The digital asset landscape continues to evolve, offering new ways for collectors to benefit from their holdings. One emerging strategy allows you to generate a steady income stream without parting with your valuable digital items. This guide explores that very opportunity.

For those involved in the crypto space, this method presents a compelling alternative to simply holding assets. It provides a dual advantage: you maintain ownership of your unique digital property while it potentially works for you. This approach differs from traditional models you may already know.

Our focus is on the current environment of services that facilitate this process. We will identify which options offer attractive annual percentage yields and dependable structures for participants. The goal is to help you make informed choices for your portfolio.

This introduction prepares you for a deeper look at selection criteria, potential risks, and security best practices. Whether you are new to this concept or an experienced investor, this guide aims to provide valuable insights for optimizing your digital asset strategy.

Key Takeaways

- Discover a method to earn from your digital collectibles without selling them.

- Understand the key differences between this strategy and traditional crypto earning methods.

- Learn how to evaluate different services based on their yield offerings and reliability.

- Gain insight into the important factors for selecting the right opportunity for your goals.

- Prepare to explore risk management and security considerations for protecting your assets.

Overview of NFT Staking and APY Concepts

Collectors can now derive ongoing value from their digital assets through innovative protocols. This approach transforms static ownership into active participation in blockchain ecosystems.

Understanding NFT Staking and Its Mechanics

When you engage in this process, your unique digital items are placed into specialized protocols. These systems utilize your assets to support network operations or provide liquidity.

The mechanics vary across different services. Some require commitment periods while others offer flexible options. Your digital collectibles’ characteristics often influence the return calculations.

How APY is Calculated for NFT Staking Rewards

Annual Percentage Yield represents the projected yearly return on your committed assets. This calculation considers multiple factors beyond simple interest rates.

The base reward rate, compounding frequency, and service fees all impact the final figure. Distribution schedules also play a crucial role in accurate projections.

Understanding these elements helps you compare opportunities effectively. It ensures you make informed decisions about where to place your valuable digital property.

Key Benefits of NFT Staking for Passive Income

Innovative protocols now enable digital asset owners to generate consistent returns while maintaining full ownership. This approach transforms collectibles into productive instruments within the crypto ecosystem.

The primary advantage lies in creating revenue streams without liquidating your holdings. You continue to benefit from potential market appreciation while earning additional income.

Monetizing Digital Collectibles Without Selling

This strategy adds functional utility to digital possessions that were previously static. Your assets work continuously to generate returns without active trading or constant monitoring.

Diversification becomes achievable by spreading your holdings across different services. This balances potential capital gains with steady passive income from various sources.

Many services offer governance participation rights, providing influence over development decisions. This creates additional value beyond financial rewards for committed participants.

The income generated can be reinvested to accelerate portfolio growth over time. This compounding effect builds wealth without requiring additional capital investment.

For long-term holders, this approach reduces opportunity costs while waiting for favorable market conditions. It provides interim returns during holding periods.

NFT staking rewards highest APY platforms: A Curated Selection

When selecting where to deploy your digital collectibles for earning potential, several key considerations emerge. The landscape offers diverse opportunities with varying approaches to generating returns.

Criteria for Choosing the Best Platforms

Evaluating services requires examining multiple factors beyond just advertised returns. Security measures should be your primary concern when trusting any service with valuable assets.

Fee structures significantly impact your net earnings. Some services charge percentage-based fees on distributions or require gas fees for transactions.

Community support and user base size indicate reliability. Established networks typically offer more robust features and responsive support systems.

Highlights of Top Staking Options

The market features various specialized approaches to earning from digital assets. Centralized exchanges provide ease of use and institutional-grade protection.

Decentralized protocols offer complete asset control and transparent operations. Gaming-integrated services combine entertainment with earning mechanisms.

| Service Type | Key Features | Supported Collections | Typical Returns |

|---|---|---|---|

| Centralized Exchanges | User-friendly interfaces, high liquidity | Limited premium collections | 15-20% range |

| Decentralized Protocols | Full asset control, transparency | Broad NFT support | 8-12% range |

| Gaming Platforms | Interactive mechanics, community engagement | Game-specific assets | Varies by activity |

Compatibility with your specific digital collectibles remains crucial. Always verify that a service supports your particular assets before committing.

In-Depth Review of Binance NFT Platform

As a major player in the cryptocurrency space, Binance has extended its services to include specialized digital asset management. This marketplace integrates seamlessly with the broader Binance ecosystem.

Pros, Cons, and User Ratings

The service offers institutional-grade security and deep liquidity pools. Users benefit from familiar interfaces and consistent protocols across all Binance products.

Community feedback shows strong satisfaction with the platform’s reliability. Ratings average 4.5/5 on Google and 4.4/5 on Trustpilot.

