Bitcoin recently surged past $95,000, capping a historic rally for digital assets. The broader market now exceeds $3.3 trillion in value, with over 17,000 coins available globally. While these numbers

Hot Posts89- Page

Modern rewards models are changing how U.S. companies win repeat business. Tokenized systems issue digital assets on a blockchain, giving customers true ownership and clear transaction history. These approaches cut

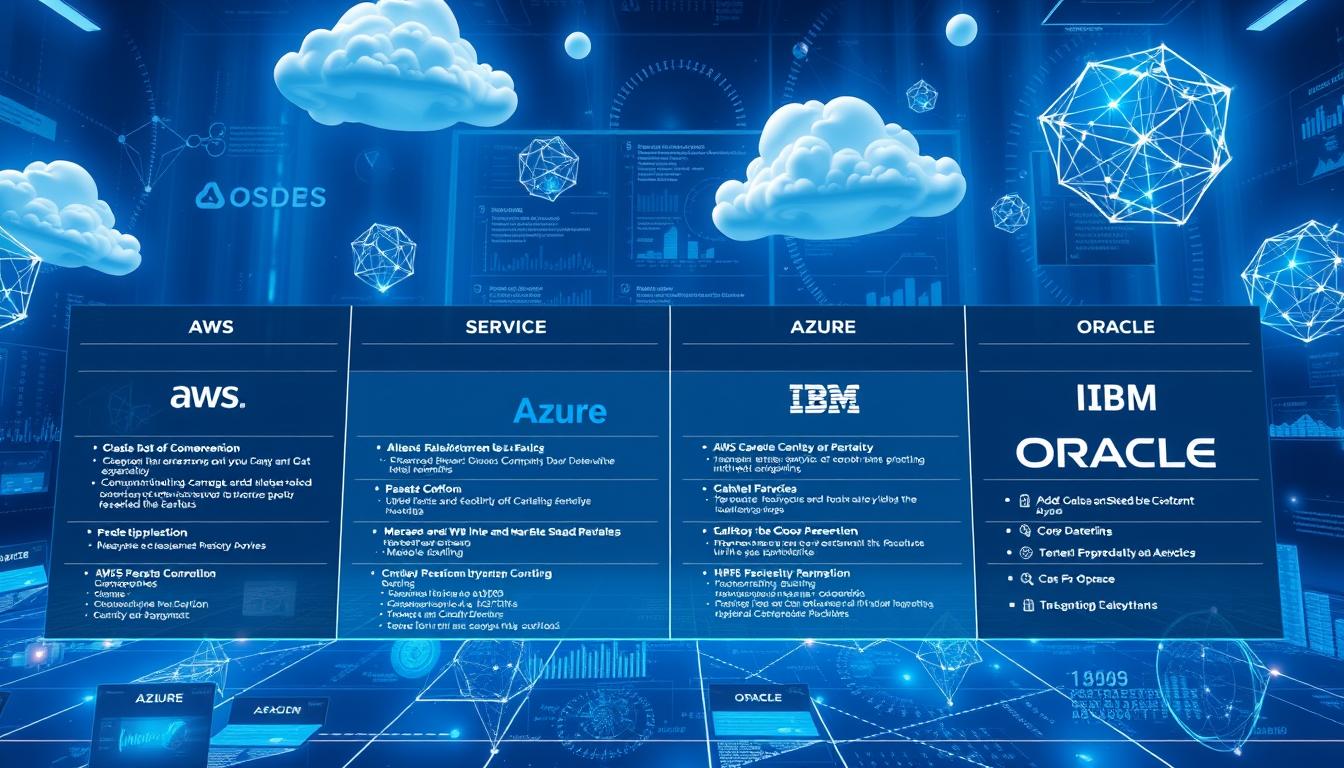

Businesses exploring distributed ledger technology now have access to managed cloud solutions that simplify deployment. Leading providers offer tools to build secure networks without heavy infrastructure investments. This analysis focuses

1. Introduction Cryptocurrency wallets come in different forms with varying levels of security, accessibility, and convenience. The appropriate wallet to use depends on your security needs, the size of

Digital collectibles have moved from hype to real tools that deepen loyalty and drive measurable value. Early drops focused on scarcity, but companies quickly learned that scarcity alone fell short.

