Entering the world of cryptocurrency trading can feel overwhelming. Markets move fast, and making smart choices is crucial. This guide provides the foundational knowledge you need to get started.

One of the most powerful tools for understanding market movements is the candlestick chart. These charts offer a visual snapshot of price action. They reveal the battle between buyers and sellers within a specific timeframe.

The concept has a rich history, dating back to 18th-century Japan. A rice trader named Munehisa Homma first used this method to track price patterns. His discovery laid the groundwork for modern technical analysis.

Digital asset markets have unique traits, like 24/7 operation and high volatility. These factors add important nuances to interpreting the data. Learning to decode these visual cues empowers you to spot trends and make informed decisions.

Key Takeaways

- Candlestick charts provide a clear picture of price movements and market sentiment.

- This visual analysis technique originated from historical Japanese rice trading.

- Cryptocurrency markets operate differently from traditional financial markets.

- Understanding these charts helps traders identify potential opportunities.

- This article offers a step-by-step approach to mastering chart interpretation.

Introduction to Crypto Candlestick Analysis

Visual charting methods form the foundation of effective trading strategies. These graphical tools help market participants interpret price movements and sentiment.

Overview of Crypto Trading Tools

Market examination relies on various analytical instruments. Candlestick displays stand out among these options. They offer comprehensive visual data through shapes and colors.

These graphical representations make sentiment interpretation significantly easier. Traders can quickly assess conditions and identify opportunities.

| Chart Type | Data Displayed | Best Use Case | Complexity Level |

|---|---|---|---|

| Line Charts | Closing prices only | Quick trend overview | Beginner |

| Bar Charts | OHLC data points | Detailed price analysis | Intermediate |

| Candlestick Charts | Full price action | Pattern recognition | All levels |

Importance of Chart Patterns in Decision Making

Pattern recognition serves a critical role in trading choices. Recurring formations historically indicate potential price movements. This helps identify optimal entry and exit points.

Specific candlestick formations enable anticipation of market reversals. They also signal continuations and consolidation periods. This transforms raw data into meaningful insights about buyer behavior.

Fundamentals of Candlestick Charts

Traders across centuries have sought methods to visualize price movements effectively. These graphical tools form the essential framework for market analysis.

History and Evolution of Candlestick Charts

This charting method originated in 18th-century Japan through rice trader Munehisa Homma. He discovered that plotting rice prices over time revealed predictive patterns.

Homma’s innovative system used bars representing price ranges during specific periods. This foundation evolved into modern candlestick analysis used globally today.

Understanding Open, High, Low, and Close Data

Each candlestick encapsulates four critical data points known as OHLC. The opening price establishes the session’s starting point.

The closing price reflects the period’s final consensus among traders. High and low values represent the extremes reached during the timeframe.

Timeframes and Their Significance in Crypto Trading

Time period selection dramatically impacts chart interpretation. Short-term charts capture minute-by-minute fluctuations for day traders.

Medium-term frames help swing traders identify multi-day price swings. Long-term charts reveal overarching trends for position traders.

Choosing the right timeframe filters market noise and aligns with specific trading objectives.

how to read crypto candlestick charts for beginners

Color interpretation forms the first layer of candlestick analysis. These visual cues provide immediate information about market direction during any timeframe.

Interpreting Candle Colors and Sizes

Green or white candles signal bullish periods. The closing price finishes higher than the opening price in these formations.

Red or black candles represent bearish movements. Here, the closing price falls below the session’s starting point.

Body length reveals intensity. Long bodies show strong buying or selling pressure. Short bodies indicate market indecision.

Step-by-Step Guide to Analyzing Price Movements

Begin by identifying your chart’s timeframe. This context determines the significance of observed patterns.

Examine individual candle characteristics first. Note the relationship between opening and closing values. Then study the body length for momentum clues.

Compare consecutive candles for trend identification. Sequences of similar colored candles suggest sustained momentum. Mixed colors may signal potential reversals.

Practical analysis combines single candle examination with pattern recognition. This approach transforms raw data into actionable trading insights.

Understanding Candlestick Anatomy

The anatomy of a candlestick reveals crucial information about price behavior and trader sentiment. Each component serves a specific purpose in conveying market dynamics.

Decoding the Candle Body and Its Meaning

The rectangular body represents the range between opening and closing prices. Its color provides immediate visual cues about market direction.

Green or hollow bodies indicate bullish sessions where closing prices exceeded opening values. Red or filled bodies show bearish periods with lower closes. The body’s length reflects the intensity of price movement during the period.

A tall body suggests strong buying or selling pressure. A small body indicates minimal price change and potential market indecision.

Exploring Wicks and Shadows for Trend Clues

Thin lines extending from the body are called wicks or shadows. They mark the highest and lowest prices reached during the trading session.

