The digital asset landscape has exploded in recent years. What began as a niche technology is now a major force in global finance. The total value of this market has surged past $3 trillion.

With over 17,000 different digital assets now available, understanding how they interact is crucial. This is where studying the relationships between them becomes vital for investors.

This type of statistical review measures if assets move together, in opposite directions, or independently. Knowing these patterns is fundamental for building strong portfolios and managing risk effectively.

In today’s fast-paced financial world, this understanding provides a real competitive edge. It’s a practical tool for anyone looking to make informed decisions in a dynamic and interconnected ecosystem.

Introduction to Cryptocurrency Price Movement Correlation Analysis

The evolution of digital currencies from obscure internet tokens to mainstream financial instruments marks one of the most significant shifts in modern finance. For years, these assets operated in isolation with minimal public interest.

This changed dramatically around 2017. Bitcoin’s surge past $1,000 and its peak near $17,000 captured global attention. It was a pivotal moment that signaled a new era.

Both retail and institutional players began entering the space in large numbers. This influx of capital and participants fundamentally altered market dynamics. The user base exploded from 100 million in 2020 to over 300 million by 2023.

Overview of Market Trends and Interconnections

This massive growth spurred new patterns. Digital assets began showing connections not just with each other, but also with traditional equities. These trends are crucial for today’s investors to understand.

The table below highlights key changes in market behavior before and after this major shift.

| Market Characteristic | Pre-2017 Era | Post-2017 Era |

|---|---|---|

| Primary Participants | Tech enthusiasts, early adopters | Institutional funds, retail investors |

| Market Perception | Niche, speculative technology | Legitimate asset class |

| Observed Interconnections | Mostly isolated movements | Growing links to stock markets |

Studying these relationships is no longer optional. It is a core component of modern portfolio strategy in a deeply interconnected financial world.

Understanding Digital Asset Correlations

Understanding the statistical connections between different digital holdings is essential for effective risk management. These relationships are measured using numerical coefficients ranging from -1 to +1.

A value of +1 means assets move perfectly together. Zero indicates no relationship. A -1 score shows opposite movements. This quantitative approach transforms guesswork into data-driven strategy.

The Role of Correlation in Risk Management

Correlation analysis helps investors avoid concentration risk. When assets move together during market swings, portfolios can suffer significant losses.

Identifying which digital assets tend to synchronize allows for better protection strategies. This knowledge prevents overexposure to similar market patterns.

How Correlations Impact Investment Decisions

These statistical relationships reveal genuine diversification opportunities. Some assets appear different but move in similar ways.

Understanding correlations helps investors build resilient portfolios. Negatively correlated holdings can offset losses in other positions. This creates a more balanced approach to digital asset allocation.

Strategic decisions become systematic rather than speculative. Investors can optimize returns while managing volatility effectively.

Cryptocurrency Price Movement Correlation Analysis: Methods and Interpretations

Quantitative approaches transform subjective market observations into precise numerical relationships that guide investment decisions. These mathematical tools provide objective measures that replace guesswork with data-driven insights.

Understanding these statistical techniques helps investors build stronger portfolios based on measurable patterns rather than speculation.

Defining Key Correlation Metrics

Two primary statistical methods quantify asset relationships. The Pearson coefficient measures linear connections between continuous data points. Kendall’s tau assesses ordinal associations and works well with smaller datasets.

These mathematical approaches convert complex market patterns into single numerical values that investors can quickly interpret.

| Metric Type | Best Use Case | Data Requirements | Strength Measurement |

|---|---|---|---|

| Pearson Coefficient | Linear relationships | Large, continuous datasets | Perfect linear association |

| Kendall’s Tau | Ordinal relationships | Smaller samples | Consistent ranking patterns |

Interpreting Coefficient Values

Coefficient values range from -1 to +1, indicating relationship strength and direction. Values near +1 show assets moving together consistently. Scores approaching -1 reveal inverse movements useful for hedging.

Numbers close to zero suggest independent assets that provide genuine diversification benefits. For deeper insights into applying these methods, explore this comprehensive guide to correlation analysis.

