Learn fast what common chart formations reveal. This short guide defines visual setups created by price movements and explains how traders use them to spot breakouts, reversals, or continuations across stocks, forex, ETFs, futures, and crypto.

Expect clear rules, not promises. You will learn how to identify each chart pattern, what it tends to indicate, and how to build a practical trading plan that stresses confirmation and risk control.

This guide targets US-based traders who want consistent language around support, resistance, and trend context. Price movements often form repeatable shapes because crowds react similarly at key levels, yet outcomes vary as volatility and market conditions change.

Key idea: no setup is a standalone signal. Every example includes entry logic, stop placement, and simple target thinking so you can apply the strategy with discipline.

For a deeper dive into technical analysis formations, see this technical analysis patterns resource.

Why Chart Patterns Matter in Technical Analysis Today

Recognizing recurring shapes in price data helps traders turn noisy movements into actionable signals.

Visual formations compress buyer and seller behavior into an easy-to-scan frame. That makes real-time monitoring simpler for intraday traders and swing players alike.

How price movements create repeatable shapes on a chart

Repeated reactions at the same support or resistance level can etch familiar shapes after strong directional moves or during consolidation.

Those regular reactions create reference points that traders use to judge risk and set stops.

What chart patterns can and can’t tell traders

These formations suggest what prices might do next based on past behavior, but they are not guarantees.

Good uses: planning entries, defining invalidation, and estimating measured moves. Limits: they don’t replace news, fundamentals, or regime shifts.

Markets where these formations are commonly used in the United States

- S&P 500 and Nasdaq stocks

- Sector ETFs and index futures

- Major forex pairs and actively traded crypto markets

Outcome bias toward bullish bearish moves depends on trend, volatility, and confirmation. For a classic reversal reference, see a well-known reversal example.

How to Read Chart Patterns Using Trend, Levels, and Context

First, decide whether price action is moving up, down, or sideways. This simple call sets the stage for everything that follows.

Identify the trend by looking for higher swing highs and higher swing lows in an uptrend, or lower highs and lower lows in a down move. Range-bound price shows clear support and resistance near the same level.

Spot the formation without forcing it

If you must redraw lines constantly, the setup is weak. Clean formations use clear swing points that make sense on multiple timeframes.

Mark key support and resistance

Use prior swing highs and swing lows, range boundaries, and reversal necklines as your primary levels. Label them before thinking about entry.

Why confirmation matters more than prediction

Wait for a validated breakout or breakdown, ideally backed by volume or follow-through. That reduces false signals and ties the pattern to real market conviction.

- Identify the trend.

- Spot the pattern that fits the market context.

- Mark support and resistance levels.

- Wait for confirmation before trading.

Support and Resistance Levels That Power Every Pattern

Identifying the key support and resistance zones helps traders place entries, stops, and targets with confidence. These zones give context to price action and make setups easier to manage.

Where support stops falling price

Support is the area where buyers tend to step in and prevent further price falls. You often see a visible bounce across several candles when buyers return.

Where resistance caps rising price

Resistance is the zone where sellers or profit-taking cap rallies. Price often pulls back from this upper boundary, forming the top of consolidations.

- Why levels exist: they reflect a shift in demand and supply—buyers stop bidding or sellers overwhelm bids.

- How levels power patterns: necklines act like support or resistance lines, and flag boundaries work as mini channels.

- Role reversal: when resistance breaks, that prior resistance can become new support on a retest, offering structured entries and stop placement.

- Zones not points: treat a level as a zone. Watch price reaction for rejection, acceptance, or a clean break before acting.

Chart Pattern Categories: Reversal, Continuation, and Bilateral Setups

A quick label—reversal, continuation, or bilateral—turns visual noise into actionable context. Use this simple split to decide how to trade and how much confirmation you need.

Reversal setups and what they signal

Reversal patterns form after a long trend and often show weakening momentum. They suggest a possible trend reversal, not a guarantee.

Because these structures imply a shift in control, traders usually demand strong confirmation before entering. That means a clean breakout or breakdown plus volume or follow-through.

Continuation setups and why they matter

A continuation pattern is a short pause in a prevailing trend. Price consolidates, then often resumes the prior trend when confirmed by a breakout.

These setups allow tighter, structure-based stops and are useful when the market trend remains intact.

