The financial landscape of 2024 demands a sophisticated understanding of crypto market correlation with stock markets. Digital asset trends are transforming investment strategies, creating complex relationships between traditional securities and cryptocurrency platforms.

Stock market analysis reveals unprecedented interconnections between digital and conventional financial instruments. Investors now recognize that crypto market correlation is not just a theoretical concept but a critical component of modern portfolio management.

Sophisticated traders are developing advanced frameworks to track and predict how cryptocurrency performance impacts broader financial ecosystems. These emerging insights provide valuable strategic advantages for understanding market dynamics.

Key Takeaways

- Crypto market correlation represents a critical investment strategy in 2024

- Digital assets increasingly influence traditional stock market movements

- Advanced analytical tools are essential for understanding market relationships

- Institutional investors are paying closer attention to cross-market correlations

- Understanding crypto market trends requires comprehensive financial knowledge

Understanding Market Correlation Fundamentals

Market correlation is a critical concept in financial analysis that helps investors understand how different assets interact and move together. In the complex world of crypto and stock markets, understanding market correlation basics becomes increasingly important for making informed investment decisions.

Exploring market correlation involves examining the statistical relationship between different financial instruments and their price movements. Investors and analysts use correlation coefficients to quantify these intricate connections across various markets.

Core Correlation Concepts

Correlation can be categorized into three primary types:

- Positive Correlation: When two assets move in the same direction

- Negative Correlation: When assets move in opposite directions

- Zero Correlation: No discernible relationship between asset movements

Measuring Correlation Coefficients

Analysts use specific mathematical tools to calculate types of correlations. The Pearson correlation coefficient ranges from -1 to +1, providing a precise measurement of asset relationships.

| Correlation Range | Interpretation |

|---|---|

| +1.0 | Perfect Positive Correlation |

| 0 | No Linear Correlation |

| -1.0 | Perfect Negative Correlation |

Practical Applications

Understanding correlation coefficients helps investors develop sophisticated strategies for portfolio management, risk assessment, and investment diversification across crypto and traditional stock markets.

The Evolution of Crypto-Stock Market Relationships

The crypto-stock relationship has undergone a dramatic transformation since Bitcoin’s inception in 2009. Initially viewed as a fringe financial experiment, cryptocurrencies have gradually integrated into mainstream investment strategies. The market evolution witnessed unprecedented shifts in how investors perceive digital assets.

Early perceptions of cryptocurrencies centered around their potential as uncorrelated assets. Investors saw them as a unique investment class completely detached from traditional financial markets. This perspective began changing as institutional investors entered the cryptocurrency landscape, bringing sophisticated analytical approaches.

- 2013-2016: Initial period of market isolation

- 2017: Significant market recognition milestone

- 2020-2022: Growing institutional involvement

Historical correlation trends reveal interesting patterns of convergence between crypto and stock markets. Major economic events like the COVID-19 pandemic accelerated this interconnectedness. Cryptocurrencies increasingly demonstrated similar behavioral characteristics to traditional stocks during market volatility.

Key technological advancements and regulatory developments have played crucial roles in reshaping the crypto-stock relationship. The introduction of cryptocurrency derivatives, exchange-traded funds, and more robust regulatory frameworks have bridged the gap between digital and traditional financial ecosystems.

Investors now recognize cryptocurrencies as a nuanced asset class with complex market dynamics, far removed from their original perception as speculative investments.

Key Factors Driving Crypto Market Correlation Analysis with Stocks

The intricate relationship between cryptocurrency and traditional stock markets continues to evolve, driven by complex interconnected factors. Investors and analysts are increasingly examining the nuanced dynamics that shape market correlations in the digital asset landscape.

Understanding the key drivers behind institutional crypto investment requires a multifaceted approach. Financial institutions are reshaping market interactions through strategic investment decisions that bridge traditional and digital financial ecosystems.

Institutional Investment Impact

Institutional crypto investment has become a critical force in market correlation analysis. Large financial entities are transforming cryptocurrency market dynamics through several strategic approaches:

- Substantial capital allocations to digital assets

- Development of cryptocurrency investment products

- Integration of blockchain technologies into existing financial frameworks

Regulatory Environment Effects

The regulatory impact on correlation between crypto and stock markets represents a pivotal consideration for investors. Government policies and regulatory frameworks significantly influence market behaviors and investment strategies.

| Regulatory Domain | Potential Market Impact |

|---|---|

| Securities Regulations | Increased institutional participation |

| Compliance Requirements | Enhanced market transparency |

| Tax Frameworks | Altered investment incentives |

Market Sentiment Indicators

Market sentiment analysis plays a crucial role in understanding crypto-stock market correlations. Investor psychology and media narratives can create significant market movements across different asset classes.