Mastering these interpretations helps investors move beyond basic strategies toward sophisticated, risk-managed approaches.

Statistical Methods in Correlation Analysis

Two primary mathematical tools help quantify how assets move together or apart. These statistical approaches provide objective measurements for relationship analysis.

Understanding these techniques is essential for accurate market assessment. They transform subjective observations into reliable data points.

Pearson vs. Kendall Correlation Coefficients

The Pearson coefficient measures linear relationships between continuous data points. It works best with normally distributed information and large datasets.

Kendall’s tau assesses ordinal associations using ranked data. This method handles outliers better and suits smaller samples.

| Method Characteristic | Pearson Coefficient | Kendall’s Tau |

|---|---|---|

| Relationship Type | Linear associations | Monotonic relationships |

| Data Requirements | Large, normal distributions | Small samples, ranked data |

| Outlier Sensitivity | Highly sensitive | More robust |

| Best Application | Clear linear patterns | Volatile market conditions |

Calculation Techniques for Price Data

Working with digital asset information requires specific preparation methods. Consistent time intervals ensure accurate comparison across different cryptocurrencies.

Handling missing values through interpolation maintains data integrity. Normalization techniques allow comparison between assets with different value scales.

These calculation approaches form the foundation for reliable relationship analysis. Proper implementation leads to more informed investment decisions.

Integrating AI and Machine Learning

Artificial intelligence has fundamentally reshaped how we understand connections between digital assets. Traditional statistical methods often miss complex patterns in market behavior. Machine learning algorithms now detect these hidden relationships with remarkable precision.

These advanced techniques process vast amounts of historical data to identify nonlinear trends. The results provide investors with deeper insights into asset interactions.

Enhancing Predictive Accuracy with Deep Learning

Deep learning model architectures represent a significant leap forward. Recurrent neural networks (RNNs) and long short-term memory (LSTM) units excel at recognizing sequential patterns.

These systems capture temporal dependencies that simpler algorithms cannot detect. Their performance in forecasting digital asset behavior consistently outperforms traditional approaches.

Machine Learning Tools and Their Impact

Various machine learning tools have demonstrated impressive capabilities in market analysis. Each approach offers distinct advantages for different types of data patterns.

| AI Model Type | Key Strength | Data Processing | Practical Application |

|---|---|---|---|

| Random Forests | Handles complex nonlinear relationships | Works with various data types | General pattern recognition |

| LSTM Networks | Captures long-term dependencies | Sequential time series data | Price trend forecasting |

| Transformer Models | Parallel processing efficiency | Simultaneous time point analysis | Real-time market predictions |

Transformer-based architectures represent the current frontier in this field. Their self-attention mechanisms process information more efficiently than previous model designs. This advancement leads to faster training times and more accurate predictive results.

Reliable Data Sources for Price Analysis

Quality analysis depends entirely on the accuracy and completeness of initial data collection. Trustworthy sources form the bedrock of any meaningful market study.

Without reliable information, even sophisticated methods yield questionable results. This section explores essential platforms for gathering accurate market data.

Insights from Major Cryptocurrency Exchanges

Leading trading platforms provide direct access to real-time price feeds and historical records. UEEx offers extensive historical data across numerous digital assets.

Coinbase delivers reliable information through its user-friendly interface. Binance provides detailed trading metrics for deeper market insights.

These exchanges serve as primary sources for foundational analysis. Each platform brings unique strengths to data collection.

Leveraging Financial Data Providers

Aggregator platforms standardize information from multiple exchanges. CoinMarketCap compiles comprehensive metrics including market capitalization.

CryptoCompare offers specialized tools for advanced studies. Yahoo Finance enables cross-asset comparison with traditional markets.

Diversifying sources helps identify inconsistencies. Cross-validation ensures analysis reflects true market conditions rather than platform-specific anomalies.

Data Collection and Preparation Techniques

Building reliable statistical models begins with meticulous data gathering and preparation. The quality of your insights depends entirely on the foundation you establish during this crucial phase.