Long upper wicks show that buyers pushed prices up but sellers forced them back down. This often indicates resistance levels. Long lower wicks suggest sellers drove prices lower before buyers intervened, revealing potential support.

Short wicks demonstrate decisive movement with prices staying near session extremes. The relationship between body size and wick length offers additional insights into market conviction.

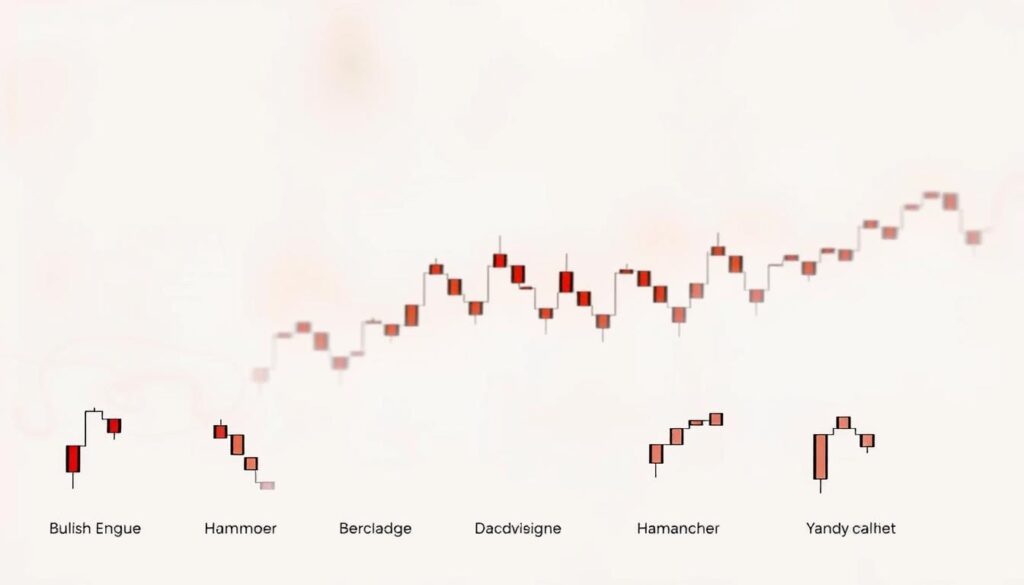

Identifying Common Candlestick Patterns

Recognizing recurring formations on price charts helps traders anticipate market movements. These visual arrangements provide clues about potential trend changes or continuations.

Bullish vs. Bearish Indicators

Bullish patterns typically emerge after price declines. They signal potential upward reversals. These formations indicate buying pressure overcoming selling momentum.

Bearish indicators appear during or after uptrends. They suggest sellers may gain control. This often precedes potential downward price movement.

| Pattern Type | Market Signal | Typical Location | Strength Indicator |

|---|---|---|---|

| Hammer | Bullish Reversal | Downtrend Bottom | Strong |

| Doji | Indecision/Reversal | Trend Extremes | Moderate |

| Engulfing | Strong Reversal | Trend Endings | Very Strong |

| Evening Star | Bearish Reversal | Uptrend Peak | Strong |

Reversal Patterns: Hammer, Doji, and Engulfing

The hammer shows a small body with a long lower wick. It appears at downtrend bottoms. This pattern suggests sellers drove prices down but buyers regained control.

Doji formations occur when opening and closing prices are nearly identical. They represent market indecision. At trend extremes, doji often signal potential reversals.

Engulfing patterns feature a large candle that completely covers the previous candle’s body. Bullish engulfing occurs during declines, while bearish engulfing appears in uptrends.

Continuation Patterns and What They Signal

Continuation patterns suggest the existing trend will persist. Unlike reversal formations, they confirm ongoing momentum.

These patterns include flags, pennants, and specific multi-candle arrangements. They typically appear during temporary pauses in strong trends.

Technical Indicators and Analysis Tools

Beyond basic candlestick patterns, quantitative tools offer deeper market insights. These mathematical indicators provide objective measurements that complement visual analysis. They help validate patterns and identify hidden opportunities.

Using Moving Averages and RSI for Confirmation

Moving averages smooth price data to reveal underlying trends. The Simple Moving Average calculates average closing prices over a specific period. Exponential Moving Averages give more weight to recent price movements.

When asset prices trade above their moving average, this suggests an uptrend. Prices below the average indicate potential downward momentum. The Relative Strength Index measures price movement speed and changes.

RSI values above 70 may signal overbought conditions. Readings below 30 often indicate oversold markets. These indicators help traders confirm candlestick patterns with statistical data.

Bollinger Bands and Volume Analysis in Trading

Bollinger Bands consist of three lines plotting volatility. The middle band is typically a 20-period Simple Moving Average. Upper and lower bands show standard deviations from this average.

Widening bands indicate increased market volatility. Contracting bands suggest calmer trading conditions. Volume analysis examines the number of units traded during each period.

