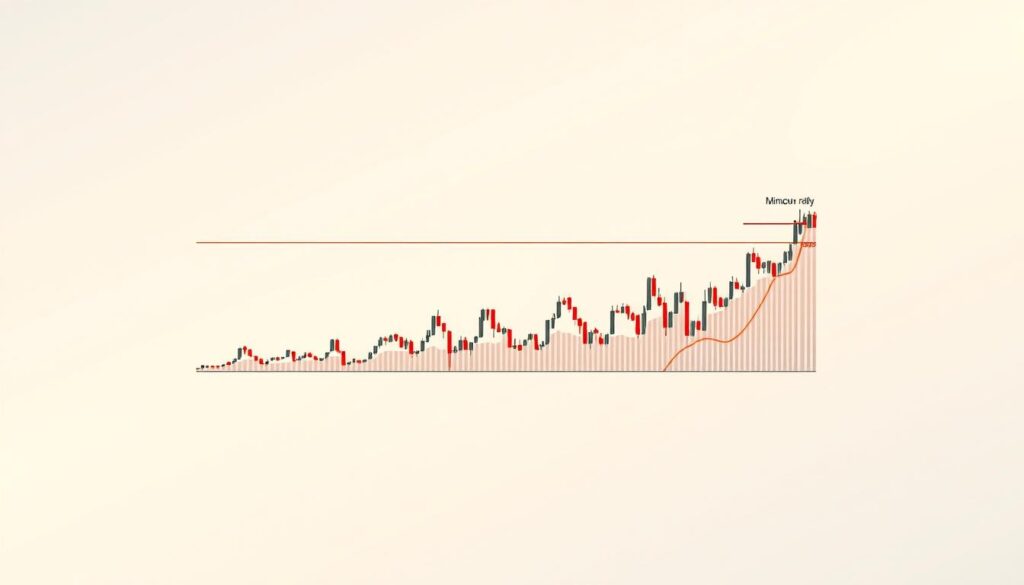

Understanding the forces behind digital asset price swings is crucial for any trader. This guide dives into the tools that measure the speed and strength of these movements. We focus on how these gauges work during significant upward trends in the crypto space.

Think of these tools like a speed radar on a highway. They help you see if a price move is accelerating or slowing down. This information is vital for spotting potential opportunities in the market.

Recent phases of consolidation have made these signals even more important. Traders use them to gauge sentiment and make informed decisions. The relationship between a digital asset’s performance and broader trends is key.

This foundational knowledge is indispensable for navigating today’s volatile landscape. Whether you’re new or experienced, understanding these concepts helps create a complete picture of potential price trajectories.

Understanding Bitcoin Rally Analysis Momentum Indicators

Momentum serves as a fundamental gauge for measuring the intensity of price movements. This concept helps traders understand whether a digital asset’s value is accelerating or decelerating.

Defining Momentum in the Cryptocurrency Market

In trading, momentum refers to the rate of price change rather than the direction itself. It compares current price levels to historical values from specific periods.

Larger differences between these prices indicate stronger momentum. This measurement helps identify faster market movements.

How Price Signals and Volatility Interact

Rapid price fluctuations create both opportunities and risks for traders. Understanding this relationship helps distinguish meaningful shifts from random market noise.

Momentum often changes direction before the actual price does. This gives traders early warning of potential trend reversals.

| Momentum Value | Interpretation | Market Condition |

|---|---|---|

| 0-30 | Weak momentum | Consolidation phase |

| 31-70 | Moderate momentum | Steady trending |

| 71-100 | Strong momentum | Accelerating movement |

Consecutive increases in these values signal building momentum. This indicates that buying pressure is accelerating within the cryptocurrency space.

Technical Insights: Bitcoin rally analysis momentum indicators

Market participants rely on specialized gauges to assess the strength and sustainability of price trends. These tools help identify when assets might be approaching turning points.

Exploring RSI, Stochastics, and Stochastic RSI

The Relative Strength Index (RSI) measures recent price changes on a 0-100 scale. Readings above 70 suggest overbought conditions, while below 30 indicates oversold territory.

Stochastics follows price velocity rather than direction itself. Created by George C. Lane, this indicator often changes before prices do.

Stochastic RSI combines both approaches for increased sensitivity. It applies the Stochastic formula to RSI values instead of price data.

Calculation Methods and Sensitivity Adjustments

Each indicator uses unique calculation methods. Stochastics compares closing prices to high-low ranges over a specific period.

