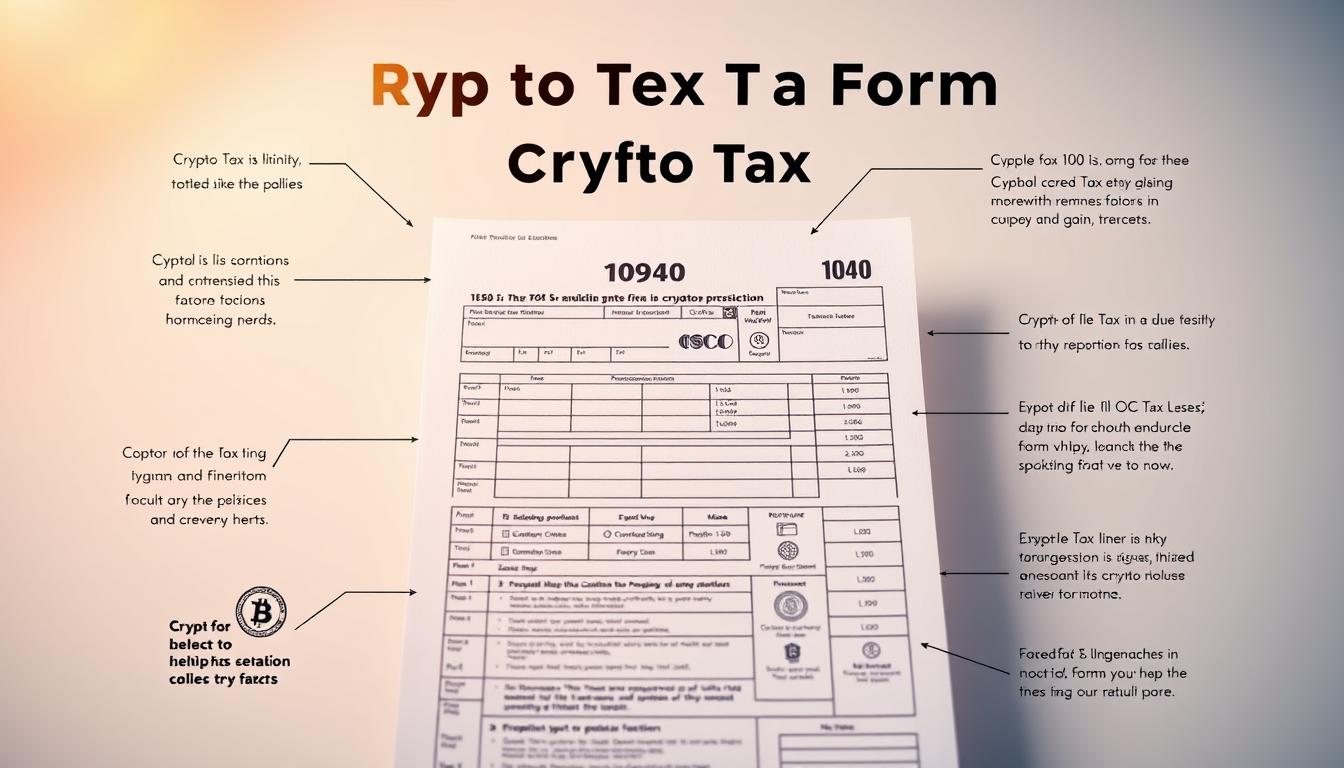

Understanding crypto tax forms is key to following IRS rules for digital assets. This guide helps simplify the process for U.S. taxpayers. It covers how to report trades in Bitcoin,

Hot Posts52- Page

The financial landscape is entering a new era of innovation. At its core lies the groundbreaking fusion of blockchain-based finance and autonomous decision-making systems. This convergence, often called DeFAI, has

As the digital asset landscape continues to evolve, the question of whether cryptocurrency is in a bubble has become a topic of intense debate. This article delves into the complexities

Investing in cryptocurrency can be confusing. But, quotes from experts and pioneers can guide you. They turn complex ideas into clear plans. These quotes show how Satoshi Nakamoto saw decentralization

The rise of artificial intelligence tokens is changing the digital world. It brings new chances for growth and innovation. As we rely more on AI-driven solutions, AI tokens are becoming

The IRS is watching cryptocurrency activities more closely. This means crypto tax audit preparation is key for all investors. Keeping organized records is crucial to avoid penalties. Not following the

The global property market has grown rapidly, with professionally managed investments reaching $8.5 trillion in 2017. Yet, many processes remain slow and disconnected. Traditional systems often struggle with delays, unclear

Three powerful forces are reshaping how businesses operate and engage with customers. Spatial computing, artificial intelligence, and decentralized systems are merging to create immersive environments that blend physical and digital

Learning about cryptocurrency lending can really help investors. This guide will explain bitcoin lending in detail. You’ll understand how it works and how it can help you. This how-to guide

Millions of Americans now hold cryptocurrency. But many don’t know about the tax rules for it. It’s important to report crypto earnings on U.S. taxes. This guide will help you