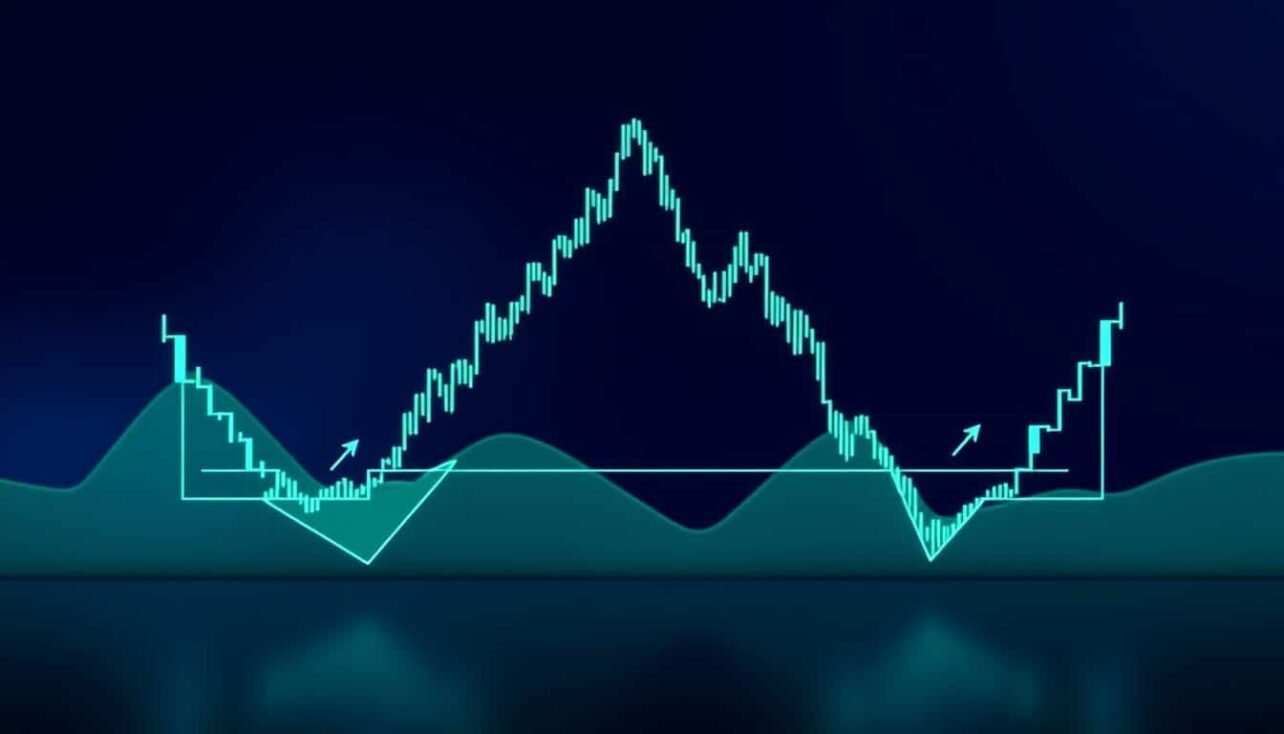

The double bottom reversal is a clear, rules-based pattern traders use to spot a shift from a downtrend to an upward move.

It shows two lows that form near the same support level and a neckline that acts as resistance. A breakout above the neckline confirms the potential bullish reversal and signals a practical entry.

Price and volume clues add conviction: lighter volume during formation, then stronger activity as price challenges the neckline. The first low appears after selling fades; the second holds the support and completes the structure.

Why traders like this strategy: it offers a defined entry above a known level, an objective stop below the second low, and a measured target based on the depth of the troughs.

This short guide will walk through entry triggers, stop placement, target setting, and the risks to weigh—like false breakouts and wider stops—so you can test the approach across charts and timeframes.

What is a double bottom pattern and why it signals a bullish reversal

A double bottom pattern forms when a market makes two distinct troughs at nearly the same price area with a peak between them that creates the neckline.

The context is important: the setup begins after a clear downtrend. The first low shows selling has slowed and buyers push price higher toward the neckline.

The second low then tests support near the earlier trough. When that level holds, it signals the market is defending the area and sellers may be exhausted.

The neckline acts as active resistance. A close above that line is the confirmation traders often require to call the move a bullish reversal.