High volume during price increases validates bullish trends. Significant volume during declines confirms bearish momentum. Volume spikes often precede major price movements.

Combining Indicators for Enhanced Accuracy

Experienced traders combine complementary tools for better results. Moving averages with volume analysis create robust trend confirmation. RSI with Bollinger Bands helps identify potential reversal points.

Proper indicator selection avoids conflicting signals. Traders adapt their combinations to match current market conditions. This multi-layered approach transforms raw data into actionable trading intelligence.

Advanced Charting Techniques for Crypto Trading

Sophisticated traders often employ mathematical tools to enhance their market analysis beyond basic pattern recognition. These advanced methods provide deeper insights into potential price levels and trend dynamics.

Implementing Fibonacci Retracement Levels

Fibonacci retracement applies mathematical ratios to identify potential support and resistance zones. Traders draw these levels between significant swing highs and lows on their charts.

Key ratios like 38.2% and 61.8% often mark where price pullbacks might stall. This helps market participants anticipate potential entry points during trend movements.

However, cryptocurrency volatility can challenge traditional Fibonacci analysis. Prices may move beyond standard levels more frequently than in traditional markets.

Exploring the Ichimoku Cloud Method

The Ichimoku Cloud offers a comprehensive view of trend direction and momentum. This Japanese indicator displays multiple data points simultaneously through a distinctive cloud formation.

When prices trade above the cloud, this signals a bullish trend. Positions below the cloud indicate bearish conditions. The cloud itself acts as dynamic support or resistance.

For deeper insights into these advanced methods, explore our comprehensive guide on crypto chart interpretation. Mastering these techniques requires practice but can provide significant analytical advantages.

Practical Trading Strategies and Tips

Developing effective strategies requires moving beyond pattern recognition to practical application. These methods help traders transform chart analysis into consistent results.

Successful approaches combine technical signals with disciplined execution. They focus on high-probability setups while managing exposure.

Identifying Trends and Market Sentiment

Trend identification begins with examining sequences of candles over specific time periods. Consecutive green candles suggest bullish momentum with buyers in control.

Series of red candles indicate bearish trends dominated by sellers. The relationship between opening and closing prices reveals immediate sentiment.

Large-bodied candles reflect strong directional conviction. Small bodies show uncertainty between market forces. This information helps gauge the strength of movements.

Risk Management and Informed Decision Making

Risk management forms the foundation of sustainable trading. Set predetermined stop-loss levels before entering any position.

Establish clear profit targets and position sizing guidelines. Even reliable patterns can produce losing trades due to market unpredictability.

Combine candlestick analysis with volume confirmation for better decisions. High trading volume validates pattern strength and trader participation.

Focus on mastering one or two patterns initially. This avoids analysis paralysis while building confidence in your approach.

Conclusion

Market participants who master visual price analysis techniques gain valuable insights into asset behavior. This comprehensive guide has explored essential concepts from basic candlestick anatomy to advanced technical analysis methods.

Understanding these visual patterns helps traders interpret market sentiment and anticipate potential future price movements. However, these formations represent probabilities rather than guarantees.

Successful application requires combining candlestick patterns with complementary tools and sound risk management. Consistent practice transforms this knowledge into confident trading decisions.

Mastery develops through sustained effort, empowering traders to navigate dynamic markets with greater precision.

FAQ

What is the main difference between a bullish and a bearish candlestick?

A bullish candlestick typically has a closing price higher than its opening price, often shown as white or green. A bearish candlestick has a closing price lower than its opening price, usually displayed as black or red. The body of the candle represents this price range.

How can I identify a potential trend reversal using candlestick patterns?

Look for specific reversal patterns like the bullish engulfing or bearish engulfing pattern. These occur when a large candle’s body completely engulfs the previous candle’s body, signaling a potential shift in market momentum. The Hammer and Doji are also key reversal indicators.

Why are wicks or shadows important on a candlestick chart?

Wicks show the highest and lowest prices reached during a specific time period. Long wicks indicate strong price rejection at those levels, providing clues about support and resistance. This information is vital for understanding the full price range and market sentiment.

What time period should a beginner use for their candlestick charts?

Beginners often start with longer timeframes, like the 4-hour or 1-day chart, to identify clearer trends and major patterns. Shorter timeframes, such as 15-minute or 1-hour charts, show more noise and are better suited for experienced traders analyzing quick price movements.

How do I use technical analysis with candlestick patterns?

Candlestick patterns are most powerful when combined with other technical analysis tools. Use indicators like moving averages or the Relative Strength Index (RSI) to confirm the signals from patterns like the engulfing pattern. This combination helps validate potential future price movements.

What does a Doji candlestick pattern signify?

A Doji has a very small body, meaning the opening and closing prices are almost identical. This pattern indicates market indecision and can signal a potential trend reversal, especially when it appears after a strong uptrend or downtrend.

No comments yet