Cryptocurrency market cycles represent complex patterns of price movements that can significantly impact investment strategies. Understanding these cycles through historical data analysis provides crucial insights for investors seeking to navigate the volatile crypto landscape. The dynamic nature of digital assets requires a strategic approach to interpreting market trends and potential future movements.

Investors who master cryptocurrency market cycles can develop more robust crypto investment strategies. By examining past performance, market participants can identify recurring patterns that help predict potential price shifts and market sentiment. Historical data reveals critical information about market psychology, trading volumes, and potential turning points in cryptocurrency valuations.

Sophisticated investors recognize that successful crypto trading goes beyond simple price tracking. Comprehensive market cycle analysis involves examining multiple factors, including technological developments, regulatory changes, and global economic conditions that influence digital asset valuations.

Key Takeaways

- Historical data provides critical insights into cryptocurrency market dynamics

- Market cycles are complex and influenced by multiple external factors

- Strategic analysis can help predict potential market movements

- Investors can develop more informed investment strategies

- Understanding market cycles reduces investment risk

Understanding the Fundamentals of Cryptocurrency Market Cycles

Cryptocurrency markets operate through complex cyclical patterns that challenge even experienced investors. These market cycles represent the dynamic nature of digital asset trading, revealing critical insights into price movements and investor sentiment.

Understanding market cycles is crucial for navigating the volatile world of cryptocurrency investments. The cycle typically encompasses different phases that reflect investor psychology and market dynamics.

Bull and Bear Market Characteristics

A bull market represents a period of sustained price increases, characterized by investor optimism and strong buying momentum. Conversely, a bear market indicates declining prices and pessimistic market sentiment. These opposing market states define the fundamental rhythm of cryptocurrency trading.

- Bull market: Prices rise consistently

- Bear market: Prices decline persistently

- Market sentiment shifts rapidly

Key Components of Market Cycles

Market cycle components include four primary stages that describe investor behavior and price movements:

- Accumulation: Initial price stabilization

- Markup: Rapid price appreciation

- Distribution: Price consolidation

- Markdown: Price decline

Cycle Duration Patterns

Cryptocurrency market cycles vary in length, typically ranging from several months to multiple years. Understanding these duration patterns helps investors anticipate potential market transitions.

| Cycle Phase | Average Duration | Typical Characteristics |

|---|---|---|

| Accumulation | 3-6 months | Sideways price movement |

| Markup | 6-12 months | Rapid price appreciation |

| Distribution | 2-4 months | Price consolidation |

| Markdown | 3-9 months | Price decline |

Historical Bitcoin Price Patterns and Their Significance

Bitcoin’s price history reveals a fascinating journey of volatility and growth that has captivated investors worldwide. The crypto price patterns demonstrate remarkable transformations from a virtually worthless digital asset to a significant financial instrument. Understanding these historical market trends provides crucial insights into cryptocurrency investment strategies.

Key milestones in Bitcoin’s price evolution include:

- Initial valuation of less than $1 in 2009

- First major price surge in 2013, breaking $1,000

- Dramatic peak of $69,000 in November 2021

- Significant market corrections and recoveries

Analyzing Bitcoin’s price history reveals cyclical patterns that reflect market sentiment and technological developments. These cycles typically involve explosive growth periods followed by substantial corrections, creating opportunities for strategic investors.

| Year | Significant Price Event | Price Range |

|---|---|---|

| 2013 | First Major Breakout | $13 – $1,000 |

| 2017 | Bull Market Peak | $1,000 – $19,188 |

| 2021 | All-Time High | $29,000 – $69,000 |

Investors can leverage these historical market trends to develop more informed investment strategies. Recognizing recurring patterns helps anticipate potential market movements and manage risk effectively in the volatile cryptocurrency landscape.