Bilateral setups and volatility

Bilateral patterns show indecision. They can resolve either way, so the breakout direction sets the bias.

Execution note: reversal setups need more conservative risk controls. Continuation patterns often use closer stops. Bilateral moves demand flexible entries tied to the breakout.

- Reversal: needs strong confirmation for a trend reversal.

- Continuation: rests then likely resumes the trend after breakout.

- Bilateral: breakout direction determines bias in volatile markets.

Preview: upcoming sections will label each example by category and list the typical confirmation trigger (breakout or breakdown) so you can apply rules with discipline.

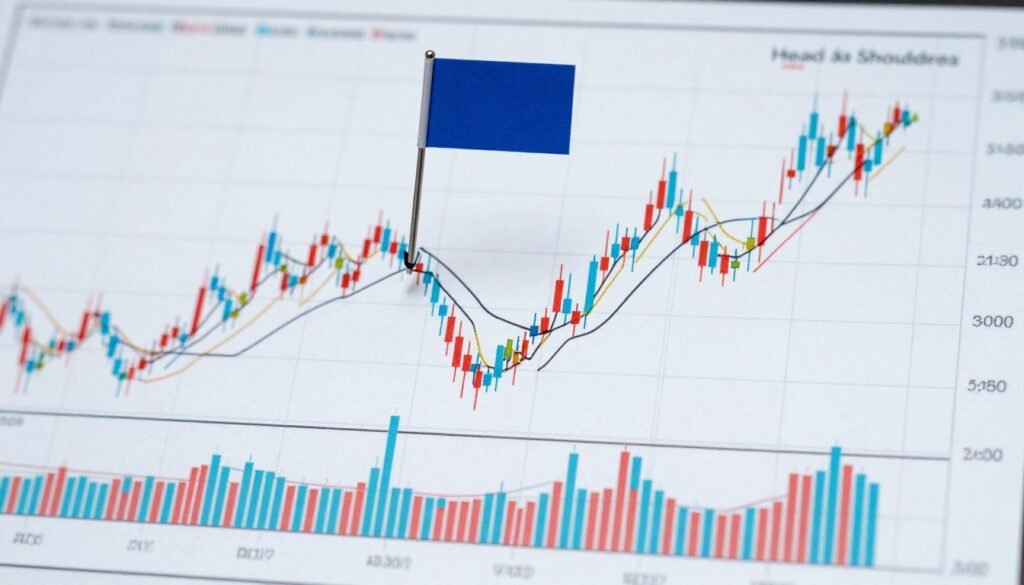

Head and Shoulders Pattern Explained: The Classic Bearish Reversal

A three-peak formation that follows a long rally warns traders the uptrend may be losing steam. The setup appears when buyers push price to a high, then a higher high, then a failed final rally. This sequence often precedes a shift to sellers.

The three-peak structure

The left peak forms, price pulls back, and the head makes the highest peak. The right peak fails to reach the high of the head. That failure shows weaker demand and less conviction from buyers.

Neckline and support level

The neckline runs across the two troughs between peaks. It acts as the key support level. A clear breakdown below this line confirms the reversal for many traders.

What it signals and reliability

This setup signals a probable trend reversal from bullish trend to bearish direction. Success depends on confirmation—volume, follow-through, and clean breaks matter. Variations exist: the neckline can slope or skew, so plan stops and targets with that in mind.

- Define entry: breakdown below neckline.

- Risk control: stop above the right peak.

- Note: false breaks occur; use confirmation.

How to Trade the Head and Shoulders Pattern With the Neckline

Trade entries after a neckline breach work best when the move is backed by clean closes, not a single intraday spike. Wait for a clear daily or session close below the line to reduce false signals.

Entry trigger

A confirmed breakdown below the neckline is the typical entry trigger. Traders prefer decisive closes and volume support rather than one-off wicks that can trap sellers.

Stop placement

Place stops above the right shoulder. A move above that level invalidates the reversal thesis and signals the trade is no longer valid.

Profit target math

Measure the vertical distance from the head to the neckline. Project that same distance down from the breakout point to set a primary target. This measured move gives a logical exit and aligns the trade with structure-based risk-to-reward planning.

Skewed necklines and retests

When the neckline slopes, wait for a clean close below the most relevant level. If price retests the line, it may either offer a secondary entry or warn of a failed breakdown. Adjust position size if the stop becomes wide due to a long formation.

