Navigating the fast-paced world of digital assets requires reliable tools. Technical analysis provides a framework for understanding market movements. Among the most respected methods is the application of Fibonacci ratios.

This mathematical concept helps identify potential support and resistance levels on a price chart. It measures the distance between significant highs and lows. Then, it applies key ratios to predict where prices might pause or reverse.

The volatile nature of cryptocurrency markets makes these tools particularly valuable. They offer a structured way to analyze chaotic price action. For a deeper look at the foundations, this beginner’s guide to Fibonacci in crypto is an excellent resource.

This article will walk you through the entire process. You will learn the mathematical foundations and see practical, step-by-step applications. We will also cover advanced strategies and crucial risk management techniques.

While it may seem complex at first, this skill is very learnable. Combining this tool with other analysis methods creates a powerful trading approach. It’s about making informed decisions, not relying on a single indicator.

Key Takeaways

- Fibonacci retracement is a technical analysis tool based on key mathematical ratios.

- It helps identify potential support and resistance levels on price charts.

- This method is especially useful in volatile markets like cryptocurrency.

- The tool works by measuring the distance between significant price points.

- Successful application requires combining it with other analysis techniques.

- Proper risk management is essential when using any trading strategy.

Introduction to Fibonacci and Its Impact on Crypto Trading

Mathematical sequences found throughout nature provide valuable insights for market analysis. These universal patterns extend their influence to price movements across various financial markets.

Background of Fibonacci in Mathematics and Nature

Leonardo Pisano, known as Fibonacci, discovered this remarkable number pattern in the 13th century. The Fibonacci sequence begins with 0 and 1. Each subsequent number equals the sum of the previous two numbers.

This creates the progression: 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, and so on. The sequence appears throughout nature in spiral shells, flower petal arrangements, and tree branching patterns.

Relevance to Cryptocurrency Markets

Cryptocurrency markets display the same mathematical patterns found in traditional finance. The inherent volatility creates frequent opportunities to apply Fibonacci analysis.

Price swings regularly establish clear highs and lows. These levels become significant for many traders watching the same Fibonacci ratios.

Understanding this mathematical foundation builds confidence in applying these tools. The widespread adoption contributes to their effectiveness across global markets.

Understanding Fibonacci Ratios and the Golden Ratio

At the heart of this analysis lie specific percentages that traders watch closely on their charts. These values are not random. They are derived directly from the mathematical properties of the sequence itself.

Key Fibonacci Numbers and Their Meaning

Dividing a number in the sequence by its successor reveals a fascinating pattern. For example, 21 divided by 34 equals approximately 0.6176. This calculation consistently produces a value near 0.618, known as the golden ratio.

Further divisions yield other critical percentages. Dividing a number by the value two places ahead gives roughly 0.382, or 38.2%. The next calculation produces the 23.6% level.

Traders also include the 50% level. This midpoint is a strong psychological area, even though it does not come from the original sequence. It often acts as a significant support or resistance zone.

The Role of the Golden Ratio (0.618) in Trading

The 0.618 value holds special significance. Its inverse, 1.618, is found by dividing a number by its predecessor. This pair of numbers forms a harmonious relationship seen throughout nature and art.

In market analysis, the 61.8% level is frequently where major price reversals occur. Traders often refer to this zone as the “golden pocket” due to its high probability of causing a trend change.

| Retracement Level | Mathematical Origin | Typical Market Behavior |

|---|---|---|

| 23.6% | Derived from sequence division | Shallow pullback; often a minor pause |

| 38.2% | Derived from sequence division | Moderate retracement; potential reversal point |

| 50.0% | Psychological midpoint (added by traders) | Significant consolidation or reversal area |

| 61.8% (Golden Ratio) | Dividing a number by its successor (~0.618) | Strong support/resistance; high reversal probability |

| 78.6% | Square root of 0.618 | Deep retracement; often the last stop before trend continuation |

Understanding these ratios provides a framework for anticipating price movements. Each level offers a potential decision point for market participants.

