Navigating the vast world of digital assets can feel overwhelming. A single tool offers powerful insights into the entire crypto landscape. It shows which projects hold the most value at a glance.

This tool often focuses on one major metric: bitcoin dominance. This figure reveals what portion of the total digital asset market belongs to Bitcoin. It acts like a gauge for overall investor sentiment.

Understanding these percentages helps you see bigger trends. You can spot when money moves into established giants or newer alternatives. This knowledge is key for making smart choices in the cryptocurrency market.

This guide will explore how to read these important market cap figures. We will look at their history and how to use them. You will learn to interpret shifts in dominance across the market.

Key Takeaways

- The chart is a fundamental tool for visualizing value distribution across digital assets.

- Bitcoin dominance is a primary metric, indicating its share of the total value.

- Analyzing dominance patterns helps identify major investment trends.

- It acts as a real-time pulse check on capital flow within the ecosystem.

- This analysis provides context for market cycles and risk assessment.

- Understanding the cryptocurrency market cap dominance chart leads to more informed decisions.

Exploring the Cryptocurrency Market Cap Dominance Chart

Understanding the distribution of value across digital assets begins with mastering one essential visualization tool. This graphical representation reveals how capital flows between different blockchain projects.

Definition and Core Concepts

The dominance chart displays each digital asset’s proportional value relative to the entire ecosystem. It shows what percentage of total value belongs to specific projects.

Market capitalization serves as the foundation for these calculations. This metric multiplies an asset’s current price by its circulating supply. The result provides a standardized way to compare different projects.

| Digital Asset | Current Price | Circulating Supply | Market Capitalization |

|---|---|---|---|

| Bitcoin | $45,000 | 19.5 million | $877.5 billion |

| Ethereum | $3,200 | 120 million | $384 billion |

| Altcoin A | $1.50 | 500 million | $750 million |

Relevance in the Cryptocurrency Market

This visualization tool helps investors make informed decisions about portfolio allocation. It shows when capital moves toward established leaders or emerging alternatives.

The chart captures the dynamic nature of the blockchain space. Shifting percentages reflect changing investor confidence and adoption rates. This makes it invaluable for identifying market cycles.

Bitcoin Dominance: A Gateway to Market Sentiment

The relationship between Bitcoin and other digital assets reveals much about investor psychology. This dynamic serves as a crucial barometer for the entire blockchain ecosystem.

Understanding Bitcoin’s Market Share

Bitcoin began with complete control of the digital asset space. Its initial 100% market share has evolved as new projects emerged.

This bitcoin dominance metric shows what portion of total value belongs to Bitcoin. It fluctuates based on many external factors.

Global economic changes and regulatory announcements affect these percentages. Technological advances also influence the distribution of value.

Impact on Investor Behavior

Investors watch BTC dominance closely for timing decisions. Rising percentages often signal cautious market sentiment.

When bitcoin gains market share, money typically flows from alternatives. This suggests a risk-averse approach among participants.

Declining dominance indicates confidence in the broader space. It often precedes periods where alternatives outperform.

This sentiment indicator helps shape portfolio strategies across different cycles.

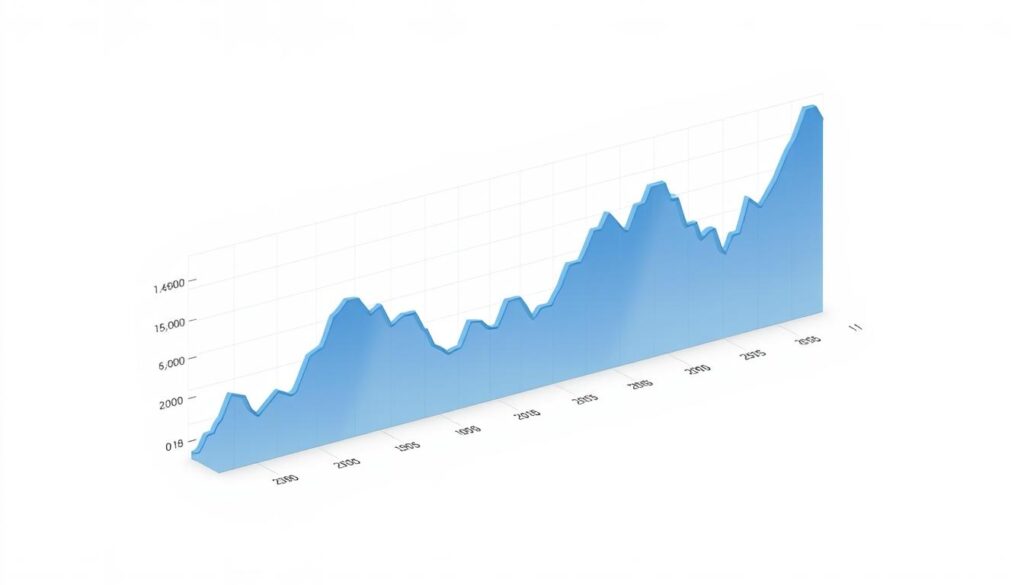

Historical Trends and Data Analysis

Analyzing past performance data reveals cyclical behaviors that repeat across different time periods. This historical perspective helps investors understand how digital assets evolve.

Looking back shows clear patterns in how value shifts between different blockchain projects. These trends provide valuable context for current conditions.

Interpreting Past Market Movements

Historical analysis of Bitcoin’s position shows distinct cycles. During bear periods, its share typically increases as investors seek stability.

Bull runs often see money flowing into alternative projects. The ICO boom and DeFi summer marked significant lows for Bitcoin’s market share.