- Rule: prefer confirmed closes below the line.

- Invalidation: stop above the right shoulder.

- Target: measured move from head to line.

- Risk: reduce size if stop distance expands.

For a deeper technical explanation of reversal setups and classic examples, see this technical reference on reversals.

Inverse Head and Shoulders: The Bullish Head and Shoulders Bottom

When downtrends lose momentum, a specific three-trough setup often signals a rotation back to buying. Traders call this the inverse head and shoulders or the head and shoulders bottom. It suggests a bearish-to-bullish reversal and forms after sustained selling pressure.

The three-trough structure

The setup shows three lows. The first low is the left shoulder with a bounce. The middle trough is the deepest — the inverse head — and the right trough is a higher low that hints at reduced selling.

Neckline as resistance and breakout signal

The neckline connects the interim rally highs and acts as clear resistance. A close above that level is the common confirmation traders seek for a valid trend reversal.

Market meaning and trading rules

Psychology: buyers absorb supply at higher prices and fail to allow a new low on the right trough. Practical trade rules favor entries on a breakout or on a retest with improved momentum and volume.

- Entry: breakout above the neckline.

- Stop: below the right trough or under the neckline on a retest.

- Note: reliable when confirmed, but use disciplined stops to avoid whipsaws.

Bull Flag and Pennant Patterns: Continuation After a Strong Move

After a strong impulsive climb, price often pauses in a tight formation before resuming the move. These setups show a clear flagpole followed by a brief consolidation that keeps the prior trend intact.

Defining the flagpole and consolidation phase

The flagpole is the sharp, fast advance that creates the expectation for more upside. The consolidation that follows is usually a short pullback or sideways drift where price compresses into defined boundaries.

Rectangular pullback vs small triangle

A bullish flag looks like a small rectangle or channel moving against the trend. A pennant resembles a tiny symmetrical triangle as the range tightens and swings grow smaller.

Confirmation: breakout and volume

Traders wait for a breakout above the consolidation boundary to confirm the continuation pattern. Volume often falls during the pause and rises on the breakout, which adds conviction.

Common timeframes traders use

Scan 1H, 4H, and Daily charts for cleaner structure. Flags often appear across 1H to Daily, while pennants are common on 1H–4H setups.

- Rule: align patterns with the higher-timeframe trend.

- Risk: place stops below nearby support to limit downside.

- Target: project the flagpole length from the breakout for measured exits.

Wedge Pattern Deep Dive: Rising Wedge vs Falling Wedge

Wedges form when price squeezes between two sloping lines, signaling fading momentum and an imminent decision. These angled formations show tightening swings and rising odds that the next move will be decisive.

How wedges differ from triangles and pennants

Wedges slope up or down and usually imply reversal pressure as momentum fades. By contrast, a triangle can be continuation or bilateral, while a pennant sits more horizontally after a strong pole.

Rising wedge mechanics

In a rising setup, price makes higher highs and higher lows while the space between lines narrows. The support line is often steeper, and a break below that line typically signals a bearish reversal.

Falling wedge mechanics

A falling formation shows lower highs and lower lows inside converging lines. A clean break above the upper resistance line often resolves bullish, marking a reversal to the upside.

Where to draw trend lines and avoid mislabels

- Connect at least two clean swing points per line; do not cut through candle bodies often.

- Keep lines steady—avoid constant redrawing that forces a tag.

- If lines don’t clearly converge, treat the area as a range instead of a wedge.

For more examples and rules, review this technical analysis patterns reference.

Triangle Pattern Essentials: Ascending, Descending, and Symmetrical Triangles

A narrowing trading range can warn that buyers or sellers are about to take control. Triangle formations form when swings compress between converging lines. They act as short consolidations that often resolve with a breakout once one side wins.

Ascending triangle as a bullish continuation setup

An ascending triangle shows a flat resistance line with rising support. Repeated tests of the same resistance while buyers push higher lows implies growing demand. Traders view a clean close above resistance as a likely continuation of the prior uptrend.

Descending triangle as a bearish continuation setup

A descending triangle flips the idea: horizontal support with falling resistance. Sellers press price lower into the same support level. A decisive breakdown often signals the trend will continue downward.

Symmetrical triangle as a bilateral setup

In a symmetrical triangle, lower highs meet higher lows. The lines converge and the direction is unclear until one side breaks. When the prior trend is weak, this formation behaves as a true two-way pattern.

