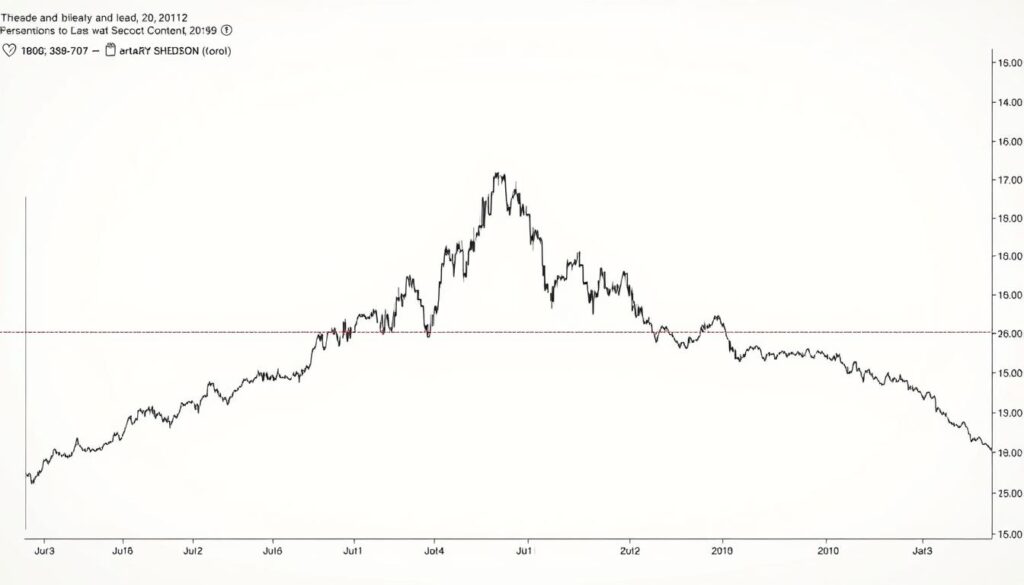

Welcome to your guide on understanding visual formations in market data. These chart patterns appear when asset prices move in specific ways. They create recognizable shapes that help predict what might happen next.

In the world of digital assets, these formations give traders valuable clues. They show the ongoing battle between buyers and sellers. Recognizing these signals can help you make smarter choices in the crypto space.

Some formations suggest a trend might reverse direction. Others indicate the current movement will likely continue. Learning to spot these visual cues takes practice but offers significant rewards.

These aren’t random lines on a graph. They represent real market psychology and historical behavior. Mastering them can improve your decision-making in fast-moving markets.

Key Takeaways

- Chart patterns are visual formations created by price movements

- They help anticipate potential market directions

- Different patterns signal various market conditions

- Recognizing these formations requires practice and observation

- They represent the ongoing battle between buyers and sellers

- Patterns can indicate both trend continuations and reversals

- Mastering chart reading enhances trading decisions

Introduction to Crypto Trading and Technical Analysis

Digital currency markets offer unique opportunities when analyzed with proper tools. This methodology examines historical price and volume data to forecast future movements. It differs from fundamental approaches that focus on intrinsic asset value.

Market participants use visual formations to spot directional changes. These shapes represent the collective psychology of buyers and sellers. Recognizing them helps align strategies with current sentiment.

The underlying principle suggests price movements follow repetitive sequences. Historical behavior often predicts future outcomes. This systematic approach provides clear entry and exit signals.

| Analysis Method | Primary Focus | Data Used | Time Horizon |

|---|---|---|---|

| Technical Approach | Price Patterns & Trends | Historical Charts & Volume | Short to Medium Term |

| Fundamental Approach | Intrinsic Value | Project Fundamentals & Metrics | Long Term |

| Combined Strategy | Comprehensive View | Both Technical & Fundamental | All Timeframes |

Volatile digital asset markets require robust interpretation methods. These tools help identify when trends might reverse or continue. Mastering this framework creates a solid foundation for informed market participation.

The visual language of charts translates complex market emotions into actionable insights. This preparation enables confident navigation through rapid price changes.

Understanding Technical Analysis Patterns for Crypto Trading

The visual language of price movements tells a compelling story. These formations, known as chart patterns, appear as distinct shapes on a chart. They reflect the ongoing struggle between market participants.

These shapes develop through collective buying and selling activity. Each formation indicates potential future price direction. Recognizing them helps gauge whether bulls or bears control the market.