Traders can adjust settings to match different assets. Customizing threshold levels helps align indicators with unique market behaviors.

| Indicator | Calculation Basis | Key Levels | Sensitivity |

|---|---|---|---|

| RSI | Price changes over period | 30/70 | Medium |

| Stochastics | Close vs. High-Low range | 20/80 | High |

| Stochastic RSI | RSI values | 20/80 | Very High |

Understanding these calculations helps interpret signals more effectively. Recent market data shows how these tools work in practice.

Period adjustments allow optimization for different trading strategies. Backtesting helps find the best settings for each cryptocurrency.

Market Trends and Volatility in the Crypto Space

Recent price consolidation phases offer valuable insights into the underlying strength of cryptocurrency markets. This stability reflects broader market dynamics where traders carefully evaluate future directions.

Indicators of Overbought and Oversold Conditions

Technical tools help identify when assets approach extreme valuation levels. The Relative Strength Index (RSI) stability mirrors healthy market absorption of recent gains.

Current conditions show cautious optimism rather than fear or euphoria. Investors weigh economic data before committing to strong positions.

Macro-Economic Influences and Investor Sentiment

External factors significantly impact cryptocurrency prices and investor behavior. Federal Reserve policies and inflation data drive market sentiment.

Analysts observe that dollar strength and rising interest rates often pressure digital assets. Conversely, potential rate cuts tend to support value preservation strategies.

| Market Condition | Investor Sentiment | Typical Duration | Volatility Level |

|---|---|---|---|

| Consolidation Phase | Cautious Optimism | 2-4 Weeks | Low to Moderate |

| Bullish Trend | Confident Buying | 1-3 Months | Moderate to High |

| Bearish Trend | Risk Aversion | 1-6 Months | High |

| Breakout Phase | Speculative Enthusiasm | Days to Weeks | Very High |

Understanding these patterns helps anticipate shifts in market conditions. For deeper insights into current market updates, analysts recommend monitoring multiple data sources.

Comparing Bitcoin with Traditional Safe-Haven Assets

Gold has long served as a protective asset during economic instability, but new alternatives are emerging. Investors increasingly consider digital options alongside traditional stores of value.

According to the New York Digital Investment Group (NYDIG), digital currencies may be establishing new roles during financial turbulence. This challenges gold’s historical dominance as the primary safe-haven choice.

Bitcoin Versus Gold: Risk and Resilience

The risk profiles of these two assets differ significantly. Gold demonstrates greater price stability and resilience during market fluctuations.

Digital alternatives offer higher growth potential but come with increased volatility. This creates distinct advantages for different investor strategies and timeframes.

Central banks continue accumulating gold reserves, reinforcing its established role. Meanwhile, younger investors often prefer digital options as modern hedges.

Impact of Global Economic Uncertainty

Global uncertainties affect both assets differently. Gold typically benefits immediately from heightened investor caution.

Digital assets respond more to specific economic concerns like inflation fears. Their performance depends on whether uncertainty favors decentralized alternatives.

Understanding these dynamics helps construct balanced portfolios. Investors can leverage gold’s stability while capturing digital growth potential.

Practical Trading Strategies and Optimal Timeframes

Effective trading requires aligning your timeframe with the right technical tools for optimal results. The chart period you choose directly impacts signal quality and trading outcomes.

Shorter intervals like 1-hour charts capture rapid price movements and volatility. These conditions create numerous trading opportunities for active participants.

Selecting Timeframes for Trading Momentum

Different time horizons serve distinct trading styles. Active traders benefit from shorter periods where price action generates clearer entry and exit signals.

Long-term holders typically use daily or weekly charts to identify major trend changes. The key is matching your chart period with your risk tolerance and goals.

Integrating Momentum Indicators into Your Strategy

Combine these tools with trend-following indicators for confirmation. This multi-layered approach increases confidence in identifying high-probability setups.

Practical integration strategies include:

- Monitoring RSI movements above 70 for strong bullish momentum

- Watching for drops below 40 indicating potential corrections

- Observing breakout opportunities when digital assets show strength versus traditional safe-havens

Customize indicator parameters through backtesting specific cryptocurrency behavior. Adjusting period settings and thresholds optimizes signal accuracy for your preferred trading range.

These insights help traders capture upside potential while managing risk effectively. The right combination of data analysis and timeframe selection creates a robust framework for decision-making.

Conclusion

This comprehensive examination reveals how technical gauges capture the current market equilibrium. The latest RSI readings suggest a period of consolidation rather than extreme sentiment.

Both digital and traditional assets now play complementary roles in modern portfolios. Gold offers stability while crypto provides growth potential for different investor timeframes.

Market participants should monitor key levels and sentiment shifts carefully. Understanding these tools helps navigate complex financial landscapes effectively.

For deeper practical application, consider exploring our guide on how to analyze crypto charts for U.S. Continuous learning remains essential for successful participation in evolving markets.

No comments yet