The digital currency world has changed. A new way to run networks is here. This method is called proof-of-stake. It replaces old systems that used lots of computer power.

This approach picks people to check transactions randomly. Coin owners help secure the system. They lock up some of their digital money. This is a big step for the environment. It uses much less energy than before.

Our guide will show you how this process works. We explain the technical side and how to join. You will learn about the good parts and the possible problems. Major platforms have already made the switch successfully.

We give you clear steps to get started. You can see how to pick the right system for you. This article looks at both sides fairly. You will understand the trade-offs between different methods.

Key Takeaways

- Proof-of-Stake is a modern consensus mechanism that is more energy-efficient than older systems.

- Validators are chosen randomly to confirm transactions, which improves network security.

- Participants must commit, or “stake,” their own cryptocurrency to become validators.

- This method addresses major environmental concerns associated with digital currency networks.

- Major networks have adopted this model, proving its real-world effectiveness and viability.

- Understanding both the advantages and potential risks is crucial for anyone looking to participate.

Introduction to Blockchain Staking Proof of Stake

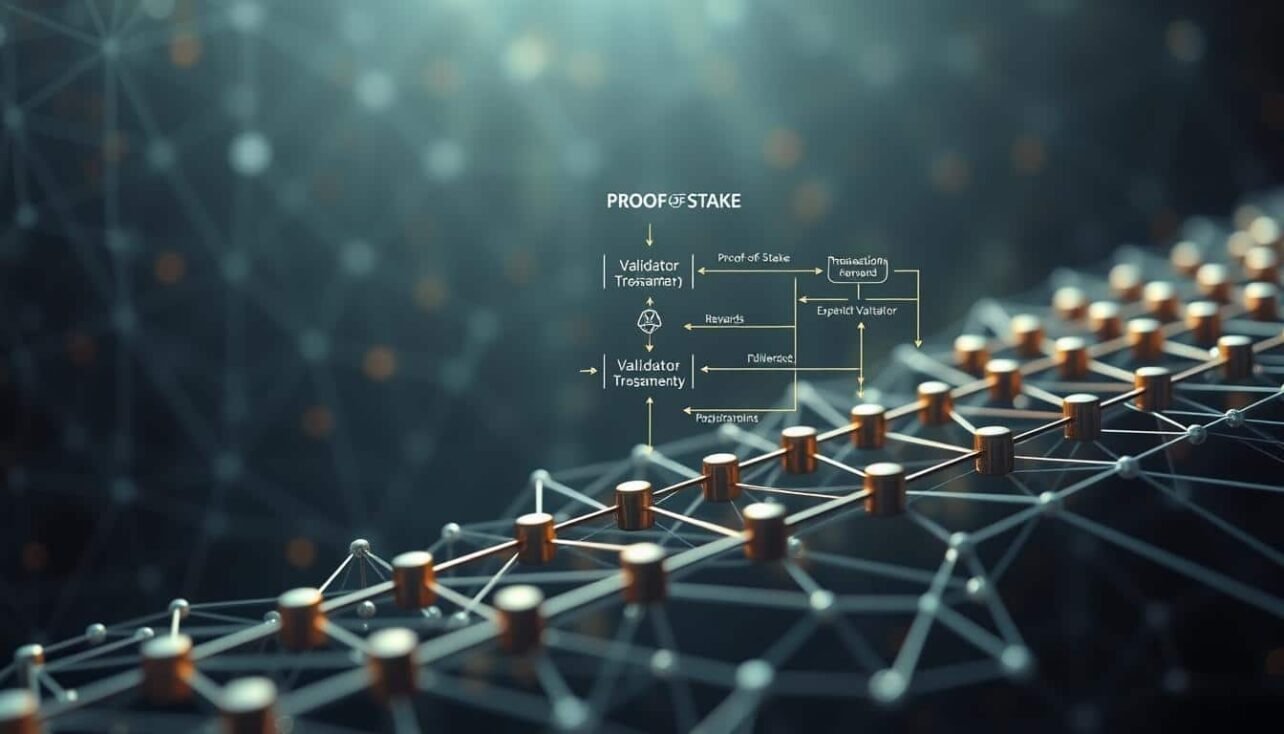

A fundamental shift in how digital agreements are verified is underway. It moves from computational races to financial commitment. This new method is known as Proof-of-Stake (PoS).

This approach selects validators based on their economic stake. They lock up their coins as collateral. This is very different from older, power-hungry systems.

What Is Proof-of-Stake?