Essential Tools for Cryptocurrency Market Cycle Analysis Historical Data

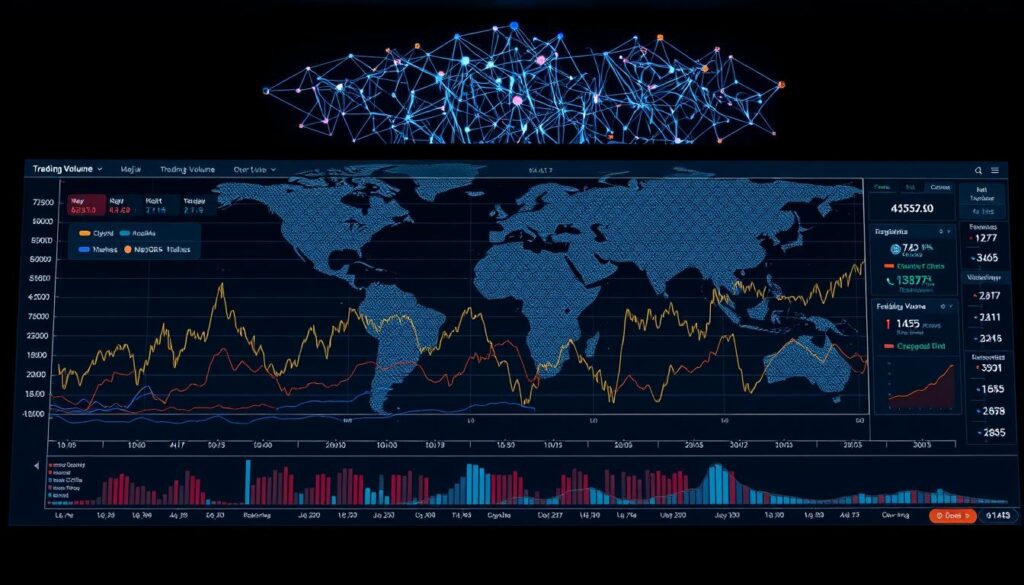

Navigating the complex world of cryptocurrency requires sophisticated crypto analysis tools that help investors make informed decisions. Understanding market trends demands powerful technical analysis platforms and advanced data visualization techniques.

Modern traders rely on comprehensive market intelligence resources to decode intricate cryptocurrency market cycles. These tools provide critical insights into price movements, trading patterns, and potential investment opportunities.

Technical Analysis Platforms

Top technical analysis platforms offer traders robust features for analyzing cryptocurrency market cycles:

- TradingView: Advanced charting capabilities

- CoinGecko: Comprehensive market data tracking

- CryptoCompare: Real-time price analysis

Data Visualization Tools

Effective data visualization transforms complex cryptocurrency data into understandable graphics. These tools help investors:

- Identify market trend patterns

- Recognize potential investment signals

- Compare historical price movements

Market Intelligence Resources

Critical market intelligence platforms provide deep insights into cryptocurrency market cycles. Glasschain and Messari offer in-depth blockchain analytics that help investors understand market dynamics.

By leveraging these advanced crypto analysis tools, investors can develop more strategic approaches to navigating the volatile cryptocurrency landscape.

The Role of Trading Volume in Cycle Identification

Trading volume serves as a critical indicator in understanding cryptocurrency market cycles. Investors and analysts rely on volume indicators to gain deeper insights into market dynamics and potential trend reversals. Trading volume analysis provides a comprehensive view of market liquidity and investor sentiment.

Key aspects of trading volume in cryptocurrency markets include:

- Measuring market participation and enthusiasm

- Confirming price movement strength

- Identifying potential trend reversals

- Assessing overall market liquidity

Sophisticated volume indicators help traders interpret market signals more effectively. Volume can reveal hidden market dynamics that price charts alone might not demonstrate. When high trading volumes accompany price movements, it typically signals stronger market conviction.

| Volume Indicator | Primary Function | Market Insight |

|---|---|---|

| On-Balance Volume | Cumulative Volume Trend | Predicts Price Momentum |

| Volume Rate of Change | Volume Acceleration | Detects Sudden Market Shifts |

| Chaikin Money Flow | Buying/Selling Pressure | Measures Market Strength |

Professional traders leverage these volume indicators to develop more robust trading strategies. By understanding market liquidity and volume patterns, investors can make more informed decisions during different cryptocurrency market cycles.