Digital platforms and social media channels now provide real-time insights into market sentiment, enabling investors to track and predict potential market shifts with unprecedented precision.

Traditional Stock Market Indicators vs Crypto Metrics

Investors diving into cryptocurrency markets quickly discover the unique landscape of stock market indicators and crypto market metrics. While traditional financial analysis relies on established stock market indicators, the crypto world demands a different approach to comparative market analysis.

Traditional stock market metrics often fall short when applied to cryptocurrencies. Key differences emerge in how investors evaluate digital assets compared to conventional stocks:

- Market Capitalization: Similar in concept, but more volatile in crypto markets

- Network Hash Rate: A unique crypto metric measuring blockchain security

- Active Addresses: Indicator of user engagement not found in stock markets

- On-Chain Volume: Transparency metric specific to blockchain transactions

Crypto market metrics provide deeper insights into digital asset performance. Unlike stock market indicators that focus on financial statements, crypto metrics reveal network health, user adoption, and technological robustness.

Investors can leverage these distinctive metrics for more comprehensive market analysis:

- Compare network activity across different cryptocurrencies

- Assess blockchain ecosystem strength

- Understand user engagement levels

- Evaluate potential investment opportunities

The emerging field of comparative market analysis bridges traditional financial analysis with cutting-edge crypto evaluation techniques. By understanding both stock market indicators and crypto market metrics, investors gain a more holistic view of digital asset performance.

Technical Tools for Correlation Analysis

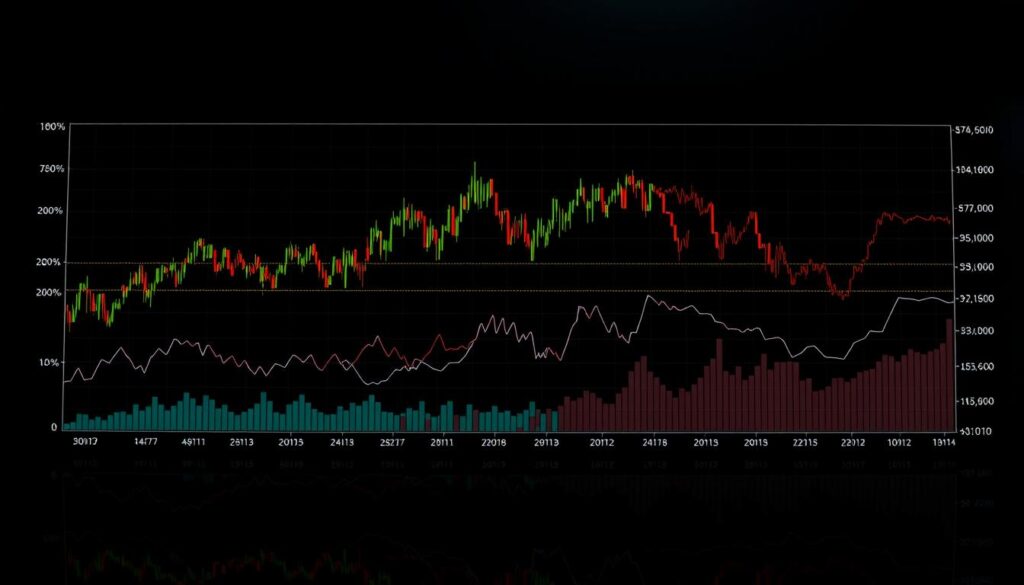

Investors and analysts rely on sophisticated correlation analysis tools to navigate the complex landscape of crypto and stock market interactions. The right software can transform raw market data into actionable insights, helping traders make informed decisions.

Professionals use advanced market data visualization platforms to decode intricate market relationships. These tools bridge the gap between raw numbers and strategic understanding.

Popular Analysis Software

- Bloomberg Terminal: Industry-standard platform for comprehensive financial analysis

- TradingView: Powerful charting and real-time crypto tracking tool

- CryptoCompare: Specialized analytics platform for digital asset correlation

Data Visualization Methods

Effective correlation analysis depends on clear visual representation. Analysts leverage multiple visualization techniques to understand market dynamics:

- Heat Maps: Show correlation strengths between different assets

- Scatter Plots: Reveal relationship patterns between crypto and stock markets

- Time Series Charts: Track correlation changes over specific periods

Real-time Tracking Tools

Modern investors demand instantaneous market insights. Real-time crypto tracking tools provide immediate correlation data, enabling quick strategic adjustments in fast-moving markets.