Learning to identify these formations takes practice. Start with common shapes like head and shoulders or triangles. With experience, spotting them becomes second nature.

These visual tools are not magic predictions. They represent statistical probabilities based on historical behavior. Similar formations have often led to similar outcomes.

| Pattern Category | Primary Signal | Typical Duration | Reliability Factor |

|---|---|---|---|

| Reversal Formations | Trend Change | Weeks to Months | High with Confirmation |

| Continuation Shapes | Trend Resumption | Days to Weeks | Medium to High |

| Bilateral Formations | Breakout Direction | Variable | Requires Signal Confirmation |

Mastering these formations involves understanding both structure and psychology. This knowledge works across various timeframes, though reliability depends on context. Proper confirmation signals enhance decision-making for market participants.

Decoding Common Crypto Chart Patterns

Price charts develop distinct formations that serve as valuable indicators for market direction. These visual shapes emerge from the constant battle between buyers and sellers. They create a roadmap for potential opportunities in digital asset markets.

What Are Chart Patterns?

Chart patterns are visual cues that appear on price graphs. They hint at where the market might move next. Think of them as the market’s way of showing its intentions.

These formations translate complex price movements into recognizable shapes. They help participants identify potential entry and exit points. Each pattern tells a story about market dynamics.

The Role of Patterns in Market Sentiment

Patterns reflect the collective emotions of all market participants. They capture moments of fear, greed, and uncertainty. This makes them powerful psychological indicators.

Different formations signal various market conditions. Some suggest trend reversals while others indicate continuation. Understanding these signals helps gauge overall sentiment.

The balance between buyers and sellers shapes these visual formations. Recognizing this balance provides insight into future price movements. It transforms raw data into actionable intelligence.

Spotting the Head and Shoulders Pattern in Crypto Charts

Among the most reliable formations in market visualization is the head shoulders pattern. This distinctive shape appears after an upward movement and signals potential trend changes. Recognizing this formation can provide valuable insights into market psychology.

Identifying the Classic Formation

The classic head shoulders formation features three peaks. The middle peak, called the head, stands highest. The two outside peaks, the shoulders, sit lower and roughly equal in height.

This pattern develops when buyers lose momentum after a strong upward move. The neckline connects the low points between these peaks. When price breaks below this line, it confirms the reversal signal.

The inverse version, known as the inverse head shoulders, shows three troughs instead. Here, the middle trough dips deepest. This bullish formation suggests a shift from downward to upward movement.

Trading the Breakout

For the standard head shoulders formation, wait for confirmation. Enter when price breaks below the neckline after the right shoulder forms. This breakout indicates the reversal is likely underway.

The inverse head pattern requires a different approach. Watch for price to push above the neckline with strong volume. This confirms the bullish reversal and suggests upward momentum.

These formations work across various timeframes on your crypto chart. Daily charts typically produce more significant moves than shorter timeframes. Always measure potential targets from the pattern’s height.

Identifying Double Top, Double Bottom, and Triple Patterns

Certain price formations offer clear indications of market direction shifts. The double top is a common bearish reversal pattern. It forms when price reaches a resistance level twice but fails to break through.

This formation signals that buyers are losing strength. After the second peak, a downward move typically follows. Traders watch for the break below the support level between the two peaks.

The double bottom is the opposite formation. It occurs when price tests a support level twice before moving upward. This bullish pattern suggests sellers are exhausted.

Triple formations provide stronger confirmation than their double counterparts. The triple top requires three unsuccessful attempts at resistance. The triple bottom needs three tests of support before reversal.

| Pattern Type | Market Signal | Confirmation Level | Typical Outcome |

|---|---|---|---|

| Double Top | Bearish Reversal | Medium | Downward Trend |

| Double Bottom | Bullish Reversal | Medium | Upward Trend |

| Triple Top | Strong Bearish | High | Significant Decline |

| Triple Bottom | Strong Bullish | High | Substantial Rise |

These formations work across various crypto markets. Always wait for proper confirmation before entering positions. The break of key levels validates the pattern‘s signal.

Exploring Triangle Patterns: Ascending, Descending, and Symmetrical

When price action narrows between converging boundaries, triangle formations emerge. These visual structures represent periods of consolidation before significant moves. Market participants watch these shapes closely for directional clues.

