Modern enterprises face growing pressure to adopt innovative solutions that enhance security and operational efficiency. Blockchain, a decentralized ledger system, has proven transformative across industries like finance, healthcare, and supply chain. However, merging this cutting-edge tool with legacy infrastructure requires careful strategy.

Legacy systems often lack the flexibility to support newer frameworks, creating compatibility hurdles. Yet, organizations that overcome these challenges unlock benefits like immutable data records, reduced fraud risks, and automated workflows. For example, 40% of companies report positive ROI after adopting blockchain, according to a comprehensive guide to blockchain integration.

Scalability remains a critical factor. While platforms like Ethereum handle 12-15 transactions per second, solutions like Solana process over 65,000 TPS. Aligning these capabilities with business goals ensures sustainable growth. Equally vital are compliance protocols and encryption standards, which safeguard sensitive data during transitions.

Key Takeaways

- Blockchain enhances data security and transparency but requires compatibility checks with legacy systems.

- Scalability solutions vary widely—choose platforms that align with transaction volume needs.

- 40% of organizations achieve measurable ROI post-integration through streamlined operations.

- Compliance and encryption are non-negotiable for maintaining trust during transitions.

- Start with pilot programs to test viability before full-scale implementation.

Understanding the Landscape of Blockchain Integration

With blockchain’s evolution past initial hype, companies face complex integration decisions. While 72% of executives recognize its value, only 14% have operational projects according to successful integration strategies. The technology now serves as a bridge between legacy frameworks and modern transparency needs.

Industries like finance and logistics lead adoption by focusing on supply chain tracking and payment automation. Others struggle with interoperability and technical debt. Three factors dominate integration success:

| Industry | Adoption Stage | Key Use Cases | Primary Challenge |

|---|---|---|---|

| Banking | Advanced | Cross-border payments | Regulatory alignment |

| Healthcare | Experimental | Patient data security | System compatibility |

| Retail | Early Adoption | Product provenance | Cost justification |

Most firms underestimate the need for specialized talent. Case studies show enterprises partnering with domain experts achieve 3x faster implementation. Pilot programs reduce risk – 68% of successful adopters started with limited-scroll trials.

Scalability remains critical. Public ledgers like Ethereum work for transparent transactions, while private networks suit sensitive data. Choosing the right architecture determines long-term viability.

Overview of Legacy Systems and Their Challenges

Aging digital frameworks continue to power critical operations across industries despite their limitations. These outdated systems often form the backbone of enterprise workflows but struggle to meet modern demands for speed and adaptability.

Defining Outdated Infrastructure

Legacy systems typically feature obsolete software, aging hardware, and rigid architectures. Key characteristics include:

- Vendor-abandoned platforms lacking updates

- Custom code requiring rare technical expertise

- Data isolation preventing cross-platform integration

| Aspect | Legacy Systems | Modern Solutions |

|---|---|---|

| Maintenance Costs | Up to 80% of IT budgets | 15-30% through automation |

| Security Updates | Annual or less | Real-time patches |

| Scalability | Limited capacity | Cloud-based expansion |

Modernization Roadblocks

Organizations face multiple hurdles when upgrading aging technology. Budget constraints top the list, with migration projects costing $1M+ for mid-sized firms. Employee resistance compounds issues – 58% of workers prefer familiar interfaces despite inefficiencies.

Data migration risks remain critical. A single error during information transfer can disrupt operations for weeks. Successful strategies involve phased rollouts and hybrid architectures that bridge old and new systems.