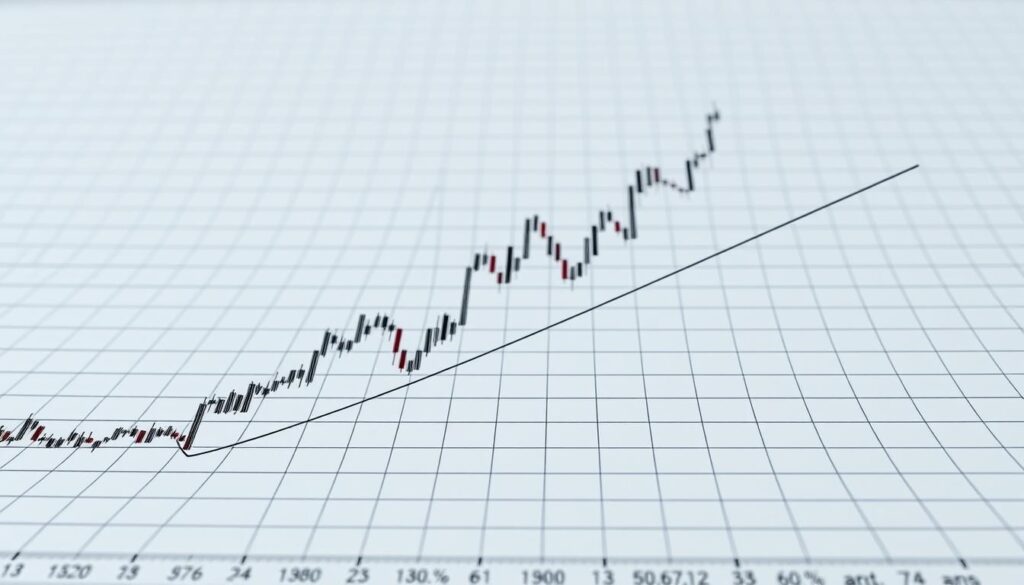

Fundamentals of Technical Analysis in Crypto Trading

The foundation of successful trading lies in interpreting price movements through established principles. Technical analysis examines historical data to forecast future market direction. This approach relies on the idea that price action reflects all available information.

Markets naturally move in waves rather than straight lines. Strong trending moves are typically followed by corrective periods. Identifying these cycles helps traders time their entries and exits effectively.

Identifying Support and Resistance Using Price History

Support and resistance form the backbone of chart analysis. Support represents price levels where buying interest becomes strong enough to halt declines. Resistance occurs where selling pressure prevents further price increases.

These levels emerge from psychological barriers in the market. Traders remember previous highs, lows, and consolidation zones. When price approaches these areas again, they often act as natural barriers.

Mathematical tools enhance traditional support and resistance analysis. They provide objective levels even when clear historical zones aren’t visible. This approach quantifies natural market rhythm at specific price points.

Multiple timeframe analysis adds depth to this process. Levels on daily charts carry more weight than those on hourly timeframes. Combining methods creates a more robust trading framework.

Effective technical analysis integrates various approaches rather than relying on single indicators. Price action, volume, and mathematical tools work together. This comprehensive method is particularly valuable in volatile markets.

How to Use Fibonacci Retracement in Crypto Trading

Strategic entry and exit points become clearer when applying objective mathematical frameworks. This approach brings structure to volatile price movements.

Step-by-Step Guide to Applying the Tool

Begin by identifying significant swing highs and lows on your chart. These represent the extreme points of a price movement.

For instance, if Bitcoin moves from $10,000 to $20,000, then pulls back, you would draw from the $10,000 low to the $20,000 high. The software automatically calculates key percentage levels.

These calculated zones often act as psychological barriers. Market participants watch these areas for potential reversals or continuations.

Common Mistakes and How to Avoid Them

Many beginners select insignificant price points or ignore the broader trend context. This reduces the effectiveness of the analysis.

Always choose the most obvious swing points on your timeframe. Combine this method with other technical signals for confirmation.

| Common Error | Impact | Solution |

|---|---|---|

| Selecting minor swings | Reduces level significance | Choose major, clear price extremes |

| Treating levels as exact prices | Misses zone-based opportunities | View levels as areas of interest |

| Ignoring trend direction | Conflicts with market momentum | Align with higher timeframe trend |

| No confirmation signals | Increases false entry risk | Wait for candlestick or volume confirmation |

The flexibility of this approach allows adaptation to various trading styles. Practice develops the judgment needed for consistent application.

