momentum extremes and mean‑reversion spots. Combine RSI with market structure — higher highs/lows in uptrends, lower highs/lows in downtrends — for clearer entry points.

On‑chain flows

Track exchange balances and large wallet transfers to infer accumulation versus distribution. Shrinking exchange reserves often signal reduced selling pressure.

Watch realized metrics and dormancy to see if long holders are spending or adding, which helps time entries within cycle phases.

Market sentiment

Use fear & greed index readings and media tone to spot behavioral extremes. Surges in search interest or euphoric coverage can signal peaks.

Conversely, muted media and low search volume can mark quieter accumulation windows for selective buying.

Liquidity and volume

Confirm moves with trading volume and order‑book depth. Breakouts with weak participation are more likely to fail.

Validate breakouts across multiple assets, including bitcoin, to check whether advances reflect broad participation or isolated pumps.

- Rules checklist: higher‑timeframe MA confirms trend; RSI not extreme; exchange flows support accumulation; sentiment not euphoric; volume confirms the move.

- Use this checklist as a pre‑trade gate. Indicators provide probabilities — require multiple confirmations to improve conviction.

- Calibrate indicators periodically; what worked in one regime may need adjustment as the crypto market evolves.

Risk-first strategies for U.S. investors in 2025’s volatile market

Start every allocation plan by protecting capital: a risk-first mindset keeps investors solvent during sudden volatility. Crypto is speculative and can go to zero, so plan with long horizons and clear limits.

Dollar-cost averaging (DCA) remains the default for taming timing risk. Use steady, scheduled buys as your base layer and avoid deploying large sums after one news swing.

Position sizing, dry powder, and staged entries

Define size rules by asset risk tiers. Put larger allocations into liquid holdings and smaller stakes into speculative names.

Keep stablecoin dry powder to act on dislocations without borrowing or panic selling. Use staged entries and preset levels to reduce emotional buys.

Profit-taking and exit frameworks

Build profit-taking ladders and predefine exits before you enter. Recycle gains into cash or higher‑conviction assets as trends mature.

Set stop or invalidation points and schedule periodic re-evaluations. For U.S. investors, weigh tax impacts of short- versus long-term holding when rebalancing.

- Document each trade’s thesis, size, and invalidation to enforce discipline.

- Diversify across assets and narratives to lower idiosyncratic risk while preserving upside to gains.

- Focus on staying solvent: consistent execution beats chasing every opportunity.

Macro and regulatory watch: Fed rates, ETFs, and policy signals

Federal Reserve decisions move liquidity and risk appetite across markets fast. A rate cut often frees capital, lifting risk assets and sometimes accelerating altseason. Hikes can reverse that, tightening credit and reducing demand for speculative tokens.

ETFs channel institutional flows. Bitcoin ETFs and potential ETH products bring steady, large-scale inflows that change how investors access crypto. These vehicles can increase adoption and shift price sensitivity to fund flows rather than only retail orders.

Regulatory changes and enforcement actions also create sharp repricings. Rule updates, agency guidance, or high-profile cases can trigger quick sell-offs or rallies across markets. Media coverage amplifies these moves and raises short-term volatility.

- Monitor Fed calendars and major policy speeches for liquidity signals.

- Track ETF filings and approvals as structural demand factors.

- Watch regulatory changes from U.S. agencies and global regulators for rule-shaping news.

Plan around known events: reduce leverage, tighten risk controls, and map scenarios for easing versus tightening. Macro and policy can temporarily override intraday or weekly edges, so keep adaptive playbooks and use resources like how to understand crypto market trends in the for ongoing context.

Your 90-day action plan to time entries without guessing tops and bottoms

Set a clear 90-day playbook that blends scheduled buys with alerted add-ons for better fills.

Start by building a ranked watchlist of assets. Note cycle context, liquidity, and why each coin belongs on the list. Keep it tight—focus where edges and volume align.

Build a watchlist, define triggers, and schedule recurring buys

Define technical and on-chain triggers: moving average recaptures, RSI oversold zones, or exchange outflows.

Then schedule recurring DCA buys as the baseline. Use smaller tranches for altcoins and larger ones for liquid assets.

Map Monday/Thursday and month-end windows to alerts

Map alerts for U.S. afternoon/evening windows and Monday/Thursday sessions. Add a tilt toward the final 10 days of each month while avoiding overcommitment on a single calendar date.

Predefine risk limits and storage choices before entering

Predefine per-position size caps, max drawdown limits, and minimum cash reserves. Decide custody now: exchange flows, cold storage steps, whitelists, and 2FA. Do not make these choices during a volatile event.