Breakout confirmation and why false breaks happen

Wait for follow-through. Traders usually demand a close outside the boundary plus volume or a second confirming candle. False breaks occur from stop runs, thin liquidity, or news spikes. Patience reduces whipsaws and improves trade quality.

- Tip: use close-based confirmation, not single-candle spikes.

- Tip: measure the base width for a logical target after a valid breakout.

- Tip: keep stops near the opposite boundary to limit risk.

Cup and Handle Pattern: Bullish Continuation With a Built-In Pullback

A two-part formation signals a likely resumption of an uptrend. It pairs a rounded recovery with a brief, shallow retreat that gives traders a structured entry point.

The cup as a rounding bottom-style recovery

The cup forms like a shallow bowl. Selling eases, accumulation appears, and price slowly drifts back toward prior highs. This rounded move shows buyers returning without a sharp reversal.

The handle as a tight retracement that resembles a wedge

The handle is a short, confined pullback or drift. It often narrows into a small channel or tight slope, proving sellers lack conviction. A shallow handle keeps the measured risk manageable.

Common breakout level: the rim/handle resistance

Key level: the rim or handle resistance marks where price failed before. Traders wait for a clean close above that level to confirm continuation.

- Entry: buy after a clear breakout above rim resistance.

- Risk: place stops below the handle low or below the breakout area depending on volatility.

- Common mistakes: buying early inside the handle or ignoring the chance of a deeper pullback in choppy conditions.

Double Bottom and Double Top: Simple Reversal Patterns Traders Rely On

Many traders favor simple two-touch reversals because they are easy to spot and trade under pressure. These reversal setups use repeated tests of a level and a clear confirmation line to validate the move.

Double bottom “W” structure and neckline breakout confirmation

A double bottom forms a clear “W” when price hits a low, rebounds, then retests a similar low. The pattern becomes a confirmed reversal when price breaks above the middle peak, often called the neckline.

Entry logic: wait for a decisive close above the neckline. Use a stop below the second bottom to limit risk.

Double top “M” structure and neckline breakdown confirmation

A double top shows an “M”: price tests resistance, falls, then retests near the prior high. The bearish reversal confirms on a clear breakdown below the intermediate trough or neckline.

Risk note: place stops above the second peak and watch for quick reversals after the breakout.

How these compare to head shoulders setups

Doubles are simpler — two major swings versus three. That makes them faster to spot and often quicker to trigger.

By contrast, the other three-peak formation can show more nuanced loss of momentum across swings and may offer different stop placement and target math.

- Define: straightforward reversal setups that rely on level tests and a clear confirmation.

- Practical: doubles can trigger quickly but can also false-break on a loose second touch.

- Rule: trade the breakout/breakdown, respect support and resistance zones, and keep disciplined stops.

Pattern Confirmation, Reliability, and Risk Levels in Real Trading

Reliability is a statistical edge — useful, not infallible, in real-time trading. A setup’s track record shows how often it produced the expected move, but it never guarantees that a reversal or continuation will occur on any single test.

Why “reliable” doesn’t mean guaranteed

Reliability describes tendency and probability. It changes with market regime, liquidity, and volatility.

In plain terms: a reliable setup simply improves the odds; it does not remove the chance of a failed breakout or an unexpected reversal.

How confirmation reduces risk

Use clear validation: a close beyond the key level, a breakout or breakdown with follow-through, and volume or successive candles in the breakout direction.

Waiting for confirmation keeps traders out of the “maybe” phase when price sits inside the formation and invalidation is unclear.

Timeframes that improve signal quality

Signals tend to be cleaner on 4H, Daily, and Weekly charts. Higher timeframes filter noise and make trend context clearer.

Remember: higher-timeframe clarity often means wider stops. Adjust size so the risk per trade stays acceptable.

- Practical rule: require a close beyond the level before entering.

- Timeframe tip: favor 4H+ for reversal setups when possible.

- Risk check: ensure the stop and position size match your acceptable loss.

Entry, Exit, and Risk Management Rules for Pattern-Based Strategies

Define precise rules for entries, stops, and targets so every trade follows a repeatable plan. Clear rules remove guesswork when price reaches a key level and the market moves fast.

