Two powerful forces are shaping our digital future. On one side, we have distributed ledger systems that power cryptocurrencies and secure vast amounts of value. On the other, a new form of advanced machinery is emerging.

This new type of machine operates on principles far beyond today’s standard computers. Its potential is immense, promising to solve problems previously thought impossible. However, this immense power also raises serious questions.

Could this advanced technology undermine the very foundations that protect our digital assets? The systems securing global financial networks rely on complex math. Some experts worry that these new machines could crack that code.

This is not just a far-off idea. Recent progress from leading tech firms shows this challenge is approaching faster than many anticipated. We need to understand the risks and the solutions now.

This article explores the real dangers and the timeline for this potential problem. We will look at how vulnerable current systems are and what experts are doing to prepare. Our goal is a clear, fact-based look at this critical issue.

Key Takeaways

- Advanced computational technology presents a potential challenge to current cryptographic methods.

- The security of digital ledgers and assets may be at risk from this new processing power.

- This is an emerging issue with a realistic timeline, not a distant theoretical concern.

- Understanding the specific vulnerabilities is the first step toward developing solutions.

- Industry leaders are already working on next-generation protection systems.

- Proactive preparation is essential for the long-term health of digital infrastructure.

Introduction: Setting the Stage for a Quantum Future

A new era of computation is emerging, one that processes data in ways that defy classical logic. This shift has direct implications for the cryptographic techniques safeguarding our most valuable digital assets.

Defining Quantum Computing and Blockchain Security

Traditional computers use bits, which are either 0 or 1. The new advanced machinery operates on qubits. Qubits can represent 0, 1, or both states at once, a property known as superposition.

This allows these systems to explore many possibilities simultaneously. They offer exponential speedups for specific complex calculations.

In contrast, the protection of decentralized ledgers relies on mathematical problems. These problems are exceptionally difficult for standard machines to solve. This difficulty is the foundation of their trust model.

Trends Influencing the Security Landscape

Many analysts predict a machine capable of breaking current encryption will arrive within 5 to 10 years. This timeline creates urgency. Preparing for these new capabilities requires massive infrastructure changes that can take over a decade.

A concerning trend is the “harvest now, decrypt later” attack. Adversaries collect encrypted data today. They plan to decrypt it once powerful enough systems are available.

The global cybersecurity community is not standing still. Significant effort is going into developing new mathematical foundations for encryption. These new algorithms are designed to be resistant to attacks from advanced machinery.

| Feature | Classical Computers | Quantum Computers |

|---|---|---|

| Basic Unit | Bit (0 or 1) | Qubit (0, 1, or both) |

| Processing Method | Sequential calculations | Parallel processing via superposition |

| Strength | General-purpose tasks | Specific complex problems (e.g., factoring) |

| Impact on Cryptography | Upholds current security | Potentially breaks current asymmetric encryption |

Foundations of Blockchain Security and Cryptography

At the heart of distributed ledger protection lies a complex system of mathematical proofs and key-based authentication. These cryptographic foundations ensure that transactions remain secure and tamper-proof across decentralized networks.

Understanding Asymmetric Cryptography in Bitcoin

Asymmetric cryptography uses paired keys to secure transactions. A private key remains secret while the corresponding public key is shared openly. This system enables digital signatures that verify transaction authenticity.

The security relies on one-way mathematical functions. Deriving a public key from a private key is computationally easy. However, reversing this process is practically impossible for standard computers.

Address Types and Their Vulnerabilities

Bitcoin originally used Pay-to-Public-Key (p2pk) addresses. These directly exposed public keys on the blockchain, creating immediate vulnerability. Early Bitcoin transactions, including Satoshi Nakamoto’s, used this method.

The evolution to Pay-to-Public-Key-Hash (p2pkh) addresses added protection. These use a cryptographic hash of the public key instead of exposing it directly. The actual public key remains hidden until funds are spent.

| Feature | Pay-to-Public-Key (p2pk) | Pay-to-Public-Key-Hash (p2pkh) |

|---|---|---|

| Public Key Exposure | Immediate and permanent | Only when spending funds |

| Security Level | Low vulnerability | Higher protection |

| Usage Era | Early Bitcoin (2009-2010) | Modern standard |

| Address Reuse Risk | Extremely high | Significant if reused |

Address reuse remains a critical concern. Many users don’t follow best practices, leaving millions of coins in addresses with exposed public keys. This creates a pool of potentially vulnerable assets.

Overview of Quantum Computing: How It Works

The fundamental rules of information processing are being rewritten by a new class of machines. These systems do not rely on the simple bits of traditional computers.

Instead, they use qubits as their basic unit. This shift enables a radically different approach to solving complex problems.

