Welcome to your complete guide on using a powerful tool for market analysis. This method helps you understand price movements in the fast-moving world of digital assets. Many people look for clear ways to make sense of sudden price changes.

This guide will take you from the basic ideas to more advanced techniques. You will see how to use these concepts on popular platforms. The core idea is to measure how much prices tend to move up and down.

These dynamic lines adjust to current conditions. This makes them especially useful when dealing with extreme price swings. You will learn several approaches to entering and exiting positions.

We will also cover how to protect your capital and steer clear of common errors. The tool itself has a strong history, developed by John Bollinger decades ago. It has proven reliable across different financial arenas over time.

Please remember this is educational material. It is designed to inform your decisions, not to serve as direct financial advice. All investment activity carries risk, and you should always do your own research.

Key Takeaways

- This guide provides a full walkthrough of a popular technical analysis tool.

- The technique is well-suited for markets known for their rapid price changes.

- You’ll learn foundational concepts and practical applications.

- Effective risk management is a critical component of any plan.

- The method has a long track record of use in various financial sectors.

- The content is strictly for educational purposes.

Introduction to Bollinger Bands in Cryptocurrency Trading

Market participants seeking to understand asset price fluctuations often turn to specialized technical measurement tools. These instruments help identify patterns and potential turning points in dynamic markets.

Overview and Purpose

This analytical method consists of three distinct lines that work together. They measure how much an asset’s value tends to move up and down over time.

John Bollinger, an American financial analyst, developed this approach in the 1980s. It has since become one of the most widely used technical indicators across various financial sectors.

The primary function is to process market volatility and define potential entry and exit levels. It also helps identify when assets might be overbought or oversold.

Relevance in Today’s Volatile Crypto Market

Digital asset markets experience significant price swings. This makes volatility measurement tools particularly valuable for today’s investors.

Many people view cryptocurrencies as potential hedges against inflation. This increases the need for reliable analytical methods that can adapt to rapid market changes.

The indicator’s dynamic nature allows it to adjust to current conditions. This flexibility is crucial when dealing with assets known for sudden momentum shifts.

Effective technical analysis helps market participants navigate uncertain conditions. It provides measurable data about price movements and potential opportunities.

The Mechanics Behind Bollinger Bands

The foundation of this analytical method lies in its three distinct components working in harmony. Each element serves a specific purpose in measuring market behavior.

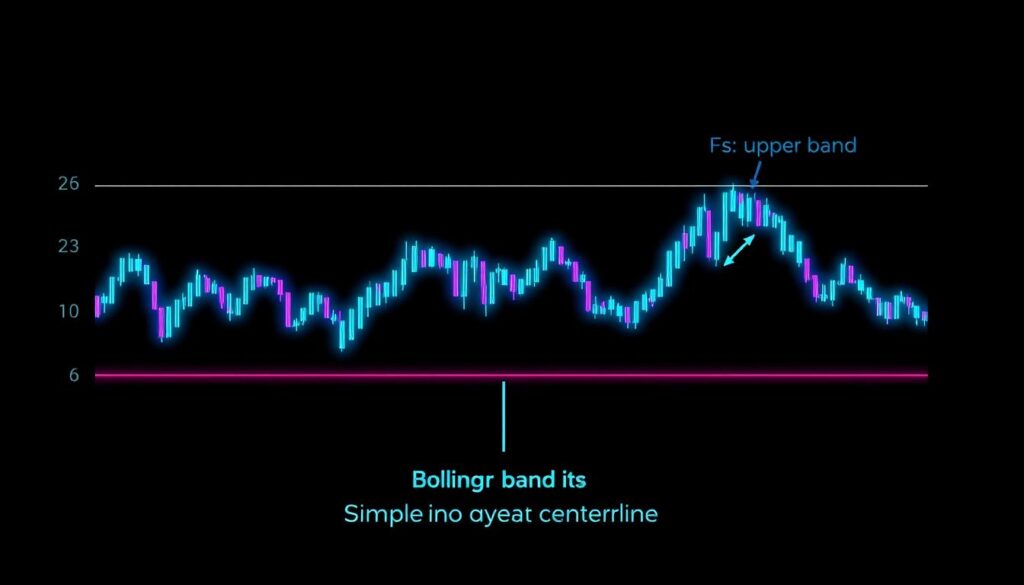

Understanding the Three Components

The middle band forms the core of the system. It represents a simple moving average calculated over a specific period, typically 20 sessions. This creates a smoothed price reference point.