- Document each transaction’s rationale, holding period, and exit rules.

- Establish weekly and monthly reviews to track results vs. benchmarks.

- Keep flexibility for unexpected opportunities, but protect capital first.

Bringing it all together: a disciplined path to buying crypto at better prices

A rules-driven approach that aligns liquidity windows with cycle context turns small edges into repeatable gains.

Identify the cycle phase first, then layer intraday (U.S. afternoons/evenings), weekly (Monday/Thursday), and month-end windows into a rules-based plan.

Use DCA as your backbone and add small, alerted tranches when indicators, on‑chain flows, and sentiment confirm lower risk. Size positions, set exits, and keep dry powder.

Track results across a 90-day playbook, revise with evidence, and stay flexible as adoption and investor interest shift. Small, consistent edges compound into material gains without chasing extremes.

FAQ

What does “best time to buy” mean for 24/7 crypto markets?

It means choosing moments that combine favorable price action, liquidity, and risk control rather than looking for a single perfect minute. Because crypto trades around the clock, investors focus on cycle phase, intraday liquidity windows, weekly and monthly patterns, and personal entry rules like dollar-cost averaging (DCA) to improve odds and reduce timing risk.

How do market cycles—accumulation, markup, distribution, markdown—affect entries?

Each cycle phase implies different risk/reward. Accumulation shows steady buys and on-chain accumulation; markup is rapid price gains and higher volatility; distribution sees profit-taking and choppy ranges; markdown shows falling prices and capitulation. Buying during accumulation or early markup with clear risk limits generally beats catching late-stage distribution or deep markdown panics without plan.

How do bull and bear markets change investor behavior?

In bull runs optimism and FOMO push retail inflows, raising prices and compressing volatility. Bears bring fear, lower liquidity, and heavier selling. Strategy shifts: favor trend-following and position sizing in bulls; prioritize risk controls, dry powder (stablecoins), and staged entries in bears.

What role do media, sentiment, and FOMO play in price moves?

Media coverage and social chatter amplify momentum. Positive headlines and celebrity mentions drive short-term inflows; negative regulatory news triggers rapid outflows. Sentiment gauges—like Fear & Greed indexes and social volume—help time entries by contrasting price action with crowd mood.

How do macro events, regulation, and tech innovation influence cycles?

Rate decisions, ETF approvals, and major protocol upgrades shift capital flows and risk appetite. For example, ETF approvals for Bitcoin or a major upgrade on Ethereum can attract institutional money, while stricter regulation can stall inflows and increase volatility. Track policy calendars and developer roadmaps as part of your signal set.

Why does the Bitcoin halving often precede bull runs?

Halving cuts new BTC issuance roughly in half, reducing miner supply pressure. If demand stays steady or grows, the supply shock can create upward price pressure over months. Markets often price in halvings early, so positioning requires balancing anticipation with actual post-halving demand dynamics.

Should investors change positioning before versus after a halving?

Some add gradually into accumulation pockets ahead of a halving; others wait for post-halving confirmation of demand and liquidity. Use staged entries and size positions relative to risk tolerance rather than making large, undiversified bets solely on halving narratives.

Are there better times of day to enter trades? What about U.S. afternoons and evenings?

Liquidity typically increases when U.S. markets wake up—often afternoons and evenings UTC—reducing spreads and slippage. Lower-liquidity periods can widen spreads and amplify price moves. Tailor trade sizes to expected liquidity windows to limit execution cost.

Do major tokens like BTC, ETH, SOL, DOGE, and SHIB move together?

Large-cap assets often show correlated moves during macro shifts and risk-on/off rotations. Smaller altcoins can diverge, showing higher volatility and idiosyncratic moves. Watch dominance metrics and cross-asset volume to understand when correlation breaks or strengthens.

How can trading volume and volatility windows refine entries?

Higher volume confirms participation and makes breakouts more reliable. Volatility windows highlight when price swings amplify, offering opportunity for larger mean-reversion moves but raising risk. Combine volume thresholds with stop rules for better execution.

Are certain weekdays better for entry—like Monday or Thursday—compared with Sunday?

Early-week sessions (Monday and Thursday) can show dislocations as institutional flows restart, sometimes creating better pricing. Weekends generally have lower liquidity, wider spreads, and higher risk of sharp moves on thin order books, so many traders avoid large weekend entries.

Why do weekend trades often carry extra risk?

Fewer market participants means less depth; a single large order or news item can move price significantly. Exchanges also may have maintenance or lower derivative liquidity. Limit order sizes and use wider stops if you must trade weekends.

What monthly patterns matter—end-of-month softness or day-of-month effects?