Key features of top tracking platforms include live price updates, correlation coefficient calculations, and interactive dashboards that transform complex data into user-friendly visualizations.

Bitcoin’s Relationship with Major Stock Indices

The cryptocurrency market leader, Bitcoin, has increasingly captured the attention of investors seeking to understand its Bitcoin-stock correlation with major stock indices. As digital assets mature, the relationship between Bitcoin and traditional financial markets becomes more complex and nuanced.

Analyzing Bitcoin’s performance reveals several key insights into its interaction with major stock indices:

- Bitcoin demonstrates a dynamic correlation with stock markets, often shifting between periods of alignment and divergence

- Macroeconomic events significantly impact Bitcoin’s relationship with traditional financial markets

- Institutional investment has played a crucial role in bridging cryptocurrency and stock market behaviors

Investors have observed interesting patterns in Bitcoin-stock correlation, particularly during economic uncertainties. The cryptocurrency market leader has shown potential as both a risk asset and a potential hedge against market volatility.

Recent research suggests that Bitcoin’s correlation with major stock indices can vary based on several factors:

- Global economic conditions

- Investor sentiment

- Regulatory developments

- Technological advancements in blockchain technology

Understanding these complex relationships requires sophisticated analysis and continuous monitoring of market dynamics. Investors and analysts increasingly recognize the importance of examining Bitcoin’s intricate connections with traditional financial markets.

Altcoin Performance Against Traditional Securities

The intersection of cryptocurrency and traditional financial markets reveals fascinating patterns of altcoin-stock correlation. Investors are increasingly examining how digital assets interact with established securities, uncovering unique market dynamics that challenge conventional investment strategies.

Cryptocurrency markets demonstrate complex relationships with traditional financial instruments. Researchers have identified several key areas of interaction between digital and traditional assets:

- Emerging correlation patterns between tech stocks and crypto markets

- Growing institutional interest in cross-asset investment strategies

- Volatility spillover effects between different market segments

Ethereum and Tech Sector Dynamics

Ethereum market analysis shows intriguing connections with technology stocks. Tech-driven cryptocurrencies often mirror innovation-focused stock performance, creating unique investment opportunities. Silicon Valley’s technological ecosystem increasingly bridges traditional and digital financial landscapes.

DeFi Tokens and Financial Sector Insights

DeFi token performance presents a revolutionary approach to financial services. These digital assets challenge traditional banking structures by offering decentralized alternatives that demonstrate remarkable adaptability in complex market environments.

Mining Stocks Correlation Exploration

Crypto mining stocks provide a fascinating lens into the broader cryptocurrency ecosystem. Their performance often reflects broader market sentiments, connecting digital asset dynamics with traditional investment frameworks.

Investors navigating these complex markets must develop nuanced understanding of cross-asset relationships. The evolving landscape of altcoin-stock correlation demands continuous research and adaptive investment strategies.

Market Volatility and Cross-Asset Dynamics

Crypto market volatility represents a complex landscape of interconnected financial movements. Understanding cross-asset correlation requires deep insights into how different markets interact during periods of economic uncertainty. Investors navigating these turbulent waters must develop sophisticated risk assessment strategies.

Key dynamics of market volatility include:

- Rapid price fluctuations in cryptocurrency markets

- Spillover effects between traditional stocks and digital assets

- Institutional investment impact on market stability

Analyzing crypto market volatility reveals intricate patterns of financial interdependence. Traders and analysts use advanced statistical models to track correlation coefficients between different asset classes.

| Asset Class | Volatility Index | Correlation Strength |

|---|---|---|

| Bitcoin | High | Moderate |

| S&P 500 | Medium | Weak |

| Ethereum | Very High | Strong |

Risk management in volatile markets demands proactive monitoring and adaptive investment approaches. By understanding the nuanced relationships between different financial instruments, investors can develop more resilient portfolio strategies.

The intersection of crypto market volatility and cross-asset correlation provides critical insights for modern financial decision-making. Sophisticated risk assessment techniques enable investors to navigate increasingly complex global markets.

Risk Management Strategies for Correlated Markets

Navigating the complex landscape of crypto and stock market interactions demands sophisticated correlated market risk management techniques. Investors must develop robust strategies to protect their portfolios from potential volatility and unexpected market shifts.