Key Indicators for Market Cycle Analysis

Cryptocurrency traders rely on various technical indicators to navigate the complex landscape of digital asset markets. Understanding these tools can provide critical insights into market trends, potential reversals, and momentum shifts.

Successful market cycle analysis requires a comprehensive approach to technical indicators. Traders use multiple methods to interpret market movements and make informed decisions.

Moving Averages: Trend Identification

Moving averages are fundamental technical indicators that help traders understand price trends. These calculations smooth out price fluctuations, revealing underlying market directions.

- Simple Moving Average (SMA) calculates average prices over specific periods

- Exponential Moving Average (EMA) gives more weight to recent price data

- Crossover points between different moving averages signal potential trend changes

Relative Strength Index (RSI): Momentum Assessment

The Relative Strength Index is a powerful momentum oscillator that measures the speed and change of price movements. RSI helps traders identify overbought and oversold conditions in cryptocurrency markets.

| RSI Value | Market Interpretation |

|---|---|

| Above 70 | Potential Overbought Condition |

| Below 30 | Potential Oversold Condition |

MACD Patterns: Trend Confirmation

The Moving Average Convergence Divergence (MACD) is a sophisticated technical indicator that combines moving averages to track market momentum. Traders use MACD patterns to confirm trend strength and potential reversals.

- MACD line shows relationship between short and long-term moving averages

- Signal line helps identify potential trend changes

- Histogram represents the difference between MACD and signal lines

By integrating these technical indicators, cryptocurrency traders can develop more robust strategies for analyzing market cycles and making informed investment decisions.

Impact of Market Sentiment on Crypto Cycles

Cryptocurrency markets are deeply influenced by investor emotions and perceptions. Market sentiment analysis has become a critical tool for understanding crypto cycle dynamics. Investors and traders now recognize that psychological factors can dramatically impact price movements, making crypto sentiment indicators essential for strategic decision-making.

Social media influence plays a significant role in shaping market sentiment. Platforms like Twitter, Reddit, and YouTube can trigger rapid price fluctuations based on viral content, expert opinions, and community discussions. Traders who effectively monitor these digital conversations gain valuable insights into potential market trends.

- Social media buzz can amplify market movements

- Sentiment tracking helps predict potential price shifts

- Community perception drives cryptocurrency valuations

Key crypto sentiment indicators include:

- Social media engagement metrics

- Sentiment analysis tools

- News sentiment tracking

- Community forum discussions

Successful cryptocurrency investors integrate market sentiment analysis into their broader investment strategy. By understanding the psychological undercurrents driving crypto markets, traders can make more informed decisions about entry and exit points during different market cycles.

Comparing Bitcoin Halving Events with Market Cycles

Bitcoin halving represents a critical moment in cryptocurrency economics that dramatically influences crypto supply and demand. This unique event occurs approximately every four years, fundamentally reshaping Bitcoin’s market dynamics by reducing mining rewards and creating scarcity.

The Bitcoin halving mechanism creates a fascinating economic phenomenon where the cryptocurrency’s supply is systematically reduced. This programmatic scarcity triggers significant market responses that investors closely monitor.

Historical Halving Data Analysis

Analyzing previous halving events reveals intriguing patterns in Bitcoin’s price movements:

- 2012 Halving: Initial price around $12, followed by a massive bull run

- 2016 Halving: Price increased from $650 to nearly $20,000 within 18 months

- 2020 Halving: Rapid price appreciation from $8,000 to $69,000

Price Impact Studies

The halving impact on price demonstrates a consistent trend of value appreciation. Each halving event has historically triggered substantial market cycles, with prices experiencing significant increases months or years after the reduction in mining rewards.