Key Characteristics of Ascending and Descending Triangles

The ascending triangle shows a flat top resistance line with rising support. This bullish triangle pattern typically forms during uptrends. Traders watch for a breakout above the horizontal resistance line.

The descending triangle features a flat bottom support with declining resistance. This bearish formation appears in downtrends. A downward breakout through support confirms the signal.

Both formations are continuation patterns. They suggest the existing trend will resume after consolidation. These triangle shapes can develop over weeks or months.

Understanding the Symmetrical Triangle

The symmetrical triangle differs from its counterparts. It features converging trend lines with equal slopes. This formation indicates balanced buying and selling pressure.

Unlike directional triangles, the symmetrical pattern can break either way. It often appears at trend endings, signaling potential reversals. According to market data, these patterns show about 62% success rates.

All triangle formations require patience. Wait for clear breakout confirmation before taking positions. Proper identification enhances decision-making on any chart.

Wedge and Rectangle Patterns in Crypto Analysis

Consolidation periods in digital asset markets often produce distinctive wedge and rectangle formations. These visual structures represent crucial decision points where market sentiment becomes concentrated. Understanding their signals can significantly improve your market timing.

Wedge formations are a special category of triangle patterns where both boundary lines slope in the same direction. The rising wedge typically forms during downtrends, showing lower highs and higher lows. This bearish reversal pattern signals weakening momentum before a downward breakout.

Conversely, the falling wedge appears in uptrends with higher highs and lower lows. This bullish formation indicates that selling pressure is diminishing. A decisive move above the upper trendline confirms the pattern‘s completion and suggests upward continuation.

Rectangle patterns form when price moves sideways between parallel support and resistance levels. The bullish rectangle typically develops at the end of downtrends, suggesting accumulation before an upward move. The bearish version appears during declines, indicating distribution before further downward movement.

Both wedge and rectangle formations require confirmation through decisive breakouts. These consolidation patterns provide clear visual cues about potential price direction. Proper identification helps market participants anticipate significant moves on their chart.

Using Flags and Pennants for Trend Continuation

After a strong directional move, markets often pause before resuming their journey. These pauses create flag and pennant formations that signal temporary consolidation. They represent brief resting periods where the market gathers strength for the next move.

These short-term continuation patterns are among the most reliable setups for market participants. They typically last one to four weeks and offer clear entry signals. According to market data, flag patterns achieve about 68% success rates.

Defining Bullish and Bearish Flags

A bullish flag begins with a sharp upward price move called the flagpole. This is followed by a consolidation period where prices form lower highs. The breakout occurs when price pushes above the consolidation area, continuing the upward trend.

The bearish version starts with a downward flagpole. Consolidation shows slightly higher highs before the downward breakout. Both formations indicate the existing momentum will likely continue after brief hesitation.

Pennants are similar to flags but feature triangular consolidation instead of parallel lines. These pennant formations have converging trendlines that create a small symmetrical triangle. Volume typically drops during consolidation then spikes at the breakout.

Market participants watch for high volume during the initial move. Decreasing volume during consolidation confirms the pattern‘s validity. The subsequent breakout with renewed volume provides the entry signal.

Analyzing Channel Patterns: Upward and Downward Channels

Diagonal parallel lines on a chart often reveal channel formations that capture market momentum. These patterns form when an asset’s price moves between two parallel lines, creating a clear trading range.

The lines represent dynamic support and resistance levels. They show the current trend‘s slope and strength. This visual structure helps traders anticipate future price direction.

An upward channel slopes higher, with the lower line acting as support. A downward channel slopes lower, with the upper line serving as resistance. Each bounce within the channel confirms its validity.

Market participants use two main strategies. They can trade within the channel, buying near support and selling near resistance. Alternatively, they wait for a breakout above or below the channel boundaries.

| Channel Type | Primary Slope | Key Signal | Success Rate |

|---|---|---|---|

| Channel Up | Upward | Trend Continuation | 73% |

| Channel Down | Downward | Trend Continuation | 72% |

Breakouts often lead to rapid price movement. According to altFINS data, these patterns show high reliability. Properly drawn lines connect significant highs and lows.

This approach works across various crypto charts. It provides a framework for understanding market structure. Mastering channels improves decision-making for all market participants.

Leveraging Breakout Patterns to Capture Trading Opportunities

Crossing key price thresholds signals powerful shifts in market dynamics. These breakout events occur when price breaks through established support or resistance lines. This action confirms that a visual formation has completed its development.