Superposition, Entanglement, and Qubits

Standard computers use bits that are either 0 or 1. A qubit, however, can be 0, 1, or both at the same time. This property is called superposition.

Superposition gives these machines immense power. Two qubits can represent four values at once. Three qubits can handle eight values.

The capacity doubles with each new qubit added. This creates exponential growth in processing capability.

Another key property is entanglement. When qubits are entangled, measuring one instantly reveals the state of its partner.

This happens no matter how far apart they are. It allows for coordinated calculations that are impossible for classical systems.

Recent Breakthroughs and Technological Milestones

Progress in this field is accelerating rapidly. Tech giants are achieving significant milestones.

For example, Google’s Willow chip has 105 qubits. It performed a specific calculation in under five minutes.

A traditional supercomputer would need an unimaginable number of years to do the same task. This demonstrates the raw potential of the technology.

The number of qubits in systems has grown quickly. IBM’s Condor chip reached 1,121 qubits in 2023.

Atom Computing also announced a system with about 1,180 qubits around the same time. Microsoft introduced its Majorana chip in early 2025.

The main challenge is that qubits are very delicate. They are easily disturbed by environmental factors, which causes errors.

New designs, like the Willow chip, aim to reduce these errors as the number of qubits increases. While powerful for specific tasks, current systems are not yet a direct danger to modern encryption. However, the gap is closing. For a deeper dive into this evolving landscape, explore this research on advanced computational technology.

| System Name | Company | Year | Qubit Count |

|---|---|---|---|

| D-Wave One | D-Wave | 2011 | 128 |

| Google Sycamore | 2019 | 53 | |

| IBM Osprey | IBM | 2022 | 433 |

| IBM Condor | IBM | 2023 | 1,121 |

| Atom Computing System | Atom Computing | 2023 | ~1,180 |

Understanding the Quantum Computing Threat to Blockchain Security

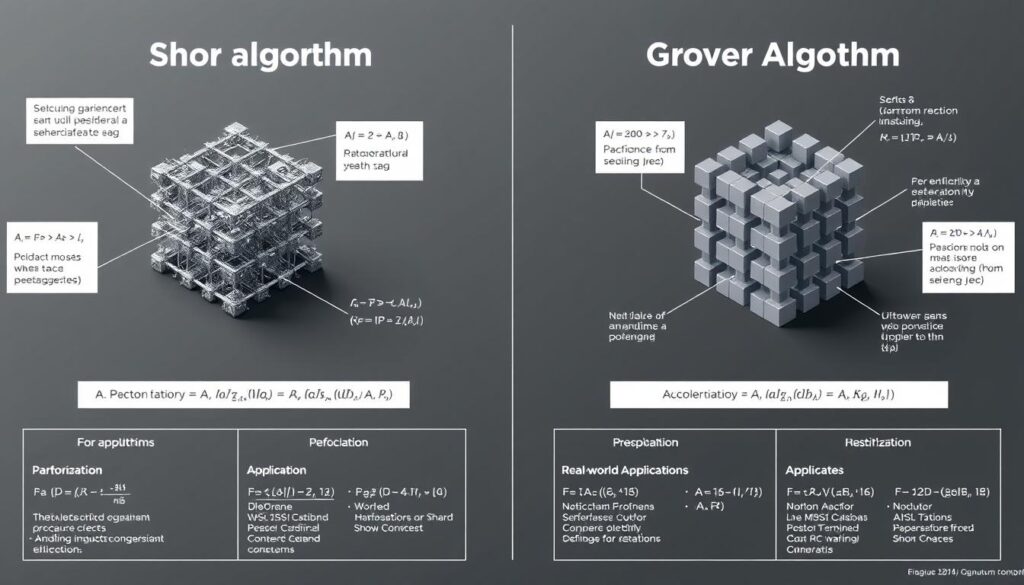

Peter Shor’s 1994 discovery revealed vulnerabilities in the mathematical problems underpinning modern encryption. Two specific algorithmic approaches pose distinct challenges to current protection systems.

These mathematical techniques could undermine the foundations that secure digital assets today.

Impact of Shor’s Algorithm on Private Key Security

Shor’s algorithm efficiently solves the complex mathematical problems behind asymmetric cryptography. This includes the Elliptic Curve Digital Signature Algorithm used in Bitcoin.

A sufficiently powerful system running this method could derive private keys from public keys. Current estimates suggest Bitcoin signatures might be compromised within 30 minutes.

This creates a critical window against Bitcoin’s 10-minute block time.

Risks from Grover’s Algorithm in Cryptanalysis

Grover’s algorithm provides quadratic speedup for unstructured search problems. It reduces computational effort from N attempts to approximately √N attempts.

This approach could dramatically accelerate Bitcoin mining. It threatens to centralize mining power among organizations with advanced hardware access.