Blockchain Technology Essentials

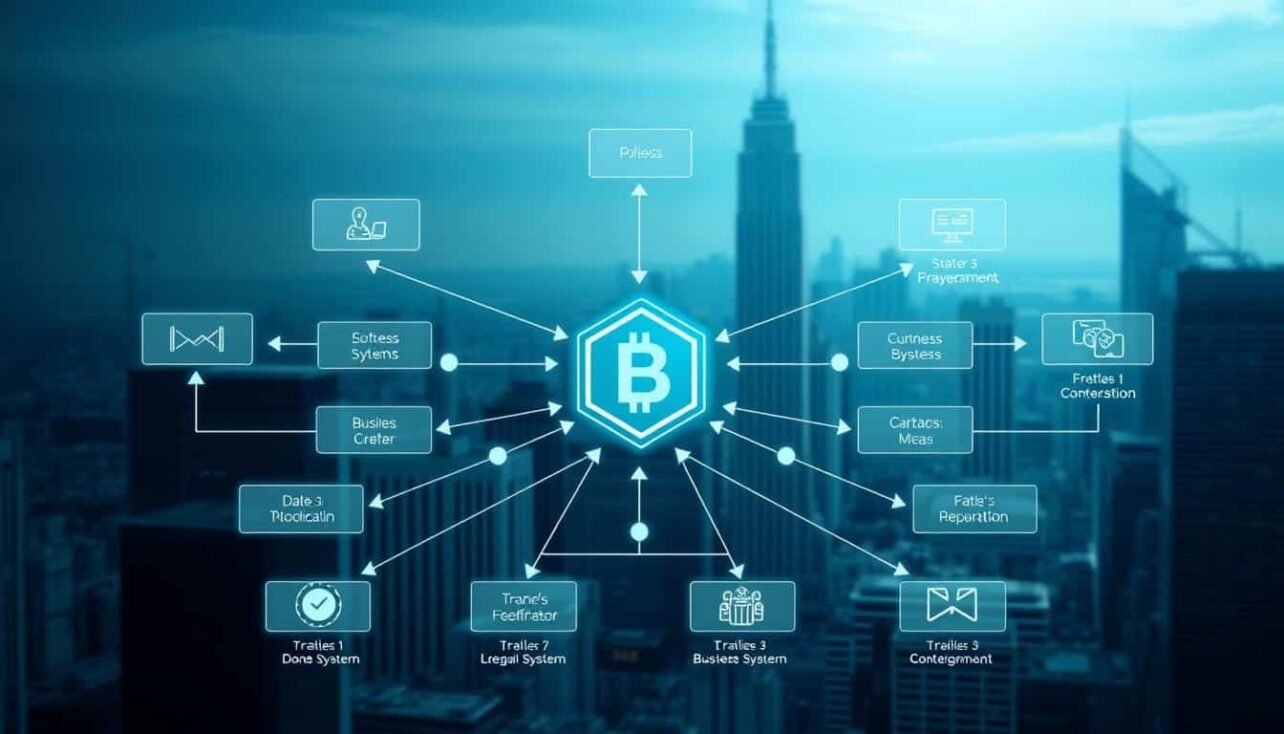

At its core, blockchain redefines data management through decentralized networks. This system replaces traditional centralized databases with peer-to-peer frameworks, enabling secure and transparent record-keeping across industries.

Decentralized Ledger and Transparency

Every transaction gets recorded across multiple nodes, creating a shared truth accessible to all participants. Unlike conventional databases controlled by single entities, this setup eliminates central authority. Participants verify activities collectively, building trust through visibility.

| Feature | Traditional Systems | Blockchain |

|---|---|---|

| Control | Centralized | Distributed |

| Data Modification | Editable | Immutable |

| Verification | Third-party | Consensus-based |

| Security | Password-dependent | Cryptography-driven |

Security Measures and Smart Contracts

Advanced encryption protects data integrity. Hash functions convert information into unique codes – altering even one character changes the entire output. Digital signatures confirm participant identities, reducing fraud risks.

Self-executing smart contracts automate agreements when preset conditions occur. For example, payment releases trigger automatically upon delivery confirmation in supply chains. This eliminates manual oversight while accelerating transactions.

Incorporating Smart Contracts and Automation

Digital agreements are evolving beyond paperwork into self-executing code. These innovations transform how organizations manage obligations, replacing manual oversight with precision-driven execution.

Automating Agreements with Code

Smart contracts operate like vending machines for business rules. When specific conditions occur – payment confirmation or delivery milestones – actions trigger automatically. This eliminates delays from human verification.

Consider these advantages:

- Real-time execution reduces processing from days to minutes

- Code enforces terms consistently, removing interpretation errors

- Multi-step workflows execute sequentially without manual nudges

Reducing Intermediaries in Transactions

Traditional contracts often require banks, lawyers, or brokers. Programmable agreements bypass these layers. For example, insurance claims can self-validate using IoT sensor data instead of adjusters.

| Process | Traditional Approach | Smart Contract Solution |

|---|---|---|

| Supply Chain Payments | 7-10 day bank processing | Instant release upon delivery scan |

| Property Transfers | Notary + title company fees | Automated deed updates via interoperable ledgers |

| Royalty Payments | Monthly manual calculations | Real-time revenue splits |

While powerful, these tools require careful design. Legal frameworks must align with code logic, and legacy systems need bridging solutions. Start with low-risk areas like invoice processing before expanding to complex agreements.

