Navigating the fast-paced world of digital assets requires more than luck. Understanding value trends helps investors make smarter choices in a space where prices shift rapidly. This guide breaks down how evaluating a crypto project’s total worth influences price behavior and long-term potential.

Digital currencies vary widely in size and stability. Larger projects often show less volatility, while smaller ones may offer growth opportunities. By studying these patterns, traders can identify which assets align with their risk tolerance and goals.

Metrics like total circulating supply and trading volume play key roles in assessing value. These factors shape how professionals and casual traders approach buying, selling, or holding specific coins. We’ll explore practical strategies for using this data to spot emerging trends before they dominate headlines.

Key Takeaways

- Market cap reflects a crypto project’s total value and relative position in the industry

- Larger-cap assets typically demonstrate more price stability than smaller counterparts

- Combining market cap data with trading volume improves investment decision accuracy

- Historical patterns help predict potential price ceilings and floors

- Regular analysis helps distinguish short-term fluctuations from meaningful trends

Understanding the Cryptocurrency Landscape

The digital finance revolution has rewritten the rules of value exchange, creating a dynamic ecosystem of over 9,000 cryptoassets. From Bitcoin’s peer-to-peer network to Ethereum’s smart contracts, these innovations span social, technological, and economic domains. At its 2021 peak, this space achieved a combined worth of $2 trillion – equivalent to the GDP of Italy.

What Beginners Need to Know

Digital currencies serve multiple purposes beyond simple transactions. Utility tokens power blockchain applications, while stablecoins like Tether mirror traditional assets. Recognizing these differences helps investors match projects to their financial goals.

| Asset Type | Primary Use | Example |

|---|---|---|

| Payment Coin | Digital cash | Bitcoin |

| Platform Token | Smart contracts | Ethereum |

| Stablecoin | Price stability | Tether |

Importance of Market Data in Digital Currencies

Real-time metrics separate speculation from strategic moves. Trading volume patterns reveal liquidity, while price history exposes volatility cycles. Unlike stock exchanges, crypto platforms never close – creating unique data streams that require constant monitoring.

Reliable information helps identify emerging opportunities. For instance, sudden spikes in a token’s activity often precede major price shifts. Combining multiple data points gives clearer signals than chasing single metrics.

What is Market Capitalization? A Beginner’s Overview

Grasping the basics of crypto valuation starts with one key metric. Market cap measures a digital asset’s total worth by multiplying its current price by all circulating coins. This simple formula reveals whether a $1 token with 10 million supply holds more value than a $100 coin with 50,000 available.

| Token | Price Per Coin | Circulating Supply | Total Value |

|---|---|---|---|

| AlphaCoin | $2.00 | 3 million | $6 million |

| BetaToken | $150 | 40,000 | $6 million |

| GammaCoin | $0.50 | 12 million | $6 million |

Though prices vary wildly, these projects share identical market caps. This comparison exposes why judging assets solely by coin price misleads investors. A low-cost token with massive supply could dominate its niche, while expensive coins might represent niche products.

Projects get classified by size for smarter investing. Giants like Bitcoin ($1.2 trillion cap) anchor portfolios, while smaller coins (

Foundations of Market Capitalization Analysis

Evaluating digital assets demands a clear grasp of supply dynamics. Two critical metrics shape how professionals assess value: circulating supply and fully diluted supply. These concepts determine whether a project’s current worth reflects its true potential or future risks.

Token Availability Today vs Tomorrow

Circulating supply counts coins actively traded right now. This number directly impacts price movements – fewer available tokens often mean higher volatility. For example, Bitcoin’s 19.5 million mined coins (of 21 million max) create scarcity that influences its $1.2 trillion valuation.

| Metric | Definition | Impact | Example |

|---|---|---|---|

| Circulating | Coins in active circulation | Current liquidity & price | ETH: 120 million |

| Fully Diluted | Total possible coins | Future valuation | BTC: 21 million cap |

Calculating Future Valuation

Fully diluted supply reveals a project’s maximum scale. This figure assumes all coins will eventually enter circulation. Assets with large gaps between current and max supply face potential price pressure as new tokens release.

Smart investors compare both metrics. A coin with 50 million circulating but 200 million max supply might lose value as more tokens emerge. Projects like Litecoin maintain predictable release schedules to minimize surprises.