Start by identifying trusted sources for historical information. Major exchanges and financial data providers offer comprehensive datasets covering extended time periods. Ensure you collect information for the same dates and frequencies across all digital assets being studied.

Data cleaning addresses common issues like missing values from exchange outages or delisting events. Techniques like interpolation fill these gaps effectively. Consistent formatting prevents calculation errors that could invalidate your entire study.

| Data Preparation Step | Key Challenges | Recommended Techniques | Impact on Final Analysis |

|---|---|---|---|

| Source Identification | Varying data quality across platforms | Cross-reference multiple exchanges | Foundation for accurate comparisons |

| Time Alignment | Different trading hours and timezones | Standardize to UTC timestamps | Ensures valid statistical relationships |

| Missing Value Handling | Gaps from technical issues or low volume | Interpolation or forward-filling methods | Maintains dataset continuity |

| Normalization | Assets with vastly different value scales | Percentage returns calculation | Enables fair comparison across assets |

Many digital assets have limited historical information compared to traditional investments. This requires careful period selection that balances sufficient data points with actual trading history.

Though time-consuming, thorough preparation ensures your subsequent work produces actionable insights rather than misleading conclusions. Proper techniques transform raw numbers into reliable analytical foundations.

Visualizing Correlation Data

Graphical tools transform complex numerical data into instantly understandable patterns. This visual work is crucial for interpreting the relationships between multiple digital assets.

Charts and maps allow investors to grasp intricate connections at a glance. They move beyond raw numbers to provide intuitive insights.

Creating Heatmaps for Quick Insights

Heatmaps use color gradients to represent statistical strengths. Warm colors like red often show strong positive links. Cool colors like blue indicate negative relationships.

Tools like Excel or Python’s Seaborn library can generate these visualizations. They make it easy to spot clusters of connected digital assets across a large matrix.

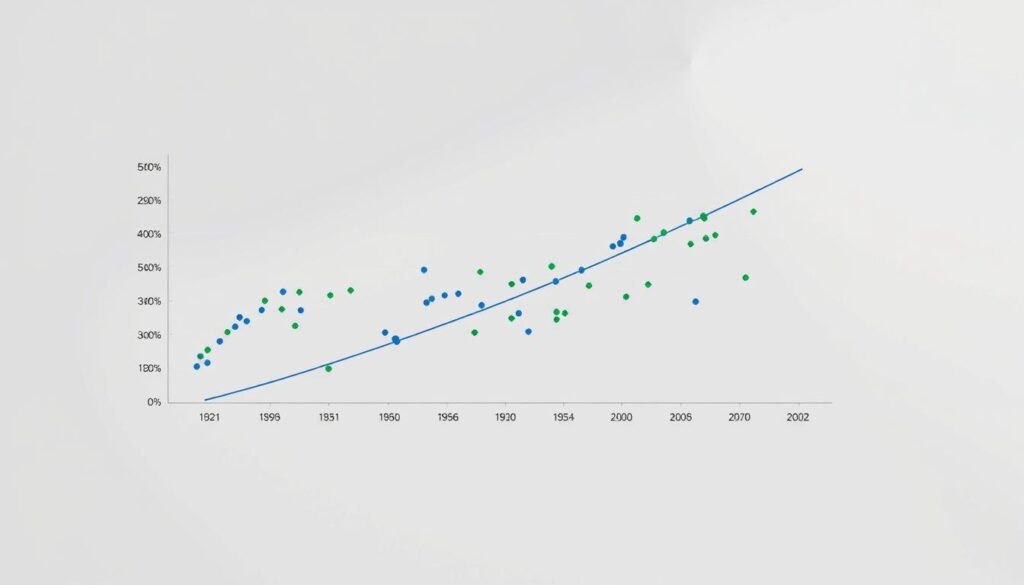

Utilizing Scatterplots to Reveal Patterns

Scatterplots display the price changes of one asset against another. The clustering of points reveals the nature of their connection.

