The digital world is growing fast, and Americans are jumping into NFTs. Non-fungible tokens, or NFTs, are unique digital items like art and music. They are secured by blockchain technology. To buy these items, you need cryptocurrency, making “how to buy NFTs with cryptocurrency in the USA” a big question.

This guide will show why crypto is key for these deals. It will also explain how U.S. buyers can safely join this growing market.

Celebrities and regular collectors alike are using platforms like OpenSea and Rarible to buy NFTs. Cryptocurrency, like Ethereum or Bitcoin, powers this world. It makes trades safe and clear. Knowing how crypto and NFTs work is important for anyone new to this area.

Key Takeaways

- Cryptocurrency is the main way to buy NFTs on big U.S. platforms.

- NFTs let you own digital art, memorabilia, and virtual items in new ways.

- U.S. tax rules and regulations affect NFT purchases and sales.

- Secure wallets like MetaMask keep buyers safe during transactions.

- Learning to buy NFTs with cryptocurrency in the USA means understanding marketplaces, fees, and digital wallets.

Understanding NFTs and Their Growing Popularity

For beginners, the first question is: What makes NFTs unique? This section explains the basics of buying non-fungible tokens. It shows how they play a role in today’s digital world.

What Are Non-Fungible Tokens?

NFTs are unique digital certificates stored on blockchain. They are different from cryptocurrencies like Bitcoin. Each NFT is special, like a digital artwork or music track. They act as digital passports for ownership.

- Blockchain ensures authenticity and scarcity

- Each NFT holds a one-of-a-kind identifier

- Used for art, collectibles, and virtual items

Why NFTs Have Captured the Digital Market

Platforms like OpenSea and Rarible made buying NFTs easy. Big sales, like Beeple’s $69 million digital artwork, showed their value. Now, creators can sell art directly, and collectors see them as digital investments.

The Connection Between Cryptocurrency and NFTs

To buy NFTs, you need cryptocurrency. Most transactions happen on blockchain networks like Ethereum. Users keep crypto in wallets like MetaMask to buy NFTs. This connects digital currency with NFT ownership.

Essential Cryptocurrency Knowledge for NFT Buyers

Before you start buying NFTs, it’s key to know the basics of digital assets with crypto. Ethereum (ETH) is at the heart of most NFTs because of its wide use and smart contract features. You need ETH to buy on platforms like OpenSea. Keep an eye on ETH’s price to manage your spending.

Gas fees on Ethereum are the costs of transactions, paid in ETH. These fees go up when the network gets busy, increasing what you pay. Use ETH Gas Station (https://ethgasstation.info/) to see current gas prices and save money.

Other blockchains like

- Solana (SOL) – fast and low-cost NFT transactions

- Tezos (XTZ) – eco-friendly and artist-friendly platforms

- Flow (FLOW) – popular for collectibles and gaming NFTs

are becoming more popular. They offer cheaper options than Ethereum, helping you save money.

US buyers can get these cryptocurrencies through exchanges like Coinbase, Binance.US, or Kraken. Make sure these platforms follow US laws to ensure your transactions are legal. Always choose licensed services to avoid scams and follow the rules.

Setting Up Your Digital Wallet for NFT Purchases

Before you start buying NFTs, you need a secure digital wallet. This guide will help you pick the right wallet, keep your funds safe, and connect it to marketplaces easily.

Popular Wallet Options for American Users

American buyers often choose easy-to-use platforms. MetaMask has browser extensions and mobile apps for Ethereum-based crypto payments. Trust Wallet works well with Binance, and Ledger Nano offers offline storage. Coinbase Wallet is great for beginners because it lets you buy crypto with fiat currency.

- MetaMask: Free, Ethereum-focused

- Trust Wallet: Multi-chain support

- Ledger Nano: Physical device for cold storage

- Hardware wallets: Ideal for large holdings

Security Features to Look For

Keep your account safe with two-factor authentication and encrypted backups. Always keep seed phrases offline and never share them. Look for wallets with anti-phishing features and audit logs. Hardware wallets are best for keeping your money safe from online threats.