Psychology matters: sellers fall into the first trough, buyers probe the peak, and a second defense of support sets up a stronger rally through resistance.

- Two lows define the shape; the peak sets the neckline for confirmation.

- Wait for a clean close above the neckline to reduce whipsaw risk.

- After the breakout, traders can define risk below the pattern and project targets from the height of the structure.

Keep discipline: the pattern appears across instruments, but the best signals come after clear downtrends and with defined troughs and neckline breaks.

Double bottom reversal

This setup gives traders a structured way to spot where selling may stop and buying can start.

The pattern is strictly bullish and acts as a visual cue that the prior downtrend might be ending. Its bearish mirror is the double top, which helps traders compare how turns form in either direction.

Quality hinges on confirmation: a clear push and close above the neckline raises the odds that momentum shifts to buyers. Early recognition helps, but the breakout is the key event that changes the trade bias.

- Core signals: a well-defined pair of troughs, a distinct neckline, and clean follow-through on a breakout.

- Use momentum studies alongside price action to validate the move, but the structure alone offers a self-contained framework.

- Risk is real—manage stops and position size since no setup is guaranteed.

After confirmation, more participants often jump in and the market can extend the new trend. This method fits naturally into a broader technical playbook and leads into the practical steps covered in the next sections.

How to identify the structure: two lows, the peak, and the neckline

Begin by marking two lows on the chart and the intervening high that forms the key line. This visual frame lets you judge whether the pattern is forming after a clear downtrend and if the lows sit in a similar price area.

First low after a downtrend: fading selling pressure

The first low is a pivotal inflection point where selling eases and buyers push for a bounce. Look for reduced momentum on the drop and a modest rally that creates the intervening peak.

Second low near the same level: support holds

The second low should test the same level as the first and often shows lighter volatility. When price finds support near that prior trough, it validates the idea that selling pressure has waned.

Neckline formation: the peak between the lows

The peak between the two troughs draws the neckline — a practical line traders use as resistance. The neckline can be horizontal or slightly sloped; connect the high point between the lows to create your levels.

- Rounded valleys often signal a steadier base than sharp V-shaped spikes and can raise pattern quality.

- Price may oscillate between the lows and the neckline as market participants digest supply and demand.

- Confirmation is a break through the neckline; the second low alone is not the signal to enter.

Annotate charts with dates and levels to track how the structure evolves. That clarity helps with timing entries and placing stops when you test this pattern in live markets. For a practical strategy guide, see this double bottom strategy.

Confirmation criteria: breakout above the neckline

A confirmed breach of the neckline turns a potential base into an actionable bullish pattern. The key is a decisive move through the resistance line that sits between the two lows.

Waiting for the close beyond resistance

Use a closing price beyond the neckline as the primary confirmation. This reduces false entries and keeps trades aligned with the actual market event.

What adds conviction

Volume and momentum rising into and after the breakout can strengthen the case, but the price close is the core criterion.

- Execution options: buy at the close above the neckline or wait for a minor pullback before entering.

- Higher-timeframe checks: confirmations on daily charts cut noise but widen stop needs.

- Risk rules: mark the neckline in advance, use a stop-loss, and size positions for each trade.

Applying a short confirmation checklist helps traders act on a clean signal. No rule removes all risk, but a confirmed breakout makes the projected objective from the pattern actionable.

Reading price and volume behavior into the breakout

Subtle shifts in volume and momentum often decide if a base will lead to a sustained move higher.

Downtrending or lighter volume during formation

When volume drifts lower as the pattern forms, it often signals reduced selling pressure. That quieter activity suggests participants are stepping back, not adding aggressive exits.

A lighter footprint during the two troughs can mean the market is absorbing supply, which makes a later breakout more credible.

Rounded valleys and pattern quality

Rounded valleys tend to reflect gradual accumulation and steadier internal flows. Smooth troughs often produce firmer follow-through than sharp spikes caused by fast, news-driven moves.

Sharp troughs can lead to premature or shallow breakouts and need extra confirmation from price and volume cues.

- Look for higher volume as price challenges the neckline — this shows demand is gaining control.

- Check oscillators for rising lows to confirm improving momentum.

- Expect several weeks on swing charts for many setups; intraday variants exist on shorter timeframes.