However, collection support remains limited to premium digital items. The setup process can challenge newcomers to the ecosystem.

APY Performance and Reliability

Supported collections typically yield between 15% and 20% annually. These competitive returns position the service among top earning options.

The platform supports digital assets on both Binance Smart Chain and Ethereum networks. A 2% transaction fee applies to each commitment operation.

Binance’s established infrastructure ensures consistent performance. The company’s Secure Asset Fund for Users provides additional protection.

Decentralized Options: Rarible and Aavegotchi Platforms

Decentralized services provide collectors with distinct advantages through community-governed protocols. These options emphasize user control and transparent operations.

Unlike centralized alternatives, they eliminate intermediary risks. Participants maintain direct ownership throughout the earning process.

Unique Features and Reward Structures

Rarible operates as a fully decentralized marketplace with non-custodial asset management. It supports Ethereum and Polygon networks for flexibility.

The service offers broad collection support but delivers modest returns between 8-12%. Users appreciate the intuitive interface despite Ethereum gas fees.

Aavegotchi introduces a gamified DeFi experience that blends interactive elements with earning mechanisms. Its Polygon integration keeps transaction costs low.

Returns range from 10-20% based on digital item rarity and user activity. The platform has cultivated an active community with strong engagement.

Both services receive positive user feedback for their distinctive approaches. Rarible scores 4.3/5 on Google reviews, while Aavegotchi maintains 4.5/5 ratings.

Gaming Meets Staking: Splinterlands and Axie Infinity

Gaming platforms introduce dynamic earning mechanisms that reward both skill and asset ownership. These interactive environments blend entertainment with financial opportunities for participants.

How Gaming Elements Enhance Staking Rewards

Splinterlands pioneered the integration of blockchain gaming with digital asset earning. This trading card game allows players to commit their in-game items for returns based on gameplay activity.

The platform offers annual percentage yields between 5-15% depending on player engagement. Users appreciate the minimal fees and intuitive processes designed for gaming enthusiasts.

Axie Infinity operates on the Ronin Network, an Ethereum sidechain with low transaction costs. This play-to-earn model delivers exceptional potential returns ranging from 12-25%.

Rewards depend on in-game performance and digital item rarity. The platform has cultivated a strong community with millions of active participants worldwide.

Both services receive positive user ratings, though they require active gameplay participation. This differs from traditional passive income strategies by blending entertainment with financial returns.

Analyzing Technical and Security Risks in NFT Staking

While earning opportunities exist, understanding the underlying risks remains paramount for protection. Different services present varying levels of exposure that require careful evaluation.

Smart Contract Vulnerabilities and Lock-In Periods

Coding errors in digital agreements represent significant technical hazards. Unaudited protocols or deliberate exploits can lead to complete loss of committed property.

Commitment terms create liquidity constraints that prove costly during market shifts. These fixed periods prevent response to emerging opportunities or urgent needs.

Market Volatility and Its Impact on Rewards

Value fluctuations affect returns through multiple channels. Underlying asset values may decline during lock-up periods.

Distribution token values can swing dramatically, converting attractive percentages into actual losses. Platform participation rates also shift with market conditions.

Service reliability encompasses operational continuity and regulatory compliance. Newer options may lack comprehensive security infrastructure, creating elevated hazards.

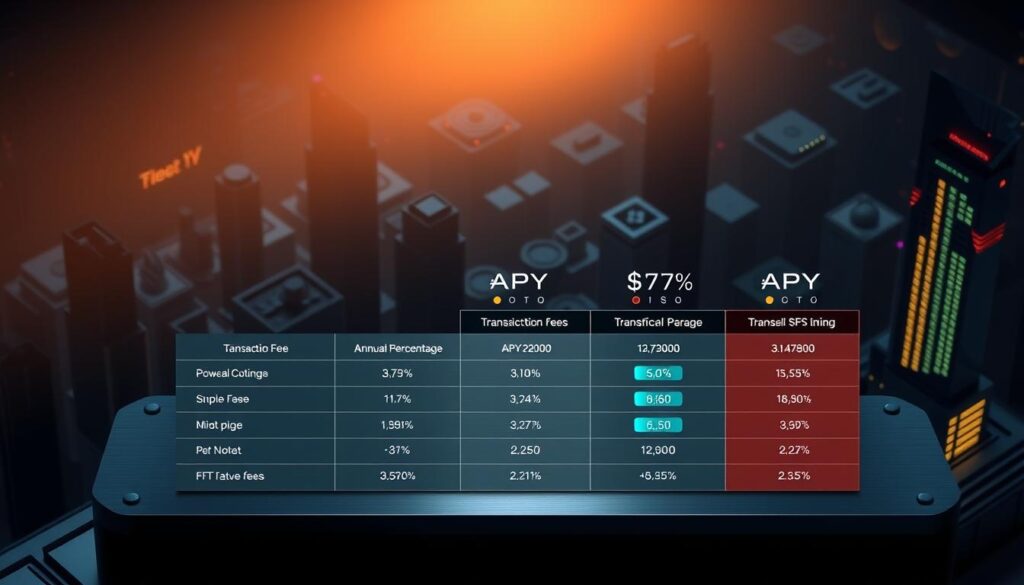

Comparative Analysis of Transaction Fees and APY Rates

Understanding the relationship between transaction costs and advertised returns is essential for maximizing net profits. Different services employ varied fee models that impact your actual earnings.