Proof-of-Stake is a specific type of consensus mechanism. In this system, validators are chosen to confirm transactions. Their chance of selection depends on the amount of cryptocurrency they commit.

This creates a direct link between financial investment and network responsibility. It replaces the need for expensive mining hardware. The system is designed to be far more energy-efficient.

Validators have a strong incentive to act honestly. If they approve bad transactions, they can lose their staked funds. This process is called slashing.

Why It Matters for Blockchain Networks

This model matters because it opens participation to more people. You don’t need a warehouse of computers. You just need to hold the network’s token.

It also drastically reduces the environmental impact of running a digital ledger. Major platforms are now adopting this method. This shows its growing importance for the future.

Understanding this system is the first step to participating. It allows you to maximize your rewards effectively. The table below highlights key differences.

| Feature | Proof-of-Stake (PoS) | Proof-of-Work (PoW) |

|---|---|---|

| Primary Resource | Owned Cryptocurrency | Computational Power |

| Energy Consumption | Low | Very High |

| Barrier to Entry | Financial | Technical & Financial |

| Security Mechanism | Slashing Staked Funds | Cost of Electricity |

Blockchain staking proof of stake: Fundamentals and Process

Becoming an active participant in a PoS network involves more than just holding coins. You must understand the core mechanics that keep the system secure and functional. This section breaks down the essential steps and rules.

How Validators Are Selected

The system chooses who confirms transactions. It is not a first-come, first-served race. Instead, selection is often randomized but weighted.

Your chance of being chosen typically increases with the amount of cryptocurrency you commit. This is a key security feature. Participants with more at stake have a stronger incentive to act honestly.

This process prevents any single entity from controlling the creation of new blocks. It ensures a fair and distributed consensus.

Understanding the Staking Requirements

To become a validator, you must lock up a specific amount of coins. This act is your commitment to the network.

For example, operating a full node on Ethereum requires a commitment of 32 ETH. This demonstrates the substantial financial pledge needed for direct involvement.

Once you stake your coins, you can be called upon to validate blocks of transactions. Multiple validators must agree on a block’s accuracy before it is finalized. This multi-party confirmation reduces risk.

Successful validators earn rewards for their work. However, malicious actions can lead to “slashing,” where a portion of the staked funds is forfeited. This aligns personal interest with network security.

Benefits of Using Proof-of-Stake Mechanisms

Energy efficiency and robust security stand as the twin pillars of this model’s appeal. These advantages directly address major concerns associated with older systems.

Enhanced Energy Efficiency

This approach uses a fraction of the power required by its predecessor. It eliminates the need for energy-intensive mining operations.

The impact is dramatic. Ethereum’s transition resulted in a 99.84% reduction in its energy consumption. This makes digital ledgers far more sustainable.

Improved Network Security

Security is strengthened through economic incentives. Validators must commit a significant financial stake to participate.

The threat of “slashing” acts as a powerful deterrent against malicious actions. This aligns personal gain with network honesty.

This mechanism also protects against majority attacks. Gaining control would be prohibitively expensive, safeguarding all transactions.

Risks and Limitations of Proof-of-Stake Systems

The transition to Proof-of-Stake consensus mechanisms introduces new types of risks alongside its improvements. While this approach offers environmental benefits, participants face distinct challenges that require careful navigation.

High Entry Costs and Centralization Concerns

Direct participation as a validator often requires substantial financial commitment. Operating a full node on major networks like Ethereum demands significant capital investment.

This high barrier can lead to centralization concerns. Larger token holders naturally have greater influence within the system. Over time, this dynamic may concentrate power among wealthy participants.

Liquidity and Technical Challenges

Committing funds to the validation process locks up tokens for extended periods. This reduces liquidity for participants who might need quick access to their assets.

Technical requirements add another layer of complexity. Validators must maintain rigorous security practices and stay current with protocol updates. Any misstep could result in penalties.

| Risk Category | Primary Concern | Potential Impact | Mitigation Strategy |

|---|---|---|---|

| Financial Barriers | High minimum stake requirements | Limited participation opportunities | Staking pools for smaller holders |

| Centralization | Wealth concentration among validators | Reduced network decentralization | Protocol-level stake limits |

| Liquidity Constraints | Locked funds during staking period | Reduced financial flexibility | Liquid staking solutions |

| Technical Complexity | Node maintenance requirements | Potential slashing penalties | Professional validator services |

Step-by-Step Guide to Starting with Proof-of-Stake

Getting involved with modern consensus protocols requires careful preparation and strategic choices. This practical guide walks you through the essential steps to begin earning returns on your digital assets.