The upper band establishes the channel’s ceiling. It adds a multiple of the standard deviation to the middle line’s value. This creates dynamic resistance levels.

The lower band completes the structure. It subtracts the same deviation multiple from the center line. This forms adaptive support boundaries.

Role of Standard Deviations in Price Volatility

Standard deviations measure how much prices vary from their average. They quantify market volatility mathematically. When prices swing widely, deviations increase.

This causes the bands to expand outward. During calm periods, deviations shrink. The bands then contract closer to the middle line.

About 95% of price action typically occurs within two standard deviations. Movements beyond these boundaries signal statistically significant events.

Crafting a “Bollinger bands cryptocurrency trading strategy”

Building a personalized plan requires adjusting the tool’s sensitivity to match your investment timeframe. A one-size-fits-all approach rarely works effectively.

The key is to align the indicator’s parameters with your specific goals and holding period.

Customizing Settings for Different Trading Styles

Your approach to the market dictates the optimal configuration. Short-term, mid-term, and long-term participants need different levels of responsiveness.

Day traders benefit from tighter settings. This helps them capture quick, small price movements.

Swing traders often use the standard default parameters. This provides a balanced view of price swings.

Position traders need wider bands. This helps them focus on the primary trend and ignore minor fluctuations.

| Trading Style | Timeframe Focus | Recommended SMA Periods | Recommended Standard Deviations |

|---|---|---|---|

| Day Trader | Short-term (minutes/hours) | 10 | 1.5 |

| Swing Trader | Mid-term (hours/days) | 20 | 2.0 |

| Position Trader | Long-term (days/weeks) | 50 | 2.5 |

Incorporating Multiple Technical Indicators

Relying on a single tool is a common mistake. Combining several indicators increases signal reliability.

Momentum oscillators like the RSI are excellent partners. They help confirm potential overbought or oversold conditions.

Volume analysis and support levels add further confirmation. This multi-layered approach helps filter out false signals.

A robust plan uses confluence from different sources. This improves the probability of successful outcomes in a dynamic market.

Implementing the Bollinger Bounce and Squeeze Techniques

Two powerful approaches help traders capitalize on different market conditions. Each method serves a distinct purpose depending on whether assets are consolidating or preparing for significant moves.

Bollinger Bounce Strategy Explained

The bounce method represents the most straightforward application. You enter long positions when the asset touches the lower boundary. Conversely, you consider short positions when it reaches the upper boundary.

This technique relies on the tendency of values to revert toward their average. Place a trailing stop at the 20-period moving average. Adjust this stop as the average changes.

Critical limitation: This approach works exclusively in sideways markets. The bands must remain relatively flat for extended periods. During strong trends, this method can lead to consecutive losses.

Identifying and Trading the Bollinger Band Squeeze

The squeeze technique capitalizes on volatility cycles. It identifies periods when the bands contract tightly, signaling extremely low volatility. These conditions often precede significant breakouts.

Wait for a prolonged period of narrowing bands. Then watch for a decisive close outside the boundaries. The expansion of the bands confirms the breakout is beginning.

Enter long positions if the price closes above the upper boundary with expanding bands. Consider short positions if it closes below the lower boundary. The longer and tighter the squeeze, the more powerful the expected move.

Recognizing Chart Patterns: W-Bottoms and M-Tops

Chart formations that interact with volatility boundaries offer valuable insights into potential market reversals. These distinctive patterns provide clear signals when asset values reach extreme levels.

Learning to identify these formations helps market participants anticipate important directional changes. The patterns work particularly well in volatile conditions.

How to Spot W-Bottom Formations

A W-bottom pattern indicates potential upward movement. Look for a double-bottom structure where the first low breaks below the lower boundary.

The second low should form inside the boundary, showing weakening downward pressure. When values bounce from this second low, it signals a likely reversal.

This pattern suggests selling momentum is fading. Participants can consider long positions as the trend changes direction.

Interpreting M-Top Signals for Reversal

M-top patterns appear at high levels and suggest downward movement. The first peak should touch or exceed the upper boundary.