Future Halving Predictions

Cryptocurrency analysts anticipate the next halving will continue the established pattern of market expansion. The decreasing Bitcoin supply combined with increasing institutional interest suggests potential for continued price appreciation.

Investors should approach halving events with strategic preparation, understanding the potential market transformations these critical moments can generate.

Altcoin Cycles and Their Relationship to Bitcoin

Cryptocurrency investors closely track altcoin market cycles to understand their complex relationship with Bitcoin. The intricate dynamics between Bitcoin dominance and alternative cryptocurrency price movements reveal fascinating patterns of market behavior.

Altcoins typically follow distinct cycle patterns that are deeply interconnected with Bitcoin’s market performance. During Bitcoin’s bull runs, investors often witness interesting shifts in crypto market correlations:

- Initial Bitcoin price appreciation triggers increased market interest

- Capital begins flowing into alternative cryptocurrencies

- Smaller cap altcoins experience heightened volatility

Understanding these cycles requires analyzing multiple factors that influence cryptocurrency price movements. Traders recognize that Bitcoin’s market position significantly impacts altcoin valuations.

| Market Phase | Bitcoin Impact | Altcoin Response |

|---|---|---|

| Early Bull Market | Strong Price Momentum | Limited Altcoin Movement |

| Mid Bull Market | Stabilizing Growth | Increased Altcoin Opportunities |

| Late Bull Market | Price Consolidation | High Altcoin Volatility |

Experienced investors leverage crypto market correlations to identify potential investment strategies. By monitoring Bitcoin’s dominance and understanding historical cycle patterns, traders can make more informed decisions about altcoin investments.

Market Capitalization Trends Throughout Cycles

The cryptocurrency market continuously evolves, with crypto market cap trends revealing critical insights into the dynamic digital asset landscape. Understanding these trends helps investors navigate the complex world of digital currencies.

Tracking the performance of top cryptocurrencies provides valuable perspectives on market dominance analysis. Investors and analysts closely monitor these shifts to understand broader market movements.

Top 10 Cryptocurrency Performance Breakdown

The cryptocurrency ecosystem showcases remarkable diversity in market capitalization and growth potential. Key observations include:

- Bitcoin maintains significant market dominance

- Ethereum continues to challenge traditional financial structures

- Emerging altcoins demonstrate increasing competitive potential

Market Dominance Shifts

Market dominance analysis reveals fascinating patterns in cryptocurrency valuation. Decentralized finance (DeFi) tokens and innovative blockchain projects are reshaping the investment landscape.

| Cryptocurrency | Market Cap Percentage | Year-over-Year Change |

|---|---|---|

| Bitcoin | 42.5% | +3.2% |

| Ethereum | 19.3% | +5.7% |

| Other Altcoins | 38.2% | +4.5% |

Investors must remain adaptable, recognizing that crypto market cap trends represent dynamic, rapidly changing ecosystems driven by technological innovation and market sentiment.

Institutional Investment Patterns in Different Cycle Phases

The landscape of institutional crypto investment has dramatically transformed in recent years. Sophisticated investors are increasingly recognizing cryptocurrency as a legitimate asset class, driving significant changes in market dynamics. Institutional adoption trends have become a critical factor in crypto market maturation.

Institutional investors typically approach cryptocurrency markets through strategic investment phases:

- Initial exploration and research

- Limited experimental investments

- Scaled allocation strategies

- Long-term portfolio integration

During market cycles, institutional investment patterns reveal distinct characteristics. Bull markets attract more aggressive investment approaches, while bear markets trigger more conservative strategies.

| Market Phase | Institutional Investment Behavior | Typical Allocation Percentage |

|---|---|---|

| Early Exploration | Research and Small Investments | 0.5% – 2% |

| Emerging Validation | Strategic Diversification | 2% – 5% |

| Mature Integration | Significant Portfolio Allocation | 5% – 10% |

Key investment firms like Grayscale, BlackRock, and Fidelity have played pivotal roles in legitimizing cryptocurrency as an institutional investment vehicle. Their strategic moves signal growing confidence in digital asset markets.