Market Capitalization Analysis and Its Impact on Cryptocurrency Prices

Digital asset valuation hinges on understanding how collective worth shapes price trajectories. Projects with larger valuations often maintain steadier pricing through higher liquidity and diversified ownership. This stability attracts institutional players, creating self-reinforcing cycles that boost credibility and reduce wild swings.

Rankings based on total value act as psychological triggers for traders. When a coin climbs into the top 10 by valuation, increased visibility often sparks buying sprees. Conversely, drops in standing may trigger sell-offs as investors question long-term viability.

Monitoring valuation thresholds helps anticipate momentum shifts. Assets approaching round-number milestones like $50 billion frequently face resistance or breakthroughs. These patterns hold across market cycles, offering clues about potential reversals.

Sector-wide movements frequently mirror leaders’ performance. Dominant projects set the tone during rallies or corrections, with smaller tokens following their directional cues. Savvy traders use these relationships to gauge broader sentiment shifts before committing funds.

Key Metrics in Crypto Market Analysis

Smart traders rely on specific measurements to cut through market noise. These tools reveal whether price changes reflect real demand or temporary hype. Three factors stand out when evaluating digital opportunities.

Price, Volume, and Market Trends

Volume confirms price direction. A surge in buying activity with rising prices suggests strong conviction. Conversely, price jumps with low activity often precede corrections.

| Scenario | Volume Level | Likely Outcome |

|---|---|---|

| Price Up | High | Sustained Growth |

| Price Down | Low | False Signal |

| Price Flat | Spiking | Breakout Imminent |

Social sentiment data adds context to these patterns. Platforms like Twitter and Reddit often buzz before major moves.

Asset Growth and Investor Stability

Long-term value creation shows in two ways:

- Consistent expansion of user base

- Steady increase in network activity

Projects with concentrated ownership (few large holders) face higher volatility. Decentralized distributions indicate healthier ecosystems. Tools like Nansen track wallet movements to spot accumulation phases.

Time-tested assets often develop loyal communities. These groups buffer against panic selling during downturns. Combining these signals helps separate flashy projects from enduring ones.

Assessing Risk and Volatility in Cryptocurrencies

Managing risk in crypto investments demands more than gut feelings—it requires decoding how valuation shifts affect portfolio safety. Market cap acts as a compass in this stormy environment, showing whether price swings stem from real growth or temporary hype.

Understanding Valuation Swings

Price changes tell only half the story. A token’s circulating supply can amplify or soften volatility. Projects with limited availability often see sharper moves when demand shifts.

| Market Cap Size | Average Daily Price Swing | Liquidity Level | Risk Profile |

|---|---|---|---|

| Large Cap ($10B+) | 2-5% | High | Moderate |

| Mid Cap ($1B-$10B) | 6-12% | Medium | Elevated |

| Small Cap ( | 15-30% | Low | High |

Large-cap assets like Bitcoin absorb big trades without major price disruptions. Smaller projects? A single whale’s move can erase 20% of value in hours.

Smart investors track supply changes alongside price. New token releases often depress values, while buybacks can signal confidence. These dynamics separate lasting projects from pump-and-dump schemes.

Risk management starts with recognizing patterns. Stable coins in the top 50 by valuation rarely drop out overnight. Volatile newcomers? Their rankings shift like desert sands—fast and unpredictable.