Connecting to NFT Marketplaces

- Select a marketplace (e.g., OpenSea or Rarible)

- Choose “Connect Wallet” on the platform

- Authorize access in your wallet app

- Verify gas fees before confirming transactions

Check wallet guides for specific steps for each platform. If you have trouble connecting, try updating your browser extensions or clearing your cache.

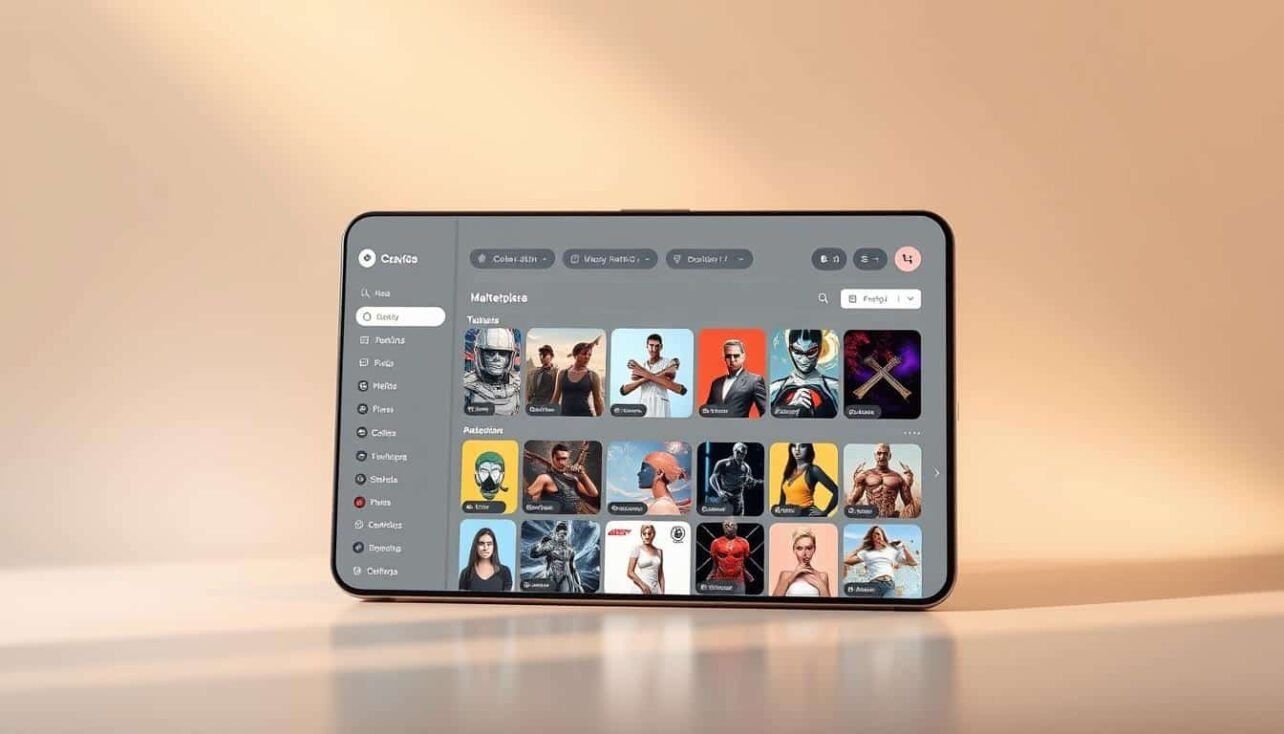

Top NFT Marketplaces Available to US Residents

Choosing the right NFT marketplace in the US depends on your goals and budget. Major platforms cater to diverse interests and meet American regulatory standards.

OpenSea is the largest NFT marketplace in the US. It offers Ethereum-based collectibles, art, and virtual real estate. Sellers pay a 2.5% fee, and buyers verify identities through KYC checks.

Rarible rewards creators with its native RARI token and supports Polygon for lower fees. Users in the US can connect crypto wallets like MetaMask directly.

SuperRare focuses on digital art, requiring artist curation before listings. It uses Ethereum with gas fees adjusted by network congestion.

NBA Top Shot dominates sports NFTs via the Dapper Labs platform. Users verify accounts with ID verification for NBA-related collectibles only.

