The digital asset landscape is constantly evolving. A single question now captivates the market: could the premier cryptocurrency ever be valued at a million dollars?

This ambitious prediction is no longer pure fantasy. The asset’s surge to $100,000 in December 2024 proved its capacity for dramatic growth. This milestone, driven by institutional adoption, makes the next target worth serious analysis.

Reaching a seven-figure valuation hinges on several critical developments. Widespread institutional adoption, similar to gold, would need to add trillions to the market cap. Major corporate integration and retail growth in emerging economies are also essential.

This convergence could push the total valuation beyond $21 trillion. For investors and skeptics alike, understanding the path to this future is crucial. We will explore the scarcity mechanisms, technological considerations, and regulatory landscape that will shape the bitcoin price.

Key Takeaways

- The $1 million valuation is a serious topic of analysis following recent price milestones.

- Achieving this goal would require a massive increase in total market capitalization.

- Institutional adoption is a primary driver for future price growth.

- The asset’s built-in scarcity through halving events supports long-term value.

- Corporate and emerging market adoption are additional critical factors.

- Regulatory developments will significantly influence the crypto asset’s trajectory.

Bitcoin’s Journey: Past Milestones and Recent Highs

The premier cryptocurrency’s path to its current valuation has been anything but linear. Its history is defined by extreme volatility, with periods of doubt often preceding massive growth.

This journey provides essential context for understanding its potential future price trajectory and the overall digital asset market.

Historic Price Movements and Breakthrough Milestones

For much of 2023, the asset was trading below $25,000. Many investors questioned its long-term viability during this phase.

The landscape shifted dramatically in early 2024. A pivotal court decision directed the SEC to reconsider spot ETFs, catalyzing a powerful rally.

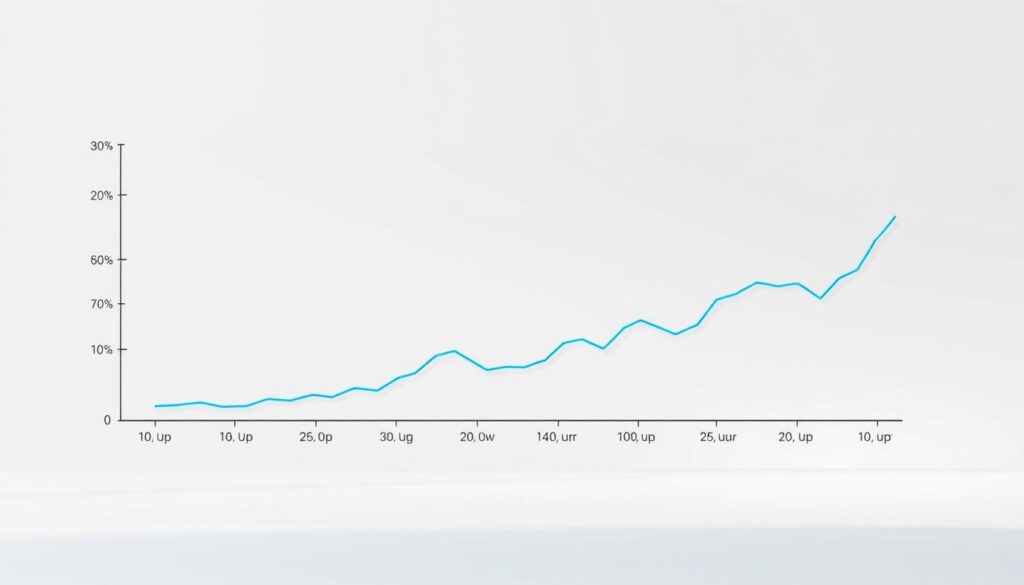

The momentum continued, pushing the bitcoin price to new heights by the end of the year. The acceleration is clear when comparing key milestones:

- Time to reach $50,000: 12 years

- Time to reach $100,000: 3 years

The Role of Major Events in Bitcoin’s Growth

Specific events have consistently shaped price trends. Regulatory announcements and political developments act as powerful catalysts.

This pattern underscores how external factors influence the bitcoin market. Over the last decade, the asset has increased in value by over 50,000%.

This historical performance fuels the current prediction of further appreciation. With a market cap of $2.3 trillion, its significance is undeniable.

Understanding this volatile past is crucial for any future prediction about the bitcoin price.