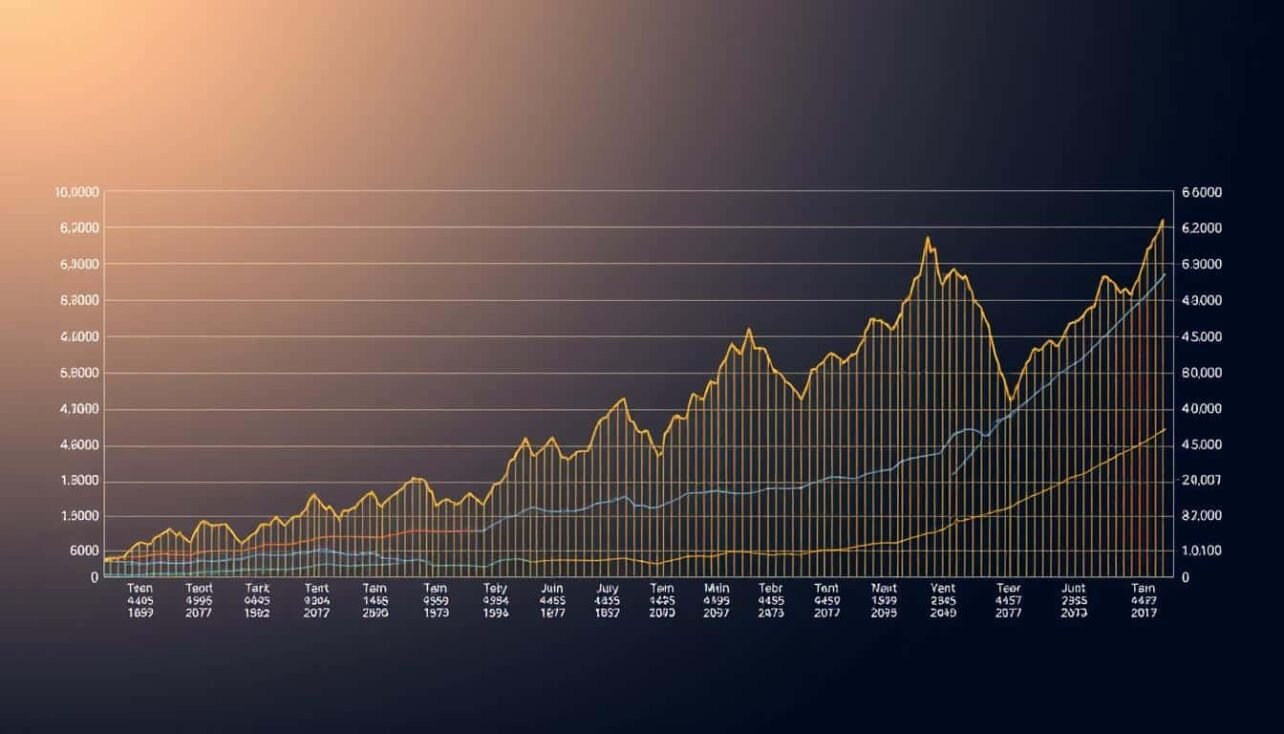

The Role of Market Trends and Timing

Timing trades in crypto requires recognizing how different asset classes behave during market cycles. Large-cap tokens often stabilize first after downturns, creating a foundation for broader rallies. Mid and small-cap alternatives typically gain momentum later as investor confidence grows.

Seasoned traders watch capital rotation patterns between valuation tiers. When Bitcoin dominance declines, funds frequently flow into alternative coins. This shift signals changing risk appetites and potential opportunities in smaller projects.

| Cap Size | Typical Cycle Phase | Average Price Swing | Common Strategy |

|---|---|---|---|

| Large ($10B+) | Early Recovery | ±4% | Accumulation |

| Mid ($1B-$10B) | Growth Expansion | ±9% | Momentum Trading |

| Small ( | Late Bull Run | ±18% | Profit-Taking |

Effective timing combines multiple indicators. Traders using understanding crypto valuations alongside volume analysis achieve better entry points. Historical data shows altcoins frequently peak 6-8 weeks after major Bitcoin rallies.

Current market phases dictate optimal approaches. During corrections, large caps often preserve value better. Bull markets reward strategic shifts to growth-oriented smaller assets. Monitoring these rotations helps balance portfolios across market conditions.