Nifty Gateway specializes in high-profile drops from brands like The New York Times. Purchases use credit cards or crypto, with buyer protections against scams.

Security varies: SuperRare and Nifty Gateway use third-party audits, while OpenSea recently introduced provenance checks. All platforms require US users to confirm location during signup.

Emerging platforms like Fan Controlled Football and Art Blocks target niche audiences, expanding the NFT marketplace in the US landscape. Research fees, asset types, and user reviews before selecting a primary platform.

How to Buy NFTs with Cryptocurrency in the USA

Buying NFTs is a straightforward process. First, pick a marketplace. Then, fund your wallet and make your purchase. Follow these steps for a hassle-free transaction.

Step-by-Step Purchase Process

- Choose a platform like OpenSea or Rarible. Browse categories or search for specific collections.

- Install a crypto wallet (e.g., MetaMask) and link it to the marketplace using your private key.

- Select an NFT, confirm the price, and click “Buy Now” or bid in auctions. Review fees before finalizing.

Gas Fees and Transaction Costs Explained

Ethereum transactions have gas fees that change with network traffic. Use ETH Gas Station to see current costs. Switching to layer-2 networks like Polygon can cut fees by 90%. Always check total costs before you buy.

Verifying Authentic NFTs Before Purchase

- Check the creator’s profile for verified badges or official handles.

- Use Etherscan to review the NFT’s smart contract address. Scammers often reuse names but not blockchain IDs.

- Research the item’s history via the marketplace’s activity log to spot suspicious transfers.

Navigating Legal and Tax Implications for American NFT Collectors

As investing in NFTs becomes more popular, knowing the legal and tax rules is key. US regulators and tax authorities are working hard to create rules for digital assets.

Current Regulatory Status of NFTs in the US

The SEC and CFTC keep an eye on NFTs to stop fraud and make sure they follow the rules. Some NFTs might be seen as securities, which means they have to report more. But, NFTs focused on collecting, like art or virtual items, have fewer rules but still need to stay updated.

Tax Reporting Requirements for Digital Assets

- The IRS sees NFTs as property, so you’ll pay capital gains taxes when you sell them.

- If you make a profit from selling NFTs, you might face a 28% tax rate on collectibles.

- You need to report all your NFT deals on IRS Form 8949, with details like dates, costs, and sale prices.

Record-Keeping Best Practices

Use tools like MetaMask or QuickBooks to keep track of every deal. Keep records of:

- When you bought and sold them

- The cost basis (the price you paid for them)

- Any fees or gas costs from the platforms

Checking your NFT collection regularly helps you stay on track with taxes.

Common Mistakes to Avoid When Purchasing Digital Art

Buying digital art as NFTs online needs careful thought. Many new buyers make mistakes that cost them a lot. Here’s how to avoid these common errors.

- Letting FOMO control decisions: Buying in a rush can lead to overpaying. Always do your research before buying.

- Ignoring gas fees: High transaction costs can increase your spending. Always check the fees before you buy.

- Phishing scams: Fake links or emails can steal your private keys. This can lead to big losses.

- Skipping creator verification: Unchecked listings can sell copies instead of real NFTs. Always verify the creator.

- Misunderstanding rights: Many NFTs only give access, not ownership. Read the terms carefully to avoid problems.

For example, one collector spent $4,500 on an NFT but then found out gas fees added another $3,000. Others have lost money by sending ETH to fake NFT marketplaces. Always double-check wallet addresses and use two-factor authentication.

Start by learning about royalty structures and seller histories. Use tools like OpenSea’s “creator” tags to check if it’s real. Stay informed to keep your investment safe.

Building a Strategic NFT Investment Portfolio

To make NFT purchases profitable, you need a solid plan. Investing in NFTs is more than following trends. It’s about finding a balance between risk and growth.

- Art: Digital art and generative pieces

- Collectibles: Rare virtual items or trading cards

- Virtual land: Platforms like The Sandbox or Decentraland

- Gaming assets: In-game items with real-world value

Don’t forget about the creators. Mix well-known artists with new talent. This way, you can spot hidden gems. Also, look at different blockchains like Ethereum, Solana, or Tezos. This helps avoid relying on just one platform.

