Decentralized finance has reshaped how assets are exchanged through innovative protocols. At the core of this evolution are algorithmic tools that enable peer-to-peer trading without relying on centralized platforms. These systems use smart contracts to create transparent, trustless environments where prices adjust dynamically based on supply and demand.

Traditional trading methods required buyers and sellers to match orders manually. New approaches instead employ mathematical models to maintain constant asset availability. This shift allows continuous transactions while reducing reliance on human intermediaries.

One critical advancement involves using blockchain-based formulas to determine fair asset values. By analyzing real-time trading activity, these frameworks establish baseline valuations that reflect genuine market conditions. This process helps stabilize markets and ensures participants receive equitable pricing.

These technologies have become particularly valuable for unique digital items requiring reliable valuation methods. They provide infrastructure that supports efficient trading while minimizing price manipulation risks. As adoption grows, these systems continue refining how decentralized markets operate.

Key Takeaways

- Algorithmic protocols replace manual order matching with continuous trading capabilities

- Smart contracts enable transparent price adjustments based on real-time data

- Mathematical models maintain asset availability without centralized control

- Dynamic valuation methods reduce reliance on human intermediaries

- Blockchain-based systems create more stable and efficient digital markets

Introduction to NFT Liquidity Pools and AMMs

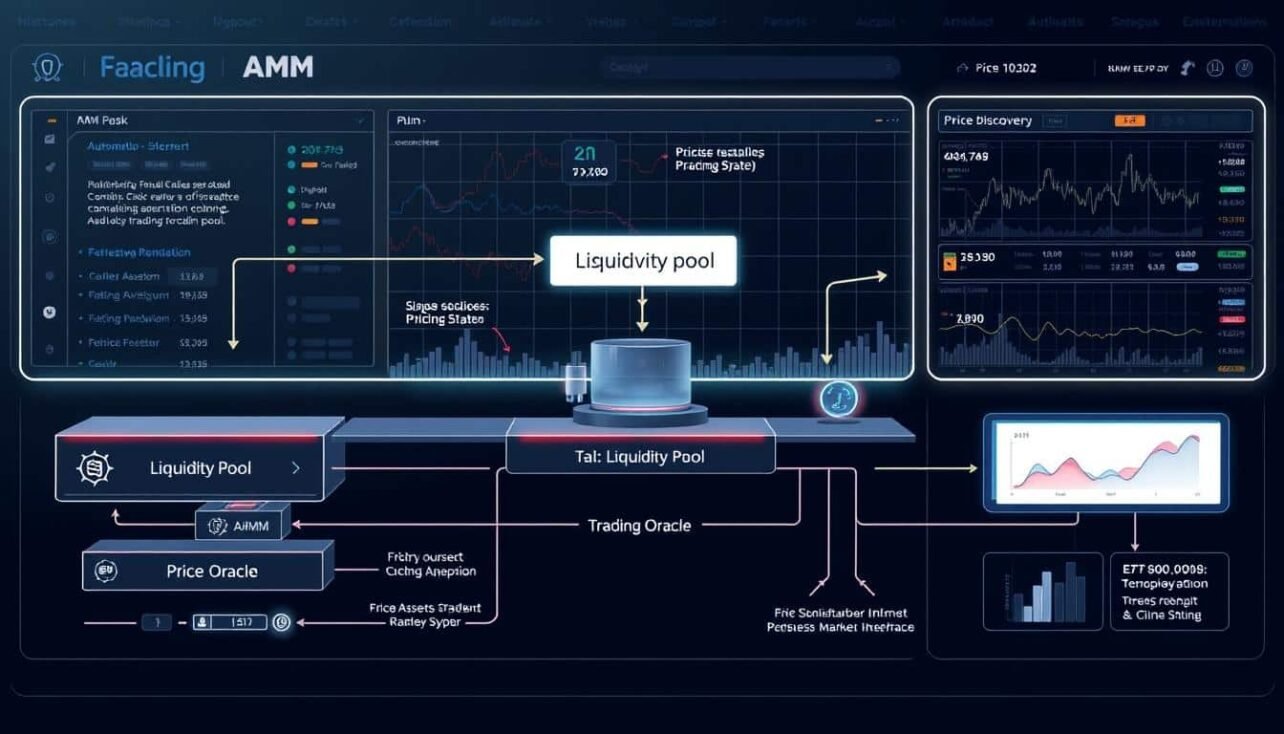

Modern trading systems leverage user-funded reserves to enable seamless digital asset exchanges. These reserves, known as liquidity pools, allow participants to trade instantly without waiting for counterparties. Automated market makers (AMMs) power this process through algorithmic pricing models that adjust values in real time.

Contributors deposit paired assets into these pools, earning a share of transaction fees generated by trading activity. This approach removes traditional intermediaries while ensuring constant asset availability. Decentralized finance platforms rely on these systems to maintain efficient markets for various digital assets.

Smart contracts govern pool operations, executing trades automatically based on predefined rules. These self-executing agreements track balances and distribute rewards transparently. By locking assets in blockchain-based protocols, users create sustainable trading environments.