Market participants watch for these decisive price breaks as entry signals. A bullish breakout happens above resistance, suggesting upward momentum. The bearish version occurs below support, indicating downward pressure.

These patterns developing over longer timeframes tend to be more reliable. Daily charts typically produce larger moves than shorter intervals. This makes timeframe selection crucial for successful execution.

Volume confirmation helps distinguish genuine breakouts from false signals. Increased activity during the price breaks validates the move. Waiting for a closing price beyond the boundary reduces false signal risk.

Proper identification of these events on your crypto chart can lead to significant opportunities. The initial momentum often continues, creating favorable conditions for market participants.

Integrating Technical Indicators with Chart Patterns>

Visual formations gain significant power when combined with mathematical tools. These complementary indicators provide additional layers of confirmation for market participants.

This approach helps validate signals and reduce false readings. It creates a more robust framework for decision-making.

Using RSI, Moving Averages, and Bollinger Bands

Moving averages smooth out price data to reveal the underlying trend. When a bullish formation aligns with price above key averages, it strengthens the signal.

The Relative Strength Index measures momentum on a 0-100 scale. Readings above 70 suggest overbought conditions, while below 30 indicate oversold levels.

Bollinger Bands show volatility through expanding and contracting bands. Formations near band edges can signal potential reversals.

Combining these tools with visual patterns creates multiple confirmation points. This layered approach helps traders make more confident decisions in dynamic markets.

Utilizing Automated Tools for Pattern Recognition in Crypto

Modern technology revolutionizes how market participants identify visual formations. Automated systems scan markets continuously, detecting opportunities that manual review might miss.

These tools work 24/7 across multiple timeframes. They analyze hundreds of assets simultaneously. This comprehensive coverage provides significant advantages.

Benefits of Automated Chart Pattern Tools

The altFINS engine exemplifies this technology’s power. It identifies 26 distinct formations across various intervals. This includes 15-minute, 1-hour, 4-hour, and daily charts.

Both classic and advanced formations receive automatic detection. Head and Shoulders, Triangles, and Flags appear alongside harmonic patterns. The system provides instant alerts for each discovery.

Machine learning algorithms power these predictions. They analyze thousands of historical situations. This creates reliable projections for future price movements.

| Feature | Manual Recognition | Automated Tools |

|---|---|---|

| Market Coverage | Limited assets | Hundreds simultaneously |

| Time Required | Hours daily | Continuous scanning |

| Pattern Types | Basic formations | 26+ including advanced |

| Detection Speed | Delayed | Instant alerts |

Specific examples demonstrate the system’s accuracy. DigiByte showed an Ascending Triangle with 11.77% projected growth. Stellar displayed an Inverse Head and Shoulders formation targeting 12.18% gains.

While automation provides efficiency, understanding formations remains valuable. Combining tool detection with personal knowledge creates the strongest approach for any market participant.

Risk Management Strategies in Technical Analysis Trading

Successful market participation depends heavily on controlling potential losses. Even the most reliable visual formations can fail unexpectedly. Proper risk controls protect your capital when setups don’t work as planned.

Stop-loss orders are essential tools for every participant. They automatically close positions when prices reach predetermined levels. This prevents small losses from becoming significant problems.

Risk-reward ratios ensure potential gains outweigh possible losses. Aim for at least 2:1 ratios in your trading decisions. This approach helps traders maintain profitability over time.

Complete exit plans include both profit targets and stop-loss points. Define these before entering any position based on chart formations. This discipline prevents emotional decision-making during volatile moments.

| Strategy | Primary Purpose | Implementation | Effectiveness |

|---|---|---|---|

| Stop-Loss Orders | Limit Losses | Automatic Position Closure | High |

| Risk-Reward Ratio | Profit Optimization | 2:1 or 3:1 Minimum | Medium-High |

| Position Sizing | Capital Protection | 1-2% per Trade Maximum | High |

| Diversification | Risk Distribution | Multiple Assets/Patterns | Medium |

External events can disrupt even well-formed patterns. News releases and regulatory changes affect market direction suddenly. Stay informed about developments that might impact your positions.

The volatile nature of digital assets requires flexible strategies. Combine visual analysis with strong risk management. This balanced approach maximizes effectiveness while protecting your investment.