When choosing NFTs, consider these factors:

- Community: A strong fanbase can increase resale value

- Utility: Items that can be used in games or apps are more valuable

- Creator reputation: Look at the creator’s past success

- Historical significance: Rare sales, like Beeple’s, often increase in value

It’s important to balance your love for NFTs with making money. Set aside some of your portfolio for collectibles that hold cultural value. At the same time, invest in NFTs that have practical uses in growing ecosystems. Experts suggest keeping 30-40% of your funds in high-risk, high-reward assets. The rest should go to stable projects. This strategy helps you stay safe from market ups and downs while still growing your digital assets.

NFT Authentication and Avoiding Scams

When you buy non-fungible tokens, it’s key to check if they’re real to avoid scams. Scammers use fake sites, fake collections, and tricks to fool buyers. To stay safe, follow these steps.

- Fake marketplace sites mimicking OpenSea or Rarible

- Counterfeit editions of popular NFT projects like Bored Ape Yacht Club

- Phishing emails demanding wallet access

Here’s how to check if something is real:

- Look up the blockchain address on Etherscan or similar tools

- Make sure the creator’s info matches their official social media

- Look for marketplace verification badges like OpenSea’s blue checkmarks

Watch out for these warning signs:

- Too-good-to-be-true “guaranteed” profit promises

- Urgent payment requests that aren’t crypto

- Creators with no history of NFTs

New tech like smart contract audits and third-party checks help. A 2023 study found 40% of US NFT scams were fake airdrops. Always check collection details on different platforms before buying.

Advanced Techniques for Seasoned NFT Collectors

For collectors looking to step up their game, learning advanced NFT strategies is key. These methods need technical skills and a good understanding of the market. They help you succeed in the competitive world of digital art.

Participating in NFT Drops and Auctions

To get into exclusive drops, join waitlists on sites like OpenSea or Rarible. Use EthGasStation to keep an eye on gas prices during these events. Top collectors suggest using Nifty Gateway for last-minute bidding on underpriced items.

- Whitelist tips: Follow artists on Twitter/X for presale alerts

- Gas optimization: Schedule transactions during off-peak hours

- Auction tactics: Monitor Foundation platform countdown timers

Leveraging Secondary Markets

Mastering the secondary market means tracking price changes on sites like X2Y2. Use NFTGo analytics to spot floor price dips. This way, you can buy assets at 20-30% off their peak. Focus on blue-chip collections like Cool Cats for the best resale chances.

Creating and Selling Your Own NFTs

Artists can create and sell their work on platforms like SuperRare or KnownOrigin. The cost to mint varies, with Ethereum-based drops needing 0.08 ETH+ in gas fees. Successful artists like Beeple grew their audience on Instagram and Discord before launching their drops.

Marketing tips for creators include:

- Collaborate with influencers for presale hype

- Use Twitter Spaces to engage collectors

- List NFTs on multiple platforms simultaneously

By combining these strategies, you can increase your earnings while managing risks in the volatile crypto market. Always check blockchain data on Etherscan before making any transactions.

Environmental Considerations of NFT Transactions

As more people get into digital assets with crypto, they’re looking at their environmental effect. Many NFTs use blockchains like Ethereum, which used to be very energy-hungry. This was because of its proof-of-work systems, which needed a lot of computing power.

Ethereum changed to proof-of-stake, cutting energy use by 99.95%. This makes NFTs on its network much better for the planet. Now, buyers can pick platforms like Tezos or Flow, which were designed to be eco-friendly from the start. These blockchains use way less energy than older systems.

- Proof-of-stake blockchains cut energy use by relying on validators instead of miners.

- Tezos hosts art NFTs with carbon-neutral transactions.

- Carbon offset programs let buyers neutralize emissions from existing digital assets with crypto.

Sustainable NFTs are now in the US market. Collectors can ask creators for clear information on energy use. They can choose projects that are open about their energy use. Tools like Nori or Cool Effect offer carbon credits to offset purchases, making digital ownership more eco-friendly.