Understanding Bitcoin’s Scarcity and Value Proposition

At the core of Bitcoin’s appeal lies a revolutionary concept: absolute digital scarcity. Its protocol enforces a hard cap of 21 million coins. This finite supply is a fundamental break from traditional currencies.

Impact of the 21 Million Coin Cap and Halving Events

The fixed supply is crucial. As of December 2024, over 19.79 million coins are already in circulation. Less than 1.21 million remain to be mined.

Programmed “halving” events intensify this scarcity. They cut the new coin creation rate in half approximately every four years. The next event is scheduled for 2028. This predictable reduction in new supply has historically supported price appreciation.

Digital Gold: Comparing Bitcoin to Traditional Assets

This scarcity fuels the “digital gold” comparison. Like the precious metal, Bitcoin is valued as a store value asset. Its value, however, is not based on physical properties but on mathematical certainty.

The total market value of all gold in the world is estimated at $24.7 trillion. This figure provides a framework for understanding how Bitcoin could grow. The digital asset offers clear advantages over physical gold.

It is more portable, easily divisible, and simple to verify. Its decentralized nature makes it resistant to confiscation. For a deeper long-term price prediction, these fundamental properties are essential to consider.

Can Bitcoin hit one million dollars: Trend Analysis Perspective

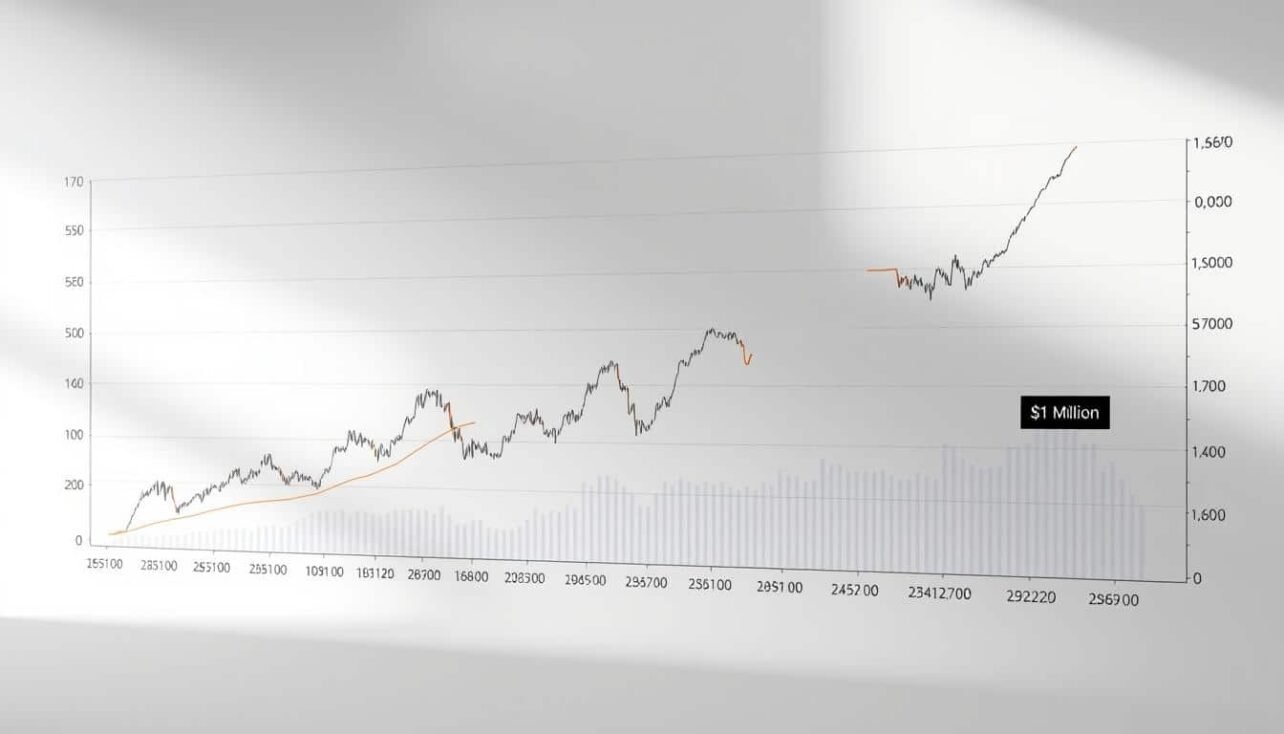

Prominent figures in the digital currency space have put forward bold predictions about future valuation milestones. Industry leaders like Michael Saylor and Coinbase CEO Brian Armstrong project the asset could reach seven figures by 2030.