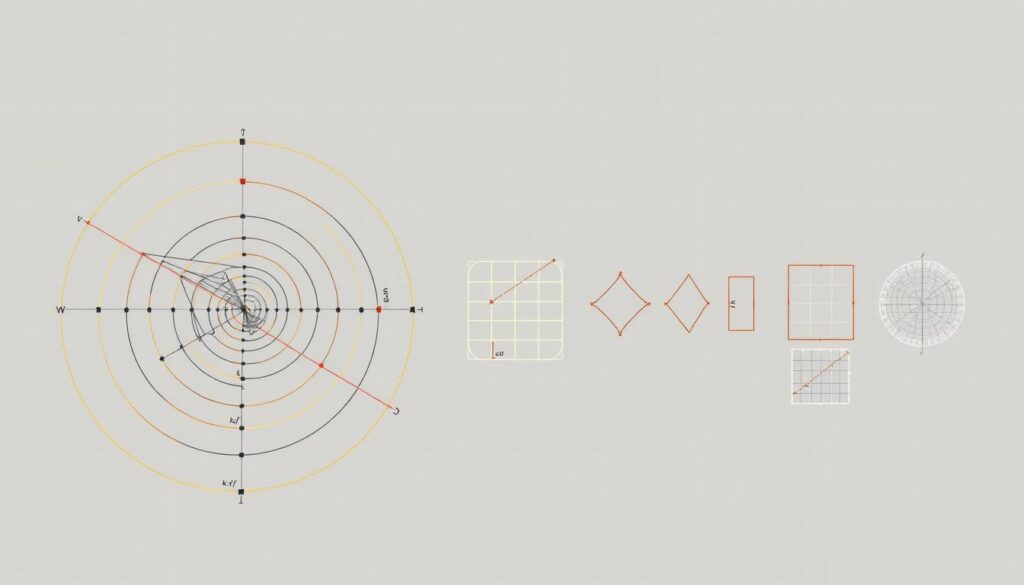

Drawing and Setting Up Fibonacci Tools on Your Chart

Implementing technical indicators begins with mastering the drawing tools available on your trading platform. Most charting software includes built-in Fibonacci functions that streamline the process.

Selecting Relevant Swing Highs and Lows

Choosing the correct price extremes is crucial for accurate analysis. Look for clear reversal points where the market direction changed significantly.

Major trend changes create the most reliable swing points. Avoid selecting minor fluctuations within consolidation patterns.

| Charting Platform | Tool Access Method | Keyboard Shortcut |

|---|---|---|

| TradingView | Drawing toolbar → Fibonacci | Alt + F |

| Exchange Native Charts | Indicators menu → Drawing tools | Varies by platform |

| GoodCrypto | Analysis tools → Fibonacci retracement | Customizable |

Utilizing Charting Platforms and Tools

Platforms like TradingView offer intuitive interfaces for technical analysis. The Fibonacci retracement tool is typically found in the drawing tools section.

For uptrends, click at the swing low and drag to the swing high. Downtrends require the opposite approach. This ensures proper level calculation.

Most applications allow adjustment of anchor points after initial placement. This flexibility helps refine your analysis as you gain experience.

Exploring Fibonacci Extensions and Their Applications

Beyond identifying pullback zones, Fibonacci analysis offers a powerful method for projecting future price objectives. Extensions help traders visualize where a trend might conclude after a retracement.

This tool complements the foundational principles of Fibonacci retracement levels for cryptocurrency price.

Projecting Future Price Levels

Applying extensions requires three clear points on a chart. Identify the initial swing low (Point A), the subsequent swing high (Point B), and the retracement low (Point C).

The tool then calculates potential targets beyond Point B. Common extension levels include 161.8%, 200%, and 261.8%.

For example, if Ethereum moves from $1,000 (A) to $2,000 (B), then pulls back to $1,500 (C), the 161.8% extension projects a price target near $2,618.

Integrating Extensions with Retracement Levels

These two tools create a complete trading framework. Retracements identify potential entry points during a pullback. Extensions then provide logical exit targets for the trend’s continuation.

This integration is especially valuable in cryptocurrency markets. Assets often make explosive moves into uncharted price territory.

| Tool | Primary Function | Key Levels | Market Context |

|---|---|---|---|

| Retracement | Measures pullback depth within a trend | 38.2%, 50%, 61.8% | Corrective phases |

| Extension | Projects trend continuation targets | 161.8%, 200%, 261.8% | Impulsive wave movements |

Extensions provide mathematical projections where historical resistance is absent. They help traders manage expectations in highly volatile conditions.

Advanced Fibonacci Patterns and Trading Strategies

Sophisticated traders often employ multi-point patterns that integrate various Fibonacci levels for enhanced precision. These advanced formations create confluence zones where multiple mathematical relationships align.

