Navigating the fast-paced world of digital assets requires more than just intuition. To build a solid approach, you need a way to test your ideas before committing real funds. This is where the power of simulation comes into play.

The process, known as backtesting, allows you to apply your specific plan to past market information. You can see exactly how your methods would have performed under real conditions. This provides invaluable insights without any financial danger.

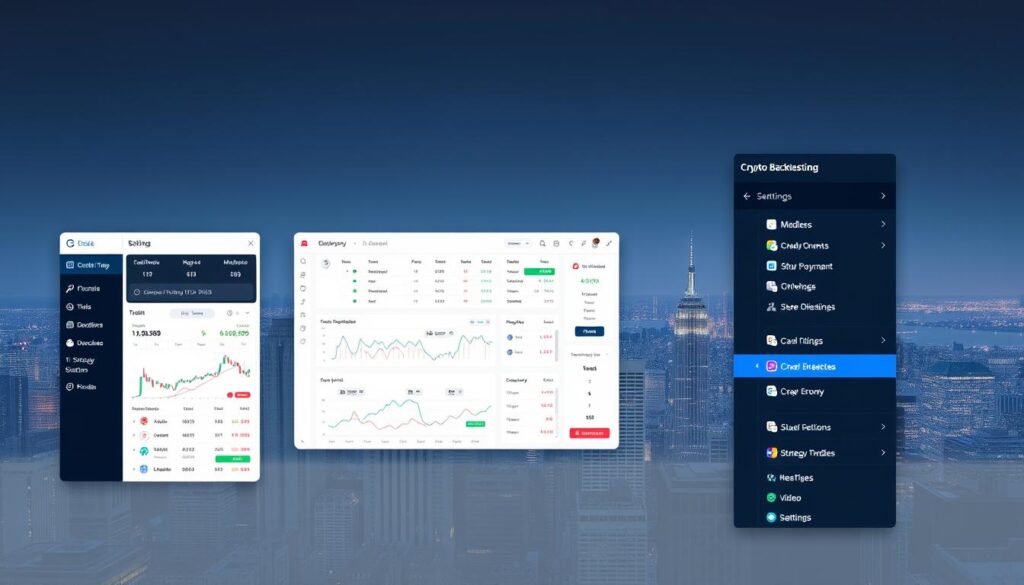

Using a dedicated platform for this analysis is a game-changer. It helps traders move from emotional reactions to a systematic, data-driven process. As discussed in this guide on backtesting your crypto trading strategy, it’s a critical step for reducing risk.

This guide will walk you through evaluating different platforms. You’ll learn about key features and how to choose the right one for your goals in the U.S. market.

Key Takeaways

- Backtesting simulates a trading plan using past market information to gauge performance.

- This process helps identify a strategy’s potential profitability before using real money.

- Accurate historical data is the essential foundation for any reliable simulation.

- Using a specialized tool provides a systematic approach to strategy development.

- This method reduces reliance on emotion and gut instinct when making decisions.

- The goal is to gain valuable insights with zero financial risk.

Understanding the Importance of Backtesting in Crypto Trading

The volatile nature of cryptocurrency markets demands more than speculative guesswork—it requires evidence-based methodology validation. Unlike traditional assets valued through balance sheets, digital currencies rely heavily on technical pattern analysis.

This fundamental difference makes historical performance evaluation essential for developing reliable approaches.

Why Backtesting Matters for Traders

Many participants in digital asset markets favor analyzing price and volume patterns to identify opportunities. Testing these methods against past scenarios provides crucial insights into potential future performance.

The primary advantage is discovering a genuine edge. This process helps identify which approaches have statistical merit before risking real capital.

Optimizing Your Strategy Based on Historical Insights

Once you identify a promising edge, you can transform it into a systematic framework. This removes emotional decision-making from the equation, which often leads to costly mistakes.

By refining entry and exit rules through thorough analysis, traders build confidence in their methods. This systematic approach prevents abandoning proven strategies during challenging periods.

Key Features and Tools for Effective Strategy Backtesting

Building a reliable approach for digital assets starts with selecting the right analytical instruments. The best platforms provide comprehensive features that transform raw information into actionable insights.

Quality charting capabilities form the backbone of any serious evaluation system. These visual interfaces allow you to see price movements and volume patterns across different time periods.

Essential Charting and Indicator Options

A robust platform offers diverse technical indicators for testing under various market conditions. From trending markets to consolidation phases, having multiple analytical options is crucial.

Accurate historical information serves as the foundation for meaningful results. Even the most sophisticated analytics become useless if the underlying numbers contain errors.

The most valuable platforms provide deep performance metrics through intuitive graphic displays. These visualizations help identify specific weaknesses in your approach quickly. For those seeking advanced capabilities, exploring smart analytical solutions can provide additional advantages.