Critical Factors Driving Bitcoin’s Price Surge

Several key factors support optimistic forecasts. Institutional accumulation and ETF capital flows provide substantial buying pressure. Macroeconomic instability and inflation concerns also drive adoption.

The growing recognition as a legitimate asset class creates additional demand. VanEck’s prediction of $644,000 by 2028 shows institutional confidence. This would position the cryptocurrency well for higher valuation.

Market Sentiment and Long-Term Predictions

Market sentiment remains the dominant force behind dramatic price swings. Regulatory announcements and economic conditions create significant volatility.

Analysts see near-term targets between $133,000 and $178,000. However, the path to seven figures faces challenges. Current adoption rates and technological limitations present hurdles.

While the transformative potential exists, stretched valuations before 2030 seem unrealistic. The timeline remains highly unpredictable despite optimistic predictions from respected sources.

Institutional Adoption and Its Impact on Bitcoin’s Trajectory

A seismic shift is underway in the financial world as major institutions embrace digital assets. This wave of institutional adoption is fundamentally reshaping the market’s dynamics and price potential.

Large-scale capital allocation from traditional finance provides the demand necessary to reach ambitious price targets. The path to a seven-figure valuation now appears more plausible.

ETFs, Institutional Investments, and Corporate Strategies

The January 2024 approval of spot ETFs marked a watershed moment. Products like BlackRock’s IBIT have seen record capital inflows, pulling thousands of coins into long-term holdings.

This action reduces circulating supply and increases scarcity. It demonstrates sustained appetite from both institutional and retail investors.

Corporate strategies have also evolved significantly. Companies now view the digital asset class as a legitimate treasury reserve.

The table below highlights leading corporate adopters and their strategies:

| Company | Strategy | Notable Impact |

|---|---|---|

| MicroStrategy | Transformed into a primary holding company | Stock appreciated 2,280% over five years |

| Tesla | Added to corporate balance sheet | Signaled mainstream corporate acceptance |

| Square | Integrated as a treasury asset | Promoted use within payment ecosystems |

This growing adoption has profound mathematical implications. If major financial institutions allocate a small percentage of reserves, the total market cap could exceed $20 trillion.

Such a scenario would push prices dramatically higher. The prediction of a million-dollar valuation hinges on this continued institutional adoption.

Technological Advancements and Security Considerations

Technical scalability and robust security protocols form the backbone of any sustainable price appreciation. The current infrastructure faces significant challenges that must be addressed for mainstream adoption.

Scalability and Transaction Efficiency Upgrades

The network currently processes only seven transactions per second. This limitation creates bottlenecks during periods of high interest.

Layer-2 solutions like the Lightning Network offer promising growth potential. These technologies enable faster settlements while maintaining base layer security.

Efficiency improvements reduce transaction time and costs. This enhances the user experience for people worldwide.

Enhancing Blockchain Security Amid Rising Valuations

As valuation increases, security becomes increasingly critical. The bitcoin market attracts more attention from potential threats.

Advanced cryptographic techniques protect the finite supply of digital assets. Multi-signature wallets and institutional custody solutions provide additional safeguards.

Many experts maintain a bullish prediction for the crypto space. However, this prediction depends on continuous technological growth.

The long-term prediction for any cryptocurrency requires robust infrastructure. Security and scalability remain essential for sustained growth.

Regulatory Developments and Economic Factors Influencing Bitcoin

The interplay between regulatory frameworks and macroeconomic conditions represents a critical determinant for digital asset growth. Government policies and economic trends create a complex landscape that will significantly influence future valuations.

Supportive vs. Adverse Regulatory Environments

Different countries approach cryptocurrency regulation with varying strategies. Supportive policies provide clarity that encourages institutional investment. The U.S. Strategic Bitcoin Reserve initiative demonstrates how government endorsement can legitimize digital assets.