While concerning, this method doesn’t fundamentally break cryptography like Shor’s algorithm does.

| Feature | Shor’s Algorithm | Grover’s Algorithm |

|---|---|---|

| Primary Target | Asymmetric cryptography | Symmetric cryptography & mining |

| Impact Level | Fundamental break | Speed improvement |

| Bitcoin Signature Risk | ~30 minutes (estimated) | Not directly applicable |

| Mining Impact | Minimal | Significant acceleration |

| Solution Required | New cryptographic foundations | Longer key lengths |

Real-World Implications for Bitcoin and Cryptocurrencies

Beyond theoretical discussions lies a concrete financial problem affecting millions of Bitcoin addresses today. Analysis reveals that approximately 4 million BTC—about 25% of all Bitcoin—sit in vulnerable positions. This represents over $40 billion at current market values.

Analysis of Vulnerable Bitcoin Addresses

The vulnerable pool consists of two main categories. First, roughly 2 million BTC remain in original pay-to-public-key addresses from Bitcoin’s early days. These coins have never moved, likely including early mining rewards.

Second, about 2.5 million BTC are stored in reused pay-to-public-key-hash addresses. Many owners have lost their private keys, preventing migration to safer storage. This creates a compounding problem for the entire ecosystem.

| Address Type | Bitcoin Amount | Estimated Value | Primary Risk Factor |

|---|---|---|---|

| Pay-to-Public-Key (p2pk) | 2 million BTC | $20 billion | Immediate public key exposure |

| Reused p2pkh Addresses | 2.5 million BTC | $25 billion | Address reuse vulnerability |

| Total Vulnerable | 4.5 million BTC | $45 billion | Combined exposure |

Market and Trust Implications for Users and Institutions

The “harvest now, decrypt later” approach poses significant dangers. Adversaries collect exposed public keys today for future decryption. If a large theft occurs, market confidence could collapse dramatically.

Institutional investors face fiduciary responsibilities regarding this risk. Even secure address holders would suffer from systemic trust erosion. This collective challenge demands urgent attention from all participants.

Post-Quantum Cryptography: The Road to Resilience

Mathematicians and security experts worldwide are building cryptographic foundations designed to withstand next-generation processing power. These new approaches represent a fundamental shift in how we protect digital information.

New Mathematical Foundations and PQC Algorithms

The U.S. National Institute of Standards and Technology (NIST) has led a multi-year effort to establish new cryptographic standards. In 2022, they selected finalist algorithms including CRYSTALS-Kyber, CRYSTALS-Dilithium, FALCON, and SPHINCS+.

These algorithms rely on novel mathematical problems that remain difficult for advanced systems. Lattice-based cryptography uses problems like the Shortest Vector Problem. Hash-based methods depend on collision-resistant functions.

| Algorithm | Mathematical Foundation | Primary Use | NIST Standard |

|---|---|---|---|

| CRYSTALS-Kyber | Lattice-based | Key Encryption | FIPS 203 |

| CRYSTALS-Dilithium | Lattice-based | Digital Signatures | FIPS 204 |

| FALCON | Lattice-based | Signatures | FIPS 205 |

| SPHINCS+ | Hash-based | Signatures | Under review |

Industry Adoption: Case Studies and Pilots

Major technology companies are already implementing these new standards. Google’s BoringSSL supports ML-KEM and ML-DSA in Chrome. Apple’s iMessage and Signal app have integrated quantum-resistant algorithms.

Financial institutions demonstrate practical applications. The Banque de France and Singapore’s Monetary Authority successfully exchanged encrypted emails using CRYSTALS algorithms. This shows how the technology integrates with existing business tools.

Many implementations use a hybrid approach. This combines classical and post-quantum algorithms for both backward compatibility and future security.

Strategies for Mitigating Quantum Risks in Blockchain

Proactive measures are essential for protecting digital assets against emerging computational capabilities. Both individual users and the broader network must implement defensive strategies.

These approaches range from simple personal practices to complex community-wide policy changes. Each method addresses different aspects of the security challenge.

Safe Address Practices and Migration Techniques

The simplest protection involves transferring funds to fresh pay-to-public-key-hash addresses. These locations keep public keys hidden until spending occurs.

Many modern wallets automatically avoid address reuse as a best practice. This basic habit significantly reduces exposure to potential attacks.

However, this individual approach has limitations. Billions in vulnerable coins belong to owners who lost their private keys. These assets cannot be migrated to safer storage.

Consensus and Policy Challenges in the Bitcoin Community

A July 2025 proposal co-authored by Jameson Lopp suggests a phased strategy. It aims to retire vulnerable legacy signature schemes by 2030.

The plan introduces new “Pay-to-Quantum-Resistant-Hash” addresses. These would incorporate advanced cryptographic algorithms for better protection.