Understanding ABCD, Gartley, and Butterfly Patterns

Advanced patterns fall into three main categories based on their complexity. Four-point structures like the ABCD pattern establish symmetrical price movements. Five-point formations such as Gartley and butterfly patterns incorporate deeper mathematical relationships.

Each pattern type offers distinct advantages for market analysis. The increased number of validation points enhances reliability. These formations help identify high-probability reversal zones.

| Pattern Type | Key Points | Primary Function | Complexity Level |

|---|---|---|---|

| ABCD Pattern | Four critical price points | Symmetrical reversal identification | Intermediate |

| Gartley Pattern | Five validation points | Precise entry zone targeting | Advanced |

| Butterfly Pattern | Extended price movements | Trend exhaustion detection | Expert |

Using Multiple Points to Enhance Trade Entries

Multi-point strategies significantly improve entry accuracy. They provide multiple confirmation signals before execution. This approach reduces false signals and enhances risk management.

The strategic integration of various pattern types creates robust trading frameworks. Each additional validation point increases confidence in market direction. This methodology represents a sophisticated approach to technical analysis.

Integrating Fibonacci with Other Technical Indicators

The true power of technical analysis emerges when multiple tools confirm the same market direction. Combining mathematical levels with traditional chart patterns creates stronger trading signals.

Trend lines and moving averages provide excellent confirmation for Fibonacci zones. When price approaches a key level while touching a major trend line, the confluence strengthens the signal.

Combining Trend Lines, Moving Averages, and Oscillators

Different indicators serve distinct purposes in market analysis. Trend tools establish directional bias, while momentum oscillators time entry points.

The 200-day moving average often aligns with significant Fibonacci retracement levels. This combination creates powerful support or resistance zones.

Oscillators like RSI and MACD add momentum confirmation. Oversold RSI readings at Fibonacci support levels increase reversal probability.

| Indicator Type | Primary Function | Fibonacci Integration |

|---|---|---|

| Trend Lines | Direction confirmation | Confluence at retracement levels |

| Moving Averages | Dynamic support/resistance | Alignment with key percentages |

| RSI/MACD | Momentum measurement | Divergence at reversal zones |

| Volume Analysis | Confirmation strength | Spikes at level interactions |

Enhancing Risk Management and Trade Confirmation

Multi-timeframe analysis adds another layer of confirmation. Check Fibonacci levels across daily and hourly charts for alignment.

This integrated approach improves risk management significantly. Requiring multiple signals reduces false entries from single-indicator reliance.

Effective strategies use 2-3 complementary tools alongside mathematical levels. This balance provides confirmation without analysis paralysis.

Conclusion

Effective market participation combines mathematical precision with disciplined execution. The principles explored throughout this guide offer a structured approach to analyzing price movements.

These mathematical tools help identify key zones where market direction may change. They provide objective reference points amid market volatility.

Remember that no single method guarantees success. The most effective trading strategies integrate multiple analytical approaches. Combine these tools with sound risk management practices.

Always consider broader market context before making decisions. Practice on historical charts to build confidence in applying these concepts.

The journey toward proficiency requires patience and consistent application. With dedication, these techniques can enhance your analytical capabilities in dynamic markets.

FAQ

What is the most important Fibonacci ratio for crypto trading?

The 61.8% level, known as the golden ratio, is often the most significant. It frequently acts as strong support or resistance in cryptocurrency markets.

Can Fibonacci retracement tools predict exact price targets?

No, these tools do not predict exact targets. They identify potential reversal zones based on mathematical patterns. Traders use these levels to find high-probability areas for price action.

Which charting platforms offer built-in Fibonacci drawing tools?

Popular platforms like TradingView, Binance, and Coinbase Advanced Trade include these tools. They allow traders to easily plot levels on their charts for analysis.

How do I choose the correct swing high and low points?

Select the most recent significant peak and trough that define a clear price move. The high should be a prominent top, and the low a distinct bottom before a trend change.

Should Fibonacci retracement be used alone for trading decisions?

A> It is best combined with other technical indicators. Using tools like RSI, moving averages, or volume analysis alongside Fibonacci levels provides stronger trade confirmation.

What are Fibonacci extensions used for in a trading strategy?

Extensions project potential profit targets beyond the initial price swing. They help traders identify where a trend might continue, useful for setting take-profit orders.

Are these patterns reliable in the highly volatile crypto market?

They can be effective, but volatility requires careful application. Using wider timeframes, like the 4-hour or daily chart, often yields more reliable signals than shorter ones.

No comments yet