Successful crypto portfolio diversification requires a multi-faceted approach that goes beyond traditional investment methods. Investors need to understand the intricate relationships between different asset classes and develop adaptive strategies.

Strategic Portfolio Diversification

Effective crypto portfolio diversification involves several key principles:

- Spread investments across multiple cryptocurrency sectors

- Include traditional stock market assets for balance

- Analyze correlation coefficients between different assets

- Regularly rebalance portfolio allocations

Advanced Hedging Strategies

Implementing sophisticated hedging strategies can significantly mitigate market risks. Investors can utilize:

- Derivative contracts to offset potential losses

- Inverse ETFs for downside protection

- Options trading to limit exposure

- Algorithmic trading techniques

The key to successful risk management lies in continuous monitoring and adapting to changing market dynamics. Investors must remain flexible and proactive in their approach to crypto and stock market correlations.

By combining rigorous analysis, strategic diversification, and dynamic hedging methods, investors can build resilient portfolios that withstand market volatility and capitalize on emerging opportunities.

Institutional Perspectives on Crypto-Stock Correlation

Institutional investors are transforming the landscape of digital asset investment through sophisticated institutional crypto analysis. Professional market participants increasingly recognize the intricate relationships between cryptocurrency and traditional stock markets, developing nuanced strategies to navigate these complex financial ecosystems.

Leading investment firms are adopting professional market insights that reveal deeper connections between digital and traditional assets. These strategies incorporate advanced correlation analysis techniques to understand market dynamics.

- Quantitative research teams analyze correlation coefficients

- Risk management departments develop sophisticated tracking models

- Investment firm strategies now include crypto-stock correlation metrics

Sophisticated institutional investors recognize that cryptocurrency markets are no longer isolated financial ecosystems. They are integrating comprehensive data analysis to create robust investment frameworks that account for cross-market interactions.

| Institutional Approach | Key Focus Areas |

|---|---|

| Goldman Sachs | Advanced crypto correlation modeling |

| BlackRock | Digital asset risk assessment |

| JPMorgan | Crypto market structural analysis |

Emerging research demonstrates that institutional investors are developing increasingly sophisticated approaches to understanding crypto-stock market relationships. By leveraging advanced data analytics and cross-market research, these professionals are creating more nuanced investment strategies.

Real-World Trading Applications and Strategies

Crypto trading strategies have evolved dramatically, transforming how investors approach digital asset markets. The intersection of traditional financial analysis and cryptocurrency trading offers sophisticated opportunities for strategic investment.

Correlation-based investing requires deep understanding of market dynamics. Traders now leverage advanced analytical techniques to identify potential opportunities across different asset classes.

Advanced Correlation Trading Methods

Successful crypto trading strategies depend on robust market risk models that can predict potential market movements. Key approaches include:

- Pair trading between correlated crypto and stock assets

- Cross-market arbitrage opportunities

- Dynamic hedging techniques

- Multi-asset correlation analysis

Risk Assessment Frameworks

Professional traders utilize sophisticated market risk models to evaluate potential investments. These models help investors:

- Quantify potential portfolio volatility

- Assess correlation coefficients between assets

- Develop predictive investment strategies

- Minimize potential downside risks

Sophisticated investors recognize that understanding market correlations can provide significant competitive advantages in both crypto and traditional financial markets.

Future Trends in Digital Asset Correlation

The landscape of digital asset evolution is rapidly transforming, presenting exciting opportunities for investors and market analysts. Future crypto trends suggest a significant shift in how digital assets interact with traditional financial markets. Emerging technologies and regulatory frameworks are reshaping market correlation forecasts in unprecedented ways.

Key developments are driving this digital transformation:

- Blockchain interoperability creating more integrated financial ecosystems

- Central Bank Digital Currencies (CBDCs) blurring traditional market boundaries

- Advanced algorithmic trading platforms enhancing cross-market analysis

Institutional adoption continues to play a crucial role in bridging cryptocurrency markets with traditional stock exchanges. Sophisticated investors are developing more nuanced strategies that leverage complex market correlation models.

Cryptocurrency markets are expected to demonstrate increasingly sophisticated relationships with global financial instruments. Predictive analytics and machine learning technologies will likely enhance our understanding of digital asset correlation patterns, providing deeper insights into market dynamics.

- Enhanced risk assessment tools

- More granular market correlation tracking

- Real-time cross-market performance analysis

The future of digital assets promises more integrated, transparent, and interconnected financial ecosystems. Investors who understand these emerging trends will be better positioned to navigate the complex landscape of digital and traditional investments.