The second peak forms inside the boundary, indicating diminished buying interest. This failure to reach new highs often precedes a trend reversal.

When confirmed, this pattern provides strong signals for potential short positions. It shows that upward momentum is losing strength.

Optimizing Bollinger Band Settings for High Volatility

Technical tools require fine-tuning to match the unique rhythm of different market environments. A one-size-fits-all configuration rarely delivers optimal results across various assets and timeframes.

Customization becomes essential for navigating the extreme price swings common in digital asset markets. Adjusting the tool’s sensitivity helps filter out noise and capture meaningful movements.

Comparing Default Versus Custom Parameters

The standard setup uses a 20-period average with 2 deviations. This works well for moderate market conditions and mid-term analysis.

However, during periods of intense price movement, these default settings can generate excessive false signals. Widening the boundaries by increasing the deviation multiplier to 2.5 or 3.0 helps account for normal fluctuations.

Conversely, during calm, low-volatility phases, tightening the settings to 1.5 deviations increases sensitivity. This helps identify smaller but significant price changes that wider bands might miss.

The table below illustrates how different parameters perform under various market conditions:

| Market Condition | Recommended Period | Recommended Deviations | Primary Benefit |

|---|---|---|---|

| High Volatility | 20 | 2.5 – 3.0 | Reduces false breakout signals |

| Low Volatility | 20 | 1.5 | Identifies smaller price movements |

| Intraday Analysis | 10 | 1.5 | Increased responsiveness for short-term moves |

For active participants focusing on quick opportunities, a 10-period average with 1.5 deviations creates a more responsive tool. This configuration reduces lag and helps capitalize on intraday movements.

The key is to test different configurations on historical data. This backtesting process helps determine which settings align best with your specific approach and the asset’s unique behavior.

Integrating Additional Trading Tools with Bollinger Bands

No single indicator provides perfect signals, making multi-indicator confirmation essential for sound decisions. Experienced market participants never rely on isolated readings from one tool alone.

Combining multiple analytical methods creates a more robust framework. This approach significantly reduces false signals and improves probability.

Enhancing Analysis with Moving Averages

Adding longer-period moving averages provides valuable context for trend direction. A 50-day or 200-day line helps confirm the overall market trend.

When price touches the lower band simultaneously with a bullish moving average crossover, signal reliability increases substantially. This confluence creates high-probability entry points.

Using RSI and Volume for Confirmation

The Relative Strength Index provides momentum confirmation for band signals. When price approaches the upper boundary while RSI indicates overbought conditions above 70, a probable decline is suggested.

Volume analysis validates breakouts. A surge during a band breach confirms genuine buying or selling pressure rather than false movement.

| Primary Tool | Complementary Indicator | Confirmation Purpose | Signal Strength |

|---|---|---|---|

| Bollinger Bands | 50-day Moving Average | Trend direction validation | High |

| Band Touch Points | RSI Momentum | Overbought/oversold confirmation | Medium-High |

| Band Breakouts | Volume Analysis | Breakout validity check | High |

| Squeeze Patterns | Multiple Indicators | Triple confirmation setup | Very High |

These combinations help traders gain maximum impact from their technical analysis. Proper integration creates the most reliable trading signals.

Managing Risk When Using Bollinger Bands

Capital preservation strategies separate successful participants from those who struggle in dynamic markets. Even the most accurate technical analysis means nothing without proper controls to protect your investment capital.

The high volatility of digital assets can quickly turn winning positions into significant losses. This makes rigorous risk management essential alongside any analytical approach.

Effective Stop-Loss Techniques

Setting explicit stop-loss orders reduces potential losses when moves go against expectations. For bounce approaches in range-bound conditions, place stops slightly beyond the opposite band.

Breakout trades benefit from stops below the consolidation range. Pattern-based entries require stops beyond the extreme of W-bottom or M-top formations.

Guidelines for Position Sizing

Proper capital allocation prevents overexposure to any single move. Designate only 1-2% of total account value per position.

Diversification across various assets further mitigates risk. Define maximum acceptable loss before entering any trade.

Consistent discipline in adhering to your risk management plan is crucial for long-term success. Calculate position size based on stop-loss distance and never exceed predetermined thresholds.