Understanding these investment patterns helps investors anticipate market movements and recognize potential opportunities across different cycle phases.

Regulatory Events and Their Impact on Market Cycles

Crypto regulations have become a critical factor in shaping cryptocurrency market dynamics. The complex landscape of global crypto policies creates significant waves of volatility and transformation within digital asset markets.

Regulatory impact on markets emerges through multiple strategic channels, influencing investor sentiment and market behavior. Different geographic regions approach cryptocurrency governance with unique perspectives, generating diverse market responses.

Major Policy Changes

Key regulatory developments can dramatically shift market cycles. Investors must track critical policy transformations that potentially trigger substantial market movements:

- Securities and Exchange Commission (SEC) enforcement actions

- International banking regulations on crypto transactions

- Tax policy modifications regarding digital asset treatment

- Anti-money laundering (AML) framework updates

Geographic Regulation Effects

Global crypto policies demonstrate substantial regional variations, creating distinct market ecosystem responses:

- United States: Stringent regulatory approach with increased institutional oversight

- European Union: Progressive framework emphasizing consumer protection

- Asia: Mixed regulatory environments with significant market impact

Understanding these regulatory nuances provides critical insights for sophisticated cryptocurrency market cycle analysis, enabling investors to anticipate potential market shifts more effectively.

On-Chain Metrics for Cycle Analysis

On-chain analysis provides cryptocurrency investors with powerful insights into market dynamics. Blockchain metrics serve as critical network activity indicators that reveal deeper market trends beyond traditional price analysis. These digital footprints offer a transparent view of cryptocurrency ecosystem behaviors.

Key on-chain metrics help traders understand market cycles by examining network interactions. Investors can decode complex market movements through several important indicators:

- Active addresses: Measures unique wallet interactions

- Transaction volume: Tracks total network movement

- HODL waves: Identifies long-term investor behavior

- Network value to transactions ratio: Evaluates network economic activity

Sophisticated blockchain metrics reveal nuanced market signals that traditional financial analysis cannot capture. Network activity indicators like transaction count and wallet growth provide real-time insights into market sentiment and potential trend reversals.

| Metric | Purpose | Market Insight |

|---|---|---|

| Active Addresses | Network Engagement | Measures User Participation |

| Transaction Volume | Economic Activity | Indicates Market Interest |

| HODL Waves | Investor Behavior | Tracks Long-Term Holdings |

By integrating on-chain analysis into investment strategies, traders can gain a more comprehensive understanding of cryptocurrency market cycles. These blockchain metrics transform raw data into actionable intelligence for informed decision-making.

Risk Management Strategies Across Different Cycle Phases

Cryptocurrency investors face unique challenges in managing risk during volatile market cycles. Effective crypto risk management requires a strategic approach that adapts to changing market conditions and protects investment portfolios.

Successful portfolio diversification begins with understanding the intricate dynamics of cryptocurrency market cycles. Investors must develop robust strategies that mitigate potential losses while capitalizing on market opportunities.

Portfolio Adjustment Techniques

Implementing position sizing strategies is crucial for managing risk in cryptocurrency investments. Key techniques include:

- Allocating a fixed percentage of portfolio to high-risk assets

- Using dollar-cost averaging to reduce market timing risks

- Maintaining a balanced mix of established and emerging cryptocurrencies

Optimal Position Sizing Methods

Investors can protect their capital through strategic position sizing approaches:

| Strategy | Risk Level | Recommended Allocation |

|---|---|---|

| Conservative | Low | 1-5% per position |

| Moderate | Medium | 5-10% per position |

| Aggressive | High | 10-15% per position |

Crypto risk management demands continuous monitoring and flexibility. Investors should regularly reassess their portfolio, adjusting position sizes based on market conditions, individual asset performance, and overall market cycles.

