The Wyckoff trading framework offers a time-tested way for traders to read price and volume and align with smart money in volatile markets.

Created by Richard Wyckoff, this approach explains how large participants accumulate at lows and distribute at highs. It uses three core laws and phase schematics to flag turning points.

In modern crypto markets, on-chain transfers and whale alerts add context that makes this framework useful for practical entry and exit decisions. Expect a clear guide to laws, phases A–E, common patterns like springs and UTADs, and trade rules.

What follows is a practical strategy guide that combines historical principles with crypto-native cues. Traders will get tools for analysis, risk controls, and confirmation techniques to apply to real assets and price movements.

What the Wyckoff Method Means for Crypto Traders Today

Reading range structure and volume together gives traders a practical lens to spot whether smart money and investors are accumulating assets or distributing them. When price stays in a sideways band, shifting volume profiles often reveal stealth buying or selling.

Crypto’s transparency and fast settlements make large wallet moves and on-chain transfers timely signals for timing entries and exits. Still, not every whale alert equals institutional intent; alerts are clues, not confirmations.

The method frames accumulation distribution as ranges with clear support and resistance. Traders use these bands to set entries, stop-losses, and take-profit levels ahead of time. Predefining invalidation points improves discipline and risk control.

- Look for rising volume into support as possible accumulation.

- Watch exhaustion volume near highs as potential distribution.

- Combine sentiment, on-chain data, and indicators to validate patterns.

Overall, this approach helps traders prioritize high‑probability scenarios while respecting uncertainty, and prepares them for how prices tend to react across phases A–E without chasing headlines.

Core Principles: Supply, Demand, and the “Composite Man” Framework

Reading supply and demand inside sideways ranges helps traders forecast likely breakouts. These three laws form the backbone of price analysis for modern trading. They help you separate real moves from traps.

Law of Supply and Demand: Reading imbalance to forecast price

Supply and demand dictate whether price climbs or falls. When demand outpaces supply inside a base, a markup becomes more likely.

Excess supply at highs often precedes markdowns. Traders watch volume and price reaction near support and resistance to judge which side dominates.

Law of Cause and Effect: From accumulation/distribution to trend

The length and compression of a range build the “cause” for a future trend. A larger cause can lead to a stronger effect — a longer, higher-magnitude move.

Use range width and volume patterns to estimate probable targets and set realistic stops and profit points.

Law of Effort vs. Result: Volume confirming (or contradicting) price

Effort shows up as volume; result is the price move. Big volume with little price progress suggests absorption or exhaustion.

Conversely, strong price advances on healthy volume confirm commitment from smart money and investors.

- Define imbalances as the bedrock of discovery — sustained demand over supply hints at markup.

- Match cause (range) to expected effect (trend size) for targets and risk sizing.

- Watch volume spikes that fail to move price — they often signal a trap or absorption.

| Law | Typical Signal | Trader Action | Why It Matters |

|---|---|---|---|

| Supply & Demand | Rising bids into support; heavy selling near highs | Buy near validated support; size cautiously at resistance | Shows who controls price discovery |

| Cause & Effect | Long range build with low volatility | Project targets from range size; plan exits | Links preparation to trend potential |

| Effort vs Result | Volume spikes with muted price action | Delay entries; look for confirmation or divergence | Detects absorption or exhaustion by larger players |

Composite Man is a mental model of how smart money builds positions. He shapes ranges, creates shakeouts, and forces liquidity to buy or sell. Traders who log supply/demand, cause/effect, and effort/result build repeatable edge and better manage trades.

For a deeper technical overview, see the wyckoff method.

The Wyckoff Market Cycle in Crypto: Accumulation, Markup, Distribution, Markdown

A cycle’s roadmap — from base to breakout to top and decline — helps traders read the next probable move.

Markets progress from accumulation after a decline into markup, then into distribution and a markdown. Price and volume at each pivot reveal who controls supply and demand.

From range to trend: How prices transition between phases

Ranges build the “cause.” A decisive breakout with rising volume converts that cause into effect and starts a new phase.

Conversely, a failed rally followed by heavy selling often heralds a markdown. Watch volume to confirm legitimacy of a move.

Re-accumulation and redistribution: Continuations within major trends

Within primary trends, re-accumulation refreshes a rally and redistribution can pause a decline. These continuation ranges let traders plan adds or trim positions.

- Map the cycle: accumulation bases → markup uptrends → distribution tops → markdown downtrends.