Erratic volume complicates reads. In those cases, rely on clear structure and confirmation rules. Consistent price and volume behavior into the breakout can meaningfully improve trade odds without changing your core plan. For more on support and resistance context, see this support and resistance guide.

How to trade the double bottom: a step-by-step approach

Start by finding a market that has declined and is forming two distinct troughs at roughly the same level. Confirm the prior downtrend so the setup has context.

Scan and validate structure. Identify two separate lows near the same price area and mark the intervening peak to draw the neckline. Use higher timeframe checks to filter noise.

Plan the entry trigger

Decide a confirmation rule in advance: a close above the neckline, a set tick filter, or a retest entry after breakout. This keeps emotion out of execution.

Set orders: market vs. limit

Choose order types that match liquidity and tolerance for slippage. Use a stop order above the neckline for automatic entries or a limit for more control. Market orders may fill quickly but can slip in fast moves.

Risk and targets: place an initial stop below the second trough and size the position so account risk is controlled. Project a take-profit by adding the trough-to-neckline distance above the neckline.

| Step | Action | Order Type | Risk Rule |

|---|---|---|---|

| Scan | Find downtrend with two similar troughs | — | Filter for clear structure |

| Confirm | Draw neckline and set confirmation rule | Stop or limit entry | Close above neckline required |

| Execute | Enter at breakout or retest | Market/Limit/Stop | Stop below second low |

| Manage | Set profit target and secondary exit | Limit orders for targets | Position size to fixed account risk |

Keep an objective checklist and log trades for improvement. For a practical guide on related setups, review how to trade double tops and double.

Entry tactics: conservative versus aggressive signals

Choosing when to act affects risk, slippage, and reward for the pattern. Traders should pick an entry plan before price tests the neckline to avoid emotion-driven mistakes.

Breakout close and retest of the neckline

A conservative approach waits for a clean close beyond the neckline as the primary confirmation. This reduces false signals and narrows the chance of quick failure.

An aggressive tactic triggers on an intrabar break above resistance. It can capture more of the initial expansion but carries higher slippage and variance if the move stalls.

- Retest entry: wait for price to pull back to the neckline and enter on a bounce to improve risk-reward.

- Immediate entry: buy at the breakout to capture momentum, accepting greater execution risk.

- Limit on retest: controls fill price but may miss the trade if momentum does not return.

| Style | Trigger | Pros | Cons |

|---|---|---|---|

| Conservative | Candle close above neckline | Fewer false signals, clearer confirmation | Smaller initial gain, slower entry |

| Aggressive | Intrabar breakout or market order | Captures early momentum | Higher slippage, more false breakouts |

| Blended | Partial on confirmation, add on retest | Balanced risk and reward | Requires active management |

Practical tips: pair entries with a volatility filter, use time-based rules to avoid late buys, anchor stops to the pattern, and adjust size for your chosen entry style. Record each entry to learn which tactic fits your market and temperament.

Stop-loss placement that respects the pattern

Protecting capital starts with a stop that respects the structure and nearby support levels. Using a clear invalidation point keeps planned losses small and predictable.

Common placement: below the second low

Place the stop below the second low because a decisive undercut usually means the pattern is invalid. If price drops past that trough, the setup has likely failed and exiting preserves capital.

- Alternatives: use a buffer under a local swing or an ATR-based cushion to handle normal volatility.

- Tighter stops: improve nominal reward-to-risk but raise the chance of being stopped out early.

- Timeframe match: longer-term trades justify wider stops; short trades need smaller buffers.

- Management: move stops to break-even or trail after a measured breakout and partial target are hit, but don’t widen stops without a predefined rule.

Practical note: use the neckline as a management reference — a close back below it often signals to reduce or exit. Size positions so the distance from entry to stop controls account risk, and backtest methods to balance protection and staying power.

Take-profit targets using the bottom-to-neckline measurement

A measured-move target gives a simple, mechanical way to set take-profits after a confirmed breakout. Calculate the vertical distance from the lowest trough to the neckline, then project that distance above the breakout level to set your primary exit.

Projecting target distance above the neckline

Use ticks, pips, or dollars depending on your instrument. For example, if the distance is 100 pips, place the take-profit 100 pips above the neckline. If it’s $2 per share, add $2 above the breakout point.

- Refine with structure: align the measured objective with prior swing highs or supply zones to avoid single-point targets.