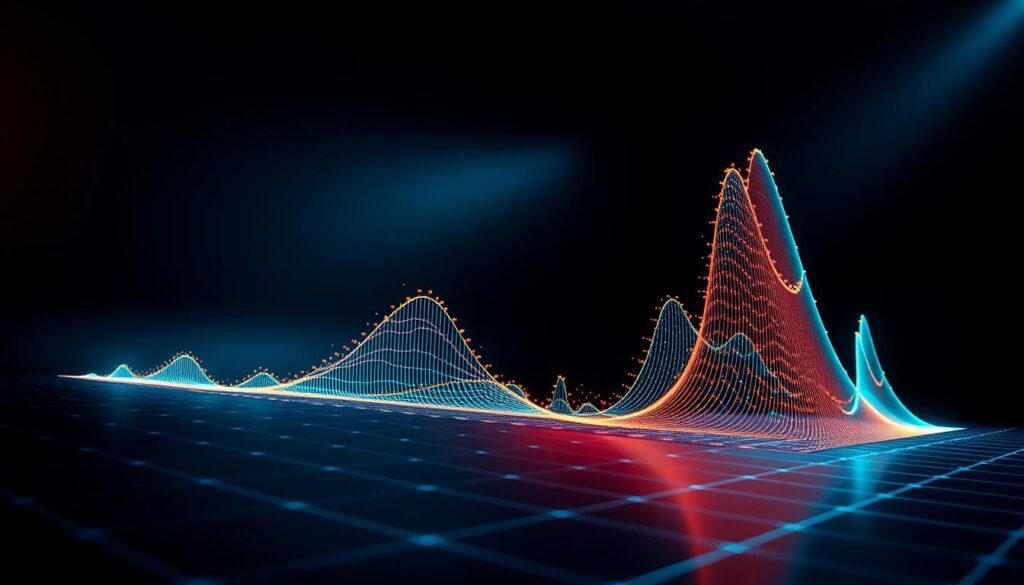

Statistical Insights: Power-Law Distributions in Crypto Prices

Over 7,000 digital currencies display mathematical patterns rarely seen in traditional finance. Power-law distributions govern extreme price swings, revealing hidden order beneath crypto’s chaotic surface. This statistical framework helps explain why 70% of tokens show predictable behavior during major price events.

Analyzing Large Price Variations

Research shows crypto markets favor dramatic jumps over gradual changes. Positive price spikes occur more frequently than crashes of equal magnitude. The median exponent for gains sits at 2.78 versus 3.11 for losses – a gap highlighting traders’ risk appetite.

| Return Type | Exponent Value | Market Implication |

|---|---|---|

| Positive | 2.78 | Frequent large gains |

| Negative | 3.11 | Rarer severe drops |

Interpreting Power-Law Exponents

Smaller exponents signal higher volatility risks. A value below 3 suggests extreme price moves happen regularly. This pattern differs from stock markets, where normal distributions dominate.

Portfolio strategies must account for these statistical realities. Traditional stop-loss orders often fail in power-law environments. Savvy investors use probability models to set realistic profit targets and risk thresholds.

How Cryptocurrency Age Influences Market Movements

Digital currencies evolve like living organisms, gaining stability as they mature. Projects surviving multiple market cycles develop distinct behavioral patterns that newer tokens lack. This aging process reshapes price dynamics and investor expectations.

The Aging Process and Maturing Markets

Research reveals 28% of digital assets show reduced volatility after three years. These veterans establish clearer support levels and attract long-term holders. Their trading volumes become less reactive to social media trends compared to fledgling projects.

| Age Category | Avg. Daily Swing | Liquidity Depth | Institutional Holdings |

|---|---|---|---|

| New (0-2 yrs) | ±14% | Shallow | |

| Developing (2-5 yrs) | ±7% | Moderate | 12-25% |

| Mature (5+ yrs) | ±3% | Deep | 34-60% |

Established projects benefit from network effects. Larger user bases create natural buy/sell pressure balance. This contrasts with newer coins where 80% of trades might come from speculators.

Time-tested assets develop infrastructure that dampens wild swings. Custody solutions, derivatives markets, and ETF options emerge – all signs of growing market confidence. These developments attract capital seeking predictable returns.

Implications for Investors and Informed Investment Decisions

Successful crypto investing demands merging discipline with real-time insights. Savvy investors balance opportunity with protection, using tools like market cap to gauge project maturity. This approach transforms raw numbers into actionable intelligence for informed investment decisions.

Strategies for Managing Risk

Diversification across valuation tiers reduces exposure to sudden swings. Allocating 60% to large-cap assets provides stability, while smaller portions target growth in emerging projects. Stop-loss orders automatically limit losses during unexpected drops.

Regularly tracking supply changes helps avoid dilution risks. Projects planning major token releases often see price declines beforehand. Combining these strategies creates multiple safety nets against volatility.

Utilizing Data for Smarter Investments

Market cap becomes powerful when paired with trading volume and social sentiment. Platforms like CoinGecko aggregate these metrics, revealing patterns invisible in isolation. Historical comparisons show how similar valuations preceded breakout rallies.

Setting alerts for specific market cap thresholds ensures timely reactions. When assets cross into new valuation tiers, liquidity often improves – reducing risk for entry/exit points. This data-driven method turns speculation into calculated informed investment decisions.

No comments yet