Unique digital items present challenges due to their indivisible nature. Specialized pools address this by aggregating similar assets or using fractionalization techniques. This adaptation preserves market fluidity while accommodating rare or high-value collectibles.

Participants are motivated by fee-sharing models and yield opportunities. These incentives encourage ongoing contributions, creating robust ecosystems where value reflects genuine demand. As more users join, the system becomes increasingly resilient against volatility.

The Role of Automated Market Makers in Decentralized Finance

Financial systems are undergoing a radical transformation through decentralized protocols. Automated market makers (AMMs) sit at the heart of this shift, replacing traditional financial intermediaries with algorithmic solutions. These systems enable peer-to-contract trading, where transactions execute automatically based on predefined mathematical rules.

Unlike conventional exchanges requiring centralized oversight, AMMs operate without need for human intervention. Anyone with internet access can contribute to these platforms, earning fees proportional to their participation. This model breaks down barriers that once limited market-making activities to institutional players.

These tools integrate seamlessly with other decentralized finance services, creating interconnected ecosystems. Users can lend, borrow, or swap assets across multiple protocols through single interfaces. Such composability amplifies utility while maintaining security through blockchain verification.

Every transaction and pricing formula remains publicly visible on distributed ledgers. This transparency builds trust by allowing real-time audits of market operations. Simultaneously, predetermined algorithms minimize counterparty risks inherent in traditional brokerage models.

By removing geographical and socioeconomic restrictions, AMMs democratize access to global markets. Farmers in rural areas and developers in urban hubs alike can now participate in sophisticated financial activities. This inclusivity fosters economic opportunities previously unavailable through conventional banking channels.

NFT liquidity pool automated market maker floor price discovery mechanisms

Digital collectible markets rely on advanced algorithms to maintain fair valuations. These systems analyze trading patterns and asset characteristics to establish baseline values. Price discovery mechanisms process real-time data like transaction frequency and collection trends to adjust valuations dynamically.

Mathematical models evaluate unique attributes such as rarity scores and historical sales. This approach ensures valuations reflect genuine demand rather than temporary speculation. Constant recalculations occur as new trades execute, keeping values aligned with current conditions.

During volatile periods, adjustment protocols activate to stabilize markets. Systems cross-reference multiple platforms to identify arbitrage gaps, promoting price consistency. This prevents significant deviations while allowing organic value shifts.

Low-activity scenarios pose challenges for traditional valuation methods. Algorithmic solutions address this by incorporating weighted averages from similar assets. Liquidity pools enhance accuracy by aggregating diverse market signals across networks.

These frameworks support decentralized financial services requiring reliable collateral pricing. Lending platforms and derivatives markets integrate this data to create stable products. As adoption grows, these systems evolve to handle increasingly complex valuation scenarios.

Understanding Liquidity Pools for NFT Trading

Trading unique digital items demands robust systems for continuous exchange. Liquidity pools solve this by pairing assets like ETH and USDC, allowing instant swaps. Users deposit these pairs to earn a share of transaction fees, creating sustainable market ecosystems.

- Fractionalizing rare items into tradeable tokens

- Grouping collectibles from the same series

- Categorizing assets by unique traits or rarity scores

These structures use smart contracts to balance supply and demand dynamically. Explore how these systems are built to grasp their operational mechanics. Providers benefit from fee distributions and governance rewards tied to participation levels.

Market volatility requires strategic approaches to mitigate risks. Diversifying across multiple systems and monitoring price trends helps protect investments. Optimized designs minimize trade friction, ensuring fair valuations even during peak activity.

Smart Contracts and the Technology Behind AMMs

Blockchain-based agreements form the backbone of modern trading systems. These smart contracts act as self-operating programs that execute trades, manage assets, and enforce rules without human oversight. Their code defines how decentralized exchanges function, from setting fees to calculating prices in real time.

Developers design these systems using modular frameworks for flexibility. Components like pricing algorithms and reward distributions operate as separate code blocks. This structure lets platforms upgrade features without compromising security or disrupting user activities.

Transparency remains a cornerstone of blockchain technology. Every trade calculation and fee allocation becomes permanently visible on distributed ledgers. Users verify operations by reviewing the same code that powers transactions, building trust through openness.

Advanced designs handle complex tasks like verifying digital asset details. Systems cross-check metadata and ownership records automatically during trades. This automation reduces errors while maintaining speed across thousands of daily transactions.

Integration capabilities allow these tools to connect with lending platforms and prediction markets. Such interoperability creates unified ecosystems where assets flow freely between services. This connectivity amplifies utility while giving users more ways to grow their holdings.

Fundamentals of Price Discovery in Automated Markets

Algorithmic trading systems revolutionize how assets are valued through mathematical precision. These frameworks analyze real-time activity to establish fair values, balancing speed with accuracy. At their core lies a simple equation: x * y = k. This formula maintains equilibrium between paired assets, adjusting values as trades occur.

