As digital networks grow more complex, the challenge of handling increasing transaction volumes becomes critical. Many distributed ledger systems face significant bottlenecks that limit their practical applications. This is where architectural approaches come into play to enhance performance.

The technology operates on different architectural levels, each serving distinct purposes in achieving network efficiency. The base protocol represents the foundation, while additional frameworks built on top handle specific tasks. Understanding this layered approach is essential for grasping how modern systems address limitations.

This distinction matters greatly for developers, investors, and daily users who interact with these networks. Different architectural choices impact transaction speed, cost, and overall system capabilities. The evolution of this technology has made scalability one of the most pressing challenges facing the industry today.

Key Takeaways

- Architectural layers serve different purposes in improving network performance

- The base protocol forms the foundation of the system

- Additional frameworks handle specific tasks to reduce main network load

- Scalability remains a critical challenge for distributed ledger technology

- Understanding different architectural approaches helps evaluate system capabilities

- These distinctions impact transaction speed, cost, and practical applications

- Both developers and users benefit from understanding layered architectures

Introduction to Blockchain Scaling Challenges

Digital ledger platforms face a pressing issue as user numbers grow: the inability to scale transaction throughput effectively. This fundamental constraint affects everyone interacting with these systems.

The Need for Scalability

Traditional payment processors handle thousands of transactions every second. In contrast, major digital ledgers manage only a fraction of this volume. This performance gap creates significant bottlenecks.

When network activity increases, users experience slower processing times and higher fees. These challenges create barriers to mainstream adoption. The entire ecosystem feels the impact of these limitations.

Security and Decentralization Considerations

The blockchain trilemma represents a core challenge for this technology. It describes the balance between three essential attributes: security, decentralization, and scalability.

Security and decentralization form the foundation of distributed networks. They cannot be compromised when seeking scalability improvements. This creates the need for innovative architectural approaches that maintain these core values.

Different architectural layers have emerged to address these scaling challenges while preserving security. Each approach offers unique advantages for specific use cases and requirements.

Understanding Layer 1 Blockchains: Architecture and Security

At the core of every distributed ledger system lies the foundational protocol that governs its entire operation. These base protocols process and validate transactions directly on their native networks.

Major examples include Bitcoin and Ethereum. Each maintains its own distinct architectural approach to data structure and node communication.

Role of Consensus Mechanisms

Consensus protocols determine how transactions gain validation across the network. Bitcoin uses Proof of Work, requiring significant computational effort.

This method provides robust security but faces processing limitations. Ethereum transitioned to Proof of Stake in 2022, dramatically improving efficiency.

The new approach validates blocks based on staked collateral rather than energy-intensive calculations. This maintains security while enhancing performance.

Real-World Examples & Limitations

Base layer protocols face inherent constraints that impact their practical use. These limitations include:

- Restricted transaction throughput during peak demand

- Higher processing costs when network activity increases

- Challenges implementing protocol changes requiring broad consensus

Security remains paramount since vulnerabilities could compromise the entire system. This necessity often limits scalability improvements at the foundational level.