- Scale out: take a portion at the measured goal and let the rest run if momentum holds.

- Adjust for volatility: widen buffers or add a secondary target in choppy markets.

Plan targets before entry and reassess if the breakout underperforms. Track realized R multiples to test whether the method fits your market and improve discipline over time.

Chart examples and trade walkthroughs for today’s market

Practical walk-throughs on stocks, futures, and forex reveal how the pattern behaves across timeframes.

Stock case: a U.S. stocks chart showed two troughs, a clear neckline, and a confirmation candle on the breakout. Volume contracted during the base and rose on the close, supporting the structural analysis.

Futures/index: a retest entry after the initial breakout allowed a tighter stop while preserving the pattern’s integrity. That execution reduced risk versus buying the first impulse.

Forex: a currency pair used a pip-based projection from bottom to neckline. Session liquidity affected the follow-through, so traders adjusted targets by time of day.

| Example | Key cue | Entry | Outcome |

|---|---|---|---|

| U.S. stocks | Contracting volume, breakout candle | Close above neckline | Target reached |

| Futures/Index | Retest after break | Re-entry on bounce | Tighter stop, partial profit |

| Forex pair | Pip projection, session bias | Measured entry at breakout | Adjusted for liquidity |

Takeaway: mark two troughs, draw the neckline, note volume, and plan entry and stop rules. Replicate this markup on your platform to internalize the process.

Double bottom vs. double top: the bullish-bearish mirror

Some chart setups act as mirror images: one signals rising odds, the other warns of declines.

Define the counterpart: A double top is the bearish counterpart that forms after a strong up move and completes when price breaks the support line under the middle trough. By contrast, the double bottom forms after a down trend and confirms above the neckline.

Key differences in trend context, signals, and psychology

Context matters. Double bottoms prefer prior downside while double tops prefer prior upside.

Signal contrast: A bottom pattern confirms on a break above resistance. The top confirms on a break below support.

- Momentum: waning downside momentum marks the bullish setup; waning upside momentum marks the bearish one.

- Trader behavior: buyers defend support in the bullish case; sellers defend resistance in the bearish case.

- Structure and rules: both use a clear line for confirmation and similar stop/target management mirrored in direction.

| Feature | Bullish | Bearish |

|---|---|---|

| Trend context | Prior downtrend | Prior uptrend |

| Confirm | Break above neckline | Break below support |

| Trader bias | Buyers step in | Sellers assert |

Takeaway: Learn both patterns to widen opportunity. Stay objective, use firm confirmation rules, and keep risk controls in place; discipline matters more than any single setup.

Timeframes and markets: where double bottoms work best

How a base resolves depends on the timeframe and market structure you trade, so tailor rules accordingly.

Intraday to multi-week setups

On intraday charts the pattern can complete in minutes to hours, producing quick movement and tighter stops.

Daily and weekly charts often take several days to weeks to form. Targets and stops widen with higher timeframes, so position sizing must change.

Forex, stocks, indices, and commodities

Forex trades 24/5 with pip-based measurement and tight spreads, which helps active traders capture small moves.

Stocks and indices reflect session dynamics and can gap at open. That affects order execution and requires end-of-day rules for many traders.

Commodities and crypto can show sharp volatility; confirmations may accelerate and produce larger follow-through or fast failures.

- Prior downtrend is ideal, but the setup can resolve higher after a flat base in some markets.

- Adjust confirmation rules and stop buffers to match typical volatility for each product and timeframe.

- Check historical performance in your chosen market to set realistic expectations for follow-through and failure rates.

| Timeframe | Typical duration | Execution note |

|---|---|---|

| Intraday | Minutes–hours | Watch spreads and liquidity |

| Daily | Days–weeks | Wider stops; end-of-day rules |

| Weekly | Weeks–months | Large targets; size for bigger drawdowns |

Practical tip: align trade duration and management with the timeframe—monitor intraday trades intrabar, but use time-based exits for daily set-ups.

Takeaway: the pattern’s versatility across markets is an advantage when paired with market-specific adjustments for liquidity, spreads, and volatility.

Indicators to confirm momentum and reduce false signals

A focused indicator check can help separate solid breakouts from quick failures and improve trade timing for the double bottom pattern.

Using RSI or MACD to spot momentum shifts

RSI divergences at the second trough often signal waning downside momentum and support the structural setup.