These market trends follow predictable rhythms over time. Periods of stability often precede sharp changes in capital distribution.

Understanding these dominance patterns offers advance warning of phase transitions. This data helps position portfolios before major shifts occur.

The performance history reveals how the ecosystem matured from Bitcoin-only to diverse alternatives. Each project captures attention at different times.

Cyclical factors like halving events and regulatory changes influence these trends. Bitcoin dominance serves as a reliable gauge of risk appetite.

Interpreting past movements through this lens identifies recurring signals. This performance analysis informs smarter investment strategies.

Historical bitcoin dominance levels provide reference points for current conditions. Investors can assess whether present dominance is unusually high or low.

API Integration and Data Retrieval

For developers and analysts seeking deeper insights, programmatic access to historical data unlocks powerful analytical capabilities. Specialized interfaces provide structured information beyond basic chart viewing.

Accessing Historical Cryptocurrency Data

The CoinMarketCap API offers comprehensive historical market data through its global metrics endpoint. This service returns valuable metrics like total capitalization and bitcoin dominance percentages.

Different subscription tiers determine how far back you can access this information. Basic plans provide current figures while professional levels include extended historical data.

Parameters and API Usage

Flexible parameters let you customize your data requests precisely. You can specify start and end dates using standard timestamp formats.

The interval parameter controls data granularity from hourly to monthly periods. This helps balance detail with processing needs.

Responses come in structured JSON format containing both metrics and status information. This market data supports custom dashboards and trading strategy backtesting.

Optional conversion parameters calculate values in multiple currencies. This feature supports international analysis requirements across different time periods.

Factors Shaping Market Dynamics

Multiple external forces converge to determine how capital flows between different blockchain projects. These factors create the complex market dynamics that investors must navigate.

Regulatory announcements and economic changes significantly impact the digital asset landscape. Major policy statements can instantly alter investor sentiment across the entire ecosystem.

Regulatory News and Global Economic Shifts

Government actions and economic conditions serve as powerful market catalysts. When regulators announce new frameworks, capital often shifts between established and emerging projects.

Global economic instability typically strengthens Bitcoin’s position as digital gold. During banking crises or inflation spikes, investors seek the relative safety of the original digital asset.

Technological Advancements in Crypto

Innovation constantly reshapes the competitive landscape. Breakthroughs in blockchain technology can redirect attention and investment toward newer projects.

The launch of innovative altcoins introduces fresh competition for market share. This technological growth creates a dynamic environment where leadership positions can change rapidly.

Investor Insights and Strategic Implications

Seasoned investors leverage dominance metrics to anticipate major shifts in the blockchain ecosystem. These tools provide valuable signals for timing entry and exit points across different digital assets.

Identifying Altcoin Season and Shifts in BTC Dominance

A sustained decline in Bitcoin’s share during bullish conditions often signals the start of an altcoin season. This pattern indicates that capital is rotating from established leaders to alternative projects.

Early investors who profit from Bitcoin’s initial surge frequently reallocate gains to other digital assets. This creates momentum for alternatives like Ethereum and Solana.

Monitoring BTC dominance helps identify optimal moments for trading strategies. Declining percentages suggest favorable conditions for alternative investments.

Risk Management and Future Trends

Strategic portfolio management uses dominance thresholds as rebalancing signals. When Bitcoin’s position falls below historical averages, increasing exposure to quality alternatives can optimize returns.

Future trends will likely continue showing volatility in capital distribution. Technological innovations and regulatory developments will shape these patterns.

Successful investors combine dominance analysis with other indicators. This comprehensive approach helps navigate the complex dynamics between different digital assets.

Conclusion

Tracking value allocation across different blockchain projects serves as a compass for navigating complex investment decisions. The bitcoin dominance metric remains an essential tool for understanding capital flows within the digital asset space.

This measurement provides critical context for portfolio strategy and timing decisions. High percentages often indicate risk-averse behavior, while lower figures suggest confidence in alternative assets.

For deeper insights into how alternative assets perform relative to Bitcoin, consider exploring our detailed altcoin analysis. This complementary perspective helps complete your analytical toolkit.

The relationship between BTC and the broader ecosystem continues to evolve. Monitoring these patterns alongside other indicators creates a comprehensive framework for informed decision-making in the dynamic crypto landscape.

FAQ

What is the total market capitalization, and why is it a key metric?

The total market capitalization represents the combined value of all digital assets. It’s a vital metric because it provides a snapshot of the entire sector’s size and overall health, helping to gauge the scale of the ecosystem.

How does BTC dominance influence altcoin performance?

When Bitcoin’s share of the total value is high, capital is often concentrated there, which can limit growth for other assets. A decline in BTC dominance frequently signals that money is flowing into altcoins, potentially indicating the start of an altcoin season.

What are the primary factors that cause shifts in market share among assets?

Major drivers include significant regulatory announcements, breakthroughs in blockchain technology, changes in global economic sentiment, and the launch of innovative projects that capture investor interest and capital.

How can investors use this data for risk management?

By monitoring trends in asset dominance, traders can identify periods of high risk or opportunity. For example, a rising BTC share might suggest a flight to safety, prompting a more conservative strategy, while a falling share could signal a time to explore altcoin growth.

Where can I find reliable historical data for analysis?

Many financial data platforms and specialized crypto sites offer APIs (Application Programming Interfaces) that provide access to historical metrics. These tools allow you to retrieve information on prices, trading volume, and dominance over specific timeframes for detailed study.

No comments yet