- Recognize springs in bases and upthrusts at tops as liquidity hunts before the next directional move.

- Annotate ranges and phase shifts to avoid trading against the prevailing trend.

Patience pays: wait for confirmation of breakouts or breakdowns rather than guessing, since markets often form complex variations that still follow supply/demand logic.

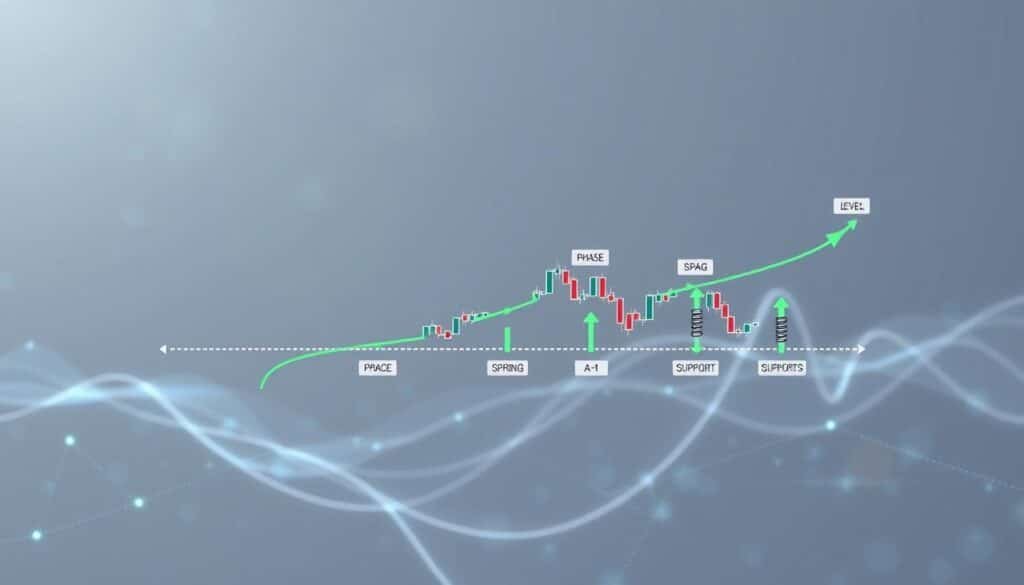

Wyckoff Accumulation Phases A-E: Mapping Support, Springs, and Strength

Breaking accumulation into A–E phases reveals how demand quietly replaces supply inside a range. Use this map to draw levels, spot tests, and plan position entries around high‑quality signals.

Phase A

Preliminary support and the selling climax mark the first sign that declines are slowing. An automatic rally follows, then a secondary test on lighter volume that shows where support holds.

Phase B

Phase B builds the range while supply is absorbed. Range highs and lows get tested repeatedly to measure remaining selling pressure and the emergence of demand.

Phase C

The spring is the classic shakeout below support that quickly reverses. Tests after the spring should hold higher lows and show improved demand, validating the base.

Phase D

Sign of strength appears as a rally through resistance on expanding volume. Pullbacks to last points of support confirm that demand now dominates and that positions can be added.

Phase E

Breakout and markup begin as prices and volume expand. Look for constructive pullbacks for trend‑following entries and manage risk just beyond the spring or structural lows.

- Drawing levels: mark support and resistance at range extremes and use tests to validate control.

- Practical note: not every accumulation shows a textbook spring; alternative structures still reflect absorption and rising demand.

- Risk: plan positions around LPS tests and place stops beyond the structural low.

Wyckoff Distribution Phases A-E: Upthrusts, Weakness, and Markdown

Distribution at market tops often starts quietly, then accelerates into visible weakness that traps late buyers.

Phase A

Preliminary supply arrives as buying climax prints and prices peak. An automatic reaction follows and sets the lower edge of the range.

A secondary test then probes that low to measure how much supply remains versus demand.

Phase B

Phase B turns choppy as range selling dominates. Down-volume often increases as smart money and investors unload inventory.

Traders should watch how prices react to swings; repeated heavy selling signals growing control by supply.

Phase C

Expect an upthrust or UTAD above resistance — a brief breakout that quickly fails. This bull trap shows weak demand despite higher prices.

Confirm failure with thin follow-through and higher volume on declines.

Phase D

Sign of weakness appears as price slices support with authority. Weak rallies become last points of supply and fail to reclaim lost ground.

These failed recoveries are high-probability clues that markdown will follow.