Understanding Fee Structures Across Platforms

Service providers use distinct approaches to charging for their offerings. Some apply fixed percentage fees while others rely on network gas costs.

Binance charges a 2% transaction fee but delivers strong annual percentage yields between 15-20%. Rarible uses Ethereum or Polygon networks with variable gas fees and offers 8-12% returns.

Gaming-focused options like Axie Infinity and Splinterlands feature minimal fees. Their yields range from 5-25% based on user activity and performance.

| Service | Fee Structure | Supported Networks | APY Range |

|---|---|---|---|

| Binance | 2% fixed fee | BSC, Ethereum | 15-20% |

| Rarible | Network gas fees | Ethereum, Polygon | 8-12% |

| Axie Infinity | Minimal fees | Ronin Network | 12-25% |

| Splinterlands | In-game economy | Hive Blockchain | 5-15% |

Layer 2 solutions like Polygon help reduce transaction costs significantly. This enables more frequent compounding of rewards and improves net returns.

The frequency of interest distribution also affects your effective yield. Daily compounding typically generates better results than weekly or monthly distributions.

The Future of NFT Staking in the DeFi Ecosystem

The decentralized finance landscape is undergoing significant transformation through new asset utilization methods. These developments create exciting possibilities for digital collectors seeking to maximize their holdings’ potential.

Several emerging trends point toward more sophisticated and accessible opportunities. The integration with broader financial protocols represents a major advancement.

Emerging Trends and Innovations

New approaches are eliminating traditional limitations while enhancing capital efficiency. Liquid derivatives allow value to circulate freely within the deFi ecosystem.

Cross-chain infrastructure enables assets to move between different blockchain networks. This flexibility opens doors to superior opportunities across multiple systems.

Fractional participation models are making premium collections accessible to more investors. Automated optimization protocols handle complex decisions for maximum returns.

Key innovations shaping the future include:

- Tradeable tokens representing committed positions

- Interoperability between different blockchain networks

- Algorithmic yield optimization across multiple platforms

- Dual-purpose assets serving financial and experiential roles

Regulatory developments will also influence how these services operate. Clear frameworks may encourage broader institutional participation in this space.

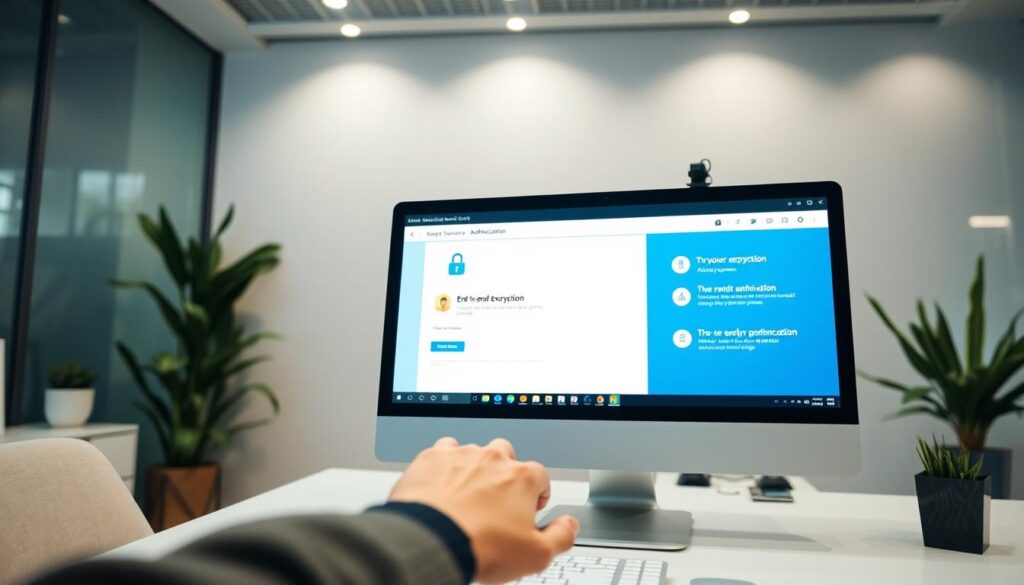

User Experience and Security Measures on Leading Platforms

Modern crypto services must balance robust security architecture with intuitive user experiences to succeed. This dual focus ensures both asset protection and accessibility for participants.