Mechanisms Behind Floor Price Determination

Three primary models govern valuation in decentralized exchanges:

| Model | Mechanism | Use Case | Impact |

|---|---|---|---|

| Constant Product | Multiplies token quantities (x*y=k) | General trading pairs | Dynamic price adjustments |

| Constant Sum | Maintains fixed price ratios | Stablecoin pairs | Reduced volatility |

| Hybrid Systems | Combines multiple approaches | Specialized assets | Balanced responsiveness |

These systems aggregate data from sales history, trading volume, and asset traits. By weighting recent activity higher, they reflect current supply demand balances accurately. This prevents outdated information from skewing valuations.

The Impact of Supply and Demand Dynamics

When buyers outnumber sellers, algorithms increase values gradually. Sudden spikes trigger stabilization protocols to prevent artificial inflation. Cross-platform arbitrage helps maintain consistent pricing across markets.

Four factors shape price changes in automated systems:

- New collection releases altering asset scarcity

- Shifts in buyer sentiment

- Large-volume trades affecting pool balances

- External market trends influencing demand

Advanced filters detect suspicious trading patterns, protecting against manipulation. These safeguards ensure valuations mirror genuine market conditions rather than temporary anomalies.

Risks and Rewards: Managing Impermanent Loss and Slippage

Participating in digital asset markets involves balancing potential gains with inherent uncertainties. Two critical challenges emerge: temporary value shifts between paired assets and unexpected trade execution gaps. Understanding these dynamics helps participants safeguard their positions while maximizing returns.

Identifying Risk Factors

Impermanent loss occurs when asset pairs diverge in value during market swings. Providers may see reduced returns compared to holding assets separately. This risk intensifies with volatile collectibles, where sudden price changes can disrupt pool balances.

Slippage arises when large trades execute at unfavorable rates due to limited availability. Markets with shallow reserves face higher slippage risks. A detailed analysis of impermanent loss shows how algorithmic models calculate these impacts in real time.

Strategies to Mitigate Price Fluctuations

Diversification across multiple asset categories reduces exposure to single-market volatility. Providers should monitor trading volumes and adjust allocations during peak activity. Automated tools rebalance portfolios when predetermined thresholds activate.

Dynamic hedging techniques offset losses through correlated assets. Time-based withdrawals during stable periods also minimize risks. Combining these approaches creates layered protection against unpredictable price fluctuations.

Successful risk management requires continuous education and adaptive strategies. By analyzing historical patterns and using predictive tools, participants can make informed decisions that align with their financial goals.

Evolution of AMMs in the Decentralized Finance Ecosystem

Algorithmic trading systems have undergone radical transformation since their 2017 debut alongside early decentralized finance platforms. What began as basic pricing formulas now powers sophisticated ecosystems where assets flow seamlessly across chains. This growth reflects broader shifts toward trustless, community-driven financial infrastructure.

Modern automated market makers tackle challenges their predecessors couldn’t. Cross-chain compatibility lets users trade assets between networks without intermediaries. Dynamic fee structures adapt to volatility, balancing incentives for providers and traders. These innovations address scalability issues that once limited adoption.

The rise of multi-chain environments pushed decentralized exchange protocols to evolve. Developers now integrate oracle networks for real-world data feeds, enhancing price accuracy. Modular designs let communities customize features like governance models or reward distributions.

Future advancements may focus on reducing energy use and improving transaction finality. As market makers refine their algorithms, they create more equitable access to global finance. This progress underscores decentralized systems’ potential to reshape economic participation worldwide.

FAQ

How do automated market makers determine floor prices for digital assets?

Platforms like Uniswap and Curve Finance use algorithms such as the constant product formula to balance supply and demand. These systems adjust rates based on trading activity, ensuring fair valuation without centralized oversight.

What risks are associated with providing tokens to decentralized exchanges?

Contributors face impermanent loss due to rate volatility, where asset values diverge from initial deposits. Slippage during high-volume trades can also reduce expected returns, requiring strategic allocation across price ranges.

How do smart contracts enhance decentralized trading platforms?

Self-executing code eliminates intermediaries by automating swaps, fee distribution, and reward calculations. Protocols like Balancer use these tools to enable customizable pools, improving capital efficiency for traders and liquidity providers.

Why are governance tokens important in decentralized finance ecosystems?

Tokens like UNI or CRV let holders vote on protocol upgrades, fee structures, and incentive programs. This democratic approach aligns platform evolution with community interests, fostering long-term sustainability.

Can concentrated liquidity minimize exposure to volatile rate shifts?

Yes. Platforms such as Trader Joe allow providers to focus funds within narrow bands, maximizing fee earnings while reducing impermanent loss risks. This strategy requires active monitoring of market conditions.

How do decentralized exchanges handle sudden supply-demand imbalances?

Algorithms dynamically adjust rates using real-time data from oracles like Chainlink. Larger pools absorb shocks better, while smaller ones may experience sharper fluctuations until arbitrageurs restore equilibrium.

No comments yet