This combination of quality charting, diverse indicators, and comprehensive analytics separates professional-grade tools from basic options. The right platform delivers clear insights into method performance without complexity.

Exploring the Crypto Trading Strategy Backtesting Tool Historical Data

Access to comprehensive market records transforms theoretical approaches into tested methodologies. The depth and accuracy of past information directly determine simulation reliability.

Modern evaluation systems offer remarkable timeframe flexibility. This allows testing various methodologies from rapid executions to long-term positions.

| Asset Category | Available Timeframes | Historical Start Date | Key Examples |

|---|---|---|---|

| Index Futures | Seconds to Monthly | January 2012 | ES, NQ, RTY, YM |

| Currency Futures | 1-30 sec up to 1M | January 2012 | 6E (Euro), 6B (Pound) |

| Commodity Futures | Multiple intervals | Various dates | CL, GC, SI, HG |

| Agricultural Futures | Full range | Extensive history | ZW, LE, HE |

Leading platforms provide information dating back to 2012 for many assets. This extensive coverage enables testing across complete economic cycles.

Data granularity proves essential for different methodologies. Intraday approaches require second-level details, while position-based methods need broader timeframes.

The quality of market records directly impacts simulation accuracy. Complete, verified information creates realistic testing environments for any methodology.

Evaluating Historical Data: Accuracy and Analytical Tools

Accurate market records serve as the bedrock for reliable performance assessment. The quality of your information directly impacts the validity of your simulation outcomes.

Data Quality and Timeframe Diversity

Clean, precise price information is non-negotiable for meaningful evaluation. Even minor errors can completely distort your metrics and lead to false conclusions.

Verify that prices align with known market events. Check for gaps in the record and ensure volume details are included.

Testing across multiple time horizons reveals whether an approach works consistently. This diversity helps identify patterns across different market conditions.

Leveraging Analytics for Better Decision-Making

Advanced platforms provide comprehensive performance metrics beyond simple profit calculations. These include risk-adjusted returns and drawdown analysis.

Graphic visualizations transform raw numbers into actionable insights. They help pinpoint specific areas for optimization in your methodology.

Effective analysis supports data-driven decisions about risk management and capital allocation. This systematic approach builds confidence in your methods.

Leveraging Technical Indicators and Market Analytics

Modern analytical platforms offer thousands of technical tools to enhance your methodology development. These instruments transform complex market information into clear, visual signals for systematic evaluation.

The right combination of indicators can reveal hidden patterns and market structure dynamics. This approach moves beyond simple price observation to comprehensive analysis.

Utilizing Standard Indicators like Zig Zag and Alligator

Basic tools like the Zig Zag indicator help filter market noise. It connects key swing points to identify clear trend reversals and support levels.

The Williams Alligator uses three smoothed averages to define market states. This visual framework helps identify directional bias and timing for entries.

Fractal markers and %R momentum tools provide additional confirmation signals. They spot overbought conditions and potential breakout points effectively.

Advanced Metrics and Visualizations for In-Depth Analysis

Volume Profile tools map where trading activity occurred within specific ranges. This uncovers true support zones based on actual volume rather than just price movements.

The Vortex Indicator confirms trend shifts by comparing directional momentum. VWAP serves as an intraday anchor for premium/discount analysis.

These advanced metrics provide deeper insights into market behavior. They help create more robust signals across different conditions.

The Role of Custom Indicators in Backtesting

Platforms supporting custom creation allow implementation of specialized techniques. Tools like Supertrend provide clear trend direction signals for various approaches.

The Traders Dynamic Index combines momentum and trend-following logic into one oscillator. This flexibility dramatically expands the types of methodologies you can test.

Understanding how to combine multiple indicators creates robust systems. Effective use requires knowing what each tool measures and how they work together.

Integrating Diverse Assets and Timeframes in Backtesting

Modern evaluation platforms now offer unprecedented access to multiple financial instruments beyond just digital currencies. This capability allows you to test your methodology across various market environments and conditions.

True robustness comes from validation across different price movements and economic cycles. A method that works in one asset class might fail in another.

Incorporating Futures, Cryptos, and Traditional Assets

Leading platforms provide comprehensive coverage including equity indices, commodities, and currency futures. You can test approaches on energy products like crude oil alongside precious metals such as gold.

Agricultural futures and currency pairs expand your testing range significantly. This diversity helps identify whether your edge is universal or specific to certain market conditions.

Timeframe flexibility is equally crucial for thorough evaluation. Platforms offering intervals from seconds to monthly charts support both rapid executions and long-term positions.

Cross-asset validation provides the confidence needed before committing real capital. It reveals whether your approach captures fundamental market dynamics.