Deep Dive into layer 1 vs layer 2 blockchain solutions explained

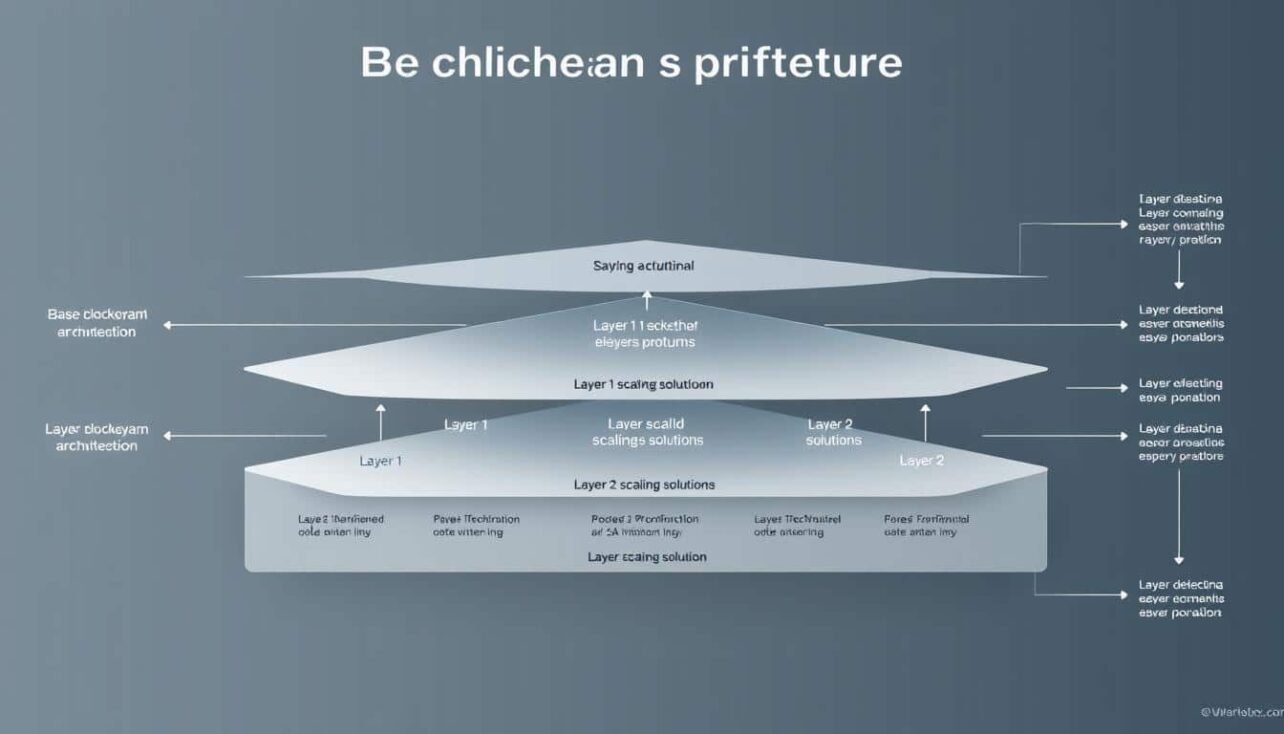

Understanding the hierarchical relationship between base protocols and additional frameworks is essential for grasping modern scaling solutions. These architectural approaches address network limitations through different implementation strategies.

The foundational level represents the core protocol where all transactions receive final validation. Supplementary frameworks operate above this base level to enhance performance.

Primary Features of Layer 1 Solutions

Base protocol modifications directly alter the fundamental rules of the network. These changes require broad consensus among participants.

Common enhancements include consensus mechanism upgrades and sharding implementations. These improvements permanently increase the main chain’s processing capacity.

Functionality and Advantages of Layer 2 Integrations

Secondary frameworks process transactions outside the main network before submitting summarized data for final settlement. This approach dramatically reduces congestion.

These integrations maintain security by inheriting protection from the underlying protocol. Multiple solutions can operate simultaneously, each optimized for specific applications.

| Feature | Base Protocol Modifications | Supplementary Frameworks |

|---|---|---|

| Implementation Scope | Network-wide changes | External additions |

| Transaction Processing | Direct on-chain validation | Off-chain with periodic settlement |

| Security Model | Native protocol security | Inherited from base layer |

| Flexibility | Requires consensus | Multiple simultaneous options |

Exploring Layer 2 Scaling Solutions and Their Role in Efficiency

Efficiency-focused architectures operate alongside base protocols to dramatically improve user experience. These supplementary frameworks handle heavy processing loads while maintaining security through their connection to the main network.

Case Studies: Lightning Network and Rollups

The Lightning Network creates payment channels for Bitcoin users. Multiple transactions occur within these channels before final settlement.

Rollups bundle thousands of transactions into single batches. This approach significantly reduces congestion on the primary chain.