This method is excellent for identifying outliers and non-linear trends. It adds valuable context to the numerical results of a statistical study.

| Visualization Tool | Primary Strength | Best For | Common Tools |

|---|---|---|---|

| Heatmap | Quick overview of many pairs | Identifying asset clusters | Google Sheets, Seaborn |

| Scatterplot | Detailed pair relationship | Spotting outliers and patterns | Excel, Matplotlib |

Effective visualization enhances analysis and communication. It turns abstract data into actionable intelligence for building better portfolios.

Risk Management Applications

Moving beyond theory, correlation data serves as a powerful shield against market uncertainty for savvy investors. This practical approach turns statistical insights into actionable defense strategies for your portfolio.

Understanding how assets interact is key to managing volatility. Portfolios built with low-correlation holdings experience smaller swings. This creates a more stable investment profile during turbulent times.

Scenario testing is another major benefit. You can model how your portfolio might react to different events before they happen. This includes bull runs, bear markets, or regulatory news.

This type of analysis helps avoid a hidden danger: concentration risk. A portfolio might look diversified but contain many assets that fall together. Identifying these links prevents overexposure.

Hedging strategies also rely on this knowledge. Using negatively correlated cryptocurrency can offset losses in primary holdings. It acts as automatic insurance when volatility spikes.

This approach does not eliminate risk. Instead, it provides a systematic way to understand and manage exposure. It transforms a statistical exercise into a vital tool for capital preservation.

Portfolio Diversification Strategies

Building a resilient investment portfolio in the digital asset space demands more than just owning multiple cryptocurrencies. True diversification requires understanding how different assets interact with each other statistically.

This approach transforms correlation data from theoretical concepts into practical portfolio management tools. Investors can create more stable holdings by strategically combining assets.

Balancing Correlated and Uncorrelated Assets

Many digital assets move in similar patterns, offering limited diversification benefits. Bitcoin and Ethereum often show strong statistical relationships.

Adding holdings like Chainlink or Cardano introduces genuine stability. These assets frequently demonstrate lower correlation with major cryptocurrencies.

This balanced approach creates independent price movement sources within a portfolio. It reduces the risk of simultaneous declines across all investments.

Hedging Opportunities to Mitigate Volatility

Negative correlation pairs present valuable hedging opportunities. When one asset declines, the other may rise, offsetting losses.

This strategy acts as natural insurance during market turbulence. It allows investors to maintain positions while managing risk effectively.

Regular review ensures these relationships remain current. Market conditions and asset interactions can change over time.

Dynamic vs. Static Correlation Analysis

Digital assets operate in constantly evolving environments where statistical relationships rarely stay fixed. Traditional static approaches provide a single snapshot of connections between holdings.

Dynamic methods track how these relationships evolve over time. This approach captures the fluid nature of digital asset interactions.

Addressing Changes in Market Conditions

Static correlation calculates average relationships across entire periods. It assumes connections remain constant despite market changes.

Dynamic approaches use advanced statistical models like DCC (Dynamic Conditional Correlation). These tools adapt to shifting market dynamics in real time.

During bull markets, different cryptocurrencies often move together. Bear markets reveal entirely different relationship patterns.

Static methods can mislead investors by showing outdated connections. Dynamic tracking provides current insights for today’s volatile markets.

Python libraries like statsmodels and arch implement these advanced techniques. They represent the professional standard for serious portfolio management.

Understanding these methodological changes helps investors navigate complex market dynamics effectively.

Impact of Global Economic and Regulatory Factors

External factors including monetary policy and geopolitical tensions have become primary drivers of cryptocurrency market dynamics. Digital assets no longer operate in isolation from traditional financial systems.

Major economic announcements create immediate reactions across both cryptocurrency and stock markets. These parallel movements reveal how interconnected global finance has become.

Effects of Monetary Policies and Geopolitics

Central bank decisions create powerful waves across all asset classes. When the Federal Reserve raised interest rates in May 2022, both Bitcoin and major stock indices declined simultaneously.

This demonstrated how monetary policy changes affect investor behavior universally. Higher borrowing costs reduce liquidity available for speculative investments.