Phase E

Breakdown and markdown confirm the transition to a bearish market. Rallies are sold and prices continue lower as supply outpaces demand.

- Practical tip: distinguish healthy breakouts from UT/UTAD by checking volume, spread, and rapid follow-through.

- Risk control: shorting distribution needs tight stops; sharp short-covering squeezes can occur before sustained markdown.

- Map resistance pivots and watch for demand failure during tests to avoid trading against the emerging downtrend.

How to apply wyckoff method crypto in real time: Price action, volume, and levels

Real-time trading demands you read price action and volume inside defined bands and act from evidence, not emotion.

Identifying accumulation vs. distribution

Label a sideways range by marking highs and lows. Watch up waves and down waves for rising or falling volume to tell accumulation from distribution.

Accumulation shows stronger volume on advances and lighter volume on declines. Distribution flips that profile.

Support, resistance, springs and upthrusts

Validate springs and upthrusts with sharp rejections, narrowing spreads on pullbacks, and improved volume when price re-enters the range.

Draw support, resistance, and a mid-range to define entries, invalidation points, and targets. Place stops beyond proven structural levels.

Multi-timeframe context

Identify the dominant trend on higher charts, then time entries on lower charts when price action and volume align. Use indicators only as confirmation.

- Checklist: absorption at support, failure at resistance, clean test with volume.

- Execution: wait for test confirmation; avoid early entries.

| Focus | Signal | Action |

|---|---|---|

| Range labeling | Sideways highs/lows | Mark levels and mid-range |

| Volume profile | Rising on advances = accumulation | Prepare buys near support |

| Tests | Spring or upthrust rejection | Enter after confirmation; set stops |

Actionable Strategies: Entries, Exits, and Risk in Crypto Markets

Start every trade with a plan: define the entry, stop, and target before you touch the market. This disciplined setup keeps emotions out of decisions and improves execution.

Trading accumulation

Buy near support after a valid spring or test when volume shows absorption. Enter on a sign of strength (SOS) or last point of support (LPS) with stops just below the structural low.

Scale in by adding increments at confirmed LPS or on a breakout with expanding volume. Keep position sizes small until confirmation aligns with the larger trend.

Trading distribution

Short near resistance after an upthrust (UTAD) or supply of weakness (SOW/LPSY) when rallies fail and selling pressure rises. Place stops above the range high to limit exposure.

Prefer confirmation: thinning volume on rallies and heavier volume on declines signals genuine distribution and improves trade odds.

Risk management

Predefine max loss per trade and use R-multiples to size positions. Place stop-losses beyond proven levels to avoid stops on normal volatility.

Limit capital at risk per idea (for example, 1–2% of the account). If you trade counter-trend, reduce size and tighten stops.

Scaling and profit-taking

Manage positions with planned partial exits into strength or weakness. Trail stops beneath rising structural pivots in a markup, or above pivots in a markdown.

Frame targets from range size and prior prices. Journal each trade and review outcomes to refine entries, scaling, and risk over time.

| Focus | Entry Trigger | Stop Placement | Profit Tactic |

|---|---|---|---|

| Accumulation | Spring / LPS / Breakout + volume | Below structural low | Partials on strength; trail under pivots |

| Distribution | UTAD / SOW / Breakdown + selling pressure | Above range high | Scale into weakness; tight trailing stops |

| Risk | Predefined R-multiple | Max loss per trade 1–2% | Close on invalidation; review plan |

Common Pitfalls and Confirmation Tactics for Wyckoff Traders

Even the cleanest setups can break down when prices meet unexpected supply or sudden news shocks.

Traders must prepare for false breakouts, event risk, and shifting market behavior. Use layered confirmations and strict risk rules to avoid getting stopped out on noise.

False breakouts and black swans: When patterns fail

Clean ranges can morph quickly. Breakouts without follow-through or sharp reversals often signal traps.

- Watch volume: a breakout with low volume is suspect.

- Protect downside: predefine max loss and place volatility-aware stops.

- Event risk: avoid large position size ahead of major news or announcements.

Confirming with indicators: RSI, moving averages, and volume tools

Layer indicators to validate price action and levels. No single tool is decisive on its own.

- RSI divergences can flag weakening momentum before prices roll over.

- Moving averages show trend slope and reclaim/loss of key levels.