Mobile Options for Managing Your NFT Collection

Managing your NFT collection on the go is now key for many US collectors. Mobile apps give easy access to NFT marketplaces in the US. They let users trade, track, and secure digital assets anytime. These tools make it easy to browse auctions or check portfolio value, all while keeping your assets safe.

Top Apps for NFT Trading on the Go

Leading apps make it easy to access NFT marketplaces in the US and more. OpenSea’s app gives direct access to its huge marketplace. Rarible’s app makes finding and bidding easy. Rainbow Wallet combines a crypto wallet with NFT tracking, focusing on security.

Zerion’s app tracks your portfolio across platforms, offering analytics to find opportunities. For those into rewards programs, these apps often connect with NFT-based rewards platforms. This can help you earn more.

Security Measures for Mobile NFT Management

- Biometric Authentication: Use facial recognition or fingerprints to lock wallets.

- Device Encryption: Enable full-disk encryption on phones to protect stored data.

- Backup Protocols: Store recovery phrases in secure, offline locations.

Avoid using public Wi-Fi during transactions. Keep your phone’s software up to date to avoid phishing. Taking these steps ensures your assets are safe while you manage them on the go.

Your Journey into the Digital Asset Frontier Starts Now

Now that you’ve learned the basics, you’re ready to buy NFTs online. First, pick a safe wallet like MetaMask or Phantom. Then, use sites like OpenSea or Rarible to make crypto payments for NFTs.

Always check if an NFT is real using tools like Etherscan before you buy. This step is crucial to avoid scams.

Joining NFT communities on Reddit or Discord can help you learn fast. Look for advice from the NFT Association or Crypto.com’s learning center. It’s better to learn slowly than to rush into buying things you don’t fully understand.

NFTs are becoming more than just art. They’re now used in music, gaming, and even virtual real estate. Make sure you know about crypto taxes in the US and keep good records. Starting small or building a big collection, your first steps are important in a growing digital world. Your actions help shape the future of ownership.

FAQ

What are NFTs and how do they work?

NFTs, or non-fungible tokens, are unique digital assets. They are verified using blockchain technology. Unlike regular cryptocurrencies, NFTs show ownership of specific items like digital art and music. This makes them unique and not interchangeable.

How can I buy NFTs with cryptocurrency in the USA?

First, create a digital wallet. Then, get cryptocurrency, usually Ethereum. Next, connect your wallet to an NFT marketplace like OpenSea. There, you can browse and buy digital assets with crypto.

Are there any fees involved in buying NFTs?

Yes, there are fees. Gas fees are needed to process your purchase on the blockchain. These fees can change based on how busy the network is. This affects the cost of buying NFTs.

What cryptocurrency do I need to buy NFTs?

Ethereum (ETH) is the most used for buying NFTs. But, some places also accept Solana, Tezos, and Flow. These have their own tokens for NFT transactions.

How do I ensure that an NFT is authentic before purchasing?

Check the smart contract address and the creator’s profile. Look at the transaction history on blockchain explorers like Etherscan. Make sure it’s on trusted marketplaces to avoid scams.

What are the legal implications of owning NFTs in the USA?

The laws on NFTs in the USA are still changing. You might face regulatory actions from agencies like the SEC. As an owner, you need to know about tax rules for digital assets. Buying and selling NFTs can lead to capital gains taxes.

What common mistakes should I avoid when buying NFTs?

Don’t let FOMO lead to hasty buys. Always check the creator’s authenticity. Watch out for gas fees. Double-check wallet addresses to avoid mistakes.

How can I build an NFT investment portfolio?

Spread your investments across different types like digital art and collectibles. Think about the long-term value of your assets. Consider the community and creator reputation to build a good collection.

Are there eco-friendly alternatives for buying NFTs?

Yes, use blockchains like Tezos or Flow. They are better for the environment than Ethereum, especially before it switches to proof-of-stake.

What mobile options are available for managing NFT collections?

Apps like OpenSea and Rarible let you manage your NFTs on your phone. You can also use portfolio trackers like Zerion. This makes it easy to trade and browse digital assets anywhere in the USA.

No comments yet