Building a Correlation-Aware Investment Portfolio

Developing a balanced crypto portfolio requires strategic correlation-aware investing techniques that adapt to rapidly changing market dynamics. Investors must recognize the intricate relationships between digital and traditional assets to create robust long-term investment strategies. Understanding market correlations helps minimize potential risks and optimize portfolio performance across different economic environments.

Effective portfolio construction begins with comprehensive data analysis and risk assessment. Investors should leverage advanced correlation tracking tools to evaluate how cryptocurrencies interact with stock market indices. A well-structured approach involves diversifying investments across multiple asset classes while maintaining awareness of potential interconnected market movements. This method allows for more precise allocation decisions that protect against unexpected market volatilities.

Strategic asset allocation remains crucial in correlation-aware investing. Modern investors need flexible frameworks that can quickly adjust to shifting market conditions. By continuously monitoring correlation patterns between crypto and traditional securities, individuals can create adaptive portfolios that respond dynamically to emerging trends. Regular rebalancing and sophisticated risk management techniques become essential components of maintaining a resilient investment strategy.

Successful long-term investment strategy in the digital asset landscape requires continuous learning and technological awareness. Investors must stay informed about emerging market trends, technological innovations, and regulatory developments that could impact asset correlations. Professional investors recommend utilizing advanced analytics and maintaining a disciplined approach to portfolio management while remaining open to innovative investment methodologies.

FAQ

What is market correlation in the context of cryptocurrencies and stocks?

Market correlation refers to the statistical relationship between the price movements of cryptocurrencies and traditional stock markets. It measures how closely the prices of different assets move in relation to each other, helping investors understand potential interdependencies between crypto and traditional financial markets.

How do institutional investments impact crypto-stock market correlations?

Institutional investments have significantly increased the correlation between crypto and stock markets. As major financial institutions like BlackRock and Goldman Sachs enter the cryptocurrency space, they bring traditional investment strategies and risk management approaches, creating more pronounced linkages between these previously separate asset classes.

What are the key indicators used to measure crypto-stock market correlation?

Key indicators include the Pearson correlation coefficient, which measures the strength and direction of the relationship between crypto and stock prices. Other important metrics include beta coefficients, trading volume comparisons, and cross-market sentiment analysis tools that track simultaneous price movements and investor behavior.

How does Bitcoin’s correlation with stock indices typically behave?

Bitcoin’s correlation with major stock indices like the S&P 500 varies over time. During economic uncertainties, Bitcoin can sometimes show inverse correlation, acting as a potential hedge. However, in recent years, it has increasingly demonstrated positive correlation, particularly during significant market events like the COVID-19 pandemic and global economic shifts.

Can cryptocurrency serve as a diversification tool in investment portfolios?

While cryptocurrencies were initially viewed as an uncorrelated asset, their current market behavior suggests more complex diversification potential. Sophisticated investors now use crypto as part of a nuanced portfolio strategy, recognizing that while complete diversification may be challenging, strategic allocation can help manage overall portfolio risk.

What technical tools are recommended for analyzing crypto-stock market correlations?

Professionals typically use advanced platforms like TradingView, Bloomberg Terminal, and specialized crypto analytics software. These tools offer real-time data visualization, including heat maps, scatter plots, and time series charts that help track and interpret complex correlation patterns between cryptocurrencies and traditional financial markets.

How do regulatory environments affect crypto-stock market correlations?

Regulatory developments can significantly impact market correlations by influencing investor sentiment and market stability. Changes in cryptocurrency regulations by bodies like the SEC or international financial authorities can create immediate and substantial shifts in how crypto assets correlate with traditional stock markets.

What role do market sentiment indicators play in understanding crypto-stock correlations?

Market sentiment indicators such as social media analysis, news sentiment tracking, and investor confidence indices provide crucial insights into potential correlation movements. These tools help investors understand the psychological factors driving simultaneous price movements in crypto and stock markets.

How have DeFi tokens correlated with traditional financial sector stocks?

Decentralized Finance (DeFi) tokens have shown increasing correlation with traditional financial sector stocks, particularly tech and fintech stocks. As blockchain technology becomes more integrated with traditional financial services, the correlation between DeFi tokens and financial sector stocks has become more pronounced.

What strategies can investors use to manage risks in correlated markets?

Effective risk management strategies include dynamic portfolio rebalancing, using hedging techniques like derivatives, implementing algorithmic trading strategies, and maintaining a diversified approach that considers the evolving correlation patterns between crypto and stock markets.

No comments yet