Defining entries around breakouts and breakdowns

Prioritize confirmation: wait for a clean close beyond the marked level rather than jumping mid-formation. Use the close, volume, or a second follow-through candle as your entry trigger.

Stop-loss logic and expanding distance on longer setups

Place stops as structure-based invalidation. That means beyond the right shoulder, below the handle low, or outside the trend line where the setup no longer makes sense.

Longer Daily or Weekly setups cover more range, so stops widen. Reduce size to keep dollar risk steady when the stop distance grows.

Risk-to-reward planning using measured moves and structure

Estimate targets from the pattern height and nearby levels. Use the measured move—such as head-to-neckline distance—to set realistic exits and calculate risk-to-reward before entry.

Managing pullbacks, retests, and failed breakouts

Treat retests as optional entries if momentum improves on the retest and support or resistance holds. If price falls back into the structure or closes back inside after a breakout, call it a failed breakout.

- Failure rule: close back inside the level or a decisive opposite breakout.

- Exit quickly: protect capital with a defined stop and re-evaluate the trading plan.

- Practical tip: size positions so a widened stop never risks more than your stated loss per trade.

Good risk controls and exact entries make pattern-based trading a process, not a guess. Stick to your rules and let the price prove the setup before committing capital.

Chart Patterns: Head and Shoulders Bull Flag Wedge in One Trading Playbook

Begin each trade by identifying whether the market trend favors continuation or reversal. That single call steers which formation you look for and how you size risk.

Choosing the right pattern for the current market trend

Start with trend: uptrend, downtrend, or sideways. In a clear trend, favor continuation setups. After prolonged moves, scan for reversal patterns that warn of exhaustion.

Combining support resistance with pattern indicates signals

Require the formation to finish at a meaningful level — a neckline, rim, or range boundary. A close beyond that level plus volume or follow-through is the confirmation many traders demand.

When to prioritize reversal patterns vs continuation pattern setups

Prioritize reversals after extended rallies or drops where momentum fades. Favor continuation setups after sharp moves followed by tight consolidation aligned with higher-timeframe trend.

Building a repeatable strategy for traders across markets

- Playbook: trend → levels → pattern → confirmation → risk plan.

- Cross-market: this logic works for US stocks, futures, forex, and crypto because it relies on price vs levels.

- Repeatability: follow the process, not the shape, for consistent outcomes.

Common Mistakes When Trading Chart Patterns and How to Avoid Them

A clear rule: if you must redraw lines to make a formation fit, it’s not a reliable setup. Patterns are indications, not guarantees, and forcing a setup turns analysis into guesswork.

Forcing setups onto random price action

Forcing looks like constant redrawing, labeling every consolidation a setup, or ignoring messy swings to justify an entry. That behavior raises the odds of false breaks and quick losses.

Filter: if multiple interpretations fit equally well, downgrade the quality and wait for clearer structure or higher-timeframe alignment before trading.

Ignoring support and resistance context

Patterns focus attention on key levels. Entering without checking support level and nearby resistance often puts you on the wrong side of the market. Price history matters—trade around proven zones, not wishful lines.

Trading without confirmation or a defined stop

Entering before a breakout or breakdown turns analysis into a prediction. Always wait for a validated close or follow-through. Every setup has an invalidation point—if you cannot name it, do not trade it.

- Plan for retests: expect false breaks; use retests as optional, disciplined entries.

- Use strict stops: do not move stops wider to avoid being wrong.

- Keep rules simple: trend → level → setup → confirmation → stop.

Conclusion

Good setups organize messy price moves into clear trade ideas with defined risk. Use chart patterns as tools to form testable hypotheses, not as guarantees. They work best when tied to trend and clear support and resistance levels.

Quick recap: the classic three-peak formation warns of a bearish reversal, while the inverse three-trough bottom signals a bullish flip. Continuation setups such as tight consolidations often resume an uptrend. Converging slopes like a wedge or a triangle show compression ahead of a likely breakout.

Confirmation over prediction: wait for a clean close beyond the line or neckline before acting. Define structure-based stops, use measured targets, and size positions to match timeframe risk.

Practice with a short checklist: identify trend, mark levels, label the pattern, set entry/stop/target, then review results. Keep this guide handy as a practical reference when a new formation appears on your chart.

FAQ

What are the core types of price formations traders watch?

