Digital collectibles are taking a groundbreaking leap forward. Unlike traditional tokens that remain unchanged, new blockchain-based assets now offer interactive capabilities. These innovations enable properties to update automatically based on real-world conditions or user interactions.

What makes these tokens unique? Their core structure uses self-executing code to modify traits over time. This shift creates opportunities for artists, gamers, and businesses to design items that evolve alongside their ecosystems.

The technology behind this advancement lies in specialized blockchain protocols. By embedding logic directly into assets, creators can build experiences that respond to events like seasons, achievements, or market trends. This flexibility unlocks applications far beyond static art or profile pictures.

Key Takeaways

- Next-generation tokens adapt their characteristics post-creation

- Code-driven updates enable real-world responsiveness

- Artists gain new tools for interactive storytelling

- Gaming items can now reflect player progress automatically

- Businesses use adaptable assets for loyalty programs

- Technical foundations combine blockchain with automated logic

This guide breaks down how these systems work, their practical implementations, and what they mean for the future of digital ownership. We’ll examine real-world examples across industries while explaining the technical foundations in simple terms.

Introduction to the World of Dynamic NFTs

The digital ownership revolution began when unique blockchain tokens reshaped how creators and collectors interact. Non-fungible tokens (NFTs) exploded in popularity as artists, athletes, and influencers launched personal collections. These tokens act as certificates of ownership, each with a unique ID and contract address stored securely on blockchains.

Understanding NFTs and Their Rise

Initially, NFTs solved a critical problem: proving authenticity for digital art. Before blockchains, anyone could copy a file. Now, creators mint tokens representing original works, giving buyers verifiable proof of ownership. This shift drew global attention as high-profile figures showcased their collections.

Mainstream adoption accelerated when platforms allowed easy token creation. Musicians released albums as NFTs, while sports franchises sold limited-edition digital collectibles. The technology’s reliability made it a staple for modern creators.

The Emergence of Dynamic Capabilities

As demand grew, developers added features beyond static ownership. Newer tokens can now adapt based on external data or user actions. Imagine a digital painting that changes with weather patterns or a game item that evolves as you level up.

These innovations expanded use cases beyond art. Games use tokens for character upgrades, while brands test them in loyalty programs. The next wave includes real-world assets like property deeds, all secured by blockchain verification.

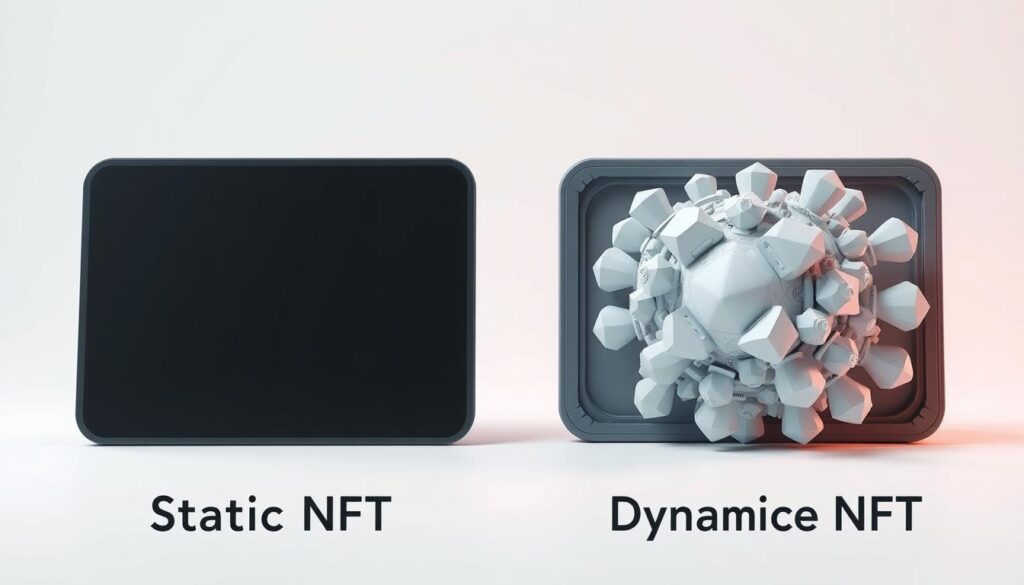

Understanding Static vs. Dynamic NFTs

Blockchain-based collectibles exist in two forms: locked-in-stone records and adaptive assets. Most tokens today fall into the first category—static nfts—which serve as frozen snapshots of ownership. These tokens dominate art projects and gaming rewards but face constraints in today’s interactive digital ecosystems.