The key to successful cryptocurrency investing lies in disciplined risk management and a willingness to adapt to changing market dynamics.

Future Predictions Based on Historical Cycle Analysis

Crypto market predictions rely heavily on understanding historical patterns and trends. Investors seeking a long-term crypto outlook must recognize that past performance provides valuable insights into potential future market behaviors. Advanced analytical techniques allow researchers to extract meaningful patterns from previous cryptocurrency market cycles, helping to anticipate potential future developments.

Future trends analysis suggests that cryptocurrency markets continue to mature, with increased institutional involvement and more sophisticated trading mechanisms. Bitcoin and other digital assets have demonstrated remarkable resilience through multiple market cycles, indicating growing mainstream acceptance. Sophisticated investors now use complex data modeling techniques to project potential market trajectories based on historical performance metrics.

Strategic investors understand that while historical cycle analysis offers critical guidance, cryptocurrency markets remain inherently unpredictable. Emerging technologies, regulatory changes, and global economic shifts can dramatically impact digital asset valuations. Successful investment strategies require continuous learning, adaptability, and a comprehensive approach to understanding market dynamics.

Technological innovations like blockchain developments, enhanced security protocols, and improved trading platforms will likely shape future cryptocurrency market cycles. Investors should maintain a balanced perspective, combining historical data analysis with real-time market intelligence to make informed investment decisions in this rapidly evolving digital asset landscape.

FAQ

What are cryptocurrency market cycles?

Cryptocurrency market cycles are recurring patterns of price movements characterized by bull and bear markets. These cycles typically include phases of accumulation, markup, distribution, and markdown, reflecting the collective sentiment and trading behavior of investors in the crypto market.

How long do typical cryptocurrency market cycles last?

Market cycles can vary, but historically, Bitcoin market cycles have ranged from approximately 3 to 4 years. However, each cycle is unique, influenced by factors such as technological developments, regulatory changes, and overall market sentiment.

What are the key indicators for identifying market cycles?

Key indicators include moving averages, Relative Strength Index (RSI), trading volume, MACD patterns, and on-chain metrics like active addresses and transaction volumes. These tools help investors analyze market trends and potential trend reversals.

How do Bitcoin halving events impact market cycles?

Bitcoin halving events historically trigger significant market movements by reducing the rate of new Bitcoin creation. These events typically precede major bull market phases, as they decrease the supply of new coins and potentially increase scarcity and value.

What role does market sentiment play in cryptocurrency cycles?

Market sentiment is crucial in driving cryptocurrency price movements. Social media trends, news events, investor psychology, and overall market perception can significantly influence buying and selling behaviors during different cycle phases.

How do institutional investors affect cryptocurrency market cycles?

Institutional investors have increasingly impacted crypto market cycles by bringing substantial capital, credibility, and sophisticated trading strategies. Their entry and exit points can create significant market movements and influence overall market trends.

What is the relationship between Bitcoin and altcoin market cycles?

Altcoins typically follow Bitcoin’s market cycles, with Bitcoin dominance playing a key role. During different cycle phases, altcoins may experience varying levels of price correlation and independent market movements.

How can investors manage risk during different market cycles?

Effective risk management strategies include portfolio diversification, position sizing, regular rebalancing, setting stop-loss orders, and maintaining a long-term investment perspective that accounts for market cycle volatility.

What tools are recommended for cryptocurrency market cycle analysis?

Recommended tools include technical analysis platforms like TradingView, data visualization tools, on-chain analytics platforms like Glassnode, and market intelligence resources that provide comprehensive market insights and historical data.

How reliable are historical market cycle predictions?

While historical analysis provides valuable insights, cryptocurrency markets are highly volatile and influenced by numerous unpredictable factors. Investors should use historical data as a guide but remain adaptable and understand that past performance doesn’t guarantee future results.

No comments yet