- Volume profile and on‑chart volume alignment confirm genuine moves versus false breakouts.

| Risk | Confirmation | Action |

|---|---|---|

| False breakout | Low volume + quick reversal | Tight stop; wait for retest |

| Event shock | Vol spike without trend follow-through | Cut size; avoid re-entry until calm |

| Weak momentum | RSI divergence + MA flatten | Veto trades or reduce size |

Practice disciplined review: log outcomes, refine filters, and prefer secondary confirmation (a successful retest) to reduce whipsaws. Align local setups with higher‑timeframe context to boost probability and keep risk per trade small.

Conclusion

By tracking phase progressions, volume, and clear support/resistance levels, traders gain a practical edge.

Core principles — supply versus demand, cause and effect, and effort versus result — translate into readable signs of accumulation and distribution. Use those reads to place entries, stops, and targets with predefined risk.

Treat the cycle as your roadmap: ranges create cause that resolves into a markup or markdown, so align positions with the dominant trend and prefer high‑quality setups.

Combine this approach with confirmation tools, keep a trade journal, and practice labeling phases on historical charts. For more on market context and timing, see how to analyze market trends.

FAQ

What are the core principles behind this trading framework?

The approach rests on three laws: supply and demand, cause and effect, and effort versus result. Traders read volume and price to gauge imbalances, estimate whether a sideways range is building a future trend, and check if rising or falling volume confirms price moves. These ideas help anticipate shifts in market control between buyers and sellers.

How do accumulation and distribution phases differ?

Accumulation happens when smart money absorbs supply in a range, often marked by springs and tests before an uptrend. Distribution is the opposite: large holders shed positions near resistance, producing upthrusts and tests before a downtrend. Distinguishing the two relies on observing price behavior and accompanying volume patterns.

What are typical signs of a spring or upthrust?

A spring is a brief move below support that quickly recovers, designed to trigger stops and reveal remaining supply. An upthrust (or UTAD) is a spike above resistance that fails to hold and returns to the range, trapping breakout buyers. Both show false moves followed by tests confirming whether supply or demand prevails.

How can traders use phases A–E to plan entries and exits?

In Phase A traders note preliminary support or supply and initial reactions. Phase B builds the range and reveals character. Phase C offers final shakeouts or bull traps. Phase D shows clear signs of strength or weakness and provides higher-probability entries. Phase E marks the trend start; traders manage exits as price leaves the range and volatility increases.

What role does volume play in this analysis?

Volume validates price moves. Rising volume with advancing price suggests genuine demand; falling volume on advances signals weak conviction. During tests and springs, lower volume on declines hints supply is being absorbed. Always match volume patterns with price action to avoid false signals.

How do re-accumulation and redistribution affect trend continuation?

These are consolidation events inside established trends. Re-accumulation pauses an uptrend, allowing renewed buyers to gather strength before the next markup. Redistribution pauses a downtrend, enabling continued selling after another markdown. Identifying them prevents mistaking consolidations for full reversals.

Which timeframes work best for applying this framework to digital assets?

Use a top-down approach: identify the primary trend on daily or weekly charts, then refine entries and exits on lower timeframes like 4-hour or 1-hour. Higher-timeframe context reduces noise and aligns trades with institutional flow, while lower frames provide actionable setups.

What practical entry techniques align with accumulation patterns?

Common entries include buying near support within the range, entering on a successful spring and low-volume test, or taking positions on a successful breakout with confirming volume. Scale in, use stop placements beyond obvious structural levels, and size positions to limit downside risk.

How should traders manage risk when trading range-based setups?

Place stops beyond key support/resistance or recent swing extremes, limit position size so a single loss stays within risk tolerance, and set clear profit targets or trailing stops during markup or markdown. Risk management must be consistent to survive sequences of losing setups.

What indicators help confirm price and volume signals?

Momentum tools like RSI and MACD can reveal divergence during tests or upthrusts. Moving averages help define trend direction and dynamic support/resistance. Volume indicators, such as OBV or VAP, enhance reading of effort versus result. Use indicators as confirmation, not primary signals.

What common mistakes should traders avoid when applying this analysis?

Avoid forcing patterns where price structure isn’t clear, overtrading small ranges, chasing breakouts without volume confirmation, and ignoring higher-timeframe context. Also, do not ignore risk controls—many losses stem from poor sizing and weak stop discipline.

Can retail traders reliably follow these principles in volatile digital markets?

Yes, but success requires patience, discipline, and practice. Volatility creates opportunities and false moves. Learning to read range structure, volume relationships, and tests improves timing. Backtest setups, keep positions small until confident, and adapt to the unique volatility of crypto assets.

No comments yet