Why Traditional Tokens Stay Frozen

Standard tokens cement their details during creation. Once minted, their traits—like artwork descriptions or ownership history—remain unchangeable. This rigidity creates three roadblocks:

- Art can’t reflect real-time events (like weather or sports scores)

- Game items won’t auto-upgrade with player achievements

- Loyalty rewards stay disconnected to customer behavior

These limitations stem from metadata being set in stone. Imagine owning a concert ticket token that can’t reflect VIP upgrades or resale opportunities. Static designs miss real-world adaptability.

The Upgrade Path: Beyond Fixed Parameters

New-generation tokens solve this through smart adjustments. Unlike their traditional cousins, these assets let creators revise details like visuals or perks. A basketball-themed token could update stats after each game, while digital art adapts to gallery trends.

| Feature | Static | Dynamic |

|---|---|---|

| Metadata Edits | Impossible | Allowed via code |

| Use Cases | Art, basic collectibles | Sports, gaming, real-time loyalty systems |

| Ownership Flexibility | Fixed | Adjustable perks/terms |

This shift doesn’t erase token DNA. Unique IDs stay consistent, ensuring authenticity while letting the asset grow with its environment. Artists gain storytelling tools, while brands unlock engagement previously reserved for physical goods.

dynamic NFT smart contract programmable metadata evolution mechanisms

Adaptive digital assets rely on a technical backbone that blends blockchain standards with real-time responsiveness. At their core, these systems use self-updating code built on ERC-721 or ERC-1155 frameworks. This foundation allows assets to modify their traits automatically when specific conditions occur.

- Code-driven rules that define when and how changes occur

- External data feeds connected via blockchain oracles

- Automated triggers that execute updates without manual input

For example, a sports-themed collectible could refresh player stats after each game using live score data. Artists might program digital pieces to shift color palettes based on gallery attendance metrics.

| Component | Role | Impact |

|---|---|---|

| Token Standards | ERC-721/1155 frameworks | Enable asset creation with mutable traits |

| Oracles | Bridge to real-world data | Feed external triggers into the system |

| Automation | Execute changes | Ensure timely, hands-free updates |

These systems validate changes through conditional checks, ensuring updates align with predefined rules. A loyalty reward token might grant bonus points only when a customer’s purchase history meets set criteria. For deeper insights into adaptive asset systems, explore how creators balance technical precision with artistic vision.

How Dynamic NFTs Work: Core Components and Principles

The magic behind adaptable digital assets lies in their technical framework. Two elements drive their ability to change: coded agreements and real-world data connections. These systems turn rigid ownership records into living assets that grow with their environments.

Smart Contract Foundations and Token Standards

Adaptable assets use paired agreements to manage ownership and traits. The first agreement creates the asset using ERC-721 or ERC-1155 standards. ERC-721 handles unique items like art, while ERC-1155 supports groups of similar assets like game power-ups.

A second agreement controls trait changes. This setup lets creators build rules for automatic updates. For example, a concert ticket could unlock backstage perks when scanned at the venue.

| Standard | Use Case | Flexibility |

|---|---|---|

| ERC-721 | Unique collectibles | Individual updates |

| ERC-1155 | Game items, tickets | Batch changes |

Integration with External Data and Oracles

Asset updates need fresh information from beyond the blockchain. Special data bridges called oracles feed weather stats, game scores, or purchase histories into the system. They check data accuracy before triggering changes.

- Oracles pull verified facts from websites or sensors

- Data gets converted into blockchain-readable formats

- Updates occur only after multiple confirmations

This setup keeps assets secure while letting them react to real events. A sports highlight reel could auto-update when players achieve milestones, powered by live game data.