MACD crossovers or histogram inflections near the neckline add confidence that momentum is turning higher.

Moving averages and neckline confluence

Watch 20 and 50 moving averages for clustering near the neckline. Their confluence provides extra validation when price breaks out.

- Use one momentum tool and one trend filter to avoid overload.

- Prefer multi-timeframe confirmation: align intraday momentum with a daily breakout in the market.

- Test indicator settings for your timeframe instead of relying on defaults.

| Indicator | What to look for | How it helps |

|---|---|---|

| RSI | Divergence at second trough | Shows waning selling |

| MACD | Crossover or rising histogram | Confirms momentum shift |

| MA 20/50 | Cluster near neckline | Offers confluence and trend context |

Remember: indicators should complement the breakout confirmation, not replace a clean close above the neckline. Record how tools behaved in each trade and keep price structure as the primary edge on your chart.

False breakouts, premature entries, and how to avoid them

Not every push through resistance signals a durable trend change—watch for confirming evidence. Premature entries often come from low liquidity moves, news spikes, or eager buyers who act before a clear close.

Patience and confirmation rules

Wait for a close beyond the neckline or set a minimum distance filter to validate signals. Use volume and momentum checks; weak expansion on breakouts warns of higher failure odds.

Retest logic and invalidation levels

A successful retest where the prior resistance holds as support is a strong sign the pattern is real. Define invalidation points in advance — a close back below the neckline or a break under the second trough cancels the idea.

- Avoid chasing extended moves; set a max entry distance from the neckline or use time-based rules.

- Use partial positions: size small on the breakout, add on a clean retest or further confirmation.

- Keep a trade journal of failed breakouts to refine filters and spot recurring causes.

| Scenario | Action | Invalidation |

|---|---|---|

| Weak volume breakout | Wait or partial entry | Close below neckline |

| News spike push | Defer until retest | Return under prior support |

| Multi-timeframe mismatch | Stand aside | Failure on higher timeframe |

Patience is a competitive edge. The double bottom pattern will recur; only confirmed setups deserve real risk from traders in this market.

Strategy integration: position sizing, risk-reward, and trade management

When risk controls match structure on the chart, traders preserve capital and can scale strategy over time.

Sizing around wider stops: back into a sensible position by choosing a fixed percent of account risk and then dividing that by the distance from entry to the stop. This keeps nominal losses steady even when stops must sit below the second trough.

Tip: use ATR or volatility bands to set the stop buffer so market noise doesn’t kick you out needlessly.

Sizing that respects account risk

Calculate position size: Account risk / (entry – stop) = units to buy. That simple math protects the plan when stops widen.

Scaling out at measured targets

Take a portion at the measured objective and trail the rest under higher lows to capture extended runs. This preserves gains while letting momentum work.

- Use a time stop if price stalls after confirmation.

- Predefine maximum trade risk and daily loss limits to protect capital during streaks of false signals.

- Align management with timeframe: tighter intraday rules, more room on swing trades.

| Scenario | Action | Management rule |

|---|---|---|

| Immediate continuation | Scale to full size or add partial | Move stop to break-even after partial profit |

| Retest of neckline | Hold or add on successful bounce | Use tighter stop under retest low |

| Failed retest / return below neckline | Exit to limit losses | Accept predefined loss; record trade |

Post-trade review: document execution, timing, and how volatility metrics matched reality. Keep rules simple and consistent to reduce hesitation and variability in outcomes.

For a quick reference on candlestick setups that complement pattern analysis, see this candlestick cheat sheet.

Advantages and limitations of the double bottom pattern

This pattern offers a practical framework for spotting potential trend changes with simple visual rules. It gives traders a repeatable trigger and an objective place to measure risk and reward.

Simplicity, clear entries, and broad applicability

Strengths: The setup is easy to read and works across timeframes and instruments. Indicators like RSI or MACD can sit beside the structure to improve decision-making without changing the core rules.

- Visual clarity and objective confirmation make trades repeatable.

- Mechanical target-setting from the trough-to-neckline distance simplifies exits.

- Versatile across asset classes and chart horizons.

Imperfect structures and risk of false signals

Limitations: Necklines can be ambiguous and valleys often lack perfect symmetry. That leads to more false breakouts during consolidation and noisy market conditions.