Optimizing Trading Decisions with Real-Time Pattern Analysis

Watching price movements unfold in real-time reveals opportunities before full confirmation. This approach focuses on emerging formations as they develop within established boundaries.

Emerging patterns form when price trades between support and resistance levels. These setups present swing opportunities for active participants. Bullish scenarios occur near support with upward bounces. Bearish situations develop when price approaches resistance and reverses.

Swing traders particularly favor these developing formations. They profit from oscillations within the range before eventual breakouts. This allows multiple opportunities within a single pattern.

Experienced participants sometimes enter before complete confirmation. This carries significant risk since formations appear clearer in hindsight. Real-time identification requires careful monitoring.

| Timeframe Focus | Trader Type | Pattern Duration | Risk Level |

|---|---|---|---|

| Hourly/Daily Charts | Short-term Trader | Days to Weeks | Medium-High |

| Weekly/Monthly Charts | Long-term Investor | Weeks to Months | Medium |

| Multiple Timeframes | Swing Trader | Variable | Balanced Approach |

Successful real-time analysis demands constant observation of price action and volume changes. Different timeframes provide varying perspectives on the same market movement.

Balance potential rewards against increased risk of pattern failure. Strong risk management becomes essential when trading developing formations on your crypto chart.

Pro Tips for Mastering Crypto Chart Patterns

Reaching professional skill levels with visual formations requires understanding common mistakes and proper validation methods. This guide helps you avoid typical errors while improving your recognition accuracy.

Avoiding Common Pitfalls

One major mistake involves acting before full formation. Wait for complete development and confirmation signals. For example, a potential head and shoulders setup might fail if the neckline isn’t properly broken.

Never view chart patterns in isolation. Consider overall market conditions and supporting indicators. Context significantly impacts reliability and interpretation.

Avoid over-reliance on any single method. These tools work best within comprehensive strategies. They provide guidance rather than absolute predictions.

Best Practices for Confirmation Signals

Always seek multiple validation points before acting. Look for supporting volume increases and indicator alignment. This reduces false signal risks significantly.

Monitor key price levels where movements may stall or reverse. These areas often determine pattern success or failure. Proper risk-reward ratios protect your capital when setups don’t work as planned.

Combine pattern recognition with broader market understanding. This balanced approach creates more reliable decision-making frameworks for all market participants.

Conclusion

Chart formations provide a visual roadmap for navigating digital asset markets effectively. These chart patterns translate complex price movements into recognizable signals that guide decision-making. Mastering this visual language enhances your ability to anticipate market direction.

Successful crypto trading combines pattern recognition with robust risk management. While technical analysis offers valuable insights, it works best within comprehensive strategies. Always consider broader market context and use proper position sizing.

Understanding chart formations requires patience and consistent practice. Avoid common pitfalls like premature entries and over-reliance on single indicators. With disciplined application, these tools become powerful assets for any market participant.

FAQ

What is the most reliable chart pattern in crypto trading?

While no pattern guarantees success, the head and shoulders formation is widely considered one of the most reliable reversal signals. Its reliability increases when the pattern forms after a strong, sustained trend and is confirmed by a significant breakout below the neckline with strong trading volume.

How can I tell the difference between a double top and a double bottom?

A double top is a bearish reversal pattern that forms after an uptrend, creating two distinct peaks at a similar price level. Conversely, a double bottom is a bullish reversal pattern that forms after a downtrend, creating two distinct troughs. The key difference is their location within the broader trend and the subsequent direction of the breakout.

What does a breakout confirmation mean?

A breakout confirmation is evidence that a price move beyond a key support or resistance line is valid and not a false signal. Traders often look for a close above or below the level, a significant increase in volume, or confirmation from other indicators like the RSI to validate the breakout before entering a trade.

Are triangle patterns continuation or reversal patterns?

Triangle patterns, including ascending, descending, and symmetrical triangles, are primarily continuation patterns. This means they typically indicate a pause in the prevailing trend before the price continues in the same direction. However, they can sometimes act as reversal patterns, so it’s crucial to wait for the confirmed breakout.

How do automated tools help with pattern recognition?

Automated chart pattern tools scan charts in real-time to identify formations like wedges and flags. These tools save traders time, reduce human error, and can provide alerts for potential setups. The benefit is a more systematic approach to spotting opportunities, but they should be used alongside a trader’s own analysis.

No comments yet