The most controversial element involves freezing funds in unmigrated legacy addresses. Miners would ignore transactions from these locations after a deadline.

This prevents future theft but raises philosophical questions about property rights. Building consensus among diverse stakeholders presents significant challenges.

Even secure addresses have a vulnerability window during transactions. When you spend funds, you reveal your public key for about 10 minutes.

Successful transition requires clear communication and adequate timelines. The balance between security improvements and ecosystem disruption remains delicate.

Timeline and Future Challenges in the Quantum Era

The timeline for a major technological shift is becoming clearer. Recent breakthroughs and aggressive company roadmaps are providing more precise projections.

This acceleration compresses the window for preparation. Organizations now face a complex set of challenges.

Current Milestones in Quantum Hardware Development

Leading firms are pushing hardware capabilities forward rapidly. Fujitsu and IonQ have published ambitious targets.

They aim to build systems with over 10,000 qubits by 2027-2030. This scale is considered a significant milestone.

Algorithmic improvements are also reducing hardware needs. A May 2025 paper by Google scientist Craig Gidney showed a dramatic reduction.

It suggested cracking a 2048-bit RSA key might require fewer than one million noisy qubits. This is a major drop from prior estimates of 20 million.

Projections for Cryptographically Relevant Quantum Computers

Most experts believe a powerful enough machine will emerge in 5 to 10 years. This creates urgency for defensive strategies.

The U.S. government has set a firm migration deadline of 2035. They estimate transition costs at $7.1 billion for non-national security systems alone.

According to a Deloitte survey, 52% of organizations are now assessing their exposure. This means nearly half have not yet started serious planning.

The core challenge is the mismatch in time. While these advanced systems may arrive in a decade, upgrading global infrastructure could take much longer.

This creates a potential vulnerability gap. Organizations must invest now based on uncertain timelines.

| Company | Target Qubit Count | Target Year | Significance |

|---|---|---|---|

| Fujitsu | 10,000+ | 2027-2030 | Major scaling milestone |

| IonQ | 10,000+ | 2027-2030 | Reaching cryptographically relevant scale |

| Various (Post-Gidney) | <1 million (noisy) | Mid-term | Lowered barrier for breaking RSA-2048 |

Conclusion

The intersection of advanced computational power and digital trust presents one of our generation’s most pressing technological puzzles. This challenge is neither science fiction nor immediate catastrophe, but a rapidly approaching reality requiring coordinated action.

Approximately 25% of Bitcoin—over 4 million coins worth tens of billions—currently sits in vulnerable addresses. This represents concrete financial risk, not theoretical concern. Expert consensus projects cryptographically relevant systems emerging within 5-10 years.

The path forward combines individual responsibility with technological innovation. Users must migrate to safe addresses while developers implement new standards. Community coordination remains essential for network-wide protections.

Success depends on timely implementation before critical thresholds are crossed. This technological evolution also brings opportunities for breakthroughs in fields like medicine and materials science. The development of privacy-enhancing technology will play a crucial role in this transition.

Preparation must begin now, not when advanced systems reach threatening capability. The cryptographic community has responded with robust solutions—success depends on coordinated global implementation to maintain trust in our digital infrastructure.

FAQ

How does a quantum computer threaten blockchain security?

Powerful quantum computers could break the mathematical problems that protect digital signatures. Algorithms like Shor’s can find private keys from public keys, compromising user funds and network trust.

What is post-quantum cryptography?

Post-quantum cryptography, or PQC, involves creating new algorithms that are secure against attacks from both classical and quantum machines. These systems rely on different mathematical challenges that are hard for qubits to solve.

When will quantum attacks become a real risk?

Experts project that cryptographically relevant quantum computers (CRQCs) are likely decades away. However, the transition to new standards takes time, so preparation needs to start now to protect data for the long term.

Which blockchain components are most vulnerable?

The main risk is to asymmetric cryptography, which secures digital signatures and private keys. Public keys visible on the ledger could be targeted by future systems using Shor’s algorithm to derive the corresponding secret keys.

What can users do to protect their assets today?

Using address types that do not reuse public keys, like Pay-to-Script-Hash (P2SH) or native SegWit, can reduce exposure. The best practice is to move funds to new addresses after each transaction.

Are there any quantum-resistant blockchains already?

Several projects are actively developing and testing networks with post-quantum algorithms. These pilots aim to prove the viability of new cryptographic foundations before a widespread industry adoption becomes necessary.

How does Grover’s algorithm affect security?

Grover’s algorithm speeds up searching, which could weaken symmetric encryption and hash functions. However, this risk is manageable by doubling the key length, unlike the fundamental threat Shor’s poses to public-key systems.

No comments yet