Stops usually sit under the second trough, which means wider nominal risk and the need for disciplined sizing to avoid large losses.

| Aspect | Advantage | Limitation |

|---|---|---|

| Readability | Clear visual rules | Ambiguous necklines sometimes |

| Risk control | Defined stop and target | Wider stops raise capital needs |

| Reliability | Works across markets | More false signals in consolidation |

Focus on high-quality structures with rounded valleys, check volume and trend context, and keep consistent analysis and position sizing to improve long-term results.

Conclusion

A reliable trading edge combines clear structure with firm risk rules and patient execution.

This guide showed a double bottom reversal as a simple bullish pattern on the chart. Mark two troughs, draw the neckline, and wait for a confirmed close before acting.

Use measured targets from the trough-to-neckline distance, place stops beneath the second trough, and add momentum or volume checks to improve conviction without overcomplicating your plan.

Practice markups, keep a trade journal, and build a checklist that defines entries, exits, and position size. Expect false signals; treat stress and margin carefully because leveraged products magnify risk in any market.

With disciplined rules and repeated review, traders can apply this pattern confidently across instruments and timeframes.

FAQ

What is the pattern and why does it signal a bullish market turn?

This chart formation shows two distinct lows separated by a peak called the neckline. It forms after a downtrend when selling pressure eases at the first low and again near the same level for the second low. A decisive close above the neckline suggests buyers regained control and signals a possible bullish trend change for traders.

How do I identify the structure: the two lows, the peak, and the neckline?

Look for a prior downtrend followed by a low, a rebound to a peak, and then a second low roughly at the same price area. Draw a horizontal or slightly sloped line across the intervening peak to mark the neckline. The clearer the two lows and the peak, the higher the pattern quality.

What confirmation should I wait for before entering a trade?

Wait for a close above the neckline on your chosen timeframe. Volume expanding on the breakout strengthens the signal. Some traders add a retest of the neckline as further confirmation before entering to reduce the chance of a false breakout.

How should I read price and volume during formation?

Ideally, volume will decline during the two lows and then pick up on the breakout. Lighter volume during the declines suggests waning selling pressure. Rounded valleys often indicate a gradual shift in momentum, which can improve the pattern’s reliability compared with jagged, erratic lows.

What step-by-step approach can I use to trade this pattern?

First, scan for a clear prior downtrend and two distinct lows. Mark the neckline at the intervening peak. Plan an entry trigger, such as a close above the neckline or a retest. Set a stop-loss below the second low and project profit targets using the distance from the lows to the neckline.

What entry tactics are considered conservative versus aggressive?

Conservative traders wait for a daily close above the neckline or a successful retest before buying. Aggressive traders enter on the initial breakout or on intraday momentum signals. Conservative entries reduce false signals but may miss some early moves.

Where should I place my stop-loss to respect the formation?

A common stop sits just below the second low, which is the pattern’s invalidation point. Position size should reflect the distance to that stop so risk per trade remains within your rules.

How do I set profit targets using the pattern?

Measure the vertical distance from the lows to the neckline and project that distance upward from the breakout point. Many traders scale out at the measured target and use trailing stops if momentum continues.

Which timeframes and markets work best for this setup?

The formation appears across intraday charts to daily and weekly frames. It works in stocks, forex, indices, and commodities. Higher timeframes generally give stronger signals, while lower timeframes require faster execution and stricter risk control.

Which indicators help confirm momentum and reduce false signals?

RSI and MACD can show bullish divergence or momentum pickup ahead of a breakout. Moving averages that align with the neckline add confluence. Use indicators as supporting evidence, not a replacement for price-based confirmation.

How can I avoid false breakouts and premature entries?

Require a clean close above the neckline, watch for increased volume, and consider waiting for a retest. Use clearly defined invalidation levels and keep position sizes smaller when the pattern looks imperfect.

How do I integrate this pattern into a full trading strategy?

Combine pattern recognition with position sizing, fixed risk per trade, and defined profit plans. Expect wider stops for some setups and scale positions or exits to maintain favorable risk-reward ratios and manage account drawdown.

What are the main advantages and limitations of trading this pattern?

Advantages include simplicity, clear entry and stop levels, and applicability across markets. Limitations are imperfect shapes, possible false breakouts, and the need for patience and discipline to wait for confirmation.

No comments yet