Use Cases for Dynamic NFTs in Digital Art and Gaming

Creative industries are discovering innovative ways to merge technology with user experiences. Adaptive digital assets now empower creators to build interactive worlds where ownership becomes a living concept. This shift unlocks possibilities that static formats couldn’t achieve.

Transforming Digital Art and Collectibles

Generative art projects demonstrate how adaptive traits create unique experiences. A digital painting might shift color schemes based on real-time weather data. Collectors could watch their artwork transform with seasons or global events.

Some pieces evolve through owner interactions. Imagine a portrait that develops new details when shared on social media. These responsive elements turn art into collaborative journeys rather than fixed endpoints.

Enhancing Gameplay through Evolving Attributes

In gaming ecosystems, adaptive assets create deeper immersion. A sword gains combat stats as players defeat enemies. Armor unlocks visual effects after completing challenges. Each upgrade gets recorded directly in the asset’s properties.

Characters carry progress across platforms. A warrior leveled up in one game could bring special abilities to another. This portability reshapes how players invest time and build digital identities.

| Application | Static Asset | Adaptive Asset |

|---|---|---|

| Artwork | Fixed appearance | Changes with external data |

| Game Items | Permanent traits | Progress-linked upgrades |

Developers use these tools to craft worlds where achievements leave permanent marks. Players gain tangible proof of their journey, while artists explore new storytelling dimensions.

NFT Tokenization Beyond Art: Real-World Assets and Property

Blockchain’s next frontier transforms physical holdings into interactive digital records. Real estate leads this shift, where adaptive tokens track evolving details like maintenance logs, ownership transfers, and market shifts. A house deed token, for instance, could auto-update with renovation permits or energy efficiency ratings.

- Paper trails get lost or altered

- Manual updates delay critical data

- Limited transparency for buyers/investors

Tokenized solutions create permanent, self-updating ledgers. Luxury watchmakers already use similar systems for tokenization of real-world assets, tracking items from factory to buyer. Buildings equipped with IoT sensors could feed live data into their digital twins, updating condition reports automatically.

| Aspect | Traditional Records | Dynamic NFT Records |

|---|---|---|

| Maintenance History | Scattered files | Single source of truth |

| Ownership Tracking | Notary-dependent | Instant blockchain verification |

| Value Updates | Annual appraisals | Real-time market adjustments |

| Accessibility | Physical archives | Global 24/7 access |

Fractional ownership models gain precision through these systems. Investors buy tokenized shares of commercial properties, receiving automated profit distributions. Royalty agreements for patents or music rights could self-calculate payments based on usage metrics.

Regulatory compliance remains crucial. Jurisdictions like Wyoming now recognize blockchain-based property titles, creating frameworks for legal disputes and tax reporting. As adoption grows, these tools will redefine how we manage tangible and intangible holdings.

Exploring the Benefits and Challenges of Dynamic NFTs

Adaptable blockchain assets bring fresh opportunities but require careful navigation. These systems streamline digital ownership while introducing new technical considerations for creators and collectors.

Automated Updates and Increased Engagement

Traditional collectibles demand new token creation for every metadata change. This process consumes significant network resources and gas fees. Adaptable alternatives enable single-asset adjustments, reducing blockchain strain while maintaining ownership history.

Consider these advantages:

- 40-60% lower transaction costs compared to static alternatives

- Real-time trait modifications without minting new items

- Enhanced user retention through evolving visual features

| Aspect | Static Systems | Adaptive Systems |

|---|---|---|

| Update Cost | $15-50 per change | $2-8 per adjustment |

| User Interaction | One-time engagement | Ongoing participation |

| Scalability | Limited by new mints | Supports mass updates |

Security Considerations and Data Integrity

External data sources introduce potential vulnerabilities. Third-party APIs powering asset changes could become attack vectors. Developers must implement multi-layered verification to maintain trust in self-modifying systems.

Best practices include:

- Using multiple oracle networks for critical data points

- Encrypting off-chain communication channels

- Conducting regular smart contract audits

While adaptable assets unlock new value streams, creators must balance flexibility with blockchain’s core strength: tamper-resistant records. Proper implementation ensures assets evolve without compromising their foundational integrity.