Traders commonly monitor reversal setups, continuation setups, and bilateral setups. Reversal setups signal a likely change in trend, continuation setups suggest a pause before the existing trend resumes, and bilateral setups leave direction open until a breakout confirms direction. Using trend and support/resistance context helps distinguish them.

How does trend context affect reading a formation?

First identify whether the market is in an uptrend, downtrend, or sideways move. A formation that appears inside a strong trend has a different probability profile than the same shape in a choppy market. Always confirm with nearby support and resistance levels before treating a signal as valid.

When should traders mark support and resistance levels?

Draw key levels at recent swing highs and lows, consolidation edges, and prior breakout points. These levels act as anchors for entries, stops, and profit targets. Broken resistance often flips to support on a retest, and broken support can become resistance.

What role does a neckline play in three-peak and three-trough setups?

The neckline connects the troughs in a three-peak structure or the peaks in a three-trough structure. A decisive break of the neckline provides the entry signal for many traders and helps calculate measured targets based on the structure’s height.

How should traders place stops when trading a breakdown or breakout?

Place stops beyond the nearest structural invalidation point—commonly above the right shoulder or above the breakout level for long setups. Adjust stop distance for timeframe: higher timeframes justify wider stops; intraday setups use tighter placements.

How do you calculate profit targets from these formations?

A common method measures the vertical distance from the pattern’s extreme (head or trough) to the neckline, then projects that distance from the breakout point. For continuation setups, traders often use the flagpole length or measured move from the consolidation.

What confirms a valid breakout or breakdown?

Look for follow-through price action, increased volume on the move, and a clean close beyond the key level. A retest that holds the breakout level with lower risk entry increases the probability of a sustained move; false breaks are common without confirmation.

How do wedge formations differ from triangular consolidations?

Wedges narrow with converging trend lines that both slope in the same general direction, often signaling a reversal bias. Triangles typically have one flat side or symmetrical converging lines and can resolve either way. Slopes and volume behavior help distinguish them.

When is a rounding base with a small pullback considered tradable?

A rounded recovery followed by a tight retracement that holds close to prior resistance can form a reliable breakout setup when the price clears the rim. Traders prefer a clear breakout with volume and a retest that holds as new support.

Which timeframes give more reliable signals for pattern-based trades?

Daily and higher timeframes generally offer higher reliability for pattern signals because they filter noise. Intraday patterns can work for active traders but produce more false signals; use tighter rules and smaller position sizes for shorter timeframes.

How do traders avoid forcing shapes onto random price action?

Use objective rules: require minimum symmetry, defined highs/lows, and a clear breakout with volume or retest confirmation. If levels are fuzzy or the pattern requires stretching trend lines, skip it—forcing increases failure risk.

What is the difference between a continuation consolidation and a reversal consolidation?

Continuation consolidation follows a strong directional move and typically displays shallow retracement and tight ranges, resolving in the original direction. Reversal consolidation shows deeper corrective moves and structural breakdowns that flip prior support or resistance.

How should traders size risk around these setups?

Base position size on a fixed percentage of account risk per trade and the distance between entry and stop. Larger stop distances require smaller position sizes to keep dollar risk consistent. Always plan risk-to-reward before entering.

What markets in the United States widely use these technical setups?

Equities, exchange-traded funds (ETFs), futures (including equity index and commodity futures), and forex pairs traded by U.S. brokers all commonly use these setups. Liquidity and clear price history make equities and major futures popular for pattern-based trading.

How can traders reduce losses from failed breakouts?

Use confirmation rules, scale into positions, place disciplined stops, and manage trade size. Consider trading retests rather than raw breakouts when markets are volatile. Cutting losers quickly preserves capital for higher-probability setups.

Are measured moves always achieved after a valid breakout?

No. Measured targets offer a logical objective, but market conditions, macro news, and liquidity can prevent a move from reaching that level. Treat measured moves as targets, not guarantees, and manage positions as price action evolves.

When should a trader prioritize reversal setups over continuation setups?

Favor reversal setups when you observe clear exhaustion after a prolonged trend, confirmed by support/resistance breaks, volume spikes, and momentum divergence. In strong trending markets, continuation setups usually offer higher probability.

What common mistakes increase pattern failure rates?

Common errors include forcing unclear formations, ignoring nearby levels, trading without confirmation, using oversized position sizes, and abandoning stop rules. A disciplined checklist reduces these mistakes and improves consistency.

No comments yet