Conversely, restrictive regulations create barriers to adoption. Clear legal frameworks reduce risk for traditional financial institutions. This enables greater capital allocation to cryptocurrencies.

| Country | Regulatory Approach | Impact on Market |

|---|---|---|

| United States | Strategic Reserve Initiative | Increased institutional participation |

| China | Restrictive Policies | Limited domestic growth |

| European Union | Comprehensive Framework | Standardized trading environment |

Global Economic Trends and Investor Responses

Macroeconomic factors drive investor behavior toward alternative assets. Persistent inflation and currency devaluation make cryptocurrencies attractive. Many seek protection against traditional financial systems.

Expanding fiscal deficits and monetary instability create favorable conditions. A weakening U.S. dollar encourages diversification into digital stores of value. These economic pressures support long-term growth predictions.

The convergence of supportive regulation and economic uncertainty could accelerate adoption. Both factors remain essential for achieving ambitious valuation targets in global markets.

Market Sentiment and Investor Behavior

Investor psychology plays a pivotal role in shaping cryptocurrency market dynamics. Emotional responses often drive price movements more than fundamental analysis.

Market sentiment creates powerful feedback loops. Positive news can trigger buying frenzies, while negative developments may cause rapid sell-offs.

The Psychology of Investing in Bitcoin

Many view this digital asset as a modern store value during economic uncertainty. This perception drives adoption during inflationary periods.

The network effect strengthens as more people participate. Each new investor increases the utility and perceived value of the entire ecosystem.

Behavioral patterns like FOMO influence short-term volatility. Long-term holders often accumulate during price dips, creating stability.

Reaching extreme valuation targets requires crossing psychological adoption thresholds. The asset must achieve utility-like ubiquity across diverse demographics.

Competition from other cryptocurrencies presents challenges. Maintaining leadership position is crucial for long-term growth forecasts.

Market sentiment represents both opportunity and vulnerability. Sustained positive perception could drive remarkable appreciation toward ambitious targets.

Conclusion

The journey toward a seven-figure valuation represents one of the most debated topics in modern finance. While achieving this milestone before 2030 appears overly ambitious, the cryptocurrency‘s history of surpassing expectations means it cannot be entirely dismissed.

Reaching such an extreme price requires a perfect convergence of factors. Widespread institutional adoption, technological improvements, and supportive regulatory frameworks must align. The asset‘s finite supply provides a fundamental value foundation, but market cap growth must be extraordinary.

This digital asset class has demonstrated remarkable resilience over the years. Its future path remains highly uncertain, influenced by global economic trends and government policies. Investors should approach ambitious forecasts with analytical skepticism while acknowledging transformative potential.

The world of cryptocurrencies continues to evolve rapidly. While the path to a million-dollar Bitcoin is laden with challenges, the asset‘s capacity for surprising growth makes it a fascinating investment case study for years to come.

FAQ

What key factors could drive the price of this cryptocurrency to such a high valuation?

Several critical factors would need to align. These include massive institutional adoption through vehicles like spot Bitcoin ETFs, widespread global adoption as a store of value, and continued scarcity due to the fixed supply and halving events. Positive regulatory developments and a weakening global economy could also push investors toward this asset class.

How does the concept of scarcity, like the 21 million coin cap, influence its long-term value?

The hard cap of 21 million coins creates a fundamental scarcity similar to precious metals like gold. This programmed scarcity, enforced by halving events that reduce the new supply, is a core part of its value proposition. As demand increases over time, this limited availability can create upward pressure on the market price.

What role do institutional investors and products like ETFs play in its future growth?

Institutional adoption is a major catalyst. The approval of spot Bitcoin ETFs by regulators like the SEC provides a regulated and accessible pathway for large-scale investment from funds, pensions, and corporations. This influx of capital from traditional finance can significantly increase demand and stabilize the market, supporting long-term growth forecasts.

How do technological upgrades on the blockchain network affect its potential?

Ongoing technological improvements, such as the Lightning Network for scalability, are crucial. Enhancements that increase transaction speed, reduce fees, and improve security make the network more robust and user-friendly. A more efficient and secure system is better positioned for mass adoption, which is essential for reaching a higher valuation.

What are the biggest risks or obstacles that could prevent it from reaching a million-dollar valuation?

Significant hurdles include adverse regulatory actions from governments worldwide, major security breaches that undermine trust, or the emergence of a superior digital asset. Additionally, prolonged bear markets, negative investor sentiment, or a failure to achieve mainstream adoption could slow or halt progress toward such a high price target.

No comments yet