Integrating Off-Chain Data with Chainlink Oracles

The true potential of adaptive digital collectibles emerges when they interact with real-world events. Chainlink’s oracle networks act as trusted messengers, delivering verified information from external sources to blockchain-based assets. This connection lets digital items reflect live conditions like weather patterns or stock prices.

Reliable Data Feeds and API Integration

Chainlink Data Feeds pull information from multiple sources to prevent errors. Sports statistics, IoT sensors, and financial markets become living inputs for collectibles. For example, a basketball highlight token updates automatically when players achieve new records.

Developers connect Web2 services using Chainlink’s Any API tool. This system converts traditional website data into blockchain-readable formats. Museums could tokenize exhibits that change based on visitor numbers tracked through API connections.

| Component | Traditional Systems | Chainlink Solution |

|---|---|---|

| Data Sources | Single provider | 7+ verified feeds |

| Verification | Manual checks | Automated consensus |

| Updates | Delayed | Every 60 seconds |

| Use Case | Basic weather NFTs | LaMelo Ball stat-trackers |

Security remains crucial. Chainlink uses three-step validation for all off-chain data. Multiple nodes confirm information accuracy before triggering asset changes. This process prevents manipulated inputs from affecting collectible properties.

Successful integrations include athlete-based tokens that evolve with career milestones. These projects demonstrate how reliable data bridges create engaging, ever-changing ownership experiences.

Smart Contract Automation for Dynamic NFT Updates

Modern collectibles require precision timing for trait adjustments. Chainlink Automation solves this through secure, decentralized task execution. This service acts as a blockchain traffic controller, initiating smart contract actions when preset conditions occur.

Time-sensitive updates work seamlessly with this system. A sports memorabilia token could refresh stats at midnight after games. Concert tickets might unlock perks precisely when doors open, using real-time triggers.

Event-driven modifications gain reliability through multiple data confirmations. Weather-responsive art pieces change hues only after three independent sensors report rain. This prevents false positives while keeping assets aligned with real-world events.

Developers save time through pre-built automation templates. These tools handle complex tasks like batch trait changes across NFT collections. The result? Scalable systems that maintain authenticity while adapting to user needs.

FAQ

What’s the difference between static and evolving non-fungible tokens?

Static tokens, like traditional digital art, have fixed traits stored in metadata. Evolving versions use code-driven logic to update traits based on real-time inputs, such as sports scores or weather changes, making them adaptable.

How do evolving tokens interact with real-world data?

They rely on decentralized networks like Chainlink to pull external data—such as live game stats or market prices—into blockchain-based agreements. This allows traits like a player’s performance or asset value to update automatically.

Can these tokens enhance gaming experiences?

Yes. For example, in-game items like weapons or characters can gain new abilities as players achieve milestones. Ubisoft’s Quartz platform experiments with evolving gear that reflects player progress.

Are there real-world applications beyond art?

Absolutely. Tokenized property deeds can adjust ownership details automatically during sales. Luxury brands like Gucci use them for limited-edition items that unlock exclusive perks over time.

What risks come with programmable metadata?

Security gaps in code or unreliable data sources can lead to incorrect updates. Projects must audit agreements and use trusted providers like Oraichain to ensure data accuracy.

How do sports leagues benefit from this technology?

Platforms like NBA Top Shot update collectibles with player stats, creating dynamic highlights. Fans own moments that evolve as athletes break records, adding long-term value.

Can metadata changes affect ownership rights?

No. Ownership remains on-chain, but traits like visuals or attributes shift. For instance, Async Art lets owners control layered artwork without altering who holds the token.

Why use oracles for off-chain data?

Oracles bridge blockchains with external systems. Chainlink’s network ensures weather, scores, or IoT data feeds trigger updates securely, keeping traits accurate and tamper-proof.

What industries adopt this innovation fastest?

Gaming, sports, and luxury goods lead adoption. For example, Sorare’s fantasy soccer cards update based on real matches, while Dolce & Gabbana’s Collezione Genesi pieces evolve with owner interactions.

How will this shape digital art’s future?

Artists like Beeple create works that respond to viewer input or environmental factors. This transforms static pieces into living art, fostering deeper engagement and new revenue models.

No comments yet