Selecting the Right PoS Network

Your first decision involves choosing which digital ledger system aligns with your goals. Consider factors like minimum commitment amounts, potential returns, and network stability.

Ethereum typically offers 4-8% annual returns, while newer systems may provide higher initial yields. Research each platform’s specific features before committing your funds.

Setting Up Your Wallet and Validator

You’ll need a compatible digital storage solution that supports validation features. Many exchanges now offer built-in participation tools that simplify the process.

Transfer your chosen cryptocurrency to this secure location. The amount you commit directly influences your potential earnings, especially if you operate independently.

Joining a Staking Pool for Smaller Holders

For those with limited assets, collective participation offers an accessible pathway. Users combine their holdings to increase selection chances.

Rewards are distributed proportionally based on individual contributions. This approach eliminates the need for large minimum commitments while maintaining earning potential.

| Participation Method | Minimum Requirement | Technical Knowledge | Potential Returns |

|---|---|---|---|

| Independent Validator | High (e.g., 32 ETH) | Advanced | Higher |

| Staking Pool | Low or None | Basic | Moderate |

| Exchange Services | Variable | Minimal | Standard |

Liquid participation options provide additional flexibility. These allow you to maintain access to your assets while still earning interest. Always review lock-up periods and withdrawal processes before committing.

Comparative Insights: Proof-of-Stake vs. Proof-of-Work

The evolution of consensus protocols presents a clear choice between computational competition and economic commitment. These two approaches represent fundamentally different philosophies for achieving network agreement.

Environmental and Efficiency Trade-offs

Proof-of-work relies on miners solving complex computational problems. This competitive process requires massive energy consumption worldwide. The environmental impact can equal small countries’ energy usage.

In contrast, proof-of-stake selects validators based on economic stake. This eliminates the computational arms race. The energy reduction exceeds 99% compared to traditional protocols.

Security and Decentralization Perspectives

Proof-of-work derives security from prohibitive computational costs. Attacking the network would require enormous power resources. However, mining operations often consolidate in regions with cheap electricity.

Proof-of-stake achieves security through economic commitment. Network attacks would demand owning majority stake at enormous financial cost. Both mechanisms maintain blockchain integrity through different security models.

| Feature | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

|---|---|---|

| Primary Resource | Computational Power | Economic Stake |

| Energy Consumption | Very High | Minimal |

| Security Model | Hardware Cost Barrier | Financial Stake Risk |

| Decentralization Risk | Mining Pool Concentration | Wealth Concentration |

| Validator Selection | First to Solve Puzzle | Random Weighted Choice |

Conclusion

Proof-of-Stake represents a fundamental rethinking of how decentralized networks achieve security and validation. This consensus mechanism has transformed the cryptocurrency landscape by aligning economic incentives with network integrity.

The system offers dramatic improvements in energy efficiency while maintaining robust security. Through practical options like staking pools, participation becomes accessible to holders at various investment levels.

As this technology evolves, it will likely drive further adoption across digital networks. Understanding these protocols is essential for anyone interested in the crypto market.

FAQ

What is the main difference between Proof-of-Work and Proof-of-Stake?

The primary distinction lies in how they achieve consensus. Proof-of-Work (PoW), used by Bitcoin, relies on miners solving complex puzzles, consuming significant energy. Proof-of-Stake (PoS) selects validators based on the amount of cryptocurrency they commit, or “stake,” making it far more energy-efficient.

How do I earn rewards from staking my tokens?

You earn rewards for helping to secure the network. By locking your tokens in a wallet to support network operations, you receive additional coins as compensation. These rewards are typically a percentage of your staked amount, similar to earning interest.

Is my staked cryptocurrency at risk of being lost?

Yes, there is a risk called “slashing.” If a validator node you are delegated to acts maliciously or goes offline frequently, a portion of the staked tokens can be penalized. It’s crucial to choose reliable validators or staking pools to minimize this risk.

Can I unstake my tokens at any time?

This depends on the specific protocol. Many networks have an “unbonding period,” which is a waiting time after you request to unstake before your tokens are liquid again. This period can range from days to weeks, affecting your liquidity.

What are the minimum requirements to become a validator?

Requirements vary by network. For example, becoming a validator on Ethereum requires a significant amount of ETH and technical expertise to run the node software. Other networks may have lower barriers, but substantial investment and technical knowledge are common themes.

What is a staking pool and should I join one?

A staking pool allows multiple users to combine their tokens to meet the minimum staking threshold. This is an excellent option for smaller holders who want to participate without the high entry cost or technical burden of running their own validator node.

No comments yet