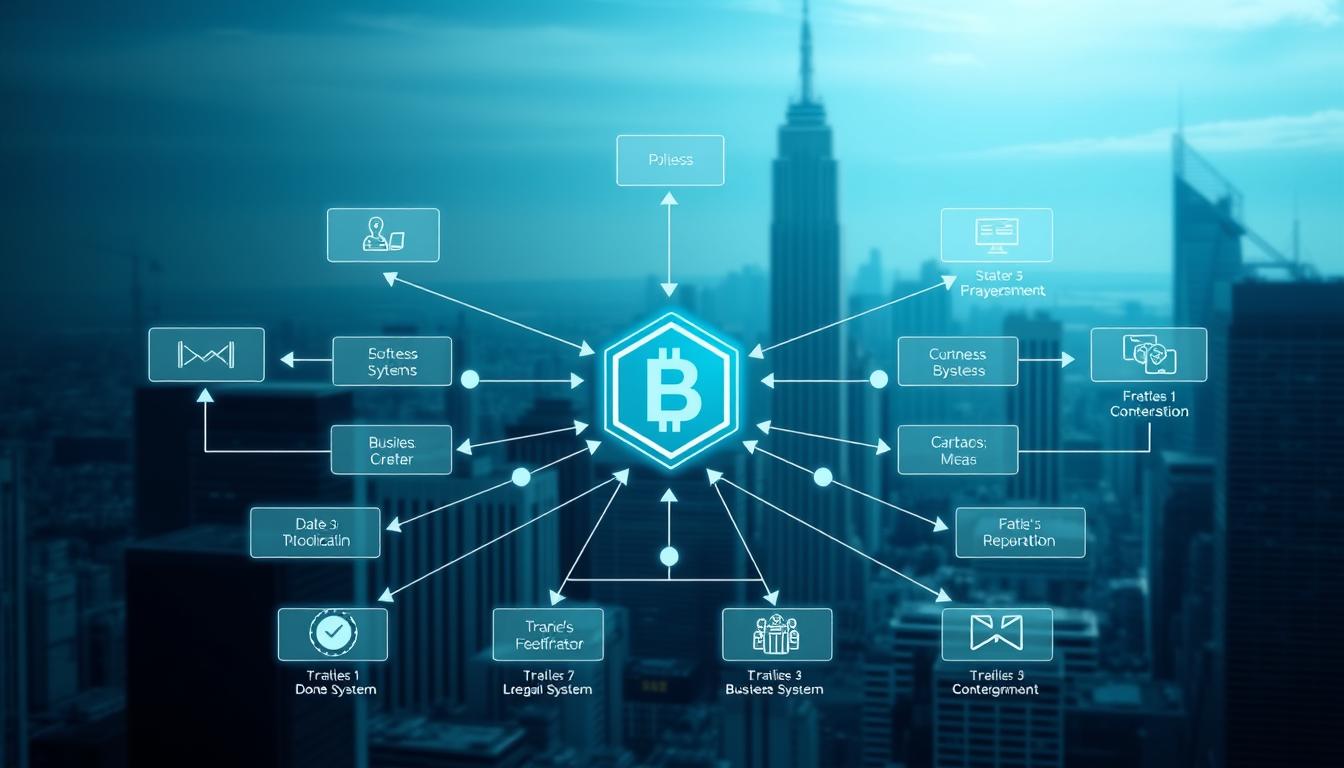

Modern enterprises face growing pressure to adopt innovative solutions that enhance security and operational efficiency. Blockchain, a decentralized ledger system, has proven transformative across industries like finance, healthcare, and supply

The digital asset landscape has transformed dramatically. What began as a niche for individual traders now attracts major financial institutions, with global regulations evolving to support secure custody and diversified

Technical analysis is a powerful method used by traders to forecast price movements. Many successful professionals in the crypto space rely on a straightforward approach. They interpret chart data using

The IRS treats digital coins as property, so selling, swapping, or using them triggers a capital gain or loss in most cases. When you earn coins — through mining, staking,

Recent studies have shown the transformative potential of advanced technologies in trading. For instance, a groundbreaking strategy achieved a remarkable 1640% return in Bitcoin trading from 2018 to 2024. This