Month-end rebalancing, fund flows, and payroll cycles can create predictable flows. Some traders see softness in the last 10 days as funds lighten positions. The “10th day” or other single-day anomalies can appear sporadically; treat them as signals only when backed by volume and context.

How should I ladder buys during month-end weakness?

Use a laddered DCA or limit orders across the weakness window to average cost without guessing a bottom. Define maximum allocation per rung and avoid increasing size purely on price without reassessing fundamentals and liquidity.

What signals indicate an upcoming altcoin season?

Drops in Bitcoin dominance, rising altcoin market capitalization, surging alt trading volumes, and positive flows into Ethereum or layer-1 projects often precede alt seasons. Monitor Altcoin Season Indexes, liquidity breadth, and capital migration via ETF or exchange flow data.

How do ETF inflows and Ethereum leadership affect capital rotation?

ETF approvals and inflows channel institutional dollars into spot markets, often lifting large caps first. Strong leadership from Ethereum or a prize-winning narrative for a layer-1 can redirect capital from BTC to ETH and related tokens, fueling broader altcoin rallies.

How can I combine cycle phase with intraday, weekly, and monthly edges?

Start with macro cycle assessment (accumulation vs. distribution) to set bias. Then layer intraday liquidity windows for execution, pick weekdays that historically show better order flow, and align monthly laddering for position sizing. This multi-horizon approach reduces single-point timing risk.

How does DCA fit with opportunistic dip buying during markdowns?

DCA provides consistent exposure while limiting timing risk. During markdowns, you can keep DCA and add opportunistic, sized entries into clear support levels. Cap total incremental exposure to avoid overconcentration in a falling market.

What indicator types should a trader use—technical, on-chain, sentiment?

Use a stacked approach: moving averages and RSI for trend and momentum; on-chain metrics like exchange balances and accumulation rates for supply-side signals; sentiment tools such as Fear & Greed and search volume for crowd positioning; and volume/liquidity measures to confirm participation.

Which on-chain flows matter most for timing entries?

Exchange inflows/outflows show selling pressure or accumulation. Large transfers to cold wallets indicate long-term holding. Stablecoin supply growth can signal dry powder ready to deploy. Combine these with price action for more reliable signals.

What risk-first strategies should U.S. investors use in volatile 2025 markets?

Prioritize position sizing, use DCA, keep a stablecoin reserve for opportunities, and set stop-loss frameworks. Consider tax-aware accounts and custody choices. Monitor regulatory developments from the SEC and Fed policy that affect liquidity and sentiment.

How much dry powder should I hold and how do I size positions?

There’s no one-size-fits-all. A common approach is to keep 10–30% in stablecoins as optionality, size individual trades so a single loss won’t harm portfolio objectives, and scale into winners rather than betting all at once.

What macro and regulatory signals deserve close watch?

Federal Reserve rate moves, inflation data, SEC guidance on spot ETFs and custody, and major policy statements from the U.S. and EU can shift risk appetite. Track headlines and official calendars to anticipate liquidity rotations.

What should a 90-day action plan include to avoid guessing tops and bottoms?

Build a watchlist of assets, define buy triggers and failure rules, schedule regular DCA buys, map preferred weekday and month-end windows to alerts, and predefine risk limits and custody choices. Reassess every 30 days or after major news events.

How important is predefining storage and exit rules before entering positions?

Very important. Decide custody—exchange, hardware wallet, or institutional custody—based on horizon and counterparty risk. Set profit-taking and stop-loss rules so emotions don’t drive decisions during volatility.

How do I adapt strategies for altcoins versus large-cap tokens?

Altcoins often need smaller position sizes, tighter liquidity checks, and quicker profit-taking due to higher volatility. Large caps like Bitcoin and Ethereum usually offer deeper liquidity and more predictable behavior, letting investors use larger, longer-term allocations.

Which historical rotations are useful analogs for today’s market?

The 2017–2018 and 2020–2021 cycles show how capital can rotate from BTC to altcoins during risk-on periods, and how sentiment and leverage can exaggerate moves. Use these analogs to study timing, but adapt for current macro and regulatory context.

How do liquidity and volume readings change entry confidence?

Strong volume and tight spreads increase confidence in breakouts or trend continuations. Thin liquidity and low volume raise the chance of false moves and slippage. Always match trade size to prevailing liquidity conditions.

What practical steps bring all these signals into a disciplined buying approach?

Create a checklist covering cycle phase, liquidity window, weekday/month cadence, indicators (MA, RSI, on-chain flows), and risk rules. Automate recurring buys, set alerts for opportunistic windows, and keep a clear exit plan before adding exposure.

No comments yet