Interface Usability and Customer Support

Well-designed interfaces make digital property management straightforward. Users appreciate clear navigation from wallet connection through reward tracking.

Poor design creates confusion and increases errors. This leads to more support requests that strain customer service resources.

Support quality varies significantly across different services. Some offer 24/7 multilingual assistance while others rely on community channels.

Advanced Security Protocols and Asset Protection

Leading services implement comprehensive protection frameworks. These include two-factor authentication and biometric verification.

Cold storage represents a critical security feature. Services like Coinbase and MEXC keep most assets in offline wallets.

Insurance coverage provides additional financial protection. Regular audits by reputable firms validate security claims independently.

Decentralized options like Lido use distributed validator networks. This approach eliminates single points of failure for enhanced reliability.

Maximizing Returns: Strategies for NFT Staking Investors

Investors seeking to optimize their digital asset earnings should consider several key approaches that balance risk and reward. Smart allocation decisions can significantly impact your overall returns over time.

Effective Staking Strategies and Best Practices

Diversifying your digital holdings across different services helps manage risk. This approach prevents overexposure to any single ecosystem.

Timing your commitments during market downturns often yields better returns. Competition for deposits increases during these periods.

Daily compounding features can boost your effective yield by 1-3%. Look for services with automatic reinvestment options.

Evaluating Reward Potential and Platform Loyalty

Loyalty programs offer tiered benefits for committed users. Holding governance tokens may unlock enhanced rates and reduced fees.

Risk-adjusted evaluation looks beyond nominal percentages. Consider smart contract security and platform reliability.

Active monitoring allows you to shift assets to better opportunities. Balance potential gains against transaction costs.

| Strategy Type | Key Benefit | Time Commitment | Risk Level |

|---|---|---|---|

| Portfolio Diversification | Risk mitigation | Medium | Low |

| Market Timing | Higher yields | High | Medium |

| Compounding Focus | Long-term growth | Low | Low |

| Loyalty Programs | Enhanced benefits | Medium | Medium |

Long-term commitment works well for investors with strong conviction. Extended periods typically unlock higher earning tiers.

Conclusion

Digital collectibles have entered a new era where they can actively generate value beyond simple ownership. This transformation allows investors to earn returns while maintaining possession of their unique items. The right approach can significantly enhance your portfolio’s performance.

Choosing where to commit your assets requires careful evaluation of multiple factors. Security, fees, and supported collections all impact your experience. No single service excels in every area, making personalized selection crucial.

Higher potential returns often come with increased risks that demand proper management. Diversification across different options helps optimize your overall results. Emerging innovations promise to make these opportunities more accessible and efficient.

Thorough research remains essential before committing any valuable holdings. The dynamic nature of this space requires ongoing education and strategy adjustment. Successful participants stay informed about new developments and security practices.

This evolving sector offers compelling ways to maximize your digital investments. With careful planning and continuous learning, you can effectively navigate this exciting landscape.

FAQ

What is the main advantage of participating in NFT staking?

The primary benefit is earning a passive income from your digital collectibles. Instead of holding assets in a wallet, you can put them to work to generate yield over time, often through a smart contract on a blockchain network.

How do I calculate the potential returns from staking my assets?

Returns are typically expressed as an Annual Percentage Yield (APY). This figure compounds interest over a year, giving you a clearer picture of potential earnings than a simple interest rate. Always check the platform’s stated APY for different lock-in periods.

Are there risks involved with locking my tokens in these programs?

Yes, several risks exist. Smart contract vulnerabilities can pose a security threat, and market volatility can affect the value of your rewards. Additionally, some platforms have mandatory lock-in periods, limiting your access to assets during that time.

What should I look for when choosing a service for earning rewards?

Prioritize security, reliability, and transparency. Look for platforms with a strong track record, clear fee structures, and robust customer support. Also, compare the APY rates and the flexibility of staking options, such as liquid staking, which offers more liquidity.

Can I earn from my digital collectibles in the gaming sector?

Absolutely. Platforms like Axie Infinity and Splinterlands integrate staking directly into their gameplay. This allows you to earn rewards by participating in the game’s ecosystem, often enhancing the yield with gaming elements and achievements.

How do transaction fees impact my overall earnings?

Network fees for initiating and claiming rewards can eat into your profits. It’s crucial to understand a platform’s fee structure—including gas fees on blockchain networks—before committing, as high costs can significantly lower your net APY.

What is the role of DeFi in the future of these reward programs?

The DeFi ecosystem is driving innovation, leading to more sophisticated yield-generating options. Emerging trends include cross-chain staking and improved liquidity solutions, making it easier for investors to maximize returns across different networks.

No comments yet