Step-by-Step Practical Guide on KuCoin

Applying technical analysis tools requires hands-on implementation through exchange interfaces. This section translates concepts into actionable steps using the KuCoin platform.

Setting Up Your Chart with Bollinger Bands

Begin by accessing the indicator menu in your KuCoin chart interface. Locate the toolbar above your price display.

Type “Bollinger Bands” into the search field. Select the tool from the technical indicators list that appears.

The system automatically applies default settings to your chart. Customize parameters like period length and deviation multiplier in the settings menu.

Executing Entry and Exit Strategies

Identify potential entry points when price touches boundary lines with confirming signals. Use additional indicators like RSI for validation.

Place orders using appropriate order types based on your risk management rules. Calculate position size carefully before executing any trade.

Establish clear exit strategies beforehand. Set take-profit targets at logical levels like the middle band for bounce approaches.

| Signal Type | Entry Condition | Exit Target | Risk Management |

|---|---|---|---|

| Bounce Play | Price touches lower band | Middle band | Stop below recent low |

| Squeeze Breakout | Close outside bands | Measured move | Stop within squeeze range |

| Pattern Confirmation | W-bottom formation | Upper band | Stop below pattern low |

Practice these steps with small positions or demo accounts first. This builds confidence before committing significant capital to your strategies.

Tips and Best Practices for Successful Trading

Successful implementation of any analytical approach demands awareness of common errors that can undermine performance. Many market participants struggle because they misunderstand how technical tools should be interpreted.

Common Pitfalls and How to Avoid Them

The most frequent mistake involves treating volatility boundaries as simple support and resistance levels. During strong trends, price can ride along these boundaries for extended periods without reversing.

This misunderstanding leads to significant losses when participants expect automatic reversals. The key insight is recognizing these tools measure market volatility rather than defining rigid price barriers.

Distinguishing between continuation and reversal signals requires dedicated practice and observation. Participants must spend time studying how price behaves relative to these indicators under different market conditions.

Always use multiple confirmation sources before making decisions. Combine signals with volume analysis, momentum indicators, and larger market patterns. This multi-layered approach filters out false opportunities.

Develop a systematic checklist for every potential trade. Ensure all conditions align properly before committing capital. Skip marginal setups that don’t meet your established criteria.

Maintain detailed records of your decisions and outcomes. This practice helps identify recurring mistakes and refine your strategies over time.

Conclusion

Mastering this dynamic technical indicator opens a clear window into market volatility and potential price movements. The true power of the Bollinger Bands lies in their adaptability across different market conditions.

Remember, their signals require careful interpretation. A trending market behaves very differently from a range-bound one. Success comes from combining this knowledge with disciplined risk management and practical experience.

Start by applying these concepts with small positions. This builds confidence over time. For a deeper dive into market mechanics, explore our guide on broader technical analysis.

This content is for educational purposes only and is not financial advice. All investments carry risk, and you should conduct your own research before making any decisions.

FAQ

What is the primary purpose of Bollinger Bands in market analysis?

The main goal is to measure market volatility and identify potential price breakouts. The bands widen during periods of high volatility and contract when the market is calm, giving traders visual cues about the current conditions.

How can I use the ‘squeeze’ to find entry opportunities?

A squeeze occurs when the bands tighten significantly, indicating low volatility. This often precedes a strong price movement or breakout. Traders watch for a decisive candle closing outside the bands after a squeeze as a potential entry signal.

Why is confirmation from other indicators like RSI important?

Using tools like the Relative Strength Index (RSI) helps confirm signals and avoid false breakouts. For example, if the price touches the upper band and the RSI shows overbought conditions, it adds strength to a potential reversal signal.

What are effective risk management techniques with this approach?

A> Key techniques include placing stop-loss orders just beyond the opposite band and using proper position sizing. This helps manage your exposure and protect your capital from sudden market shifts.

How do I customize the settings for different assets?

The default setting is a 20-period simple moving average with two standard deviations. For slower-moving assets, you might increase the period. For more sensitive signals on fast markets, you could reduce the period or adjust the standard deviations.

What is a common mistake traders make when using these bands?

A frequent error is assuming a touch of the upper or lower band is an immediate reversal signal. It’s crucial to wait for price action confirmation, as bands can be tested multiple times during a strong trend.

No comments yet