This comprehensive testing environment helps develop adaptable methodologies. You can transition between asset classes as opportunities arise in live market conditions.

User Experiences and Success Stories

Hearing directly from those who use these platforms daily provides the most honest assessment of their value. Real testimonials reveal how different approaches work in various market conditions.

Real Testimonials from Backtesting Platform Users

Smartboy shared in May 2025 how testing ORB and ILM methods across London, New York, and Asia sessions helped refine his approach. The customizable interface allowed perfect adjustments for future trades.

Jelmer noted the platform’s user-friendly design makes accessing session data straightforward. Detailed journal features enable thorough trade reviews and help filter unsuccessful entries.

Mitchel Hodge appreciated how the system balances customer value with long-term sustainability. This builds trust while maintaining innovation in fast-changing markets.

ASCIENDE compared multiple software options and found comprehensive features including free services and diverse assets. The auto-save system and high-quality information stood out significantly.

How User Feedback Shapes Product Evolution

Leading platforms actively incorporate suggestions from experienced participants. This continuous improvement process adds features based on real usage patterns.

Juan Manuel Martin highlighted professional support that enhances the overall experience. User insights drive refinements that benefit the entire community of traders.

These authentic experiences provide valuable perspective when evaluating different options. They reveal both practical benefits and areas for improvement in actual workflow applications.

Getting Started with the Right Backtesting Software – A Buyer’s Guide

Three distinct approaches exist for validating your market methodology before implementation. Each method suits different skill levels and time commitments.

Choosing Platforms Like FX Replay and Tradewell

Manual testing involves reviewing charts and spreadsheet data. This works for non-programmers but consumes significant time.

Code-based evaluation uses languages like Python. It offers power but requires programming knowledge.

Automated platforms provide the ideal middle ground. They handle the complex process without coding requirements.

Tradewell features a no-code interface for easy parameter input. It supports diverse time intervals from intraday to weekly charts.

The platform includes thousands of indicators for comprehensive testing. Multiple data sources ensure accurate information for hundreds of pairs.

| Feature | Tradewell | FX Replay |

|---|---|---|

| Interface Type | No-code parameters | Customizable UI |

| Cost to Start | Free access | Free services |

| Data Sources | Multiple providers | High-quality feeds |

| Special Features | Analytical metrics | Auto-save system |

Free trials let you test software with your capital at risk. This helps verify platform suitability before financial commitment.

Evaluate interfaces for clarity and customization options. Good design reduces learning curves and improves workflow efficiency.

Look for detailed performance metrics and risk management insights. These help determine if a method warrants live market use.

Conclusion

The journey from speculative ideas to profitable execution begins with rigorous testing against past market conditions. This process transforms subjective concepts into objective, data-driven approaches.

Effective evaluation requires the right combination of accurate information, diverse indicators, and user-friendly platforms. These resources make systematic testing accessible to all participants, regardless of technical background.

Successful market participants treat this as an ongoing refinement process. They continuously test new ideas and optimize existing methods as conditions evolve.

Begin with free trials to experience how systematic evaluation improves decision-making. Remember that past results don’t guarantee future outcomes. Proper risk management remains essential when transitioning to live markets.

Investing time in learning these techniques prevents costly mistakes. It accelerates the development of profitable approaches in volatile digital asset environments.

FAQ

What is the primary benefit of using a backtesting platform?

The main advantage is the ability to test your investment ideas against past market conditions without risking capital. This process helps you refine your approach, understand potential outcomes, and build confidence before executing live orders.

How accurate are the results from a backtesting tool?

Accuracy heavily depends on the quality and depth of the historical data used. Top-tier platforms provide clean, tick-by-tick data across thousands of assets and various timeframes. However, past performance does not guarantee future results, as markets can change.

What types of assets can I backtest strategies on?

Many modern software solutions support a wide range of markets. You can typically analyze strategies for cryptocurrencies, forex pairs, stocks, indices, and commodities. Some advanced platforms also include futures and options for a comprehensive view.

Which technical indicators are most useful for analysis?

Useful indicators vary by strategy. Common tools include moving averages for trends, the RSI for momentum, and Bollinger Bands for volatility. Platforms like FX Replay also offer specialized indicators like the Zig Zag for pattern recognition and the Alligator for trend confirmation.

Can I test a strategy that uses news or social media signals?

This depends on the platform’s capabilities. Some advanced analytics tools can integrate economic calendars or social sentiment data into the backtesting process. You should check if the software supports this type of data integration for a more complete analysis.

How do I choose the right backtesting software?

Look for a platform that balances powerful features with user-friendliness. Key factors include data quality, available indicators, customization options, and clear performance metrics. Reviewing user testimonials for products like Tradewell can provide real-world insights into the platform’s value.

No comments yet