Geopolitical events similarly influence risk appetite across markets. Political tensions between nations can drive investors toward or away from volatile assets.

Regulatory announcements produce some of the most dramatic market shifts. China’s 2021 mining ban caused significant declines across multiple digital assets.

These external forces create correlation patterns that reflect shared sensitivities. Monitoring global developments has become essential for understanding market behavior.

Case Studies: Historical Market Events and Reactions

Real-world examples provide the clearest evidence of how major developments influence digital asset relationships. Studying past events reveals consistent patterns between different holdings.

These case studies demonstrate measurable effects across the market. They show how specific triggers create widespread reactions.

Bitcoin Halving and its Effect on Correlations

The April 2024 halving reduced mining rewards from 6.25 to 3.125 BTC. This supply change created anticipation that affected multiple digital assets.

Historical data shows BTC and ETH typically move together around these events. The results demonstrate how supply factors ripple through connected coins.

Another clear example occurred with SEC ETP approval in January 2024. Bitcoin‘s value climbed from $50,000 to over $75,000 within months.

During this period, ETH and other major coins showed similar upward price trends. This example confirms the strong connection between leading digital assets.

These historical events provide valuable lessons for investors. Understanding these patterns helps anticipate future market results.

Technical Innovations: Transformer-Based Forecasting Models

Transformer technology represents a quantum leap in predictive modeling for financial markets, offering unprecedented accuracy in understanding asset relationships. These advanced models process information differently than traditional approaches.

Unlike sequential processing methods, Transformers analyze all data points simultaneously. This parallel approach delivers superior performance in complex market environments.

Comparing Transformers with LSTM and RNN Models

Traditional LSTM and RNN models process data sequentially, creating bottlenecks. They often struggle with long-term patterns in volatile markets.

Transformer algorithms use self-attention mechanisms to capture both immediate and distant relationships. This architecture handles large datasets more efficiently than recurrent networks.

The results show Transformers consistently outperform older techniques. They achieve better forecasting accuracy across different time horizons.

Hybrid Approaches and Their Benefits

Hybrid models combine multiple algorithms for enhanced performance. They integrate self-attention for long-term patterns with specialized mechanisms for short-term accuracy.

Recent research tested a dual-branch framework on ten years of market data. The results demonstrated consistent superiority over single-method approaches.

This innovative work establishes hybrid Transformers as the professional standard. They justify the technical complexity through tangible improvements in predictive capability.

Future Trends in Cryptocurrency Correlation Analysis

As digital markets mature, analytical tools are evolving from retrospective observation to predictive intelligence. This shift represents one of the most exciting trends in modern financial analysis.

Tomorrow’s investment strategies will leverage increasingly sophisticated computational approaches. These methods transform how we understand connections between different assets.

Emerging Algorithms and Big Data Analytics

Next-generation machine learning algorithms will automatically detect subtle relationship changes. They alert investors when historical patterns shift in dynamic markets.

Big data integration creates multidimensional analytical models with unprecedented power. These systems process information from social media, blockchain transactions, and traditional financial indicators.

Sentiment analysis adds crucial context to statistical relationships. It explains why certain digital assets move together during specific events.

Hybrid approaches combine statistical rigor with AI flexibility for superior performance. This represents the future standard for navigating complex market dynamics.

Investors adopting these emerging trends early gain significant advantages. They access insights unavailable through conventional methods.

Conclusion

The ability to quantify connections between various crypto holdings separates strategic investors from casual participants. This understanding transforms portfolio management from guesswork to data-driven decision making.

Mastering these statistical relationships provides concrete advantages. Investors can build resilient portfolios that withstand market volatility. They identify genuine diversification opportunities beyond surface-level differences.

This work is not a one-time exercise but requires continuous monitoring. As markets evolve, so do asset relationships. For ongoing insights into market patterns, explore our guide on analyzing crypto market trends.

The growing $3 trillion market demands sophisticated approaches. Correlation analysis represents the competitive edge needed for long-term success in dynamic financial environments.

No comments yet