Smart Contracts and Off-Chain Processing

Automated contracts manage complex off-chain operations. They enable rapid processing while preserving security guarantees.

Additional architectures include nested systems and state channels. Each solution offers unique advantages for specific applications.

| Solution Type | Primary Function | Transaction Speed |

|---|---|---|

| Payment Channels | Off-chain micropayments | Instant settlement |

| Rollup Technology | Batch processing | High throughput |

| Nested Systems | Delegated processing | Scalable execution |

Developers continue expanding these capabilities. The growing ecosystem ensures broader adoption across various use cases.

Comparative Analysis: Balancing Scalability, Speed, and User Experience

Choosing between foundational protocols and supplementary frameworks involves significant trade-offs across several performance metrics. Each approach delivers distinct advantages for different use cases and requirements.

Pros and Cons of Both Approaches

Base networks offer maximum security through direct on-chain validation. They maintain true decentralization without external dependencies. However, these systems face constrained capacity during high demand periods.

Elevated processing costs and slower speeds create challenges for users. Supplementary frameworks dramatically improve transaction capacity and reduce fees. They maintain protection through their connection to the underlying system.

Technical complexity and potential centralization concerns represent notable drawbacks. Understanding these scalability differences helps users select appropriate solutions.

Impact on Transaction Fees and Network Throughput

Base protocol costs fluctuate significantly based on network demand. Users often experience fee spikes during congestion periods. This creates accessibility issues for smaller-value transactions.

Supplementary frameworks reduce expenses by orders of magnitude. Their approach enables micro-payments and high-frequency trading. Throughput multiplies as processing occurs outside the main chain.

User experience improves with predictable costs and faster confirmation times. Both individual users and enterprise applications benefit from these efficiency gains.

Conclusion

Rather than competing approaches, the future of digital ledger systems lies in complementary strategies working in harmony. Both foundational protocols and supplementary frameworks address the core challenges facing modern networks.

Users and developers benefit from understanding how different architectural levels serve distinct purposes. Some applications demand maximum security through direct on-chain validation. Others prioritize speed and reduced costs through off-chain processing.

The technology continues to evolve through innovation at multiple levels. This ensures the entire ecosystem can scale effectively while maintaining essential principles. The most successful implementations will seamlessly integrate improvements across the architecture.

FAQ

What is the main difference between a Layer 1 and a Layer 2 blockchain?

The core difference lies in their function. A Layer 1 is the base network, like Bitcoin or Ethereum, that provides foundational security and consensus. A Layer 2 is a secondary framework built on top of a Layer 1 to enhance its scaling and efficiency by handling transactions off the main chain.

Why are Layer 2 solutions necessary for networks like Ethereum?

As user adoption grows, base layer networks can become congested, leading to slow processing times and high transaction fees. Layer 2 solutions are essential to increase throughput, reduce costs, and improve the overall user experience without compromising the security of the underlying blockchain.

How do Layer 2 solutions maintain the security of the base Layer 1 chain?

Most Layer 2 technologies, such as rollups, periodically publish compressed transaction data back to the main Layer 1 blockchain. This allows the base layer to act as a secure anchor, ensuring the validity of off-chain activity and preserving decentralization.

Can you give an example of a Layer 2 solution in use today?

A prominent example is the Lightning Network for Bitcoin. It enables instant, low-cost payments by creating private payment channels between users. Another is Arbitrum, an Ethereum rollup that helps smart contracts scale by processing computations off-chain.

Do Layer 2 solutions work with smart contracts?

Yes, many are specifically designed for smart contracts. Solutions like Optimistic and ZK-rollups can execute complex contracts off-chain, bundling the results before submitting them to the mainnet. This drastically boosts efficiency for decentralized applications (dApps).

What are the trade-offs when choosing between Layer 1 and Layer 2?

Layer 1 offers maximum security and decentralization but can face scaling challenges. Layer 2 provides greater speed and lower costs but adds complexity to the ecosystem. The choice depends on the specific needs for throughput, user experience, and security.

No comments yet