How to integrate blockchain technology into existing business systems

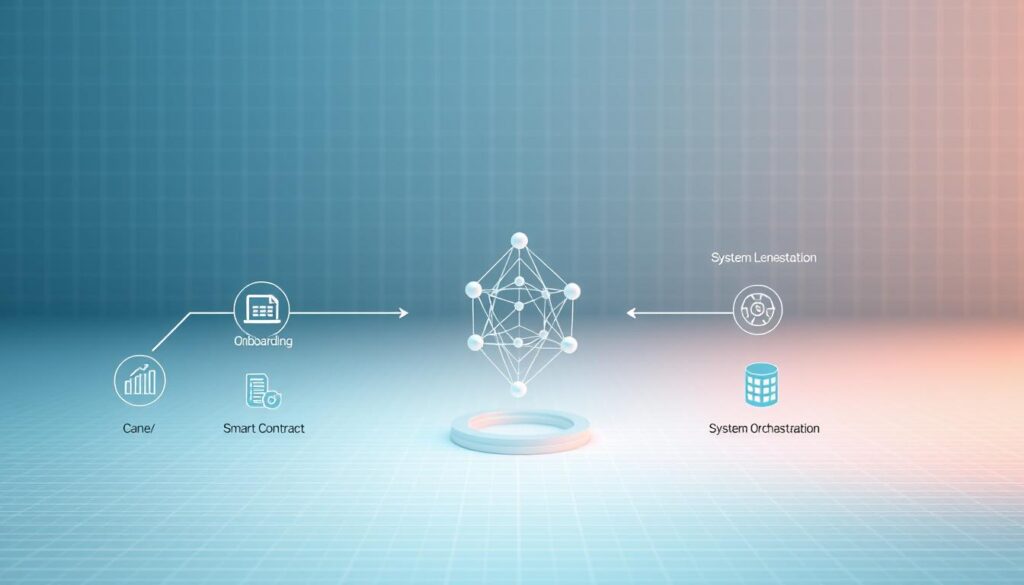

Effective modernization strategies demand meticulous planning and phased execution. Begin by defining clear objectives – whether reducing transaction costs or enhancing supply chain visibility. Measurable targets like 30% faster processing or 95% audit accuracy keep teams aligned.

Start with pilot programs using minimum viable products. A logistics company might test shipment tracking across three routes before full deployment. This approach identifies technical gaps while building stakeholder confidence through tangible results.

Smart contract development requires rigorous testing environments. Financial institutions now run simulated transactions mirroring peak volumes to prevent live-system failures. Security layers like biometric authentication complement blockchain’s native encryption for multi-tiered protection.

| Phase | Focus Area | Success Indicator |

|---|---|---|

| Planning | Workflow Analysis | API Compatibility Score |

| Testing | Contract Validation | 0 Critical Bugs |

| Launch | User Adoption | 85% Training Completion |

Cross-functional teams accelerate deployment. IT specialists collaborate with department leads to map data flows, while legal advisors ensure compliance. Post-launch monitoring tools track KPIs like transaction success rates for continuous optimization.

Enhancing Data Security and Integrity with Blockchain

Data breaches cost businesses $4.35 million on average in 2022, pushing security to the top of corporate priorities. Decentralized ledger systems address these challenges by redefining how organizations protect critical assets.

Encryption and Decentralized Storage

Blockchain secures information through military-grade cryptography. Each record gets converted into a unique hash – altering one character changes the entire code. This makes unauthorized edits instantly detectable.

Unlike centralized databases, data distributes across thousands of nodes. Even if attackers compromise one server, the network remains intact. Healthcare providers use this approach to protect patient records while maintaining accessibility.

Implementing Immutable Audit Trails

Every action leaves a permanent fingerprint on the ledger. Financial institutions track fund movements with 100% accuracy, eliminating reconciliation errors. Regulators access real-time transaction histories during audits.

This integrity stems from consensus protocols. Multiple nodes must validate changes before acceptance. Fraudulent claims drop by 47% in sectors using these systems, according to recent case studies.

Over 60% of adopters report measurable security improvements within six months. As cyber threats evolve, decentralized architectures offer robust defense mechanisms traditional frameworks can’t match.

Improving Transparency, Traceability, and Trust

Real-time accountability is reshaping expectations in global supply chains. Blockchain creates unalterable records visible to all authorized parties, eliminating hidden agendas. A supply chain study reveals 77% of executives see this transparency as transformative for operational reliability.

Traceability extends beyond basic tracking. Organizations verify product origins within seconds, meeting strict regulations effortlessly. Pharmaceutical companies now follow ingredients from factory to pharmacy using distributed ledgers.

Shared data access reduces conflicts between partners. When all stakeholders view identical transaction histories, disputes drop by 43% in logistics sectors. This alignment streamlines processes while cutting resolution time.

Trust builds through verifiable actions, not promises. Immutable audit trails let customers confirm ethical sourcing claims instantly. Food producers using this approach report 68% higher consumer confidence ratings.

These advancements create competitive advantages beyond compliance. Organizations adopting ledger-based transparency gain faster partner onboarding and stronger investor relationships. The future belongs to businesses embracing open, traceable operations.

No comments yet